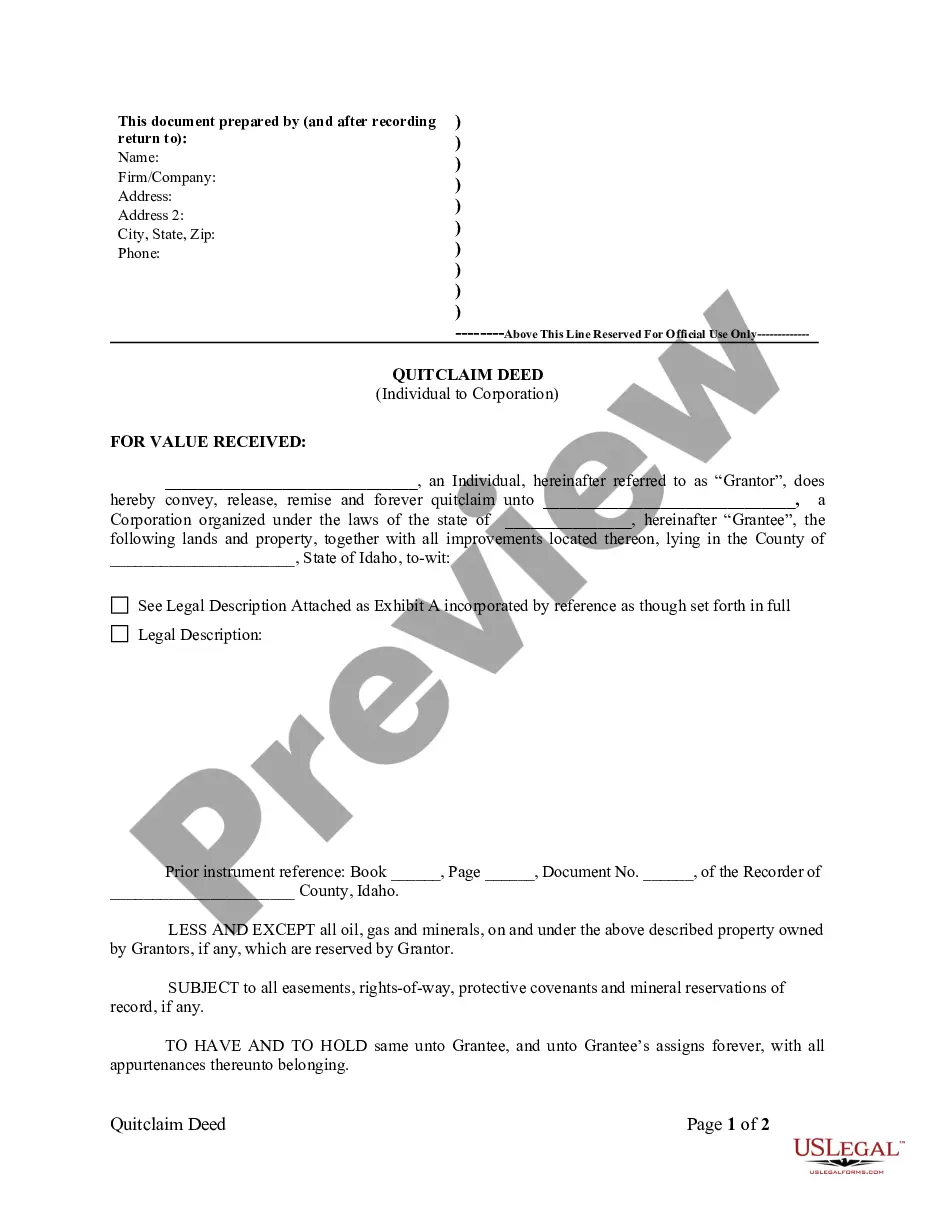

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Nampa Idaho Quitclaim Deed from Individual to Corporation is a legal document used to transfer the ownership of a property from an individual to a corporation in Nampa, Idaho. This type of deed is commonly utilized when an individual wants to transfer a property they own to a corporation, often for business or investment purposes. Key components of a Nampa Idaho Quitclaim Deed from Individual to Corporation include the names of the granter (individual transferring the property) and the grantee (corporation receiving the property), a clear description of the property being transferred, and the legal language indicating the transfer of ownership rights from the granter to the grantee. This deed type does not make any guarantees or warranties regarding the property's title, condition, or liens, unlike a warranty deed. Different variations of Nampa Idaho Quitclaim Deed from Individual to Corporation may include specific clauses or provisions tailored to meet the unique needs or requirements of the transfer. Some common variations include: 1. Nampa Idaho Quitclaim Deed with Financial Consideration: In this variation, the individual transferring the property to the corporation may receive financial consideration, such as cash or shares of stock in the corporation, as part of the transfer agreement. 2. Nampa Idaho Quitclaim Deed with Restrictive Covenants: This type of quitclaim deed may include additional clauses or provisions that impose certain restrictions on the use or future transfer of the property by the corporation. 3. Nampa Idaho Quitclaim Deed with Reverted Clause: A reverted clause specifies that if certain conditions are not met within a specified time frame, ownership of the property will automatically revert to the individual granter. 4. Nampa Idaho Quitclaim Deed for Tax Purposes: This variation may be used when the transfer from the individual to the corporation is primarily for tax planning or estate planning purposes, allowing for potential tax benefits or exemptions. It is crucial to consult with an attorney or legal expert familiar with Idaho real estate laws when preparing and executing a Nampa Idaho Quitclaim Deed from Individual to Corporation, as the specific requirements and regulations may vary.A Nampa Idaho Quitclaim Deed from Individual to Corporation is a legal document used to transfer the ownership of a property from an individual to a corporation in Nampa, Idaho. This type of deed is commonly utilized when an individual wants to transfer a property they own to a corporation, often for business or investment purposes. Key components of a Nampa Idaho Quitclaim Deed from Individual to Corporation include the names of the granter (individual transferring the property) and the grantee (corporation receiving the property), a clear description of the property being transferred, and the legal language indicating the transfer of ownership rights from the granter to the grantee. This deed type does not make any guarantees or warranties regarding the property's title, condition, or liens, unlike a warranty deed. Different variations of Nampa Idaho Quitclaim Deed from Individual to Corporation may include specific clauses or provisions tailored to meet the unique needs or requirements of the transfer. Some common variations include: 1. Nampa Idaho Quitclaim Deed with Financial Consideration: In this variation, the individual transferring the property to the corporation may receive financial consideration, such as cash or shares of stock in the corporation, as part of the transfer agreement. 2. Nampa Idaho Quitclaim Deed with Restrictive Covenants: This type of quitclaim deed may include additional clauses or provisions that impose certain restrictions on the use or future transfer of the property by the corporation. 3. Nampa Idaho Quitclaim Deed with Reverted Clause: A reverted clause specifies that if certain conditions are not met within a specified time frame, ownership of the property will automatically revert to the individual granter. 4. Nampa Idaho Quitclaim Deed for Tax Purposes: This variation may be used when the transfer from the individual to the corporation is primarily for tax planning or estate planning purposes, allowing for potential tax benefits or exemptions. It is crucial to consult with an attorney or legal expert familiar with Idaho real estate laws when preparing and executing a Nampa Idaho Quitclaim Deed from Individual to Corporation, as the specific requirements and regulations may vary.