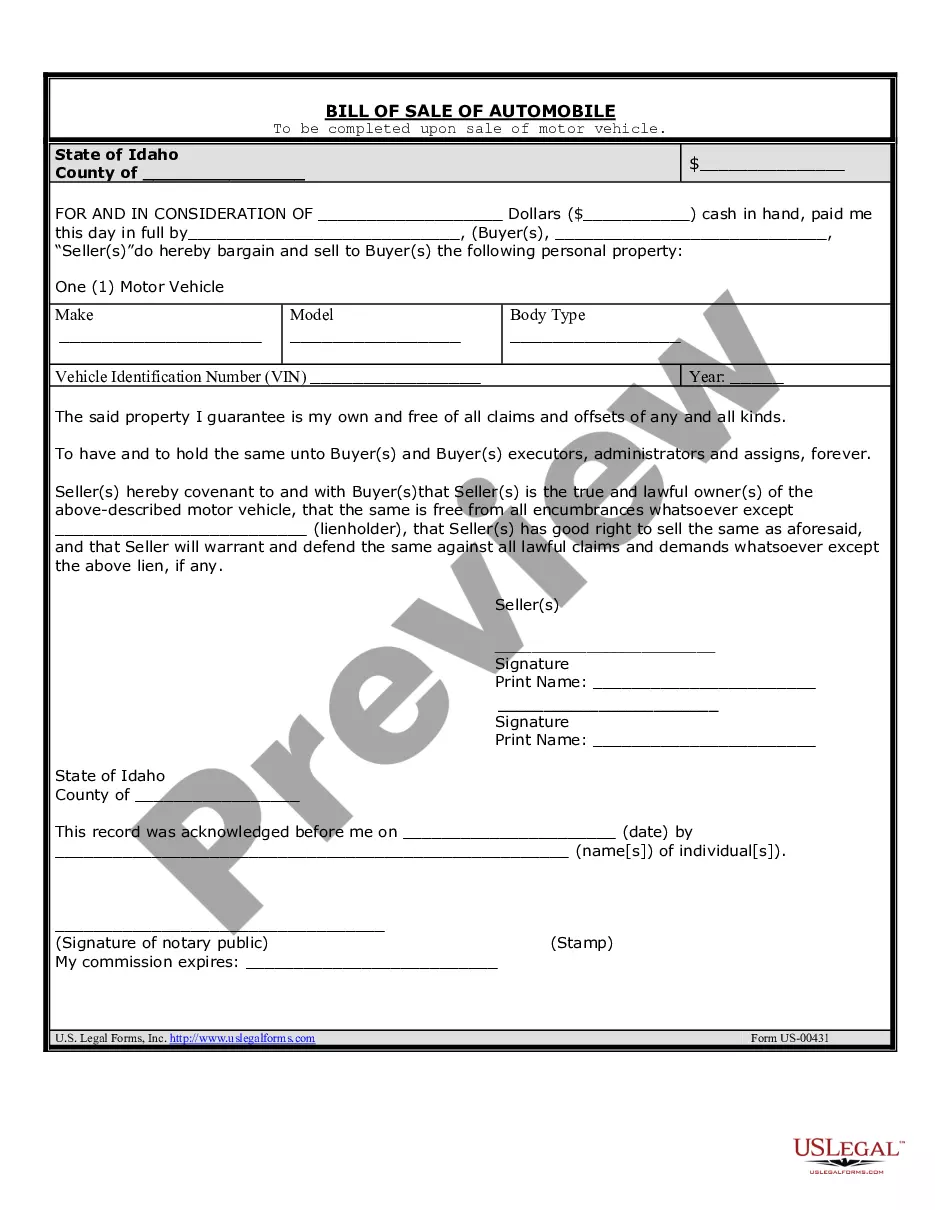

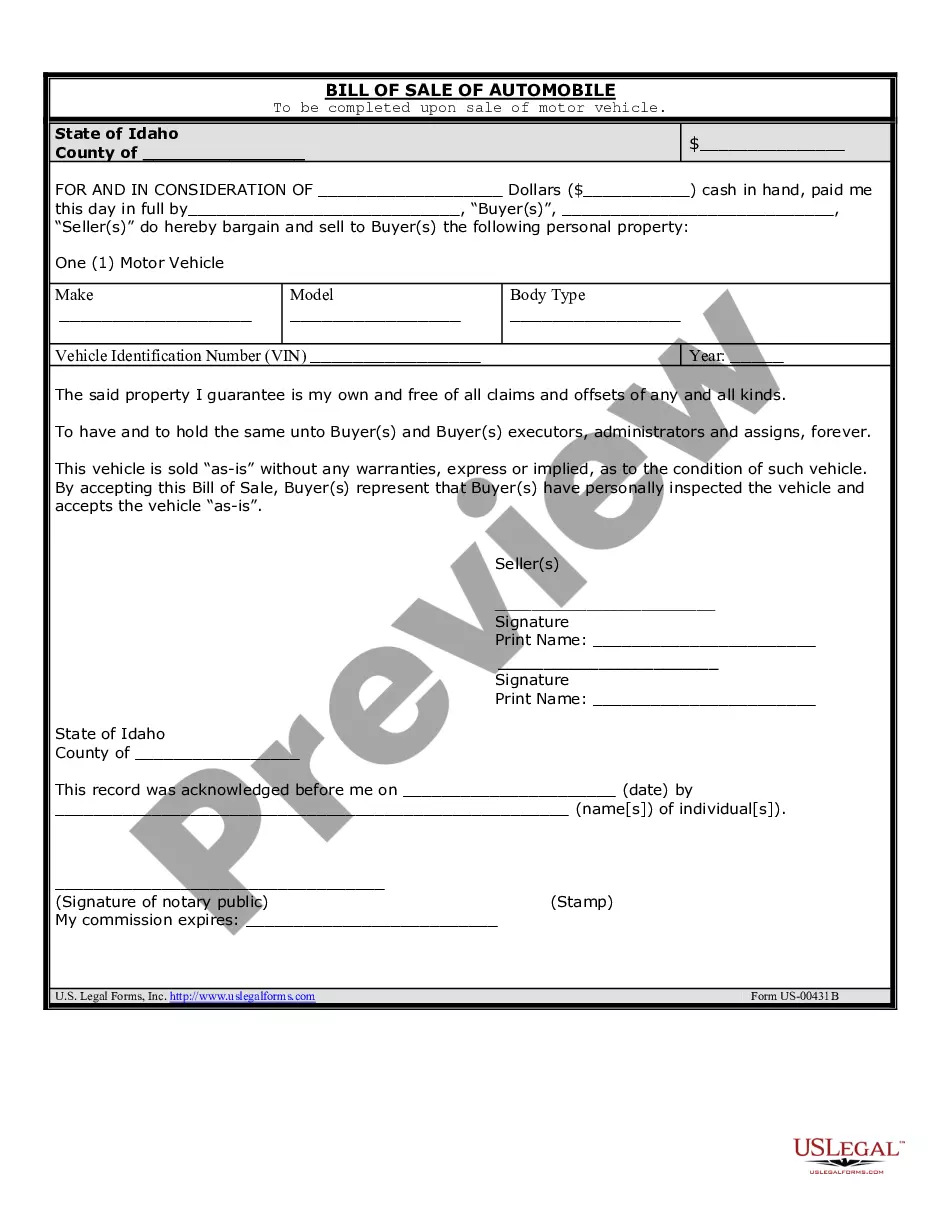

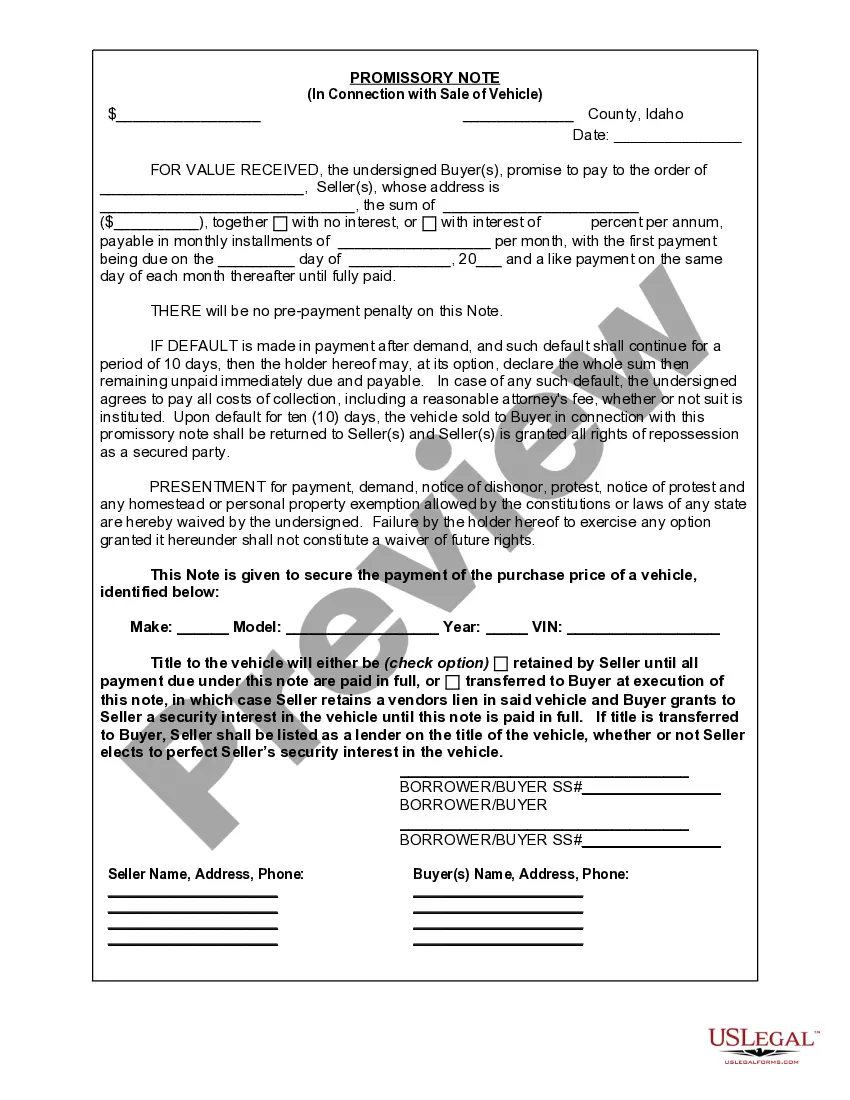

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Meridian Idaho Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle in Meridian, Idaho. This note serves as a written promise to repay the loan amount along with any accrued interest within a specified period. Keywords: Meridian Idaho, Promissory Note, Sale of Vehicle, Automobile, loan agreement, buyer, seller, legal document, terms and conditions, loan amount, interest. There are different types of Meridian Idaho Promissory Notes in Connection with the Sale of Vehicle or Automobile, which may include: 1. Simple Promissory Note: This is a basic promissory note that outlines the loan amount, interest rate (if any), repayment terms, and any other relevant terms and conditions of the loan agreement. 2. Installment Promissory Note: This type of promissory note divides the total loan amount and interest into equal monthly installments, specifying the due date and payment amount for each installment. 3. Secured Promissory Note: In this type of promissory note, the buyer pledges collateral, such as the vehicle being purchased, to secure the loan. If the buyer fails to repay the loan, the seller has the right to seize the collateral. 4. Unsecured Promissory Note: This promissory note does not require any collateral. Instead, it relies on the borrower's promise to repay the loan as specified in the terms and conditions. 5. Balloon Promissory Note: A balloon promissory note defers a significant portion of the principal loan amount, requiring the borrower to make smaller monthly payments with a large final "balloon" payment due at the end of the loan term. When drafting a Meridian Idaho Promissory Note in Connection with the Sale of Vehicle or Automobile, it is crucial to consult with legal professionals or use customizable templates to ensure compliance with Idaho state laws and to accurately reflect the agreed-upon terms negotiated between the buyer and seller.A Meridian Idaho Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle in Meridian, Idaho. This note serves as a written promise to repay the loan amount along with any accrued interest within a specified period. Keywords: Meridian Idaho, Promissory Note, Sale of Vehicle, Automobile, loan agreement, buyer, seller, legal document, terms and conditions, loan amount, interest. There are different types of Meridian Idaho Promissory Notes in Connection with the Sale of Vehicle or Automobile, which may include: 1. Simple Promissory Note: This is a basic promissory note that outlines the loan amount, interest rate (if any), repayment terms, and any other relevant terms and conditions of the loan agreement. 2. Installment Promissory Note: This type of promissory note divides the total loan amount and interest into equal monthly installments, specifying the due date and payment amount for each installment. 3. Secured Promissory Note: In this type of promissory note, the buyer pledges collateral, such as the vehicle being purchased, to secure the loan. If the buyer fails to repay the loan, the seller has the right to seize the collateral. 4. Unsecured Promissory Note: This promissory note does not require any collateral. Instead, it relies on the borrower's promise to repay the loan as specified in the terms and conditions. 5. Balloon Promissory Note: A balloon promissory note defers a significant portion of the principal loan amount, requiring the borrower to make smaller monthly payments with a large final "balloon" payment due at the end of the loan term. When drafting a Meridian Idaho Promissory Note in Connection with the Sale of Vehicle or Automobile, it is crucial to consult with legal professionals or use customizable templates to ensure compliance with Idaho state laws and to accurately reflect the agreed-upon terms negotiated between the buyer and seller.