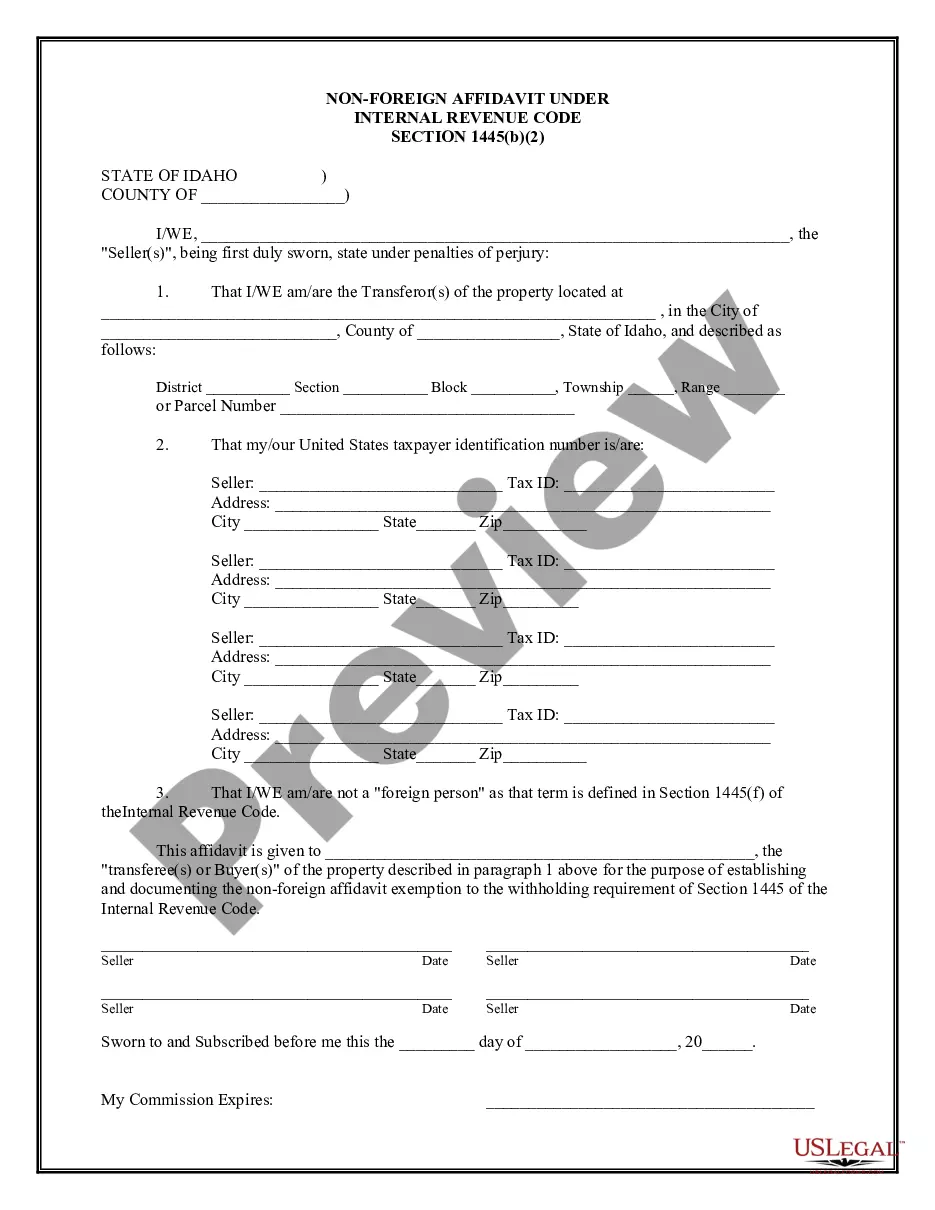

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Meridian Idaho Non-Foreign Affidavit Under IRC 1445 is a legal document that serves to confirm an individual or entity's non-foreign status during a real estate transaction subject to withholding tax regulations. This affidavit is required by the Internal Revenue Code (IRC) section 1445, which covers the taxation of foreign persons involved in the selling or disposing of U.S. real property interests. The Meridian Idaho Non-Foreign Affidavit Under IRC 1445 is essential in ensuring compliance with federal tax laws and preventing any potential withholding tax obligations. By completing this affidavit, the party confirms that they are not a foreign individual or entity and are exempt from the withholding tax requirements imposed on non-resident sellers. There are a few different types of Meridian Idaho Non-Foreign Affidavit Under IRC 1445, including: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual, who is a U.S. citizen or resident alien, is involved in the real estate transaction as a seller or transferor. It confirms the individual's non-foreign status and exempts them from any withholding tax obligations. 2. Entity Non-Foreign Affidavit: When the seller or transferor is a domestic entity, such as a corporation, partnership, or limited liability company (LLC), this type of affidavit is required. It verifies the entity's non-foreign status, ensuring exemption from withholding tax requirements. 3. Trust Non-Foreign Affidavit: If the seller or transferor is a trust, a trust non-foreign affidavit must be completed. This affidavit confirms that the trust is a U.S. trust and meets the non-foreign status criteria under IRC section 1445. It's crucial to accurately complete the Meridian Idaho Non-Foreign Affidavit Under IRC 1445, providing all necessary information and ensuring compliance with federal tax laws. Failing to do so may result in potential penalties, delays, or complications in the real estate transaction. It is advisable to seek professional guidance or consult with a tax attorney or accountant experienced in real estate transactions to correctly complete the affidavit and meet all legal obligations.Meridian Idaho Non-Foreign Affidavit Under IRC 1445 is a legal document that serves to confirm an individual or entity's non-foreign status during a real estate transaction subject to withholding tax regulations. This affidavit is required by the Internal Revenue Code (IRC) section 1445, which covers the taxation of foreign persons involved in the selling or disposing of U.S. real property interests. The Meridian Idaho Non-Foreign Affidavit Under IRC 1445 is essential in ensuring compliance with federal tax laws and preventing any potential withholding tax obligations. By completing this affidavit, the party confirms that they are not a foreign individual or entity and are exempt from the withholding tax requirements imposed on non-resident sellers. There are a few different types of Meridian Idaho Non-Foreign Affidavit Under IRC 1445, including: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual, who is a U.S. citizen or resident alien, is involved in the real estate transaction as a seller or transferor. It confirms the individual's non-foreign status and exempts them from any withholding tax obligations. 2. Entity Non-Foreign Affidavit: When the seller or transferor is a domestic entity, such as a corporation, partnership, or limited liability company (LLC), this type of affidavit is required. It verifies the entity's non-foreign status, ensuring exemption from withholding tax requirements. 3. Trust Non-Foreign Affidavit: If the seller or transferor is a trust, a trust non-foreign affidavit must be completed. This affidavit confirms that the trust is a U.S. trust and meets the non-foreign status criteria under IRC section 1445. It's crucial to accurately complete the Meridian Idaho Non-Foreign Affidavit Under IRC 1445, providing all necessary information and ensuring compliance with federal tax laws. Failing to do so may result in potential penalties, delays, or complications in the real estate transaction. It is advisable to seek professional guidance or consult with a tax attorney or accountant experienced in real estate transactions to correctly complete the affidavit and meet all legal obligations.