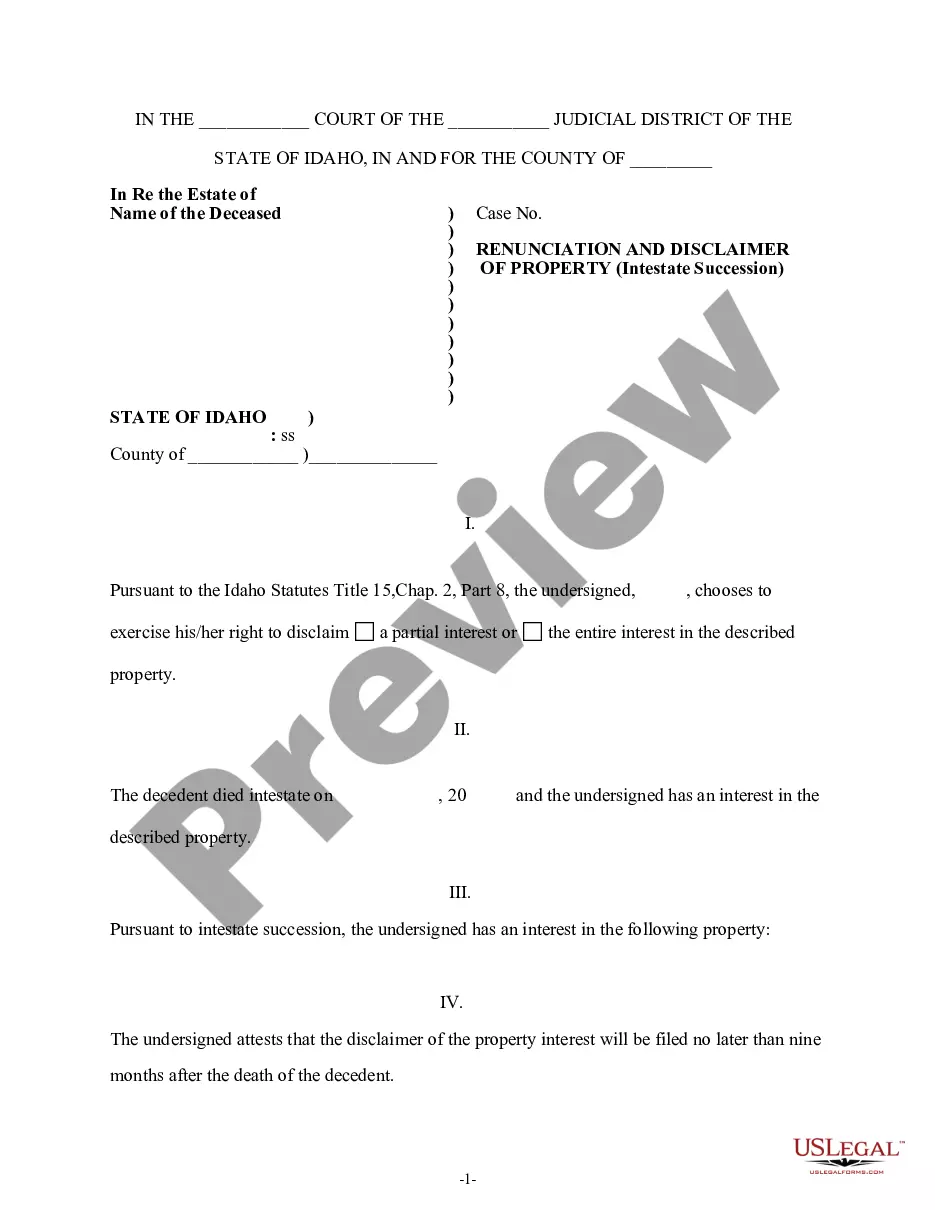

Idaho Renunciation and Disclaimer of Property received by Intestate Succession

Idaho Statutes

TITLE 15 UNIFORM PROBATE CODE

CHAPTER 2 INTESTATE SUCCESSION & ; WILLS

PART 8. GENERAL PROVISIONS

Renunciation.

(a)

(1) A person or the representative of an incapacitated

or unascertained person who is an heir, devisee, person succeeding to a

renounced interest, donee, beneficiary under a testamentary or nontestamentary

instrument, donee of a power of appointment, grantee, surviving joint owner

or surviving joint tenant, beneficiary of an insurance contract, person

designated to take pursuant to a power of appointment exercised by a testamentary

or nontestamentary instrument, or otherwise the recipient of any benefit

under a testamentary or nontestamentary instrument, may renounce in whole

or in part, powers, future interests, specific parts, fractional shares

or assets thereof by filing a written instrument within the time and at

the place hereinafter provided.

(2) The instrument shall: (i) describe the property or interest

renounced; (ii) be signed by the person renouncing; and (iii) declare the

renunciation and the extent thereof.

(3) The appropriate court may direct or permit a trustee under a

testamentary or nontestamentary instrument to renounce or to deviate from

any power of administration, management or allocation of benefit upon finding

that exercise of such power may defeat or impair the accomplishment of

the purposes of the trust whether by the imposition of tax or the

allocation of beneficial interest inconsistent with such purposes. Such

authority shall be exercised after hearing and upon notice to all

known persons beneficially interested in such trust or estate, in the manner

provided by this act.

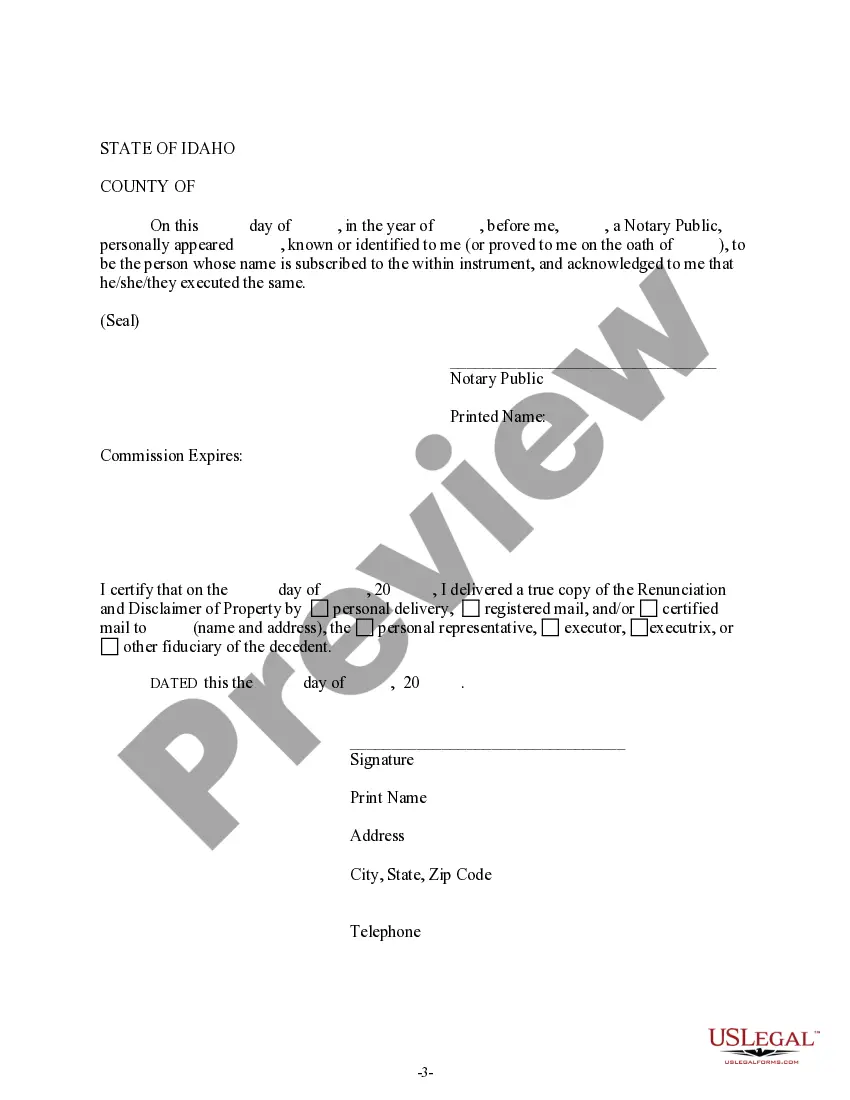

(b) The writing specified in subsection (a) of this section must be

filed within nine (9) months after the transfer or the death of the decedent,

or donee of the power, (whichever is the later) or, if the taker of the

property is not then finally ascertained, not later than nine (9) months

after the event that determines that the taker of the property or interest

is finally ascertained or his interest indefeasibly vested. The writing

must be filed in the court of the county where proceedings concerning the

decedent's estate are pending, or where they would be pending if commenced.

If an interest in real estate is renounced, a copy of the writing may also

be recorded in the office of the recorder in the county in which said real

estate lies. A copy of the writing also shall be delivered in person or

mailed by registered or certified mail to the personal representative of

the decedent, the trustee of any trust in which the interest renounced

exists, and no such personal representative, trustee, or person shall be

liable for any otherwise proper distribution or other disposition made

without actual notice of the renunciation.

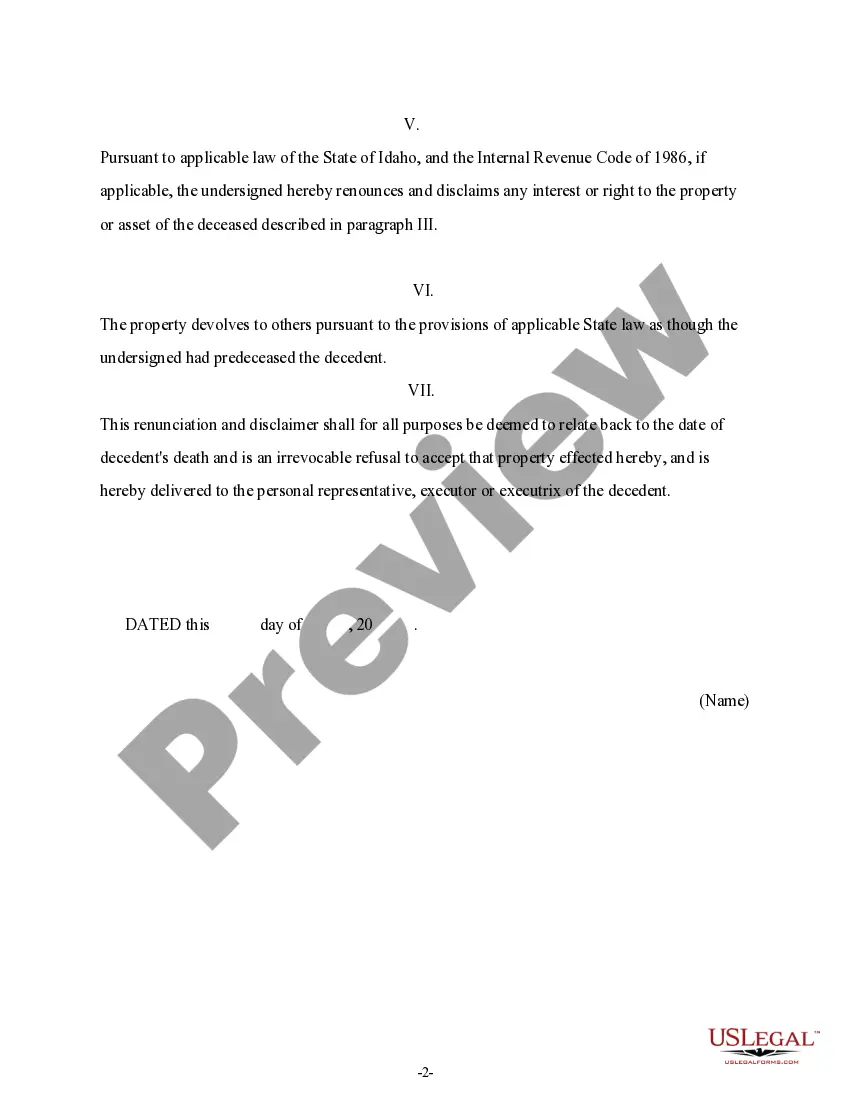

(c) Unless the decedent or donee of the power has otherwise indicated,

the property or interest renounced passes as if the person renouncing had

predeceased the decedent, or if the person renouncing is designated to

take under a power of appointment as if the person renouncing had predeceased

the donee of the power. A future interest that takes effect in possession

or enjoyment after the termination of the estate or interest renounced

takes effect as if the person renouncing had predeceased the decedent or

the

donee of the power. In every case the renunciation relates back for all

purposes to the date of death of the decedent or the donee, as the case

may be.

(d) The right to renounce property or an interest therein is barred

by: (1) assignment, conveyance, encumbrance, pledge or transfer of property

therein or any contract therefor; (2) written waiver of the right to renounce;

or (3) sale or other disposition of property pursuant to judicial process,

made before the renunciation is effective.

(e) The right to renounce granted by this section exists irrespective

of any limitation on the interest of the person renouncing in the nature

of a spendthrift provision or similar restriction.

(f) The renunciation or the written waiver of the right to renounce

is binding upon the person renouncing or person waiving and all persons

claiming through or under him.

(g) This section does not abridge the right of any person to assign,

convey, release, or renounce any property or an interest therein arising

under any other statute.

(h) An interest in property existing on the effective date of this

act as to which, if a present interest, the time for filing a renunciation

has not expired, or, if a future interest, the interest has not become

indefeasibly vested or the taker finally ascertained may be renounced within

nine (9) months after the effective date of this act.

(i) In clarification and amplification of subsection (a) (1) of

this section, and to make clear the existing terms thereof, a renunciation

may be made by an agent appointed under a power of attorney, by a conservator

or guardian on behalf of an incapacitated person, or by the personal representative

or administrator of a deceased person. The ability to renounce on behalf

of the person does not need to be specifically set forth in a power of

attorney if the power is general in nature.

Title 15, Chap. 2, Part 8, §15-2-801.