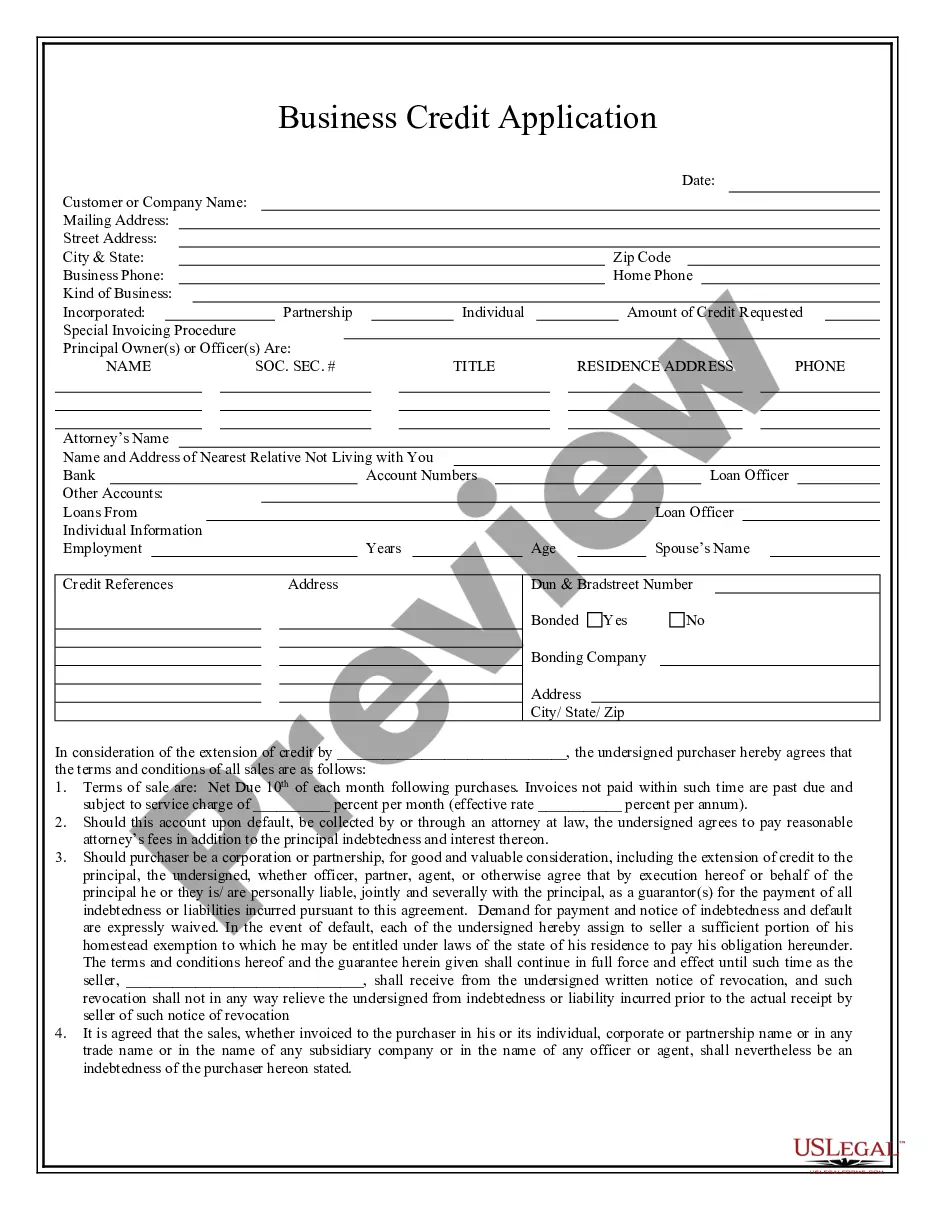

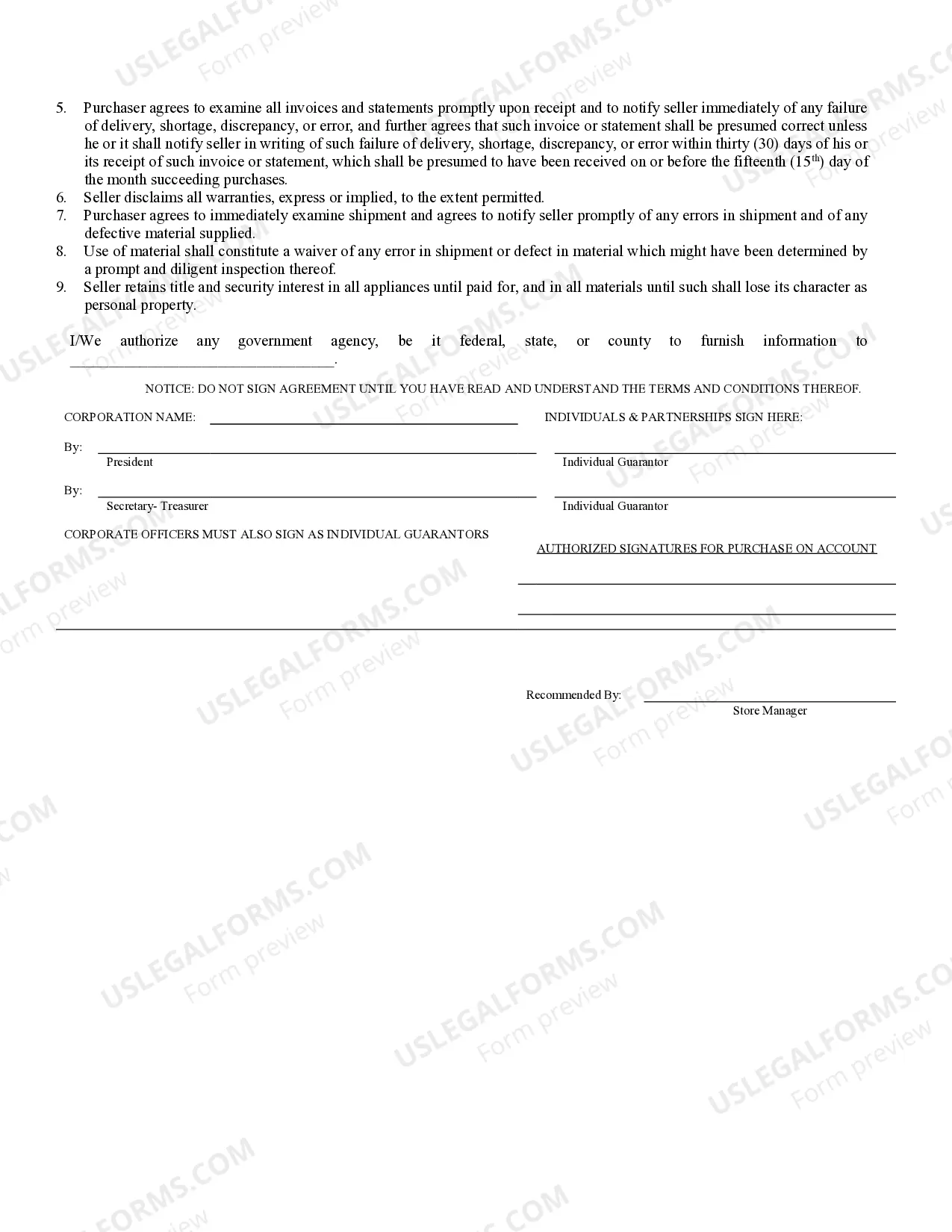

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Meridian Idaho Business Credit Application is a standard form utilized by businesses in Meridian, Idaho, to apply for credit from financial institutions or creditors. This application plays a significant role in facilitating the establishment of credit accounts designed specifically for businesses operating in the Meridian area. The Meridian Idaho Business Credit Application typically requests essential information required by financial institutions to evaluate the creditworthiness of a business. This includes the business's legal name, contact information, federal employer identification number (VEIN), and a detailed description of the nature of the business. Additionally, the application may require information about the business owner(s), such as their personal details, social security numbers, and previous business history. Financial details like annual revenues, ownership structure, and information about existing debt or credit lines may also be requested. The completion of a Meridian Idaho Business Credit Application enables financial institutions to assess the risk associated with extending credit to a business. Lenders may evaluate the business's credit history, financial statements, and other supporting documents to make an informed decision regarding credit approval and determine favorable credit terms, such as interest rates and credit limits. Different types of Meridian Idaho Business Credit Applications may exist depending on the institution or creditor offering the credit. These variations may involve specific requirements or additional sections tailored to the unique policies and procedures of the respective financial institution. It is crucial for businesses to carefully review each application's terms, conditions, and requirements to ensure that they satisfy the specific needs and guidelines of the lender. By diligently completing the Meridian Idaho Business Credit Application, businesses in Meridian gain the opportunity to establish credit accounts that can facilitate access to working capital, purchase essential equipment or inventory, and manage day-to-day business expenses. It is essential for businesses to maintain accurate and up-to-date financial records to enhance their creditworthiness and increase the chances of credit approval for future endeavors.Meridian Idaho Business Credit Application is a standard form utilized by businesses in Meridian, Idaho, to apply for credit from financial institutions or creditors. This application plays a significant role in facilitating the establishment of credit accounts designed specifically for businesses operating in the Meridian area. The Meridian Idaho Business Credit Application typically requests essential information required by financial institutions to evaluate the creditworthiness of a business. This includes the business's legal name, contact information, federal employer identification number (VEIN), and a detailed description of the nature of the business. Additionally, the application may require information about the business owner(s), such as their personal details, social security numbers, and previous business history. Financial details like annual revenues, ownership structure, and information about existing debt or credit lines may also be requested. The completion of a Meridian Idaho Business Credit Application enables financial institutions to assess the risk associated with extending credit to a business. Lenders may evaluate the business's credit history, financial statements, and other supporting documents to make an informed decision regarding credit approval and determine favorable credit terms, such as interest rates and credit limits. Different types of Meridian Idaho Business Credit Applications may exist depending on the institution or creditor offering the credit. These variations may involve specific requirements or additional sections tailored to the unique policies and procedures of the respective financial institution. It is crucial for businesses to carefully review each application's terms, conditions, and requirements to ensure that they satisfy the specific needs and guidelines of the lender. By diligently completing the Meridian Idaho Business Credit Application, businesses in Meridian gain the opportunity to establish credit accounts that can facilitate access to working capital, purchase essential equipment or inventory, and manage day-to-day business expenses. It is essential for businesses to maintain accurate and up-to-date financial records to enhance their creditworthiness and increase the chances of credit approval for future endeavors.