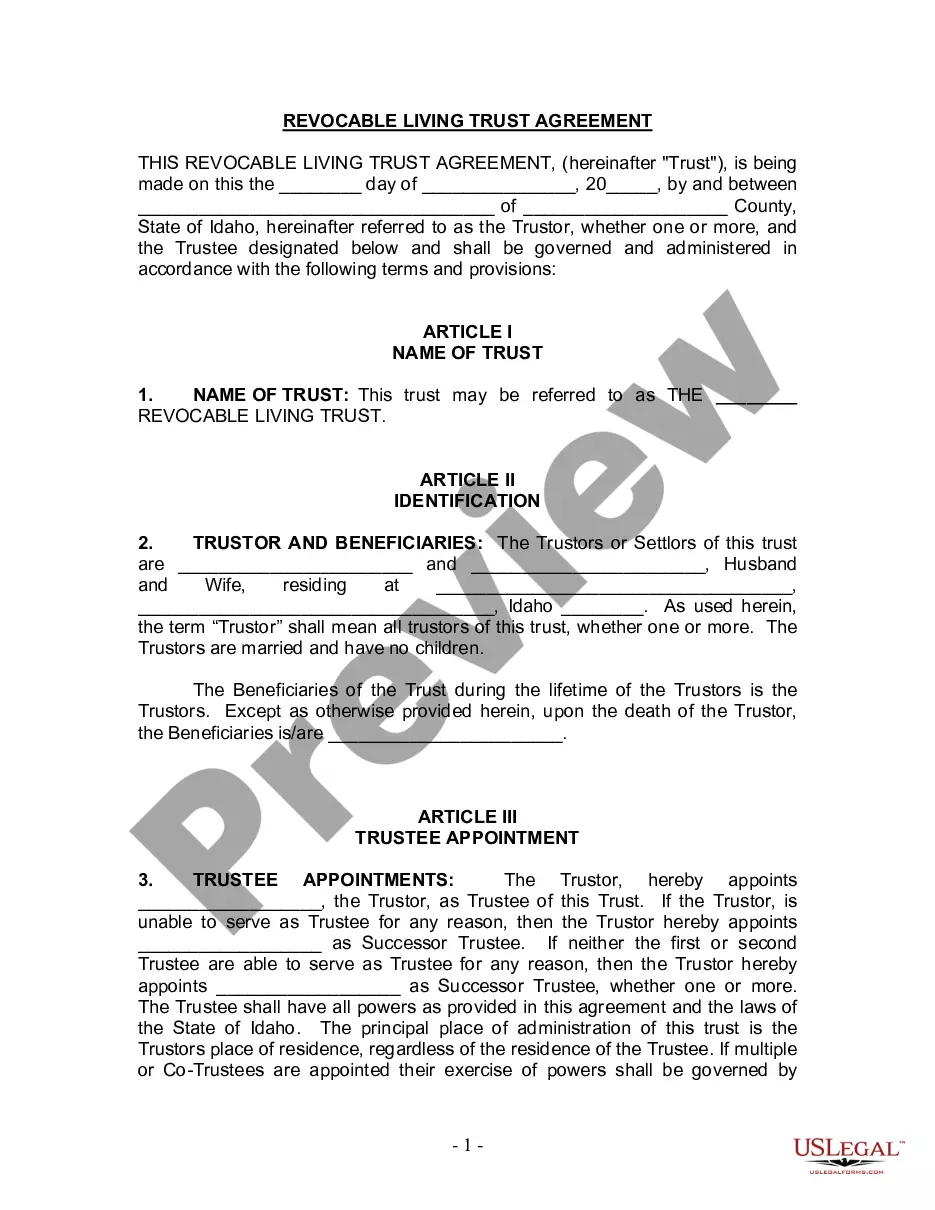

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Meridian Idaho Living Trust for Husband and Wife with No Children: A living trust is a legal document that allows individuals to transfer their assets into a trust during their lifetime and stipulate how those assets should be managed and distributed upon their death. In the case of a husband and wife with no children residing in Meridian, Idaho, establishing a living trust can offer several benefits and ensure that their estate is handled according to their wishes. The Meridian Idaho living trust for a husband and wife with no children is a type of revocable living trust that is specifically tailored to accommodate the unique circumstances of couples without offspring. This trust provides a comprehensive solution for estate planning while offering flexibility and control over their assets during their lifetime and after their passing. Here are a few key features of the Meridian Idaho living trust for husband and wife with no children: 1. Asset Management: The trust allows couples to designate a trusted person or institution as the successor trustee to manage their assets if they become incapacitated or upon their death. This ensures that their assets are being taken care of by someone they have chosen and trust. 2. Distribution of Assets: Without children, the trust provides the couple with the ability to determine how their assets will be distributed among beneficiaries, such as charities, friends, or other family members. 3. Avoidance of Probate: By placing assets within the trust, the couple can avoid the probate process, which can be expensive and time-consuming. This allows for a faster and more efficient transfer of assets to beneficiaries. 4. Privacy: Unlike a will, which becomes public record upon probate, a living trust provides privacy for the couple, their assets, and their beneficiaries. 5. Disability Planning: The trust can include provisions for the management of assets and healthcare decisions in the event that one or both spouses become incapacitated. Different types of Meridian Idaho Living Trust for Husband and Wife without children: 1. Joint Living Trust: This type of living trust is established jointly by both spouses, and they become co-trustees. It allows them to manage and control their assets together. 2. Testamentary Trust: This trust comes into effect after the death of one spouse and is established within their will. It allows a surviving spouse to create a trust for the management and distribution of their assets. In conclusion, a Meridian Idaho Living Trust for Husband and Wife with No Children is a versatile estate planning tool that provides couples with control, protection, and peace of mind. By establishing this trust, couples can ensure that their assets are managed and distributed according to their specific wishes, while avoiding probate and maintaining privacy. Consider consulting with an experienced estate planning attorney to help you tailor a living trust to meet your unique needs and goals.Meridian Idaho Living Trust for Husband and Wife with No Children: A living trust is a legal document that allows individuals to transfer their assets into a trust during their lifetime and stipulate how those assets should be managed and distributed upon their death. In the case of a husband and wife with no children residing in Meridian, Idaho, establishing a living trust can offer several benefits and ensure that their estate is handled according to their wishes. The Meridian Idaho living trust for a husband and wife with no children is a type of revocable living trust that is specifically tailored to accommodate the unique circumstances of couples without offspring. This trust provides a comprehensive solution for estate planning while offering flexibility and control over their assets during their lifetime and after their passing. Here are a few key features of the Meridian Idaho living trust for husband and wife with no children: 1. Asset Management: The trust allows couples to designate a trusted person or institution as the successor trustee to manage their assets if they become incapacitated or upon their death. This ensures that their assets are being taken care of by someone they have chosen and trust. 2. Distribution of Assets: Without children, the trust provides the couple with the ability to determine how their assets will be distributed among beneficiaries, such as charities, friends, or other family members. 3. Avoidance of Probate: By placing assets within the trust, the couple can avoid the probate process, which can be expensive and time-consuming. This allows for a faster and more efficient transfer of assets to beneficiaries. 4. Privacy: Unlike a will, which becomes public record upon probate, a living trust provides privacy for the couple, their assets, and their beneficiaries. 5. Disability Planning: The trust can include provisions for the management of assets and healthcare decisions in the event that one or both spouses become incapacitated. Different types of Meridian Idaho Living Trust for Husband and Wife without children: 1. Joint Living Trust: This type of living trust is established jointly by both spouses, and they become co-trustees. It allows them to manage and control their assets together. 2. Testamentary Trust: This trust comes into effect after the death of one spouse and is established within their will. It allows a surviving spouse to create a trust for the management and distribution of their assets. In conclusion, a Meridian Idaho Living Trust for Husband and Wife with No Children is a versatile estate planning tool that provides couples with control, protection, and peace of mind. By establishing this trust, couples can ensure that their assets are managed and distributed according to their specific wishes, while avoiding probate and maintaining privacy. Consider consulting with an experienced estate planning attorney to help you tailor a living trust to meet your unique needs and goals.