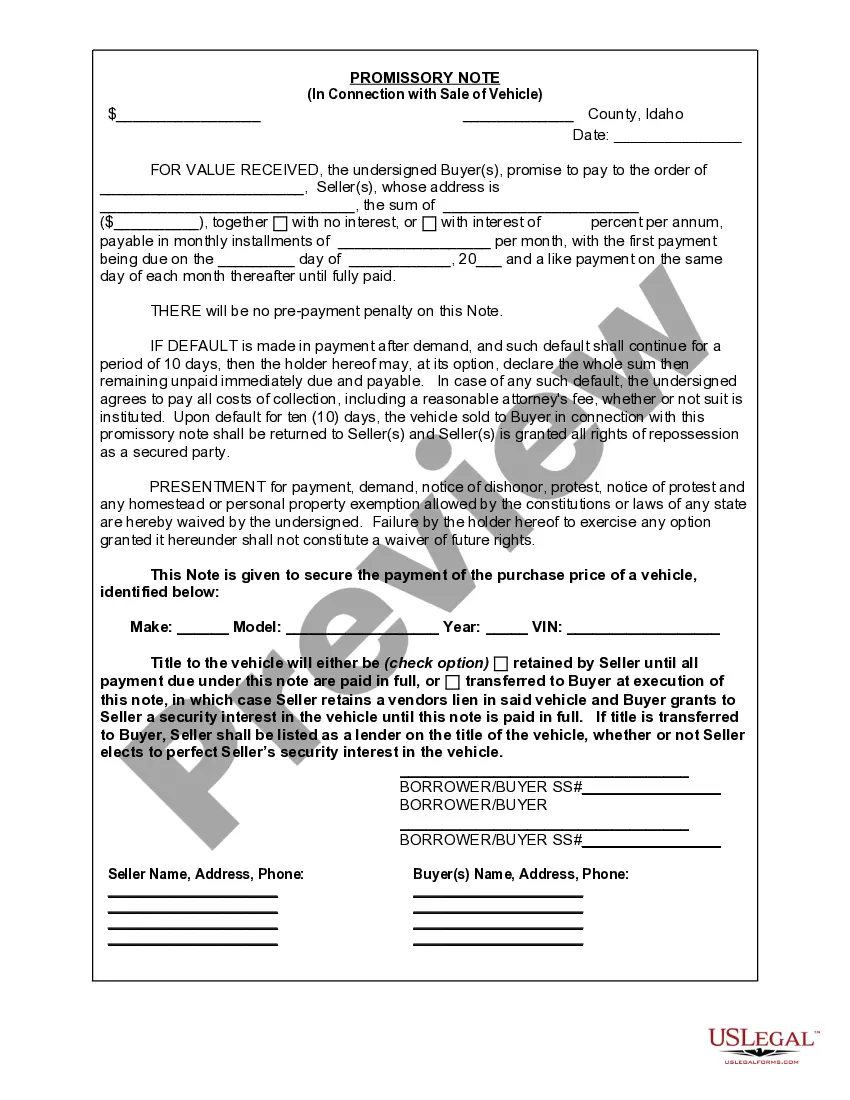

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Nampa Idaho promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a financing agreement between the buyer and seller. This note serves as an agreement to repay the loan amount in installments over a specified period of time. Keywords: Nampa Idaho, promissory note, sale of vehicle, sale of automobile, financing agreement, buyer, seller, terms and conditions, loan amount, installments, specified period of time. There are different types of Nampa Idaho promissory notes in connection with the sale of a vehicle or automobile. These types include: 1. Fixed Installment Promissory Note: This type of promissory note establishes fixed monthly or quarterly installments that the buyer agrees to pay over a defined repayment period. The interest rate is typically fixed, providing stability and predictability for both parties. 2. Balloon Promissory Note: A balloon promissory note involves smaller monthly installments throughout the loan term, but with a lump sum payment due at the end. The lump sum payment, also known as the balloon payment, is often larger than the previous installments and will include any outstanding balance. 3. Adjustable Rate Promissory Note: An adjustable rate promissory note stipulates that the interest rate on the loan may fluctuate based on market conditions. This type of note is commonly used when the seller offers a variable interest rate to the buyer. 4. Secured Promissory Note: A secured promissory note is backed by collateral, typically the vehicle being purchased. If the buyer defaults on the loan, the seller has the right to repossess and sell the vehicle to recover the remaining debt. 5. Unsecured Promissory Note: An unsecured promissory note does not require any collateral. While this type of note may be riskier for the seller, it allows for greater flexibility in the terms and conditions of the loan. In conclusion, a Nampa Idaho promissory note in connection with the sale of a vehicle or automobile is a vital document that establishes the terms of a financing agreement between the buyer and seller. Different types of promissory notes exist, including fixed installment, balloon, adjustable rate, secured, and unsecured promissory notes, each catering to specific circumstances and preferences of the parties involved.A Nampa Idaho promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a financing agreement between the buyer and seller. This note serves as an agreement to repay the loan amount in installments over a specified period of time. Keywords: Nampa Idaho, promissory note, sale of vehicle, sale of automobile, financing agreement, buyer, seller, terms and conditions, loan amount, installments, specified period of time. There are different types of Nampa Idaho promissory notes in connection with the sale of a vehicle or automobile. These types include: 1. Fixed Installment Promissory Note: This type of promissory note establishes fixed monthly or quarterly installments that the buyer agrees to pay over a defined repayment period. The interest rate is typically fixed, providing stability and predictability for both parties. 2. Balloon Promissory Note: A balloon promissory note involves smaller monthly installments throughout the loan term, but with a lump sum payment due at the end. The lump sum payment, also known as the balloon payment, is often larger than the previous installments and will include any outstanding balance. 3. Adjustable Rate Promissory Note: An adjustable rate promissory note stipulates that the interest rate on the loan may fluctuate based on market conditions. This type of note is commonly used when the seller offers a variable interest rate to the buyer. 4. Secured Promissory Note: A secured promissory note is backed by collateral, typically the vehicle being purchased. If the buyer defaults on the loan, the seller has the right to repossess and sell the vehicle to recover the remaining debt. 5. Unsecured Promissory Note: An unsecured promissory note does not require any collateral. While this type of note may be riskier for the seller, it allows for greater flexibility in the terms and conditions of the loan. In conclusion, a Nampa Idaho promissory note in connection with the sale of a vehicle or automobile is a vital document that establishes the terms of a financing agreement between the buyer and seller. Different types of promissory notes exist, including fixed installment, balloon, adjustable rate, secured, and unsecured promissory notes, each catering to specific circumstances and preferences of the parties involved.