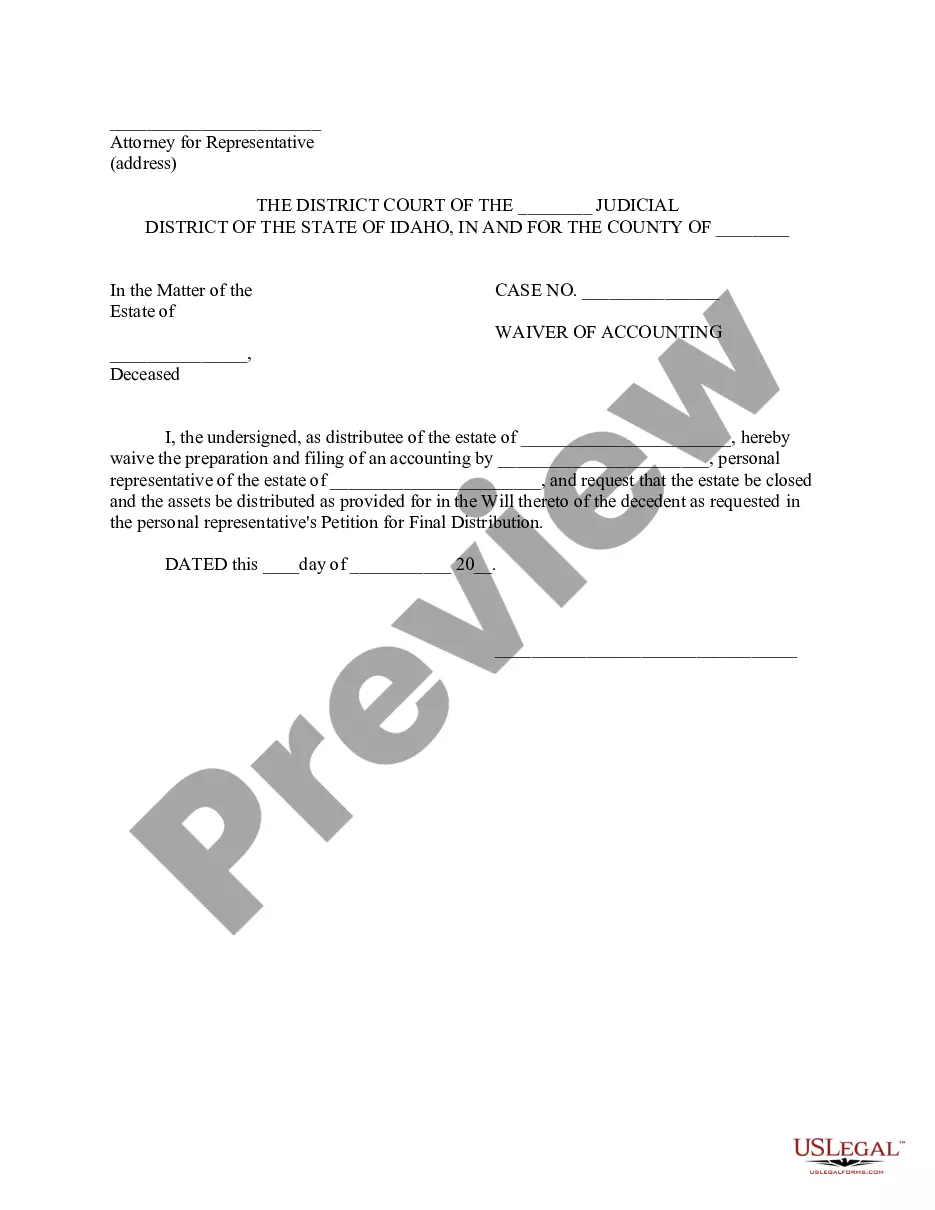

Waiver of Accounting: A Waiver of Accounting is filed by an heir to the estate. It states that he/she waives the right for an accounting of the estate's assets and debts, filed by the Personal Representaive. Instead, he/she states that the distribution of the assets, as provided for in the deceased's will, is acceptable. This form is available in both Word and Rich Text formats.

Meridian Idaho Waiver of Accounting is a legal document used in estate administration to expedite the distribution of assets to beneficiaries without the requirement of preparing a formal accounting report. It is typically executed by beneficiaries who have been provided with sufficient information about the estate's financial transactions and wish to forgo the detailed accounting process. The Meridian Idaho Waiver of Accounting relieves the estate executor or personal representative from the obligation of filing a detailed report with the probate court, thereby saving time and cost associated with preparing the accounting statement. This waiver is commonly employed when there is a high level of trust between the executor and beneficiaries, and there is no suspicion of mismanagement or fraud. By executing the Meridian Idaho Waiver of Accounting, beneficiaries acknowledge that they have received adequate information regarding the estate's income, expenses, and distribution of assets. They understand that they have the right to request a formal accounting if necessary, but choose to waive it to expedite the administration process. Although there are no specific types of Meridian Idaho Waiver of Accounting document, variations may exist in terms of language and format. Some write-ups may be tailored to address specific circumstances, such as when there are multiple beneficiaries with varying degrees of involvement or when there are complex or contentious assets involved. In conclusion, the Meridian Idaho Waiver of Accounting is a legal document that enables beneficiaries to waive the formal accounting requirement during estate administration. By doing so, they expedite the distribution of assets without the need for a detailed accounting report. This waiver is commonly used in cases where there is trust and transparency among the parties involved.