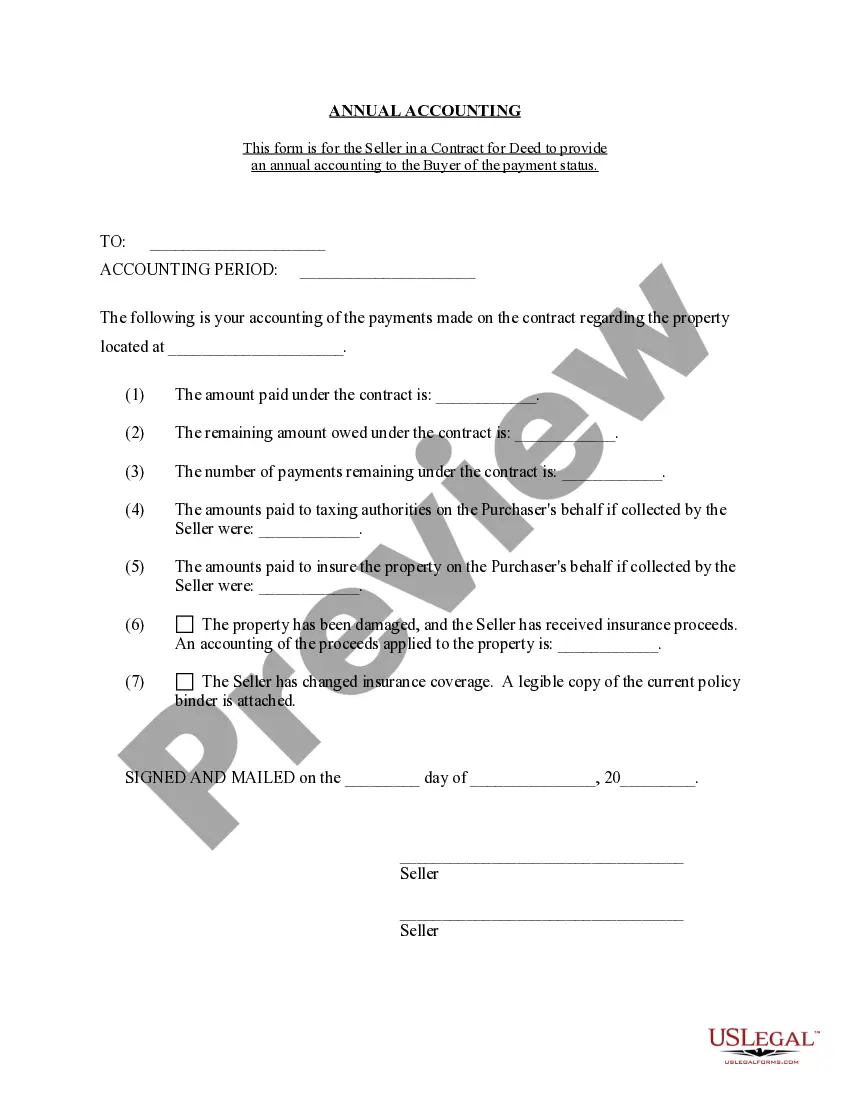

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Meridian Idaho Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial report prepared by the seller of a property sold under a contract for deed arrangement in the city of Meridian, Idaho. This statement outlines the financial transactions and details related to the contract throughout the year, providing transparency and accountability for both parties involved. Keywords: Meridian Idaho, contract for deed, seller, annual accounting statement, financial report, property, transactions, transparency, accountability Depending on the specific terms and conditions agreed upon between the buyer and seller, there can be variations in the types of Meridian Idaho Contract for Deed Seller's Annual Accounting Statement. Here are a few examples: 1. Basic Accounting Statement: This type of statement includes essential financial information such as the total amount paid by the buyer, any outstanding balance, interest calculations, and payments made towards property taxes and insurance. It provides a clear overview of the ongoing financial status of the contract for deed. 2. Detailed Expense Breakdown Statement: Unlike a basic accounting statement, this type of annual report provides a more detailed breakdown of expenses incurred by the seller related to the property. It includes specific descriptions and amounts for repairs, maintenance, property management fees, or any other expenses related to the property. 3. Income and Expense Statement: This statement focuses on both the income generated and expenses incurred by the seller throughout the year. It includes details of rental income from the property (if applicable) and deducts expenses such as property taxes, insurance, maintenance costs, and any other relevant expenses. This statement helps in assessing the profitability of the contract for deed. 4. Tax Reporting Statement: This type of statement specifically caters to tax requirements. It provides information on any tax deductions, property tax payments made by the seller, and other relevant tax-related details necessary for filing tax returns. These are just a few examples of the potential types of Meridian Idaho Contract for Deed Seller's Annual Accounting Statements. The specific format and content may vary based on the agreement between the buyer and seller, as well as the complexity of the contract for deed. It is essential for both parties involved to clearly define the structure and content of the statement to ensure transparency and avoid any potential disputes.The Meridian Idaho Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial report prepared by the seller of a property sold under a contract for deed arrangement in the city of Meridian, Idaho. This statement outlines the financial transactions and details related to the contract throughout the year, providing transparency and accountability for both parties involved. Keywords: Meridian Idaho, contract for deed, seller, annual accounting statement, financial report, property, transactions, transparency, accountability Depending on the specific terms and conditions agreed upon between the buyer and seller, there can be variations in the types of Meridian Idaho Contract for Deed Seller's Annual Accounting Statement. Here are a few examples: 1. Basic Accounting Statement: This type of statement includes essential financial information such as the total amount paid by the buyer, any outstanding balance, interest calculations, and payments made towards property taxes and insurance. It provides a clear overview of the ongoing financial status of the contract for deed. 2. Detailed Expense Breakdown Statement: Unlike a basic accounting statement, this type of annual report provides a more detailed breakdown of expenses incurred by the seller related to the property. It includes specific descriptions and amounts for repairs, maintenance, property management fees, or any other expenses related to the property. 3. Income and Expense Statement: This statement focuses on both the income generated and expenses incurred by the seller throughout the year. It includes details of rental income from the property (if applicable) and deducts expenses such as property taxes, insurance, maintenance costs, and any other relevant expenses. This statement helps in assessing the profitability of the contract for deed. 4. Tax Reporting Statement: This type of statement specifically caters to tax requirements. It provides information on any tax deductions, property tax payments made by the seller, and other relevant tax-related details necessary for filing tax returns. These are just a few examples of the potential types of Meridian Idaho Contract for Deed Seller's Annual Accounting Statements. The specific format and content may vary based on the agreement between the buyer and seller, as well as the complexity of the contract for deed. It is essential for both parties involved to clearly define the structure and content of the statement to ensure transparency and avoid any potential disputes.