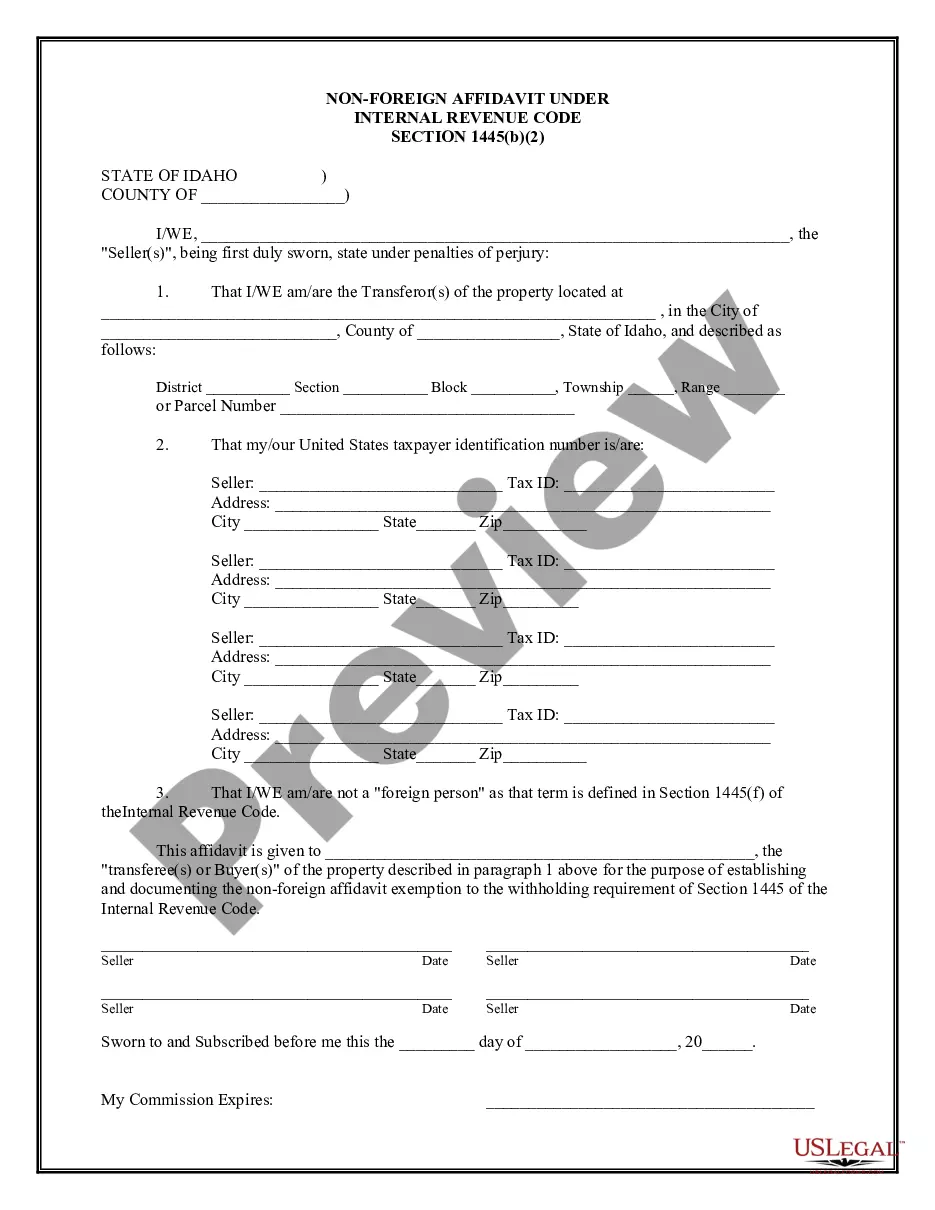

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Nampa, Idaho Non-Foreign Affidavit Under IRC 1445: A Comprehensive Explanation In Nampa, Idaho, individuals involved in real estate transactions may come across the requirement of filing a Non-Foreign Affidavit Under Internal Revenue Code (IRC) Section 1445. This affidavit is an essential document that serves to confirm the tax-exempt status of a seller or transferor in relation to the sale or transfer of a United States real property interest (US RPI). When selling or transferring a US RPI, the buyer or transferee is required to withhold a certain percentage of the total purchase price, and the Non-Foreign Affidavit serves as proof that the seller or transferor is not a foreign person subject to withholding under IRC Section 1445. This affidavit ensures compliance with federal tax law and provides protection to the buyer or transferee against any potential liability in case the seller is deemed foreign after the transaction. Key Components of the Nampa, Idaho Non-Foreign Affidavit: 1. Identification of Parties: The affidavit includes the names, addresses, and tax identification numbers (TIN) of both the seller or transferor and the buyer or transferee. These details are crucial for the proper identification and record-keeping of the parties involved. 2. Affirmation of Non-Foreign Status: The affidavit requires the seller or transferor to affirm that they are not a foreign person as defined under IRC Section 1445. A foreign person, in this context, refers to individuals who are not citizens or residents of the United States. 3. Supporting Documentation: In addition to the affidavit, the seller or transferor may need to provide supporting documentation to further establish their non-foreign status. This might include a certification from the Internal Revenue Service (IRS) or any other acceptable documentation proving their U.S. citizenship or resident alien status. Different Types of Nampa, Idaho Non-Foreign Affidavit Under IRC 1445: 1. Individual Non-Foreign Affidavit: This type of affidavit applies when the seller or transferor is an individual and wishes to confirm their non-foreign status under IRC Section 1445. 2. Entity Non-Foreign Affidavit: In situations where the seller or transferor is an entity, such as a corporation, partnership, or trust, an entity non-foreign affidavit is utilized. This affidavit affirms that the entity is not considered foreign for tax purposes according to IRC regulations. 3. Certification from Qualified Withholding Partnership (TWP): The TWP certification is a variant of the non-foreign affidavit that applies specifically to partnerships. It certifies that a partnership is not a foreign person and provides relevant information about the partnership's partners and their respective Tins. Ensuring Compliance and Facilitating Smooth Transactions: Nampa, Idaho Non-Foreign Affidavit Under IRC 1445 is a crucial requirement that facilitates the smooth execution of real estate transactions while remaining compliant with federal tax regulations. By accurately completing the affidavit and providing the necessary supporting documentation, both buyers and sellers can ensure a secure and hassle-free property transfer process. It is advisable to consult with a qualified tax professional or legal advisor when dealing with Nampa, Idaho Non-Foreign Affidavit Under IRC 1445 to ensure all requirements are met and the transaction proceeds without any complications.