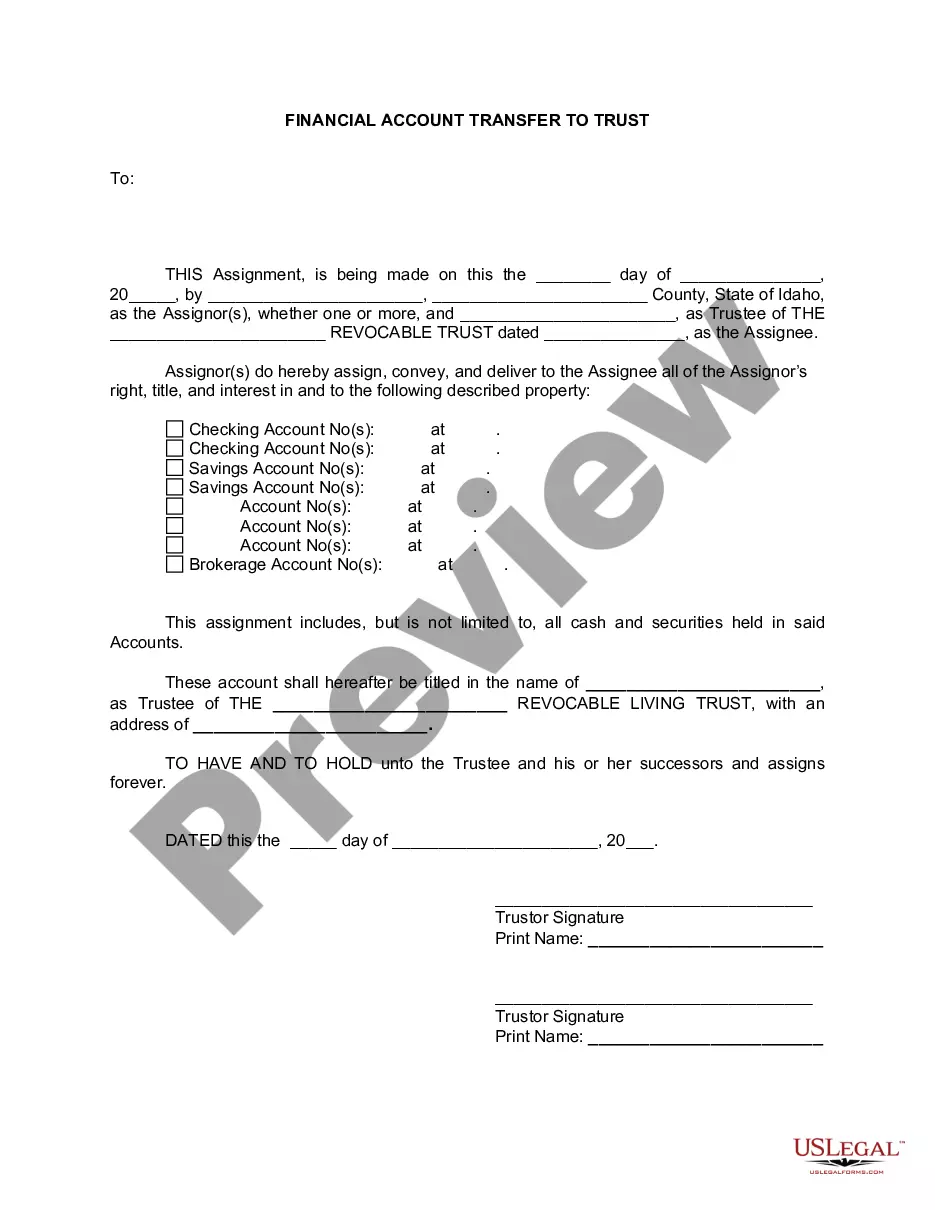

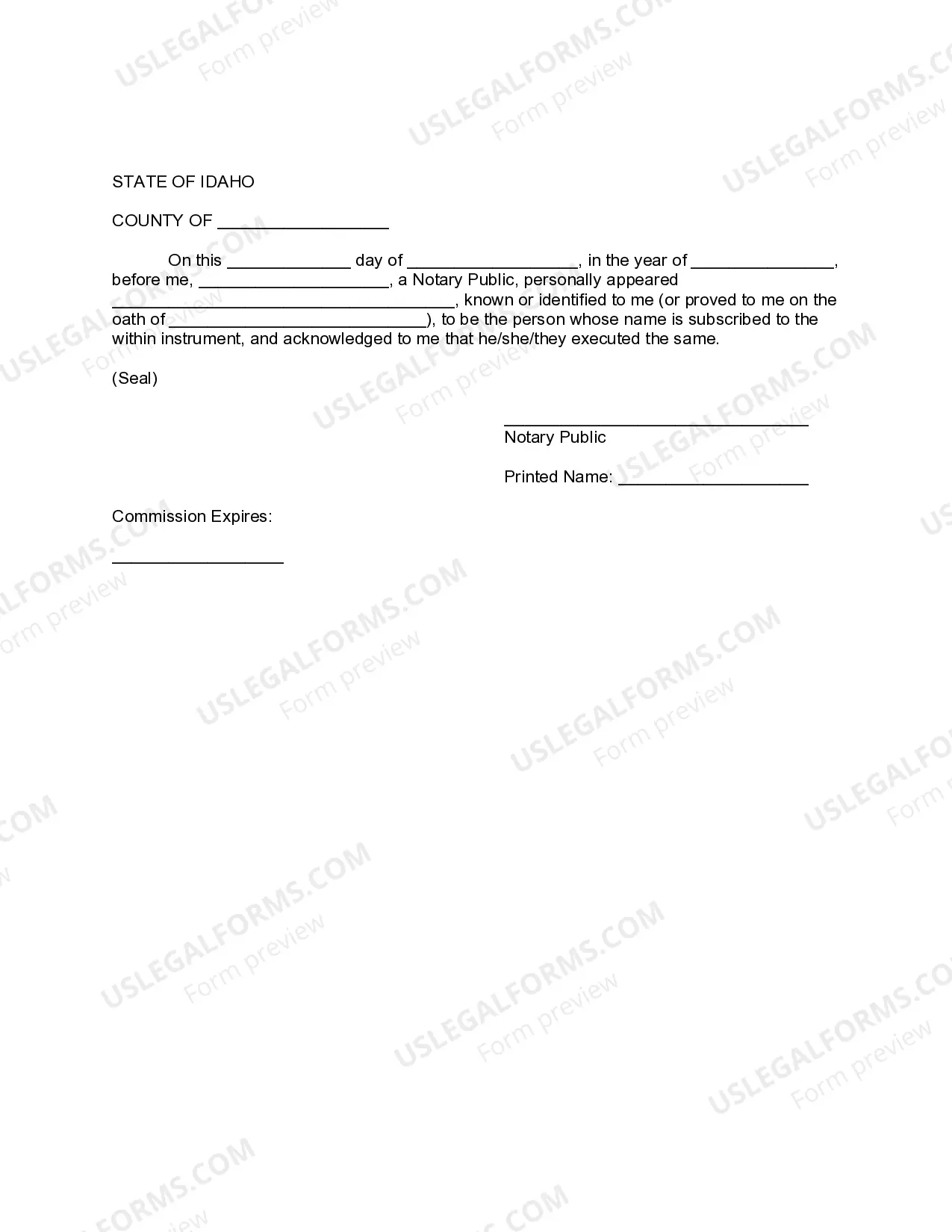

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Nampa Idaho Financial Account Transfer to Living Trust — Securely Preserve Your Assets When it comes to managing your financial accounts and ensuring the smooth transfer of your assets, Nampa Idaho offers a reliable and efficient option — the Financial Account Transfer to Living Trust. A Living Trust is a legal arrangement that allows you to transfer ownership of your assets into a Trust, which can be managed by a trustee of your choosing. The Nampa Idaho Financial Account Transfer to Living Trust provides individuals with a secure way to protect their financial assets and ensure they are properly distributed according to their wishes. By transferring your financial accounts to a Living Trust, you can avoid probate court, reduce estate taxes, and maintain privacy since Living Trusts do not become part of the public record. Different Types of Nampa Idaho Financial Account Transfer to Living Trust: 1. Bank Account Transfer to Living Trust: With this type of transfer, you can transfer your savings and checking accounts, certificates of deposit (CDs), and money market accounts into your Living Trust. This ensures that your funds are protected and easily accessible for your designated beneficiaries after your passing. 2. Investment Account Transfer to Living Trust: If you have stocks, bonds, mutual funds, or other investment accounts, this transfer option allows you to retitle these accounts in the name of your Living Trust. This ensures a smooth transition of ownership and control over your investments, while avoiding the complexities of probate. 3. Retirement Account Transfer to Living Trust: Retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k)s, can also be transferred into a Living Trust. This transfer option allows you to designate specific beneficiaries who can continue to benefit from your retirement savings in a tax-advantaged manner. 4. Real Estate Transfer to Living Trust: In addition to financial accounts, you can transfer real estate properties, such as your primary residence, vacation home, or rental properties, into your Living Trust. This transfer option helps simplify the management and distribution of your real estate assets while ensuring your intentions are carried out. By utilizing the Nampa Idaho Financial Account Transfer to Living Trust, you take a proactive approach to estate planning and asset protection. It is advisable to consult with an experienced estate planning attorney or financial advisor to fully understand the implications and benefits of this trust option. Take control of your financial future and ensure your loved ones are provided for by considering this transfer option today.Nampa Idaho Financial Account Transfer to Living Trust — Securely Preserve Your Assets When it comes to managing your financial accounts and ensuring the smooth transfer of your assets, Nampa Idaho offers a reliable and efficient option — the Financial Account Transfer to Living Trust. A Living Trust is a legal arrangement that allows you to transfer ownership of your assets into a Trust, which can be managed by a trustee of your choosing. The Nampa Idaho Financial Account Transfer to Living Trust provides individuals with a secure way to protect their financial assets and ensure they are properly distributed according to their wishes. By transferring your financial accounts to a Living Trust, you can avoid probate court, reduce estate taxes, and maintain privacy since Living Trusts do not become part of the public record. Different Types of Nampa Idaho Financial Account Transfer to Living Trust: 1. Bank Account Transfer to Living Trust: With this type of transfer, you can transfer your savings and checking accounts, certificates of deposit (CDs), and money market accounts into your Living Trust. This ensures that your funds are protected and easily accessible for your designated beneficiaries after your passing. 2. Investment Account Transfer to Living Trust: If you have stocks, bonds, mutual funds, or other investment accounts, this transfer option allows you to retitle these accounts in the name of your Living Trust. This ensures a smooth transition of ownership and control over your investments, while avoiding the complexities of probate. 3. Retirement Account Transfer to Living Trust: Retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k)s, can also be transferred into a Living Trust. This transfer option allows you to designate specific beneficiaries who can continue to benefit from your retirement savings in a tax-advantaged manner. 4. Real Estate Transfer to Living Trust: In addition to financial accounts, you can transfer real estate properties, such as your primary residence, vacation home, or rental properties, into your Living Trust. This transfer option helps simplify the management and distribution of your real estate assets while ensuring your intentions are carried out. By utilizing the Nampa Idaho Financial Account Transfer to Living Trust, you take a proactive approach to estate planning and asset protection. It is advisable to consult with an experienced estate planning attorney or financial advisor to fully understand the implications and benefits of this trust option. Take control of your financial future and ensure your loved ones are provided for by considering this transfer option today.