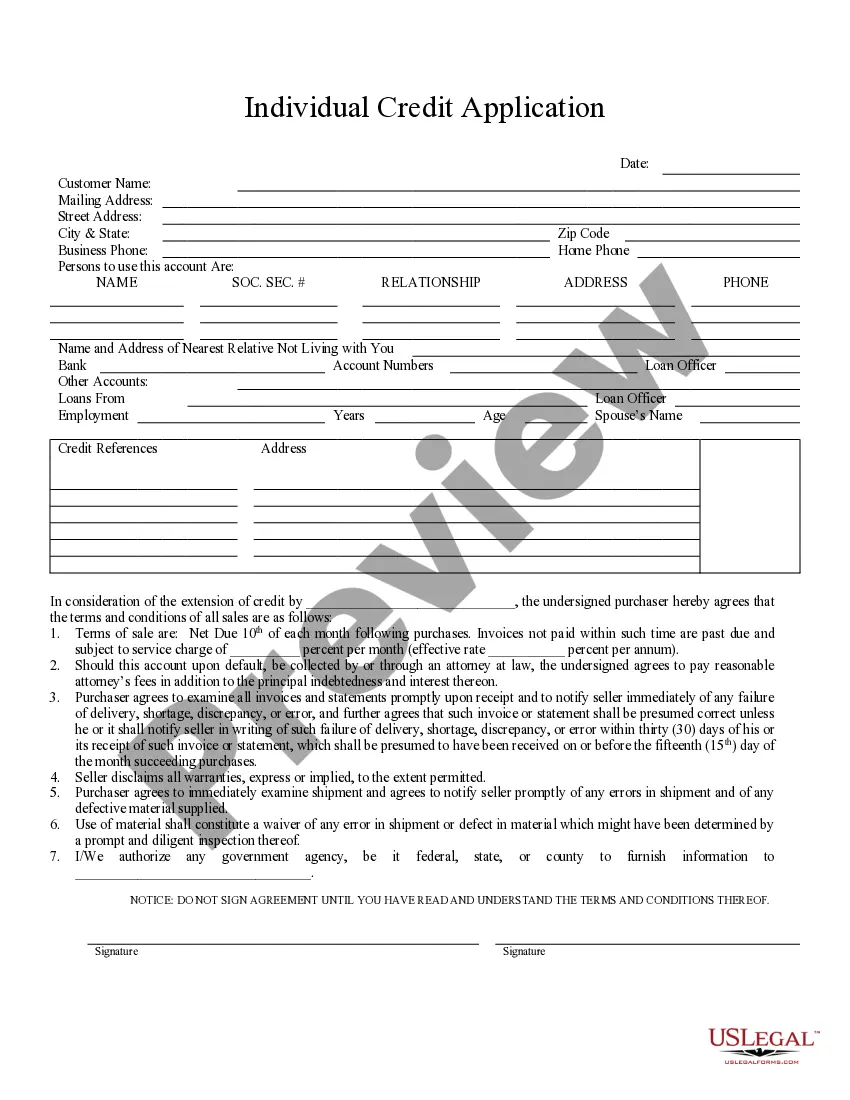

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Nampa Idaho Individual Credit Application is a comprehensive and detailed form that individuals in Nampa, Idaho can complete to apply for credit from various institutions. This application is specifically designed to assess an individual's creditworthiness and financial stability. It contains several sections that gather personal and financial information, allowing lenders in Nampa to make informed decisions regarding extending credit. The Nampa Idaho Individual Credit Application typically includes the following sections: 1. Personal Information: This section requires applicants to provide their full name, contact details (address, phone number, email), social security number, date of birth, and other identification details. This information helps lenders in verifying the applicant's identity. 2. Employment Information: Here, applicants are required to state their current employer's name, address, and contact information. They may also need to provide details such as their job title, years of employment, and monthly or annual income. Lenders evaluate this information to assess the applicant's ability to repay the loan. 3. Financial Information: This section gathers details about the applicant's financial position, including their bank account information, assets (such as property, vehicles, or investments), liabilities (loans, mortgages, credit card debts), and monthly expenses. This information helps lenders evaluate the applicant's capacity to handle additional credit obligations. 4. Credit History: In this section, applicants are expected to disclose their credit history, including any outstanding debts, bankruptcies, foreclosures, or late payments. Lenders thoroughly examine this section to determine the applicant's creditworthiness and evaluate the risk involved in extending credit. 5. References: Applicants may be asked to provide personal or professional references who can vouch for their character and reliability. These references may be contacted by lenders to obtain additional information about the applicant's creditworthiness. 6. Purpose of Loan: This section requires the applicant to specify the purpose of the loan or credit they are seeking. This information helps lenders understand the applicant's intentions and assess the suitability of granting credit for the stated purpose. It is important to note that while the Nampa Idaho Individual Credit Application is a general term, there may be various specific credit applications available for different purposes or types of credit. These can include but are not limited to: — Nampa Idaho Auto Loan Credit Application: Specifically for individuals seeking credit to finance the purchase of a vehicle. — Nampa Idaho Mortgage Credit Application: Designed for those applying for credit to buy or refinance a home. — Nampa Idaho Personal Loan Credit Application: Tailored for individuals seeking credit for personal reasons such as debt consolidation, medical expenses, or home improvements. Completing the Nampa Idaho Individual Credit Application accurately and thoroughly is crucial, as any incomplete or misleading information could negatively impact the credit decision. It is advisable to read and understand all instructions provided with the application and ensure that the form is filled out with accuracy and honesty.Nampa Idaho Individual Credit Application is a comprehensive and detailed form that individuals in Nampa, Idaho can complete to apply for credit from various institutions. This application is specifically designed to assess an individual's creditworthiness and financial stability. It contains several sections that gather personal and financial information, allowing lenders in Nampa to make informed decisions regarding extending credit. The Nampa Idaho Individual Credit Application typically includes the following sections: 1. Personal Information: This section requires applicants to provide their full name, contact details (address, phone number, email), social security number, date of birth, and other identification details. This information helps lenders in verifying the applicant's identity. 2. Employment Information: Here, applicants are required to state their current employer's name, address, and contact information. They may also need to provide details such as their job title, years of employment, and monthly or annual income. Lenders evaluate this information to assess the applicant's ability to repay the loan. 3. Financial Information: This section gathers details about the applicant's financial position, including their bank account information, assets (such as property, vehicles, or investments), liabilities (loans, mortgages, credit card debts), and monthly expenses. This information helps lenders evaluate the applicant's capacity to handle additional credit obligations. 4. Credit History: In this section, applicants are expected to disclose their credit history, including any outstanding debts, bankruptcies, foreclosures, or late payments. Lenders thoroughly examine this section to determine the applicant's creditworthiness and evaluate the risk involved in extending credit. 5. References: Applicants may be asked to provide personal or professional references who can vouch for their character and reliability. These references may be contacted by lenders to obtain additional information about the applicant's creditworthiness. 6. Purpose of Loan: This section requires the applicant to specify the purpose of the loan or credit they are seeking. This information helps lenders understand the applicant's intentions and assess the suitability of granting credit for the stated purpose. It is important to note that while the Nampa Idaho Individual Credit Application is a general term, there may be various specific credit applications available for different purposes or types of credit. These can include but are not limited to: — Nampa Idaho Auto Loan Credit Application: Specifically for individuals seeking credit to finance the purchase of a vehicle. — Nampa Idaho Mortgage Credit Application: Designed for those applying for credit to buy or refinance a home. — Nampa Idaho Personal Loan Credit Application: Tailored for individuals seeking credit for personal reasons such as debt consolidation, medical expenses, or home improvements. Completing the Nampa Idaho Individual Credit Application accurately and thoroughly is crucial, as any incomplete or misleading information could negatively impact the credit decision. It is advisable to read and understand all instructions provided with the application and ensure that the form is filled out with accuracy and honesty.