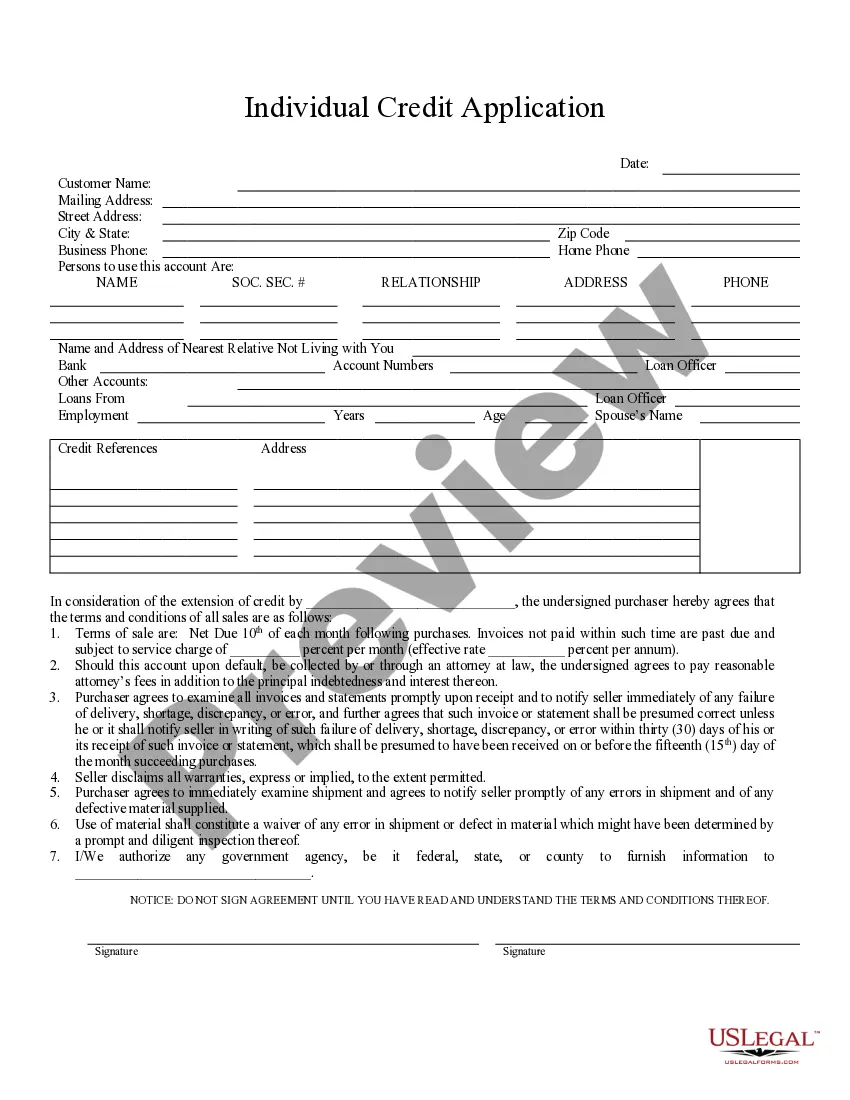

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Meridian Idaho Individual Credit Application is a vital process for individuals residing in Meridian, Idaho, who are seeking to obtain credit from financial institutions or lenders. This application serves as a comprehensive evaluation tool used by lenders to assess an individual's creditworthiness and financial stability before approving a credit request. The Meridian Idaho Individual Credit Application typically requires applicants to provide detailed personal and financial information. Key details may include the applicant's full name, contact information, social security number, employment history, current income, monthly expenses, and residential address history. Additionally, the application may also request information about the applicant's assets, liabilities, existing debts, and previous credit history. It is essential to accurately complete the Meridian Idaho Individual Credit Application to ensure a fair evaluation and enhance the likelihood of credit approval. Inaccurate or incomplete information may lead to delays or even rejection of the credit request. Different types of Meridian Idaho Individual Credit Applications may exist based on specific credit needs. Some examples include: 1. Mortgage Loan Application: This type of credit application is designed for individuals seeking to finance a new home or refinance an existing mortgage. It typically requires additional information related to the property being purchased or refinanced. 2. Auto Loan Application: Individuals interested in purchasing a new or used vehicle in Meridian, Idaho, would typically complete an auto loan application. This form may require details about the intended vehicle, such as make, model, year, and VIN number. 3. Personal Loan Application: For individuals in need of funds for personal reasons such as debt consolidation, home renovation, or medical expenses, a personal loan application is appropriate. This application focuses on the individual's financial situation and may not require the disclosure of specific collateral. 4. Credit Card Application: Individuals interested in obtaining a credit card can complete a specific credit card application. This application may emphasize credit history and existing debts, along with personal and financial information. It is important to note that each financial institution or lender may have its own unique Meridian Idaho Individual Credit Application. Therefore, it is essential to carefully review and comply with the requirements of the specific lender, ensuring all relevant fields are completed accurately and honestly. In conclusion, the Meridian Idaho Individual Credit Application is a crucial step for individuals residing in Meridian, Idaho, who seek to secure credit. By providing detailed personal and financial information, applicants increase their chances of obtaining credit from lenders for various purposes, such as mortgages, auto loans, personal loans, or credit cards.Meridian Idaho Individual Credit Application is a vital process for individuals residing in Meridian, Idaho, who are seeking to obtain credit from financial institutions or lenders. This application serves as a comprehensive evaluation tool used by lenders to assess an individual's creditworthiness and financial stability before approving a credit request. The Meridian Idaho Individual Credit Application typically requires applicants to provide detailed personal and financial information. Key details may include the applicant's full name, contact information, social security number, employment history, current income, monthly expenses, and residential address history. Additionally, the application may also request information about the applicant's assets, liabilities, existing debts, and previous credit history. It is essential to accurately complete the Meridian Idaho Individual Credit Application to ensure a fair evaluation and enhance the likelihood of credit approval. Inaccurate or incomplete information may lead to delays or even rejection of the credit request. Different types of Meridian Idaho Individual Credit Applications may exist based on specific credit needs. Some examples include: 1. Mortgage Loan Application: This type of credit application is designed for individuals seeking to finance a new home or refinance an existing mortgage. It typically requires additional information related to the property being purchased or refinanced. 2. Auto Loan Application: Individuals interested in purchasing a new or used vehicle in Meridian, Idaho, would typically complete an auto loan application. This form may require details about the intended vehicle, such as make, model, year, and VIN number. 3. Personal Loan Application: For individuals in need of funds for personal reasons such as debt consolidation, home renovation, or medical expenses, a personal loan application is appropriate. This application focuses on the individual's financial situation and may not require the disclosure of specific collateral. 4. Credit Card Application: Individuals interested in obtaining a credit card can complete a specific credit card application. This application may emphasize credit history and existing debts, along with personal and financial information. It is important to note that each financial institution or lender may have its own unique Meridian Idaho Individual Credit Application. Therefore, it is essential to carefully review and comply with the requirements of the specific lender, ensuring all relevant fields are completed accurately and honestly. In conclusion, the Meridian Idaho Individual Credit Application is a crucial step for individuals residing in Meridian, Idaho, who seek to secure credit. By providing detailed personal and financial information, applicants increase their chances of obtaining credit from lenders for various purposes, such as mortgages, auto loans, personal loans, or credit cards.