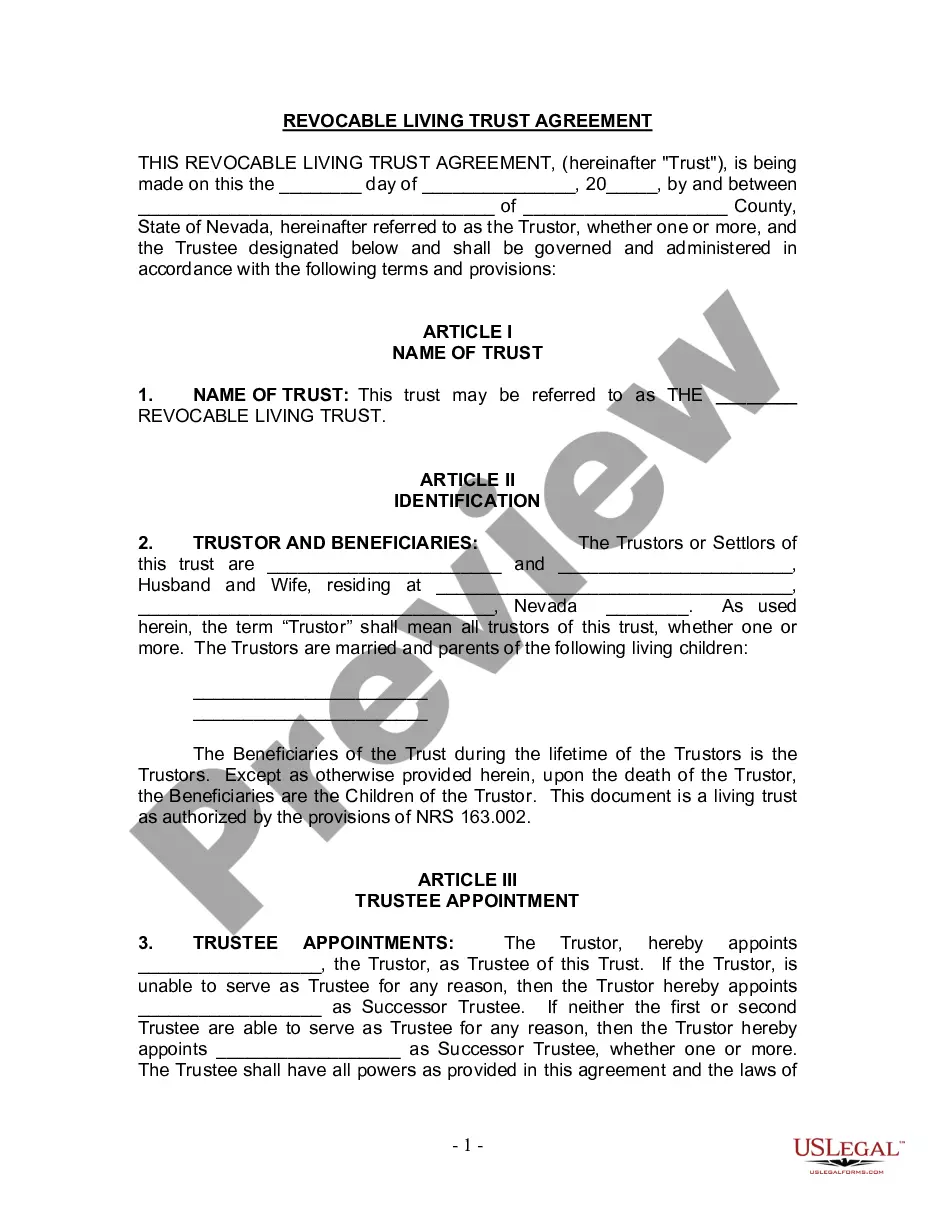

The Nampa Idaho Chapter 13 Plan refers to a specific bankruptcy plan available to individuals residing in Nampa, Idaho who are seeking debt relief and financial restructuring. This plan falls under Chapter 13 of the United States Bankruptcy Code, which allows individuals with regular income to create a manageable payment plan to repay their debts over a period of three to five years. Unlike Chapter 7 bankruptcy, where eligible assets may be liquidated to repay creditors, Chapter 13 bankruptcy provides a resourceful option for debtors to retain their assets while repaying their debts through a court-approved repayment plan. The Nampa Idaho Chapter 13 Plan offers a structured framework for debtors to resolve their financial difficulties and regain control over their finances. One of the key benefits of the Nampa Idaho Chapter 13 Plan is that it allows debtors to catch up on their mortgage payments and avoid foreclosure on their homes. This can be especially beneficial for individuals who have fallen behind on mortgage payments and are at risk of losing their homes. By incorporating past due mortgage payments into the repayment plan, debtors can gradually bring their mortgage arrears up to date, effectively saving their homes. Another advantage of the Nampa Idaho Chapter 13 Plan is its ability to consolidate and manage various types of debts, including credit card debt, medical bills, personal loans, and more. Debtors can propose a repayment plan tailored to their unique financial circumstances, taking into account their income and reasonable living expenses. It is important to note that there are no distinct types of Chapter 13 plans specific to Nampa, Idaho. However, debtors can customize their repayment plans based on their individual needs and the amount of disposable income available to them. The court will review and approve the proposed plan, ensuring it meets the necessary requirements set by the Bankruptcy Code. In summary, the Nampa Idaho Chapter 13 Plan provides individuals with a viable solution to manage their debts, catch up on mortgage payments, and retain their assets. By formulating a repayment plan suited to their financial situation, debtors can gradually repay their debts over a specified period while maintaining a reasonable standard of living.

Nampa Idaho Chapter 13 Plan

Description

How to fill out Nampa Idaho Chapter 13 Plan?

If you are looking for a relevant form, it’s impossible to choose a better service than the US Legal Forms site – one of the most extensive libraries on the internet. With this library, you can find a large number of document samples for organization and individual purposes by types and states, or keywords. With our high-quality search option, discovering the latest Nampa Idaho Chapter 13 Plan is as elementary as 1-2-3. Furthermore, the relevance of each and every file is proved by a team of skilled lawyers that on a regular basis check the templates on our platform and revise them according to the most recent state and county regulations.

If you already know about our system and have an account, all you need to receive the Nampa Idaho Chapter 13 Plan is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the sample you want. Look at its explanation and use the Preview function (if available) to explore its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to find the proper file.

- Affirm your decision. Choose the Buy now button. After that, pick your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Indicate the format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the acquired Nampa Idaho Chapter 13 Plan.

Each form you add to your user profile does not have an expiration date and is yours forever. You can easily gain access to them via the My Forms menu, so if you want to receive an additional duplicate for enhancing or creating a hard copy, feel free to come back and download it again whenever you want.

Make use of the US Legal Forms professional catalogue to gain access to the Nampa Idaho Chapter 13 Plan you were seeking and a large number of other professional and state-specific samples on a single website!

Form popularity

FAQ

When you complete your Chapter 13 repayment plan, you'll receive a discharge order that will wipe out the remaining balance of qualifying debt. In fact, a Chapter 13 bankruptcy discharge is even broader than a Chapter 7 discharge because it wipes out certain debts that aren't nondischargeable in Chapter 7 bankruptcy.

Plan confirmation serves as a formal approval of your plan. It locks it in stone so-to-speak. This is a big milestone in Chapter 13 because you normally get certain privileges back when your plan is confirmed. You can start rebuilding your credit, for example. It also makes it easier to get a new car.

As noted earlier, only the debtor may file a plan of reorganization during the first 120-day period after the petition is filed (or after entry of the order for relief, if an involuntary petition was filed). The court may grant extension of this exclusive period up to 18 months after the petition date.

CHAPTER 13 BANKRUPTCY If you have a month where you receive an unexpected lump sum or windfall, you must pay the lump sum in to the bankruptcy as well. Just like in Chapter 7 Bankruptcy, however, you get to keep whatever you win after the creditors are paid off.

Success Rate for Chapter 13 Bankruptcy Consumers should be aware that there is less than 50-50 chance filing for Chapter 13 bankruptcy will be successful, according to a study done by the American Bankruptcy Institute (ABI).

Firstly, all Chapter 13 payment plans must repay all priority claims and administrative expenses in full. These types of debts include taxes, child support, alimony, attorneys' fees and court costs.

A 100% plan is a Chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. It is required to pay back all secured debt and 100% of all unsecured debt.

If you want, any case can be 60 months, which is the maximum length allowed in Chapter 13. To qualify for a 36-month plan, the amount of gross income received in the 6 calendar months prior to filing your case must be below the median income for your household size and geographic area.

A 100% plan is a Chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. It is required to pay back all secured debt and 100% of all unsecured debt.