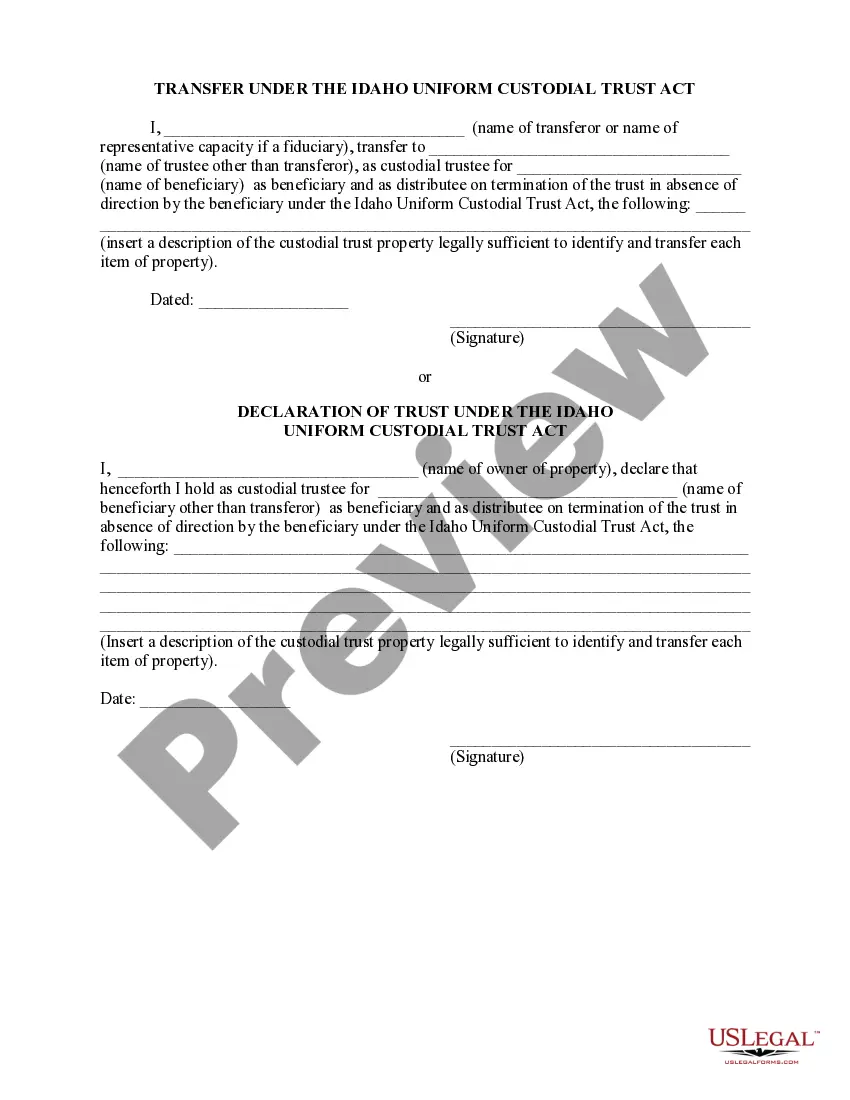

Nampa, Idaho is a city located in Canyon County, known for its vibrant community and various offerings. Nestled in the heart of the Treasure Valley, Nampa is a rapidly growing city with a population of approximately 99,277 residents. One of the key aspects of Nampa Idaho 68-1318 is its methods and forms for creating custodial trusts. Custodial trusts are crucial tools for managing and safeguarding assets for beneficiaries, typically minors or individuals who cannot directly handle their affairs. In Nampa, Idaho, specific regulations outlined in the statutes under section 68-1318 provide the legal framework for creating these custodial trusts. Understanding the methods and forms for establishing such trusts is essential for individuals seeking to secure and manage assets on behalf of beneficiaries. The primary method for creating custodial trusts in Nampa, Idaho, is through compliance with the guidelines stated in section 68-1318 of the state's legal statutes. This method ensures that the process remains legally valid and adheres to the necessary requirements. Individuals interested in establishing custodial trusts need to thoroughly familiarize themselves with these statutes to ensure that all legal obligations are met. Additionally, various forms are typically required when creating custodial trusts in Nampa, Idaho. These forms serve as crucial documentation, helping to establish the trust and outline its terms and conditions. Some commonly used forms may include but are not limited to: 1. Custodial Trust Agreement: This document outlines the specifics of the trust, including the assets to be held, the designated custodian, and the identified beneficiary. It also lays out the key terms and conditions governing the trust's administration and distribution. 2. Appointment of Custodian Form: This form designates an individual or entity to act as the custodian of the trust. The custodian is responsible for managing and protecting the assets held within the trust until the beneficiary reaches a specified age or specific conditions are met. 3. Beneficiary Designation Form: This form identifies the intended beneficiary of the custodial trust. It outlines the beneficiary's personal details, such as name, date of birth, and their relationship to the person establishing the trust. 4. Asset Inventory Form: This form provides a comprehensive list of the assets being transferred into the custodial trust. It includes details such as property descriptions, financial accounts, and any other relevant assets. It is important to note that while these forms are commonly used, specific requirements may vary based on individual circumstances and the preferences of legal counsel. Consulting with an experienced attorney specializing in estate planning and trusts can ensure compliance with Nampa, Idaho 68-1318 and provide customized solutions tailored to individual needs. In conclusion, Nampa, Idaho's 68-1318 statute governs the methods and forms for creating custodial trusts. These trusts play a vital role in the management and protection of assets for beneficiaries. Understanding the legal requirements and utilizing the appropriate forms is crucial to establish valid custodial trusts. By complying with these regulations, individuals can ensure the proper execution and administration of their custodial trusts in Nampa, Idaho.

Nampa Idaho 68-1318. Methods And Forms For Creating Custodial Trusts

Description

How to fill out Nampa Idaho 68-1318. Methods And Forms For Creating Custodial Trusts?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no law education to draft this sort of papers from scratch, mainly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge collection with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you want the Nampa Idaho 68-1318. Methods And Forms For Creating Custodial Trusts or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Nampa Idaho 68-1318. Methods And Forms For Creating Custodial Trusts in minutes using our trustworthy platform. If you are already a subscriber, you can go on and log in to your account to get the needed form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps prior to obtaining the Nampa Idaho 68-1318. Methods And Forms For Creating Custodial Trusts:

- Ensure the template you have found is specific to your location since the rules of one state or county do not work for another state or county.

- Preview the form and read a quick description (if provided) of scenarios the document can be used for.

- In case the one you selected doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Pick the payment method and proceed to download the Nampa Idaho 68-1318. Methods And Forms For Creating Custodial Trusts as soon as the payment is completed.

You’re all set! Now you can go on and print out the form or complete it online. If you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.