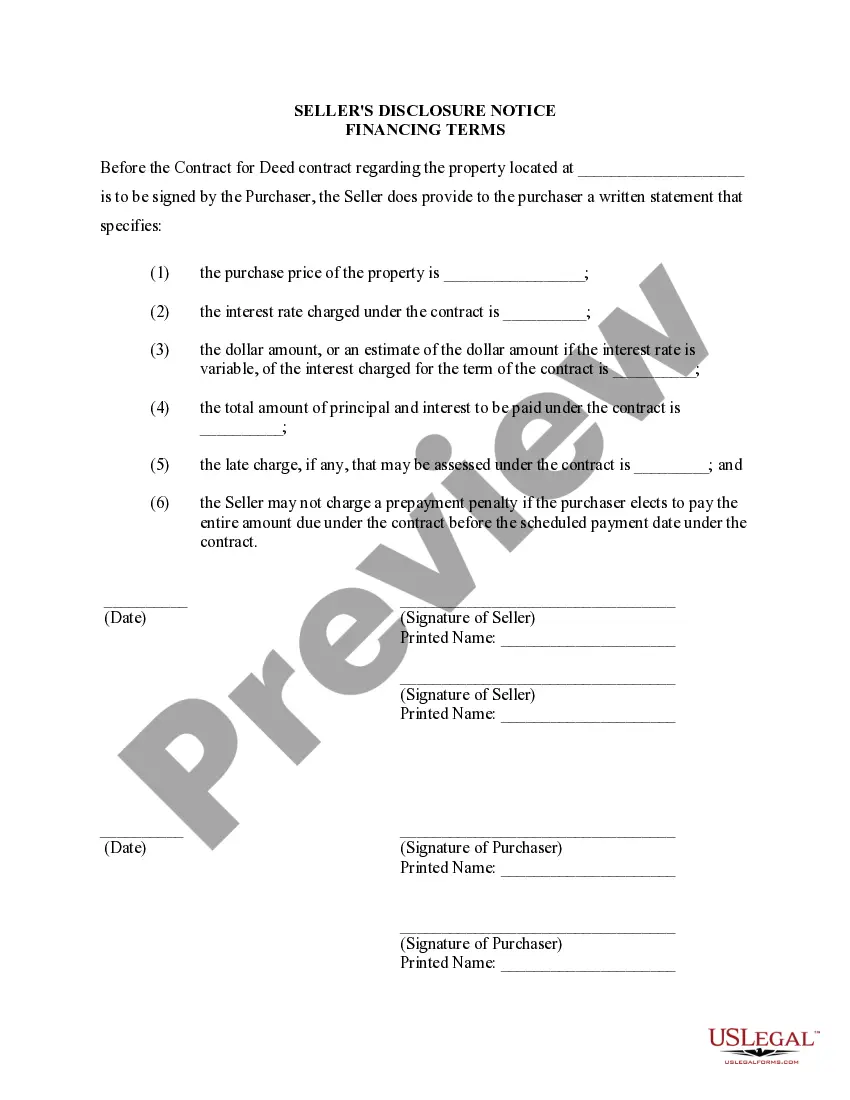

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

When entering into a Contract or Agreement for Deed, also known as a Land Contract, in Nampa, Idaho, it is important for sellers of residential properties to provide a detailed disclosure of financing terms to the buyer. This disclosure contains essential information regarding the financial aspects of the transaction, ensuring transparency and clarity for both parties involved. Here are the various types of Nampa Idaho Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed: 1. Principal Amount: The disclosure will specify the principal amount, which represents the total cost of the property being sold under the Land Contract. 2. Interest Rate: The disclosure will include the agreed-upon interest rate charged on the principal amount. This determines the cost of borrowing the funds over the duration of the Land Contract. 3. Payment Schedule: The disclosure will outline the payment schedule, including the frequency, due dates, and any late payment penalties. It provides clarity regarding the timing and amount of payments required from the buyer. 4. Duration: This aspect of the disclosure defines the length of the Land Contract. It specifies the number of years or months required for the buyer to complete the purchase and make full payment to the seller. 5. Down Payment: The disclosure may detail the required down payment, which represents the initial payment made by the buyer to secure the property. It may be expressed as a percentage of the principal amount or a fixed dollar amount. 6. Balloon Payment: In certain cases, the seller may structure the financing terms to include a balloon payment. This means that a large, final payment becomes due at a specified date, usually towards the end of the Land Contract. The disclosure will clearly state the amount and due date of the balloon payment, if applicable. 7. Prepayment Penalties: The disclosure may include information regarding any prepayment penalties imposed on the buyer if they decide to pay off the Land Contract earlier than the agreed-upon schedule. This clause protects the seller against financial losses resulting from early termination of the contract. 8. Default and Remedies: The disclosure will outline the consequences of defaulting on payments by the buyer, including late fees or penalties, potential acceleration of the remaining balance, or even foreclosure. It also includes remedies available to the seller in case of default. 9. Property Condition: Although not strictly related to financing terms, the disclosure might also include information about the current condition of the property. This section serves as a reminder to the buyer that they are purchasing the property in its current state, potentially with existing defects or issues. It is crucial for sellers in Nampa, Idaho, to provide a comprehensive Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed. This transparent document ensures that both parties have a clear understanding of the financial obligations and conditions of the Land Contract before entering into the agreement.When entering into a Contract or Agreement for Deed, also known as a Land Contract, in Nampa, Idaho, it is important for sellers of residential properties to provide a detailed disclosure of financing terms to the buyer. This disclosure contains essential information regarding the financial aspects of the transaction, ensuring transparency and clarity for both parties involved. Here are the various types of Nampa Idaho Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed: 1. Principal Amount: The disclosure will specify the principal amount, which represents the total cost of the property being sold under the Land Contract. 2. Interest Rate: The disclosure will include the agreed-upon interest rate charged on the principal amount. This determines the cost of borrowing the funds over the duration of the Land Contract. 3. Payment Schedule: The disclosure will outline the payment schedule, including the frequency, due dates, and any late payment penalties. It provides clarity regarding the timing and amount of payments required from the buyer. 4. Duration: This aspect of the disclosure defines the length of the Land Contract. It specifies the number of years or months required for the buyer to complete the purchase and make full payment to the seller. 5. Down Payment: The disclosure may detail the required down payment, which represents the initial payment made by the buyer to secure the property. It may be expressed as a percentage of the principal amount or a fixed dollar amount. 6. Balloon Payment: In certain cases, the seller may structure the financing terms to include a balloon payment. This means that a large, final payment becomes due at a specified date, usually towards the end of the Land Contract. The disclosure will clearly state the amount and due date of the balloon payment, if applicable. 7. Prepayment Penalties: The disclosure may include information regarding any prepayment penalties imposed on the buyer if they decide to pay off the Land Contract earlier than the agreed-upon schedule. This clause protects the seller against financial losses resulting from early termination of the contract. 8. Default and Remedies: The disclosure will outline the consequences of defaulting on payments by the buyer, including late fees or penalties, potential acceleration of the remaining balance, or even foreclosure. It also includes remedies available to the seller in case of default. 9. Property Condition: Although not strictly related to financing terms, the disclosure might also include information about the current condition of the property. This section serves as a reminder to the buyer that they are purchasing the property in its current state, potentially with existing defects or issues. It is crucial for sellers in Nampa, Idaho, to provide a comprehensive Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed. This transparent document ensures that both parties have a clear understanding of the financial obligations and conditions of the Land Contract before entering into the agreement.