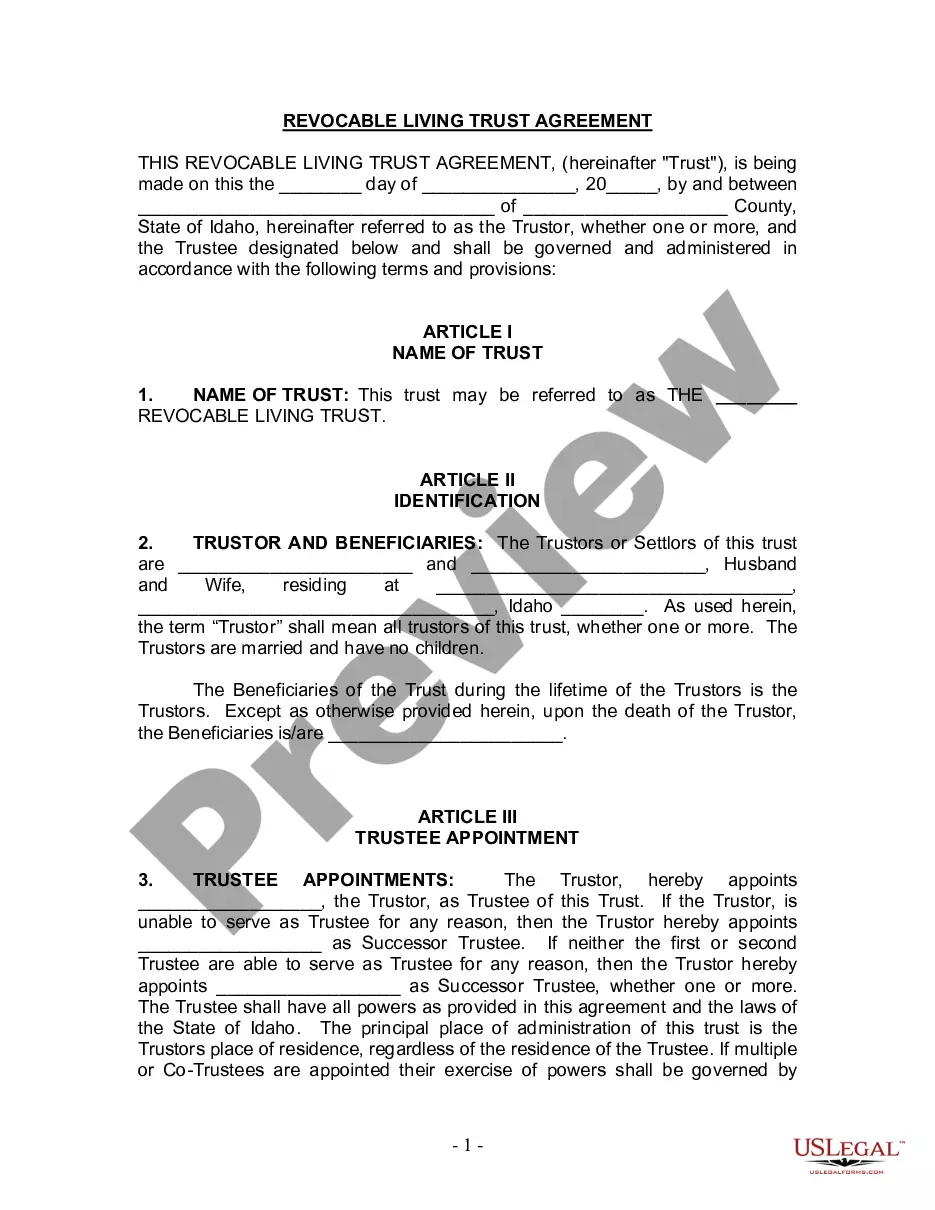

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A living trust is a legal document that allows individuals to manage and distribute their assets during their lifetime and after their death. In Nampa, Idaho, a living trust designed specifically for a husband and wife with no children offers a range of benefits and considerations to ensure their estate planning needs are met. The primary advantage of establishing a living trust for a husband and wife with no children is the ability to avoid probate. Probate proceedings can be time-consuming, expensive, and public, thus making a living trust an appealing alternative. By creating a trust, the assets are held separately as trust property, allowing for a smooth transfer of ownership upon the death of either spouse. Through a living trust, the couple can also ensure their wishes concerning asset distribution are fulfilled. They have the flexibility to outline specific instructions as to how their assets should be managed and distributed, providing a unique level of control and protection. This type of trust allows the couple to establish provisions for each other, with instructions in place for any potential beneficiaries upon their deaths. Nampa, Idaho offers different types of living trusts for husband and wife with no children, depending on their specific circumstances and objectives. One such type is a revocable living trust. This type of trust enables the couple to make changes, additions, or amendments throughout their lifetime. It provides flexibility and allows them to maintain full control over their assets and property while they are alive. Another type of living trust available in Nampa, Idaho, is an irrevocable living trust. Unlike a revocable trust, this type cannot be altered or revoked once it is established. Although it restricts the couple from making changes, an irrevocable trust offers certain advantages, such as potential estate tax savings, asset protection, and eligibility for certain government benefits, if applicable. Additionally, a special needs trust can be considered for a husband and wife with no children who may have dependents with disabilities or unique care requirements. This type of trust ensures that any assets or income left behind are utilized to support the needs of the dependents without affecting their eligibility for government assistance programs. In conclusion, a Nampa, Idaho living trust for a husband and wife with no children allows for seamless asset management, control over the distribution of assets, and the avoidance of probate. Whether choosing a revocable, irrevocable, or special needs trust, establishing a living trust tailored to individual circumstances ensures peace of mind and security for both spouses.A living trust is a legal document that allows individuals to manage and distribute their assets during their lifetime and after their death. In Nampa, Idaho, a living trust designed specifically for a husband and wife with no children offers a range of benefits and considerations to ensure their estate planning needs are met. The primary advantage of establishing a living trust for a husband and wife with no children is the ability to avoid probate. Probate proceedings can be time-consuming, expensive, and public, thus making a living trust an appealing alternative. By creating a trust, the assets are held separately as trust property, allowing for a smooth transfer of ownership upon the death of either spouse. Through a living trust, the couple can also ensure their wishes concerning asset distribution are fulfilled. They have the flexibility to outline specific instructions as to how their assets should be managed and distributed, providing a unique level of control and protection. This type of trust allows the couple to establish provisions for each other, with instructions in place for any potential beneficiaries upon their deaths. Nampa, Idaho offers different types of living trusts for husband and wife with no children, depending on their specific circumstances and objectives. One such type is a revocable living trust. This type of trust enables the couple to make changes, additions, or amendments throughout their lifetime. It provides flexibility and allows them to maintain full control over their assets and property while they are alive. Another type of living trust available in Nampa, Idaho, is an irrevocable living trust. Unlike a revocable trust, this type cannot be altered or revoked once it is established. Although it restricts the couple from making changes, an irrevocable trust offers certain advantages, such as potential estate tax savings, asset protection, and eligibility for certain government benefits, if applicable. Additionally, a special needs trust can be considered for a husband and wife with no children who may have dependents with disabilities or unique care requirements. This type of trust ensures that any assets or income left behind are utilized to support the needs of the dependents without affecting their eligibility for government assistance programs. In conclusion, a Nampa, Idaho living trust for a husband and wife with no children allows for seamless asset management, control over the distribution of assets, and the avoidance of probate. Whether choosing a revocable, irrevocable, or special needs trust, establishing a living trust tailored to individual circumstances ensures peace of mind and security for both spouses.