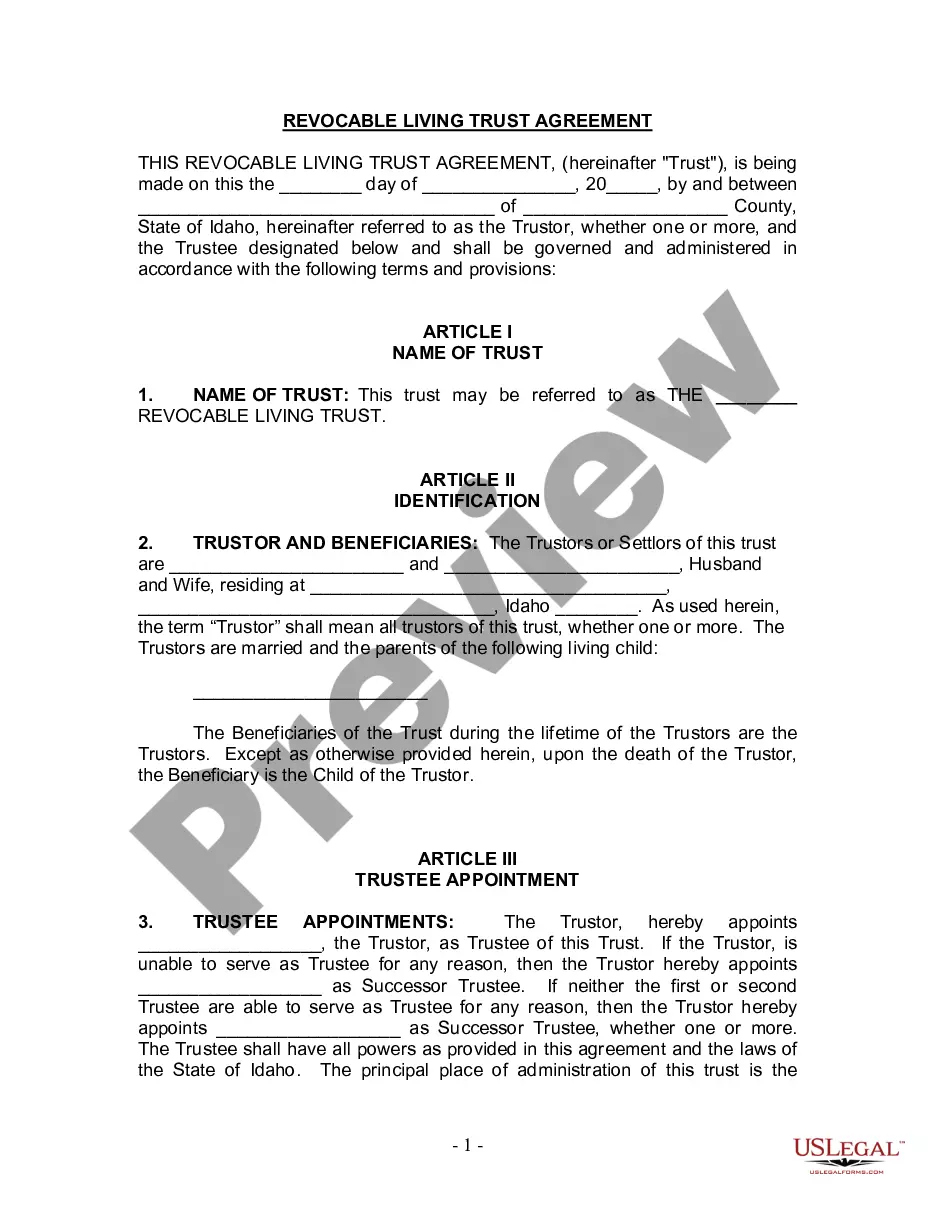

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Meridian Idaho Living Trust for Husband and Wife with One Child is a legal arrangement created by a married couple residing in Meridian, Idaho, to protect and manage their assets during their lifetime and ensure the smooth transfer of those assets to their child upon their passing. This type of living trust offers numerous benefits such as avoiding probate, maintaining privacy, and providing flexibility in estate planning. The Meridian Idaho Living Trust for Husband and Wife with One Child can be further classified into two types based on revocability: 1. Revocable Living Trust: This is the most common type of living trust, allowing the couple to maintain complete control over their assets and make changes to the trust terms or beneficiaries as desired. They can serve as the trustees during their lifetime, managing and using their assets as before. In the event of their incapacity or death, a successor trustee takes over and ensures the smooth administration of the trust, distributing assets to the designated child according to the trust terms. 2. Irrevocable Living Trust: In this type of living trust, the couple transfers their assets permanently into the trust, relinquishing all control and ownership rights. Once established, changes to the trust terms are typically not permitted. The benefit of the irrevocable living trust is that it provides certain tax advantages and protects assets from creditors. It also ensures that the assets are transferred to the child without going through probate. Irrespective of the type chosen, a Meridian Idaho Living Trust for Husband and Wife with One Child typically includes the following key elements: 1. Granter: The married couple who establishes the trust and transfers their assets into it. 2. Trustee: The person or entity responsible for managing the trust and distributing assets as per the trust terms. The granters can serve as trustees during their lifetime, and a successor trustee is named to take over after their passing. 3. Beneficiary: The child of the couple who will ultimately receive the assets held in the trust. 4. Successor Trustee: An individual or institution designated to manage the trust in the event the granters are unable to do so. 5. Trust Assets: Real estate, bank accounts, investments, personal property, and any other assets the couple wishes to place in the trust. 6. Trust Terms: The specific instructions and conditions under which the assets are to be managed, invested, and ultimately distributed to the child. This includes details like when and how the child will receive the assets, and any restrictions or provisions regarding the use of these assets. The Meridian Idaho Living Trust for Husband and Wife with One Child offers an effective way for couples to maintain control and protect their assets, ensuring a smooth transition to their child while avoiding the probate process. It is strongly advised to consult with an experienced estate planning attorney in Meridian, Idaho, to create a living trust that meets the specific needs and goals of the couple and their child.A Meridian Idaho Living Trust for Husband and Wife with One Child is a legal arrangement created by a married couple residing in Meridian, Idaho, to protect and manage their assets during their lifetime and ensure the smooth transfer of those assets to their child upon their passing. This type of living trust offers numerous benefits such as avoiding probate, maintaining privacy, and providing flexibility in estate planning. The Meridian Idaho Living Trust for Husband and Wife with One Child can be further classified into two types based on revocability: 1. Revocable Living Trust: This is the most common type of living trust, allowing the couple to maintain complete control over their assets and make changes to the trust terms or beneficiaries as desired. They can serve as the trustees during their lifetime, managing and using their assets as before. In the event of their incapacity or death, a successor trustee takes over and ensures the smooth administration of the trust, distributing assets to the designated child according to the trust terms. 2. Irrevocable Living Trust: In this type of living trust, the couple transfers their assets permanently into the trust, relinquishing all control and ownership rights. Once established, changes to the trust terms are typically not permitted. The benefit of the irrevocable living trust is that it provides certain tax advantages and protects assets from creditors. It also ensures that the assets are transferred to the child without going through probate. Irrespective of the type chosen, a Meridian Idaho Living Trust for Husband and Wife with One Child typically includes the following key elements: 1. Granter: The married couple who establishes the trust and transfers their assets into it. 2. Trustee: The person or entity responsible for managing the trust and distributing assets as per the trust terms. The granters can serve as trustees during their lifetime, and a successor trustee is named to take over after their passing. 3. Beneficiary: The child of the couple who will ultimately receive the assets held in the trust. 4. Successor Trustee: An individual or institution designated to manage the trust in the event the granters are unable to do so. 5. Trust Assets: Real estate, bank accounts, investments, personal property, and any other assets the couple wishes to place in the trust. 6. Trust Terms: The specific instructions and conditions under which the assets are to be managed, invested, and ultimately distributed to the child. This includes details like when and how the child will receive the assets, and any restrictions or provisions regarding the use of these assets. The Meridian Idaho Living Trust for Husband and Wife with One Child offers an effective way for couples to maintain control and protect their assets, ensuring a smooth transition to their child while avoiding the probate process. It is strongly advised to consult with an experienced estate planning attorney in Meridian, Idaho, to create a living trust that meets the specific needs and goals of the couple and their child.