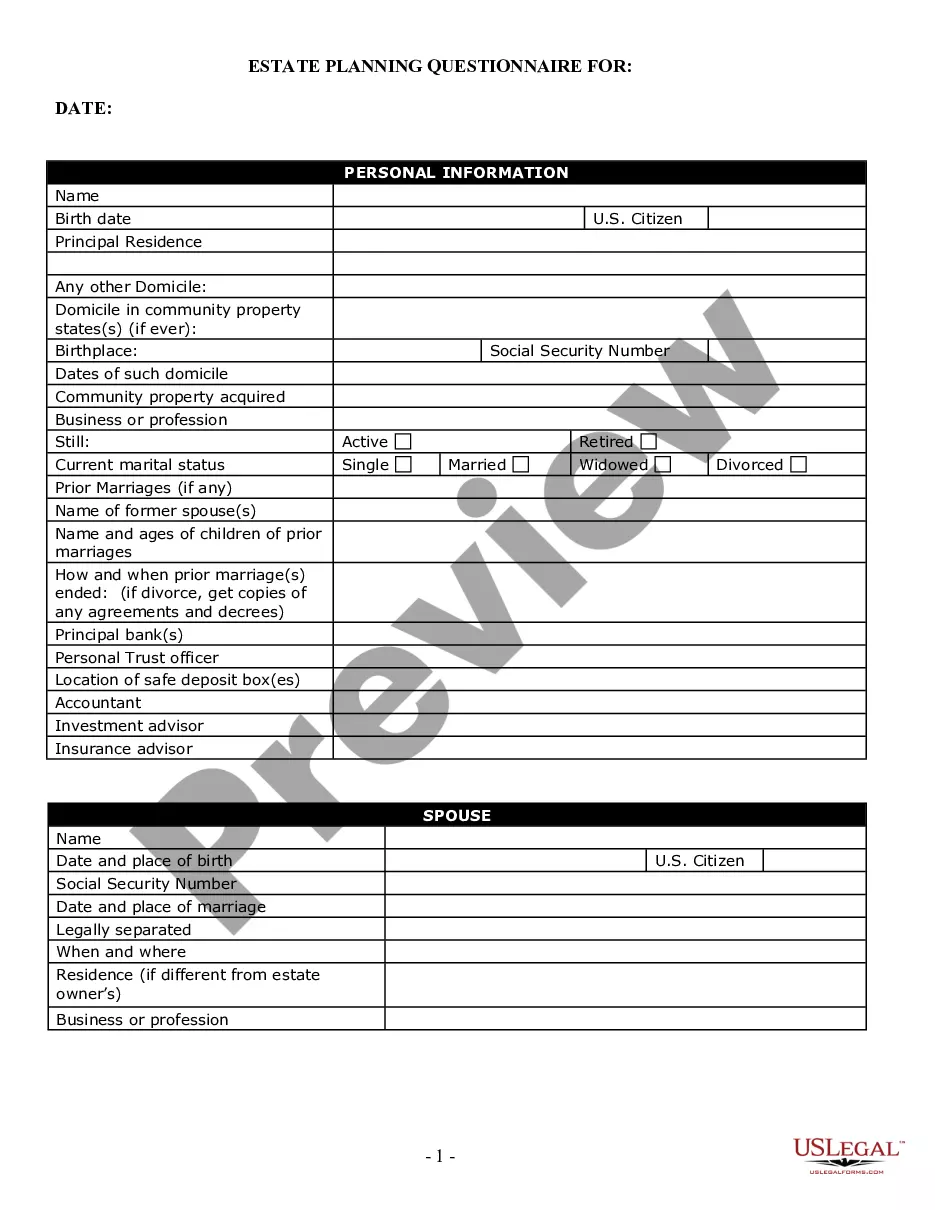

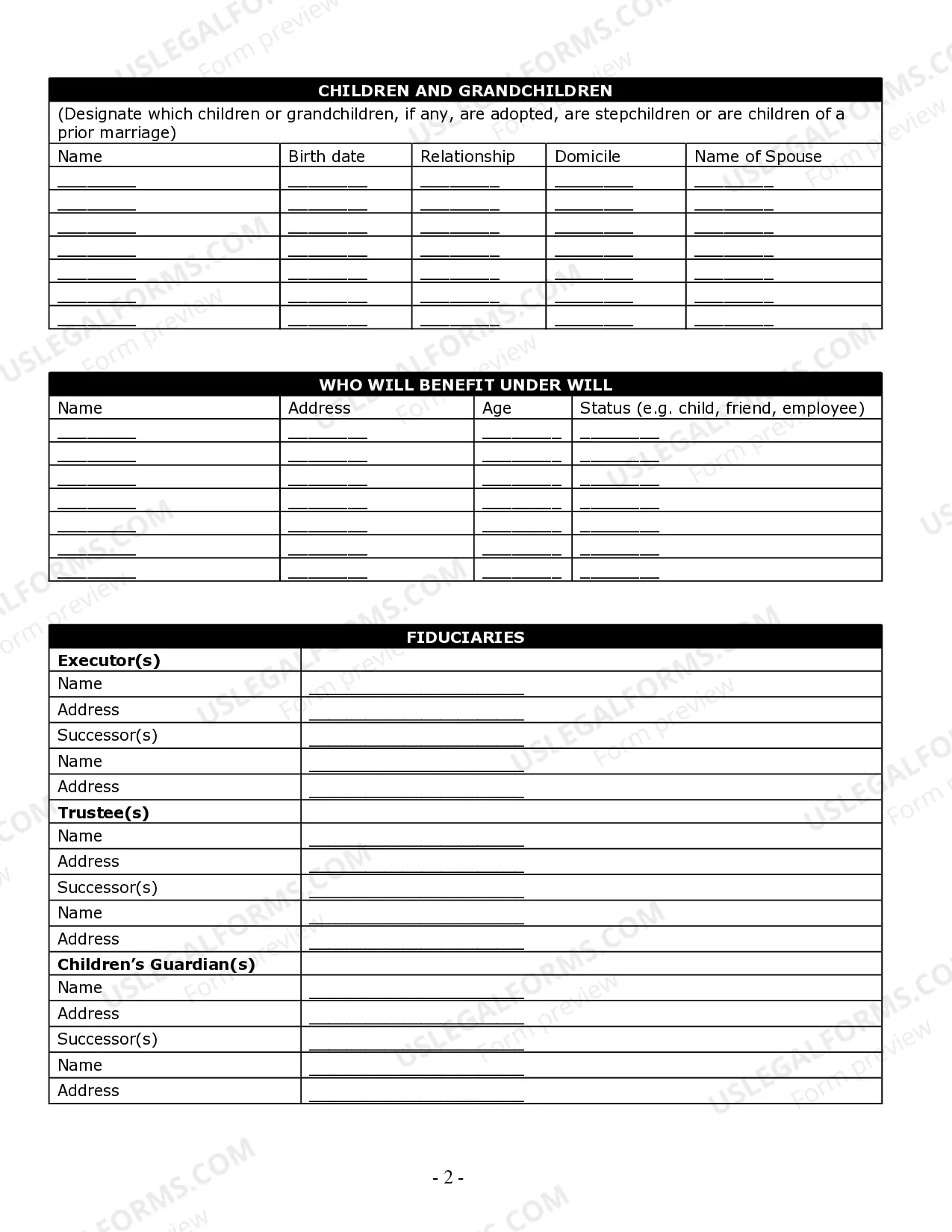

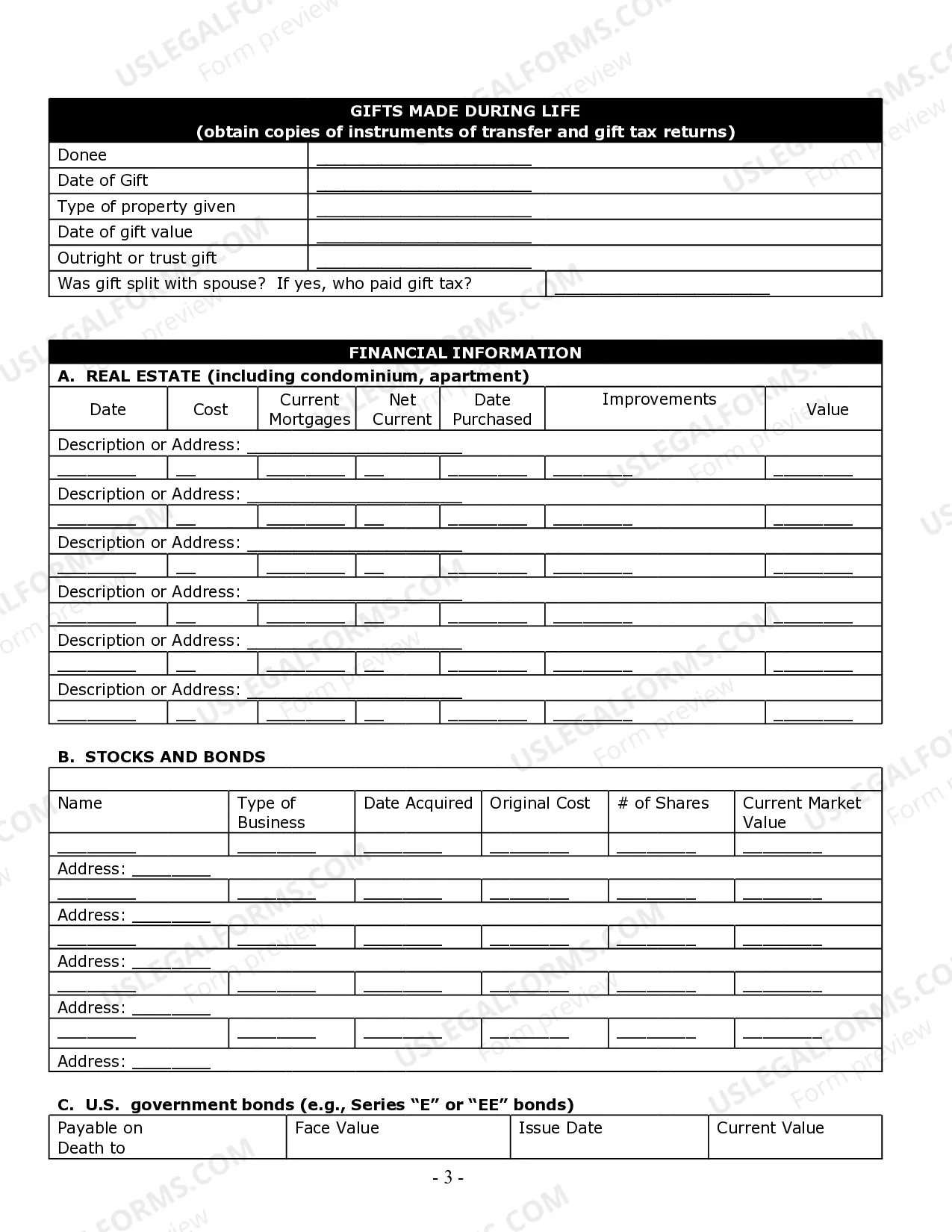

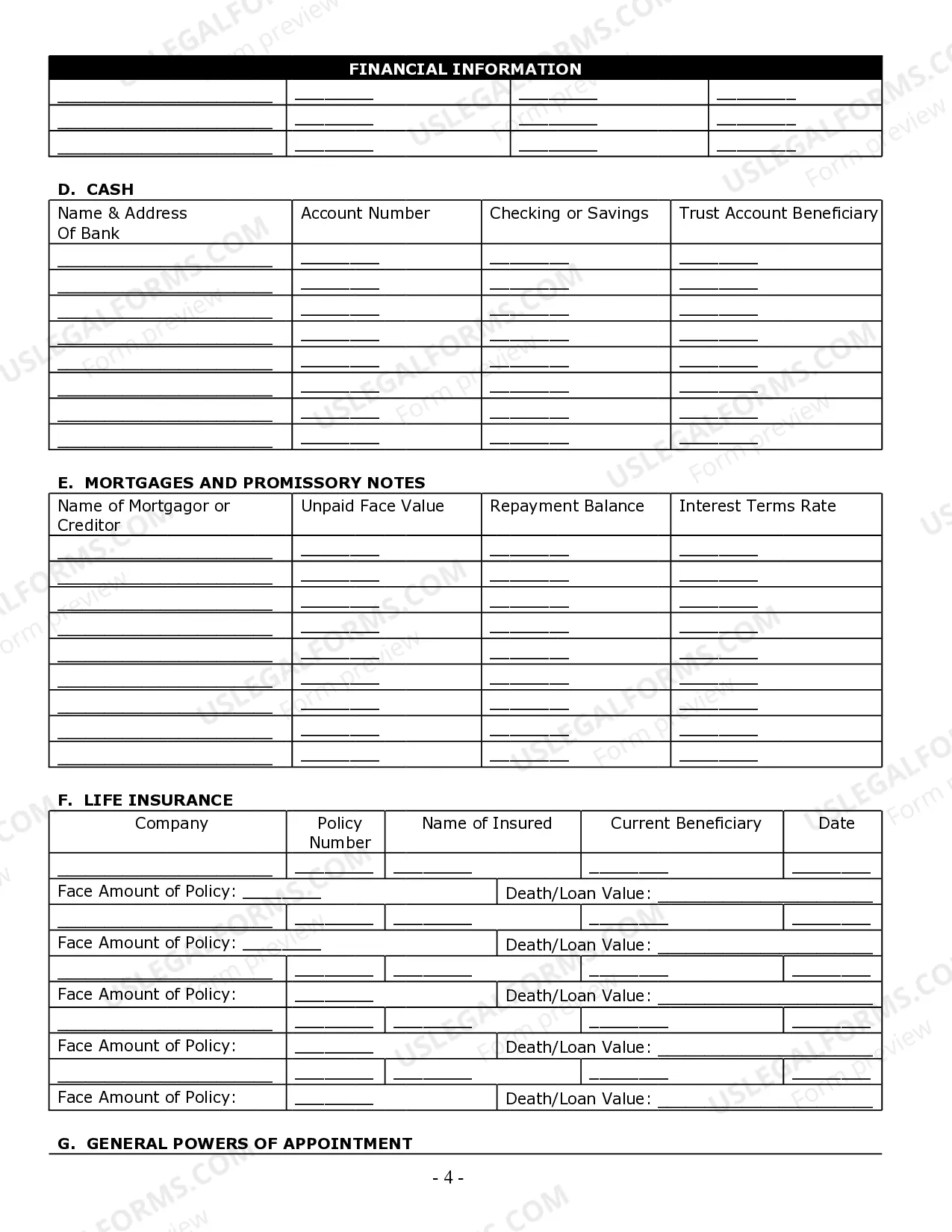

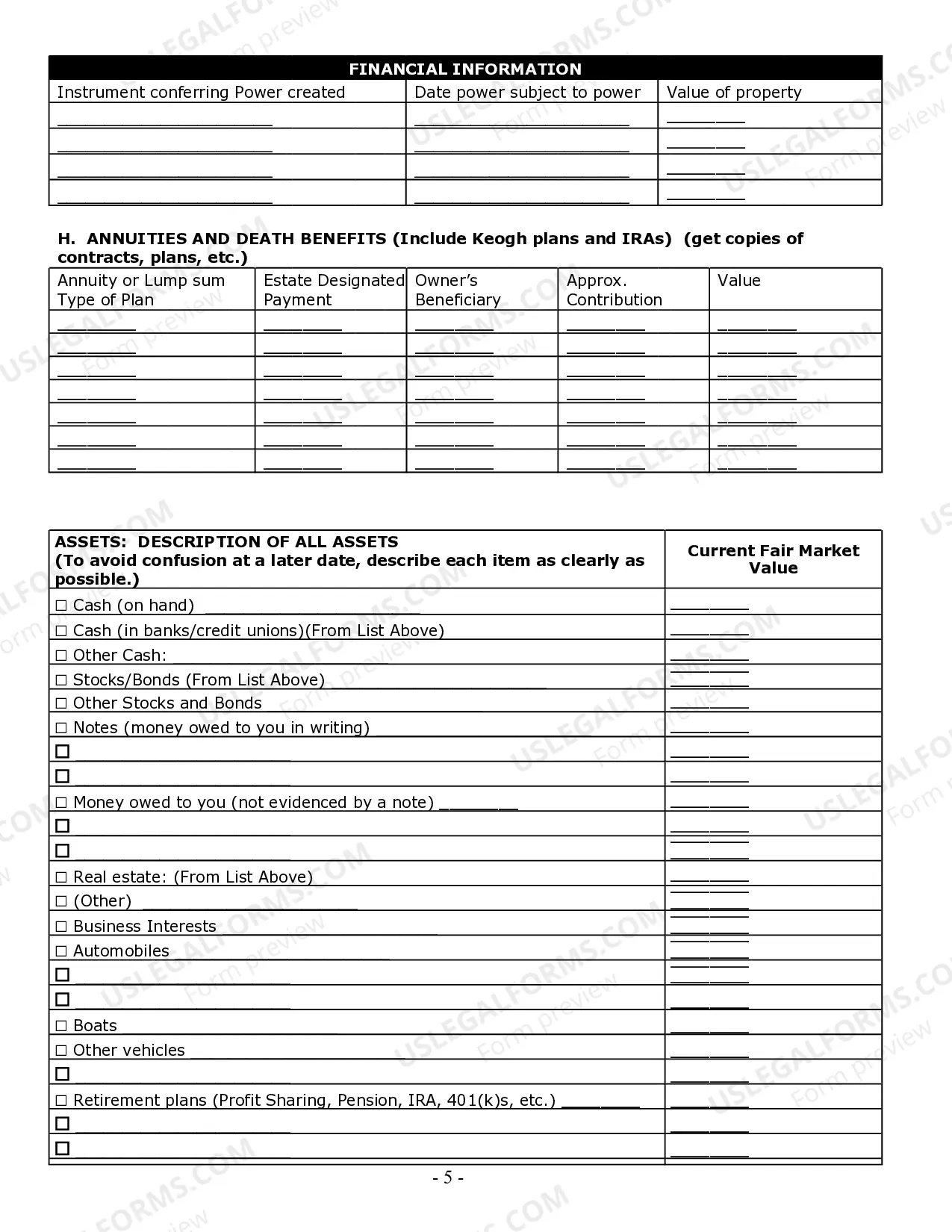

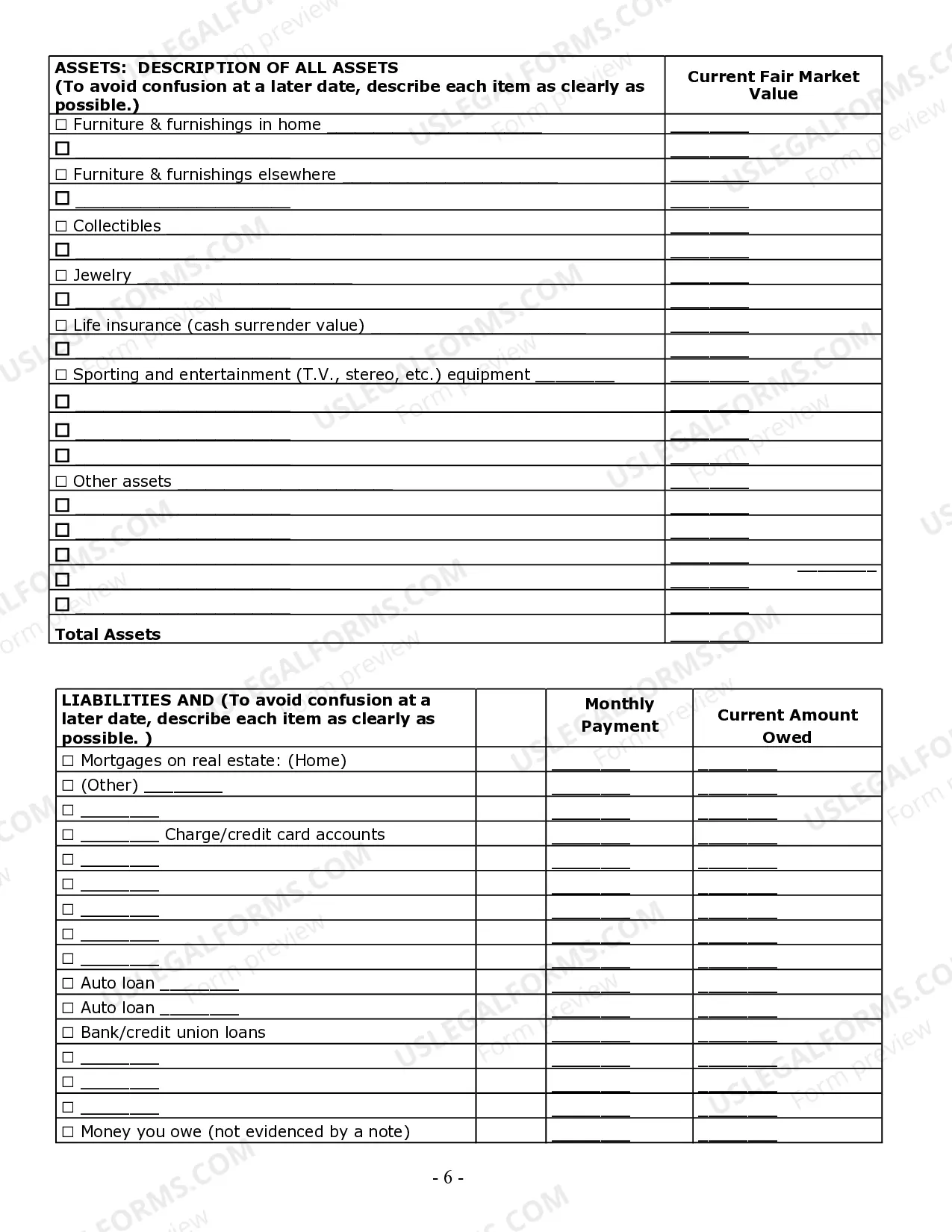

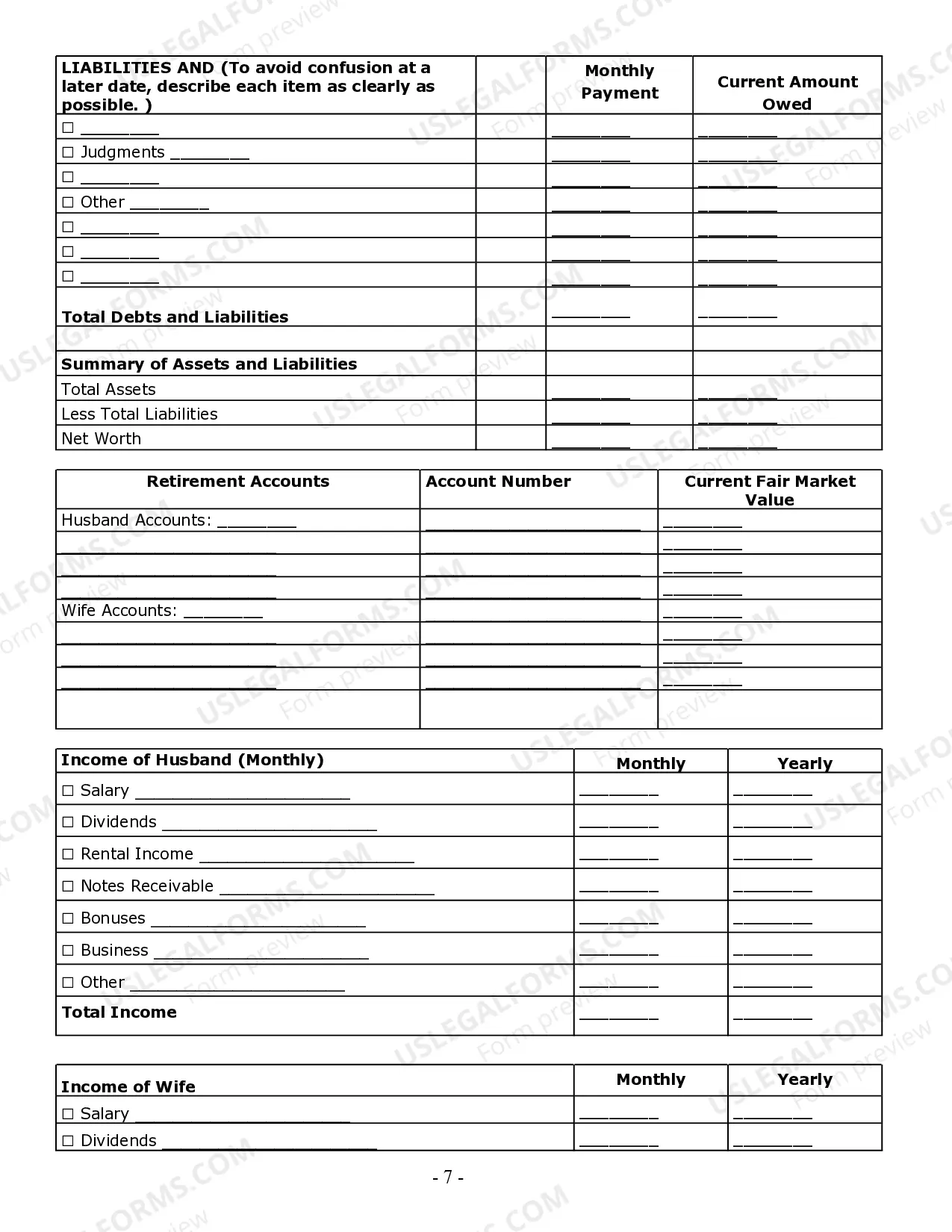

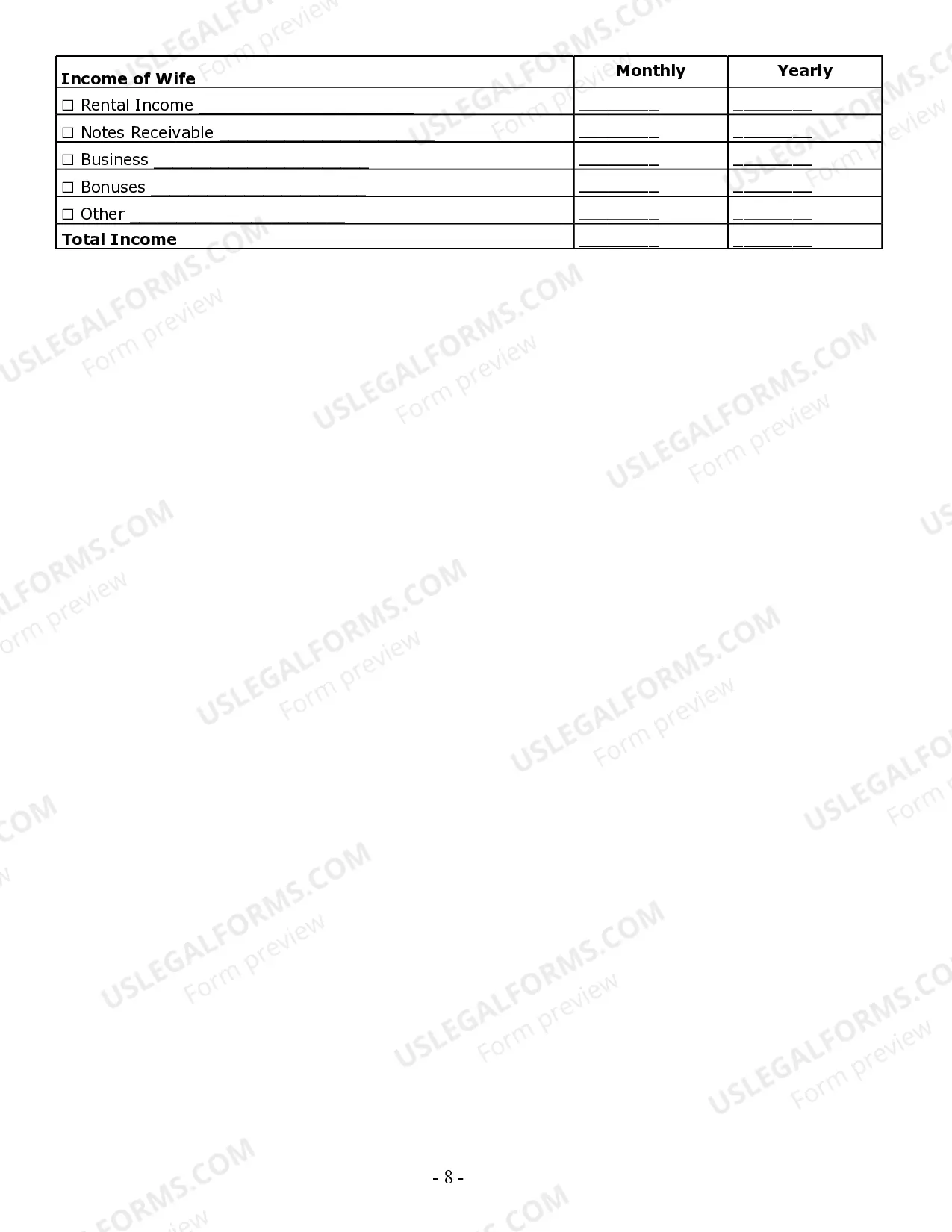

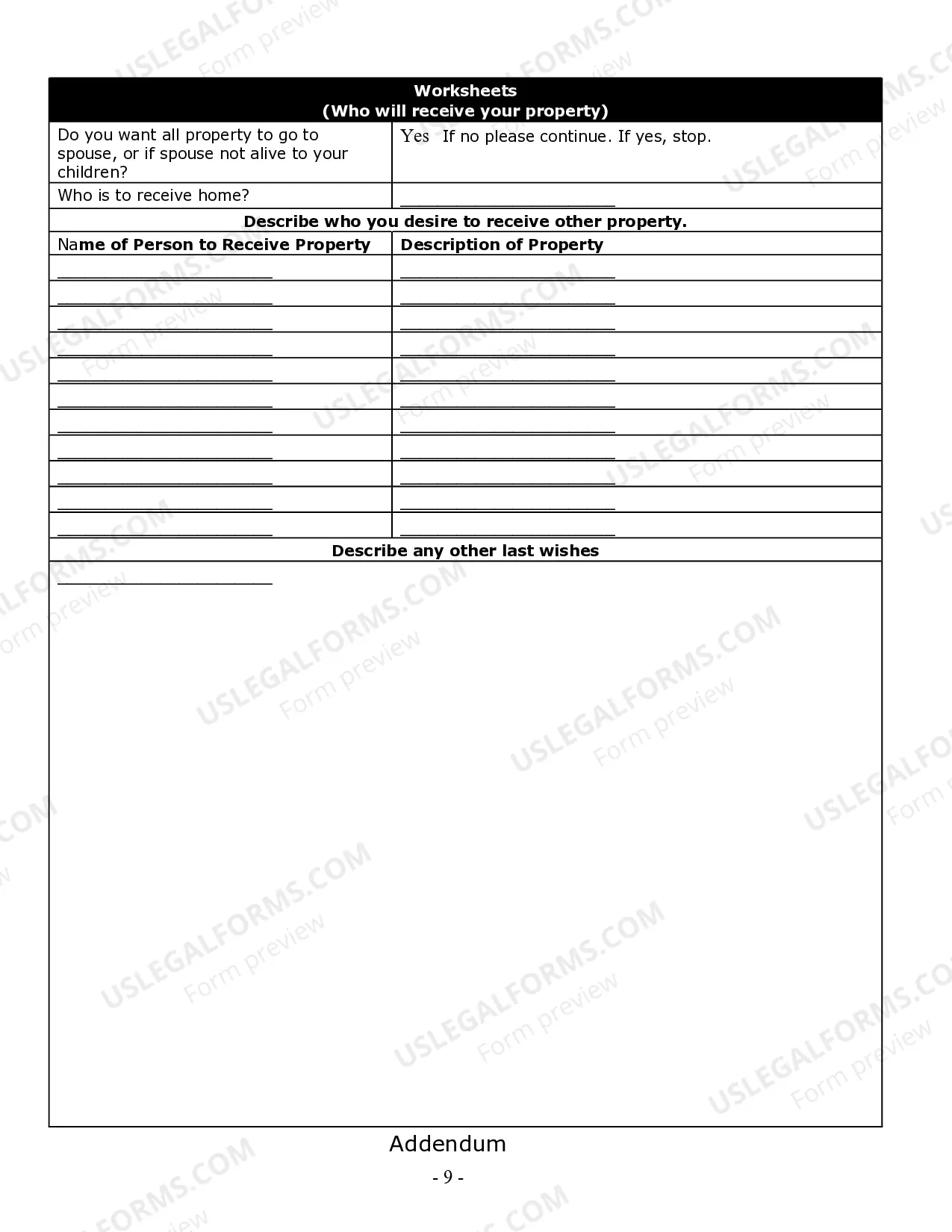

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

The Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets serve as essential tools in assisting individuals or families residing in Cedar Rapids, Iowa, in their estate planning process. These meticulously-designed documents encompass a comprehensive set of questions and sections relevant to the creation and management of an individual's or family's estate plan. Whether it's a simple will or a more complex trust arrangement, these questionnaires and worksheets aim to ensure that all aspects of an individual's or family's estate planning needs are thoroughly examined and addressed. The Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets are equipped with various sections to cover a wide range of topics crucial to the estate planning process. These may include personal information, family details, financial assets and liabilities, beneficiary designations, healthcare directives, power of attorney specifications, guardianship decisions for minor children, charitable giving preferences, and funeral arrangements. By delving into such aspects, the questionnaires and worksheets enable individuals or families to establish a comprehensive and personalized estate plan that aligns with their wishes and goals. While specific variations of the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets may exist to suit individuals' unique circumstances, some common types can be identified. These may include: 1. Basic Estate Planning Questionnaire: This questionnaire collects fundamental information about the individual's or family's personal and financial situation, acting as a foundation for initiating the estate planning process. 2. Advanced Estate Planning Questionnaire: Geared towards individuals with more complex estate planning requirements, this questionnaire might delve deeper into matters such as business succession planning, tax planning, asset protection strategies, and charitable giving plans. 3. Trust-Based Estate Planning Questionnaire: For those considering the establishment of one or more trusts within their estate plan, this questionnaire is specifically tailored to gather information about trust beneficiaries, trustees, desired distribution methods, and any specific instructions regarding trust management. 4. Probate Avoidance Questionnaire: This type of questionnaire focuses on strategies aimed at minimizing the potential administrative complexities and costs associated with probate proceedings, allowing individuals or families to explore alternative estate planning options. The Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets offer an invaluable framework for individuals or families embarking on the estate planning journey. By systematically addressing various aspects of estate planning, these documents facilitate the creation of a well-structured, personalized, and legally sound estate plan that ensures the seamless transfer of assets, protection of loved ones, and adherence to one's wishes.