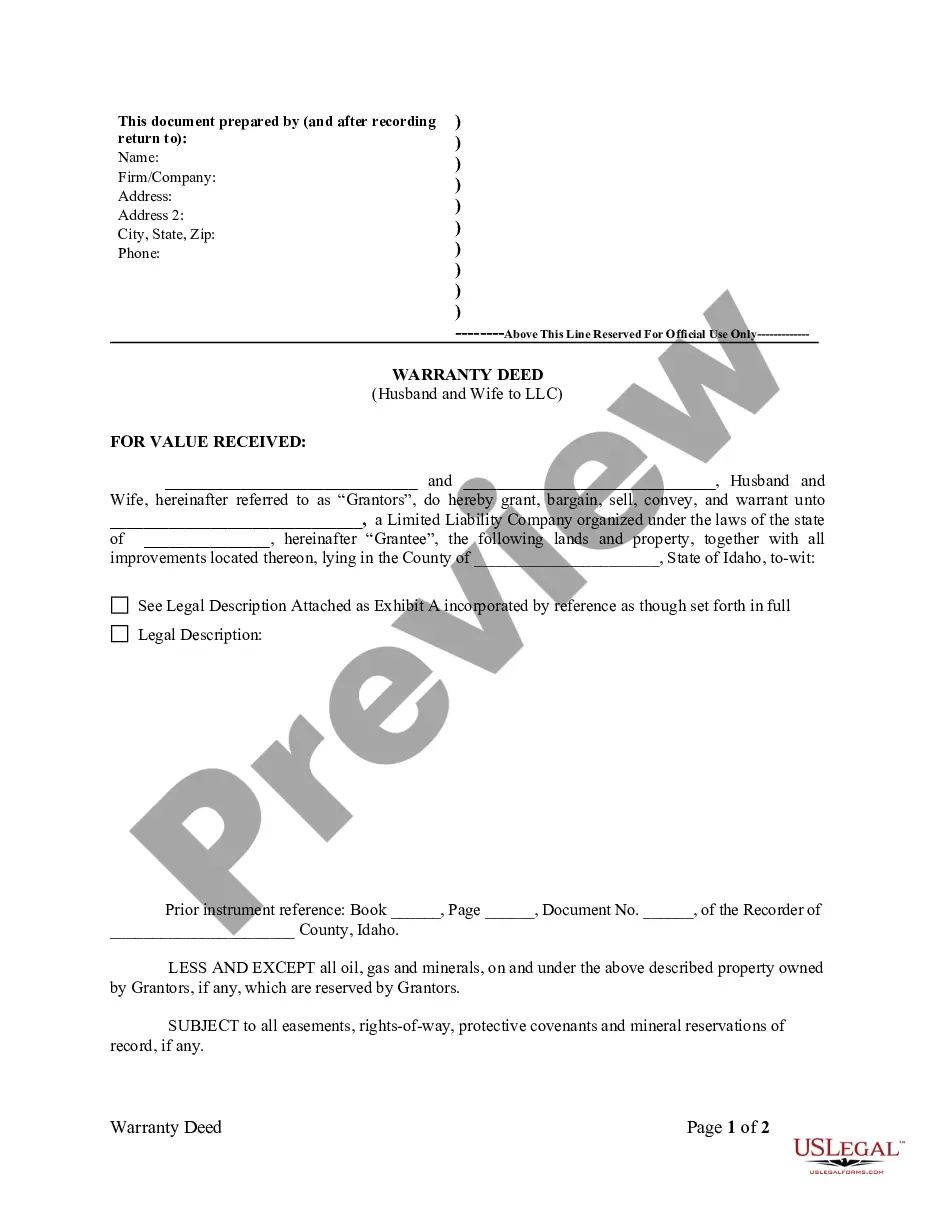

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

A Meridian Idaho Warranty Deed from Husband and Wife to LLC is a legal document that transfers property ownership from a married couple to a limited liability company (LLC) while providing specific warranties that protect the purchaser's interests. This type of deed is commonly used when a married couple wishes to transfer their property to an LLC, which allows for greater asset protection, tax advantages, and flexibility in managing the property. The Meridian Idaho Warranty Deed from Husband and Wife to LLC ensures that the LLC receives the property in its entirety, free from any encumbrances or claims, and with a guarantee that the sellers (husband and wife) have the legal authority to sell the property. This deed also ensures that the sellers will defend the LLC against any future claims that may arise regarding the property. There are different variations of the Meridian Idaho Warranty Deed from Husband and Wife to LLC, each serving specific purposes based on the circumstances of the property transfer. These variations include: 1. General Warranty Deed: This type of deed provides the broadest and strongest protection for the purchaser, as it guarantees the property's title against any claims or defects that may arise, even if they occurred before the sellers acquired the property. 2. Special Warranty Deed: With a special warranty deed, the sellers only guarantee that they have not caused any defects or claims to arise during their ownership period. This means that the purchaser may not have protection against previous defects or claims. 3. Quitclaim Deed: Unlike the warranty deed, a quitclaim deed offers no warranties or guarantees regarding the property's title. It simply transfers whatever interest the sellers have in the property to the LLC. This type of deed is less commonly used for real estate transactions where strong protection of the purchaser's interests is desired. It is essential for both the sellers and the LLC to consult with a qualified real estate attorney to ensure that the Meridian Idaho Warranty Deed from Husband and Wife to LLC accurately reflects their intentions and provides the necessary legal protections. This legal professional will guide them through the deed creation process, address any specific requirements related to Meridian Idaho laws, and ensure compliance with necessary legal formalities. By using a warranty deed, the married couple can effectively transfer their property to the LLC while safeguarding the purchaser's interests and enjoying the many benefits an LLC structure offers in managing and protecting the property.A Meridian Idaho Warranty Deed from Husband and Wife to LLC is a legal document that transfers property ownership from a married couple to a limited liability company (LLC) while providing specific warranties that protect the purchaser's interests. This type of deed is commonly used when a married couple wishes to transfer their property to an LLC, which allows for greater asset protection, tax advantages, and flexibility in managing the property. The Meridian Idaho Warranty Deed from Husband and Wife to LLC ensures that the LLC receives the property in its entirety, free from any encumbrances or claims, and with a guarantee that the sellers (husband and wife) have the legal authority to sell the property. This deed also ensures that the sellers will defend the LLC against any future claims that may arise regarding the property. There are different variations of the Meridian Idaho Warranty Deed from Husband and Wife to LLC, each serving specific purposes based on the circumstances of the property transfer. These variations include: 1. General Warranty Deed: This type of deed provides the broadest and strongest protection for the purchaser, as it guarantees the property's title against any claims or defects that may arise, even if they occurred before the sellers acquired the property. 2. Special Warranty Deed: With a special warranty deed, the sellers only guarantee that they have not caused any defects or claims to arise during their ownership period. This means that the purchaser may not have protection against previous defects or claims. 3. Quitclaim Deed: Unlike the warranty deed, a quitclaim deed offers no warranties or guarantees regarding the property's title. It simply transfers whatever interest the sellers have in the property to the LLC. This type of deed is less commonly used for real estate transactions where strong protection of the purchaser's interests is desired. It is essential for both the sellers and the LLC to consult with a qualified real estate attorney to ensure that the Meridian Idaho Warranty Deed from Husband and Wife to LLC accurately reflects their intentions and provides the necessary legal protections. This legal professional will guide them through the deed creation process, address any specific requirements related to Meridian Idaho laws, and ensure compliance with necessary legal formalities. By using a warranty deed, the married couple can effectively transfer their property to the LLC while safeguarding the purchaser's interests and enjoying the many benefits an LLC structure offers in managing and protecting the property.