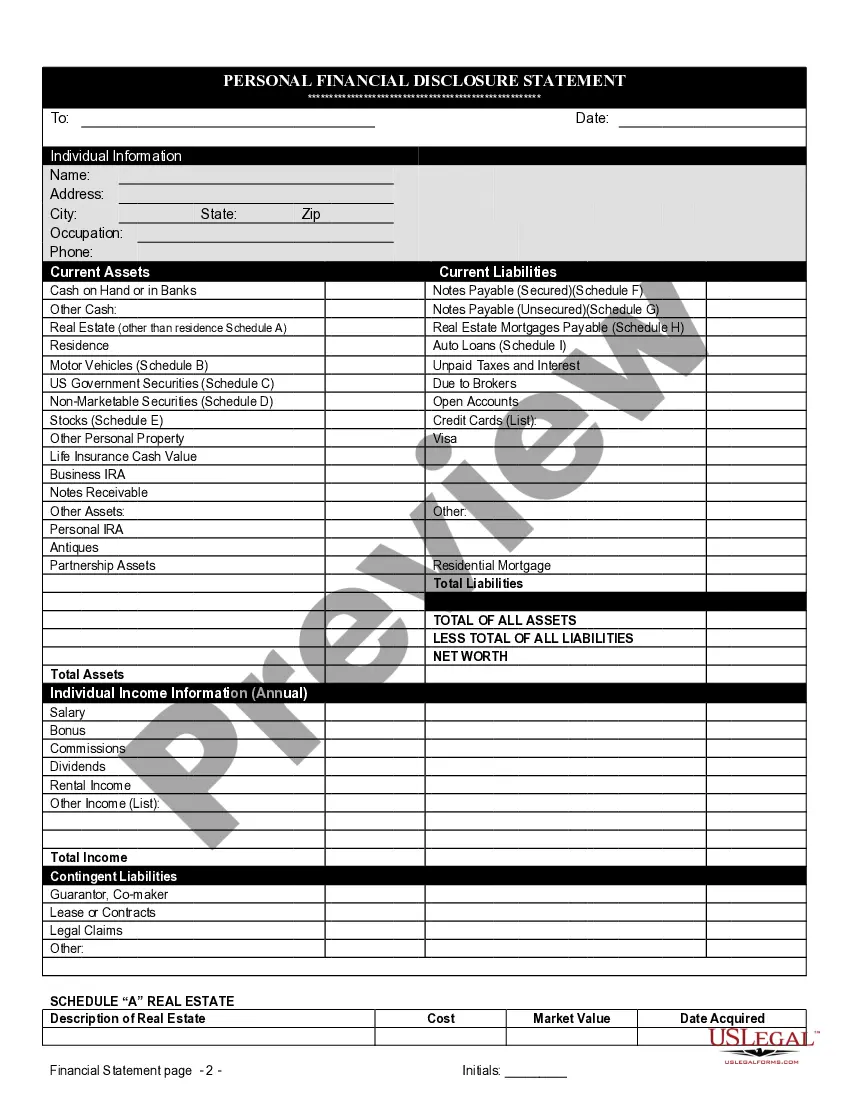

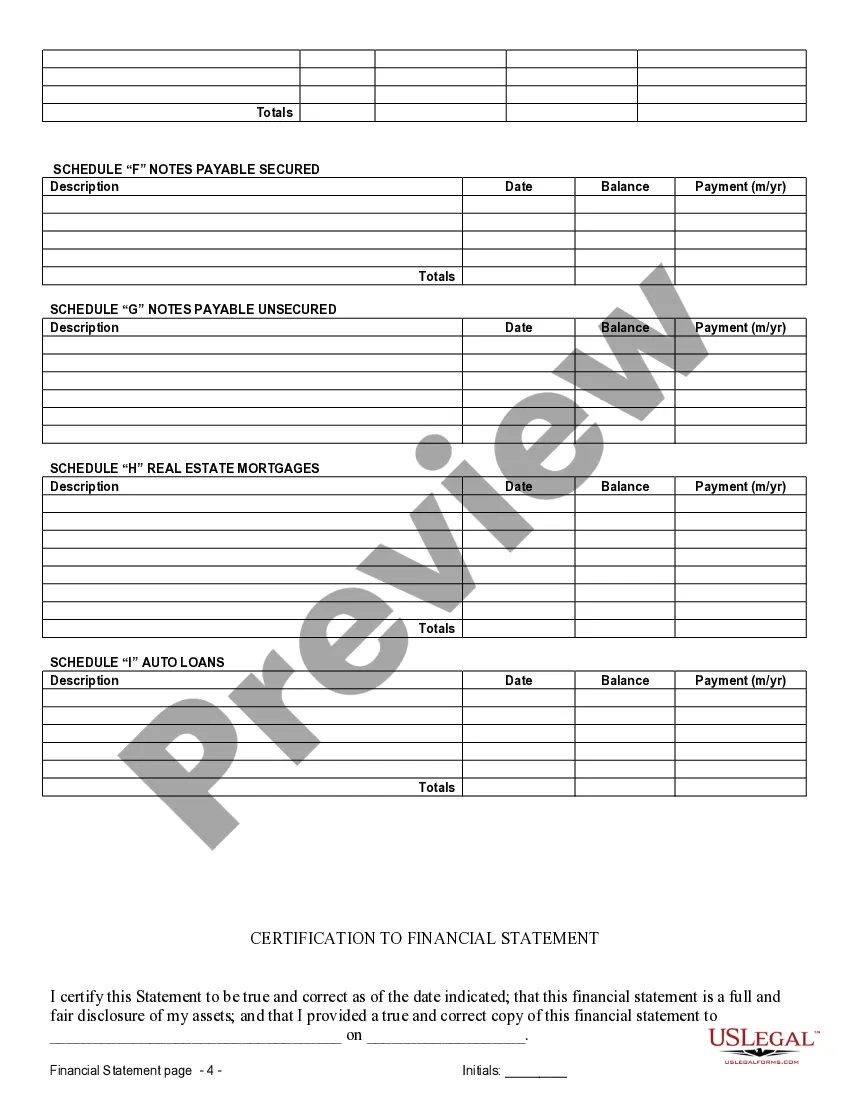

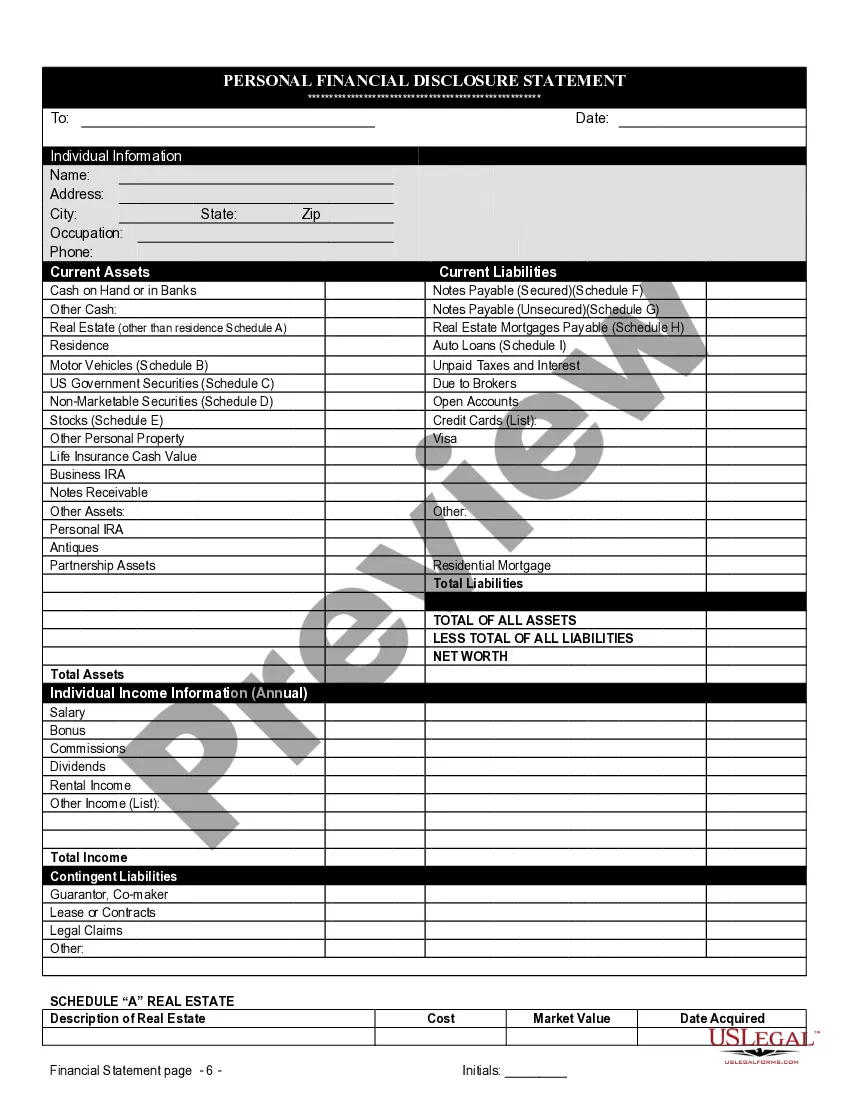

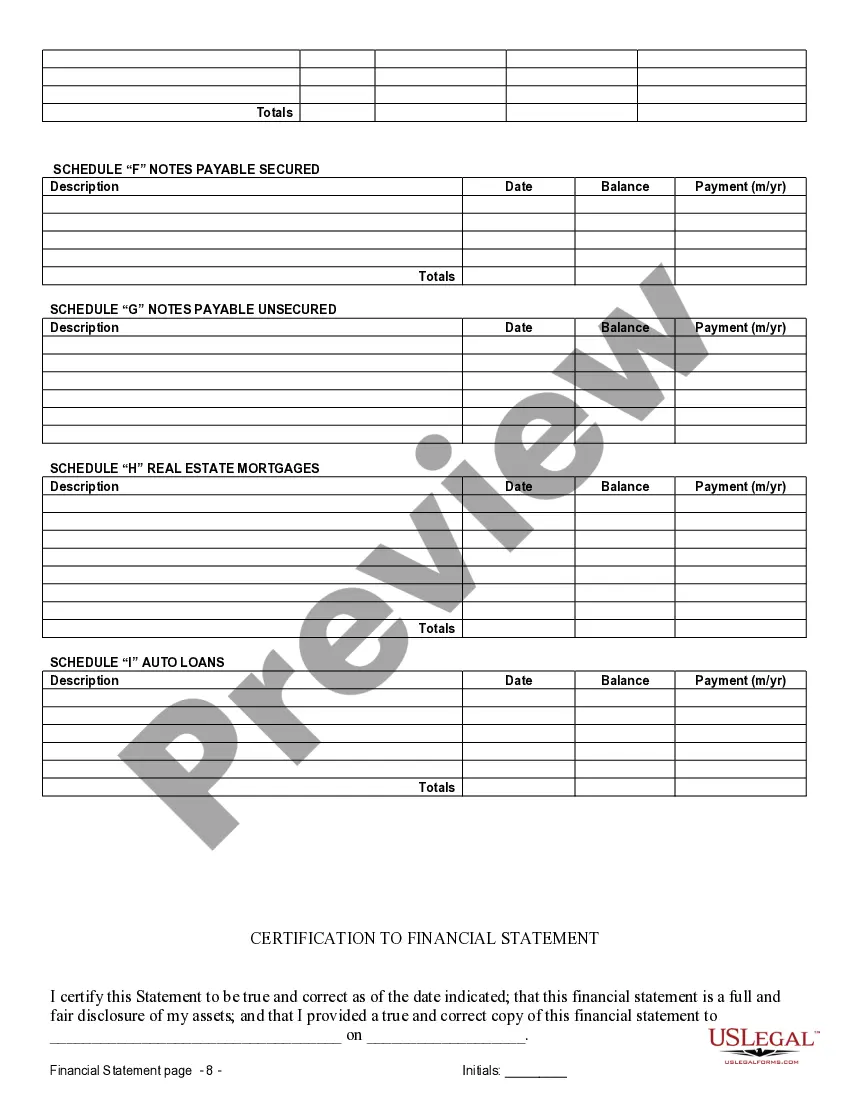

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

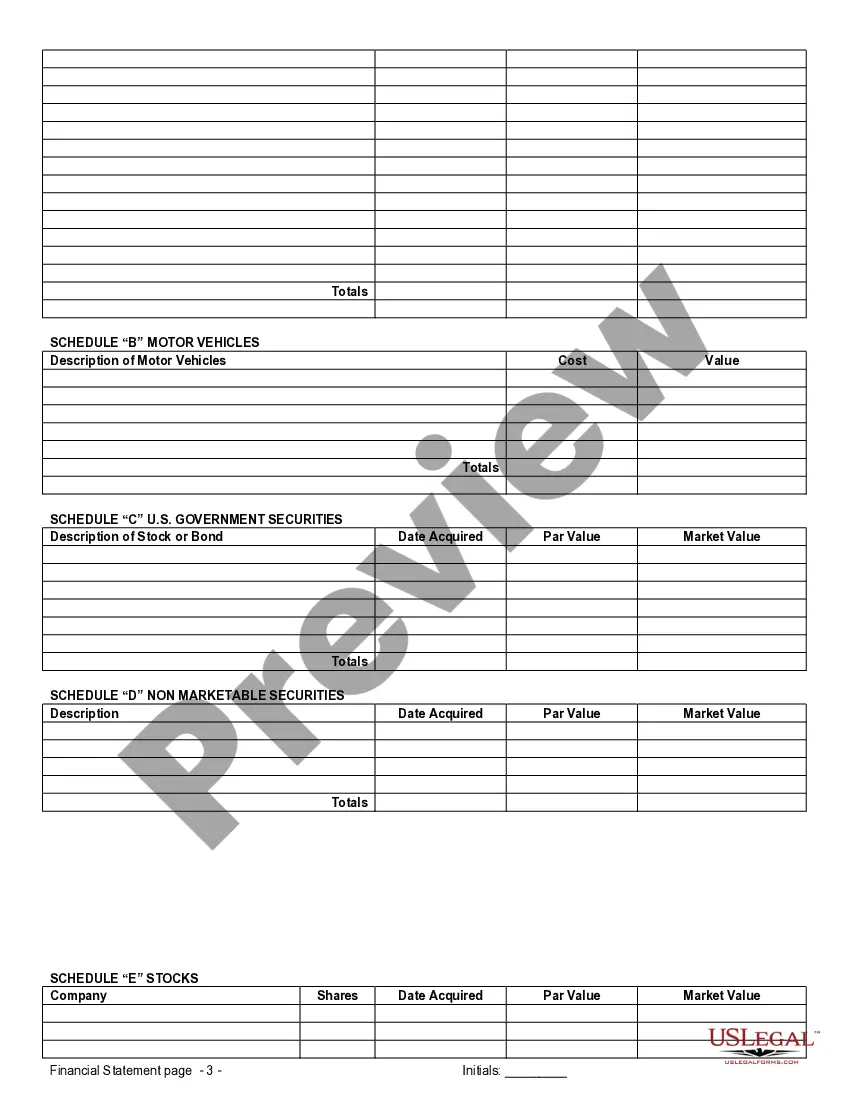

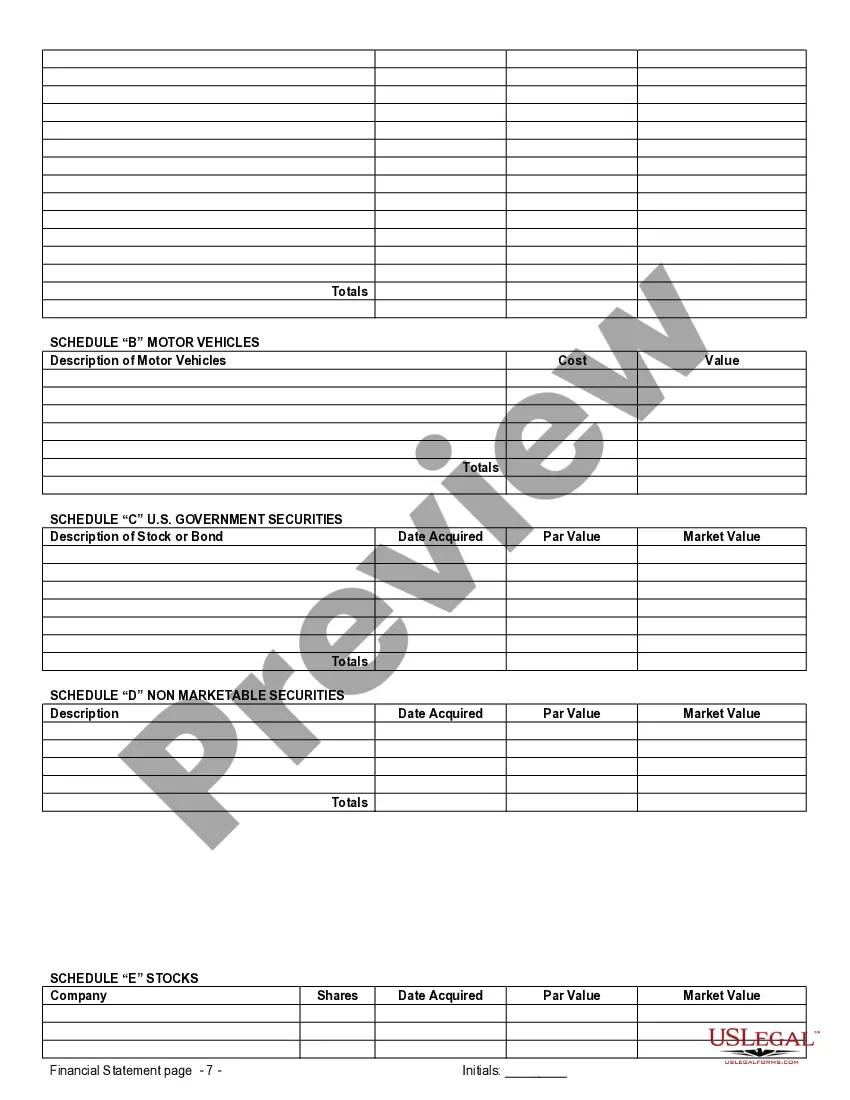

Nampa Idaho Financial Statements in Connection with Prenuptial Premarital Agreement — Detailed Description and Types In Nampa, Idaho, financial statements play a critical role in the context of prenuptial or premarital agreements. These agreements are legally binding documents entered into by couples before they get married. They outline the distribution of assets, debts, and other financial matters in the event of a divorce or separation. Financial statements are utilized to provide an accurate representation of the couple's financial situation, ensuring transparency and fairness during the agreement's creation. 1. Personal Financial Statements: Personal financial statements are a key component of a prenuptial agreement in Nampa, Idaho. These statements generally include detailed information about each spouse's income, expenses, assets, and liabilities. They provide a comprehensive overview of an individual's financial status and form the foundation for determining how the couple's finances will be managed in the future. 2. Balance Sheets: Balance sheets are vital financial statements used in connection with prenuptial agreements. They present an overview of an individual's assets, liabilities, and net worth. Balance sheets generally list assets such as real estate properties, vehicles, bank accounts, investments, and personal belongings, along with any associated debts or liabilities. 3. Income Statements: Income statements, also known as profit and loss statements, focus on an individual's income and expenses. These statements detail the sources of income, including employment salaries, bonuses, investments, rental income, or any other sources of revenue. Additionally, income statements list expenses such as rent/mortgage payments, utilities, insurance, debt payments, and other regular expenditures. 4. Tax Returns: Tax returns are crucial financial documents required in connection with prenuptial or premarital agreements. They provide detailed information about a person's income, deductions, credits, and tax obligations. Tax returns not only validate the accuracy and completeness of financial information but also help assess the tax implications of the prenuptial agreement. 5. Retirement Account Statements: For individuals with retirement accounts like 401(k)s or IRAs, providing statements related to these accounts within the prenuptial agreement is essential. These documents showcase the current value of the accounts, the contributions made, and any applicable plans for distribution in the event of a divorce or separation. 6. Business Financial Statements: If either or both individuals involved in the prenuptial agreement own a business, submitting business financial statements may be necessary. These statements include profit and loss statements, balance sheets, and cash flow statements related to the business. They provide an overview of the financial health of the business and may detail income generated, assets held, and debts owed. It is worth noting that the specific financial statements required for a prenuptial agreement may vary based on the unique circumstances of the individuals involved. Consulting with a qualified attorney specializing in family law in Nampa, Idaho, is crucial to determine which financial statements are necessary and to ensure compliance with local laws and regulations.Nampa Idaho Financial Statements in Connection with Prenuptial Premarital Agreement — Detailed Description and Types In Nampa, Idaho, financial statements play a critical role in the context of prenuptial or premarital agreements. These agreements are legally binding documents entered into by couples before they get married. They outline the distribution of assets, debts, and other financial matters in the event of a divorce or separation. Financial statements are utilized to provide an accurate representation of the couple's financial situation, ensuring transparency and fairness during the agreement's creation. 1. Personal Financial Statements: Personal financial statements are a key component of a prenuptial agreement in Nampa, Idaho. These statements generally include detailed information about each spouse's income, expenses, assets, and liabilities. They provide a comprehensive overview of an individual's financial status and form the foundation for determining how the couple's finances will be managed in the future. 2. Balance Sheets: Balance sheets are vital financial statements used in connection with prenuptial agreements. They present an overview of an individual's assets, liabilities, and net worth. Balance sheets generally list assets such as real estate properties, vehicles, bank accounts, investments, and personal belongings, along with any associated debts or liabilities. 3. Income Statements: Income statements, also known as profit and loss statements, focus on an individual's income and expenses. These statements detail the sources of income, including employment salaries, bonuses, investments, rental income, or any other sources of revenue. Additionally, income statements list expenses such as rent/mortgage payments, utilities, insurance, debt payments, and other regular expenditures. 4. Tax Returns: Tax returns are crucial financial documents required in connection with prenuptial or premarital agreements. They provide detailed information about a person's income, deductions, credits, and tax obligations. Tax returns not only validate the accuracy and completeness of financial information but also help assess the tax implications of the prenuptial agreement. 5. Retirement Account Statements: For individuals with retirement accounts like 401(k)s or IRAs, providing statements related to these accounts within the prenuptial agreement is essential. These documents showcase the current value of the accounts, the contributions made, and any applicable plans for distribution in the event of a divorce or separation. 6. Business Financial Statements: If either or both individuals involved in the prenuptial agreement own a business, submitting business financial statements may be necessary. These statements include profit and loss statements, balance sheets, and cash flow statements related to the business. They provide an overview of the financial health of the business and may detail income generated, assets held, and debts owed. It is worth noting that the specific financial statements required for a prenuptial agreement may vary based on the unique circumstances of the individuals involved. Consulting with a qualified attorney specializing in family law in Nampa, Idaho, is crucial to determine which financial statements are necessary and to ensure compliance with local laws and regulations.