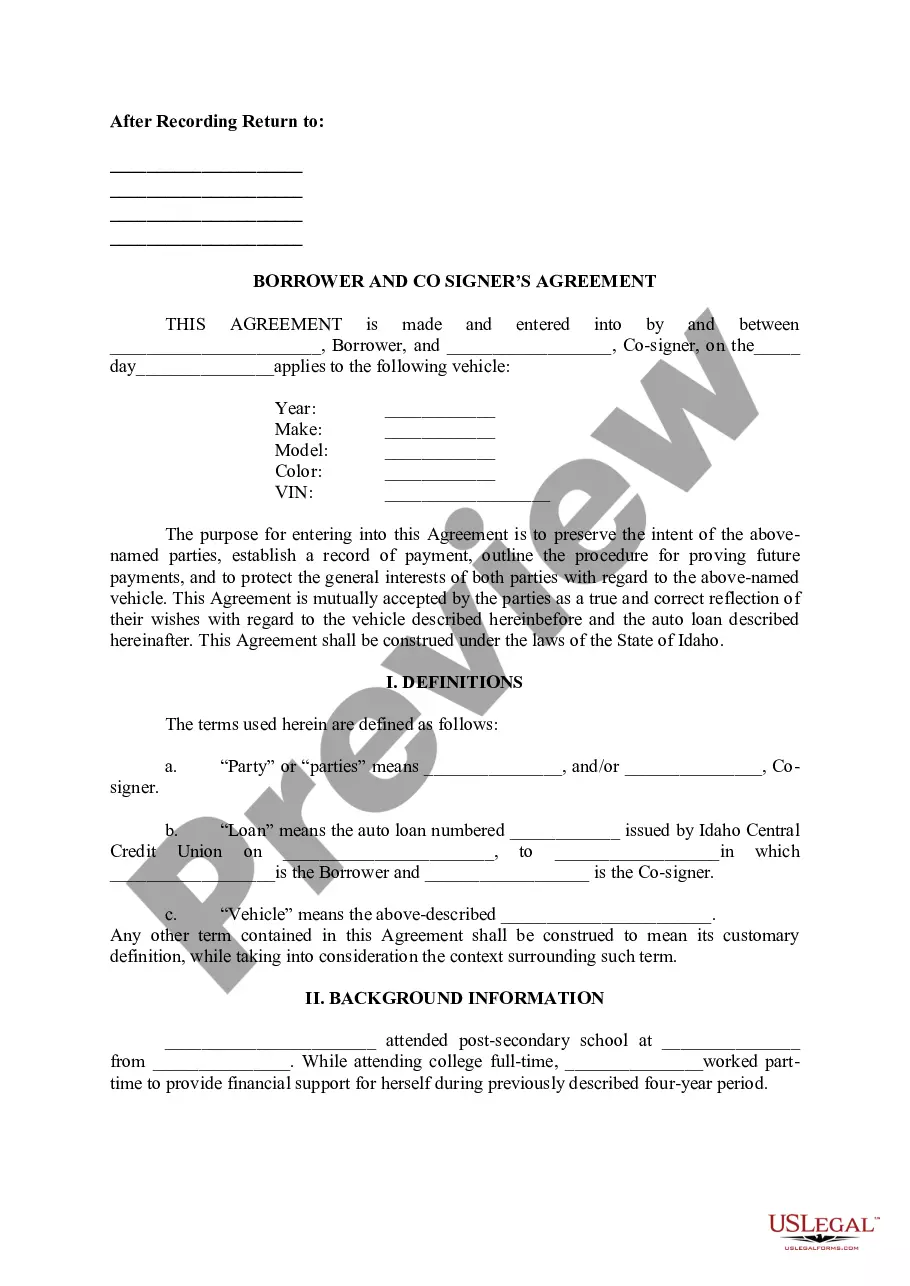

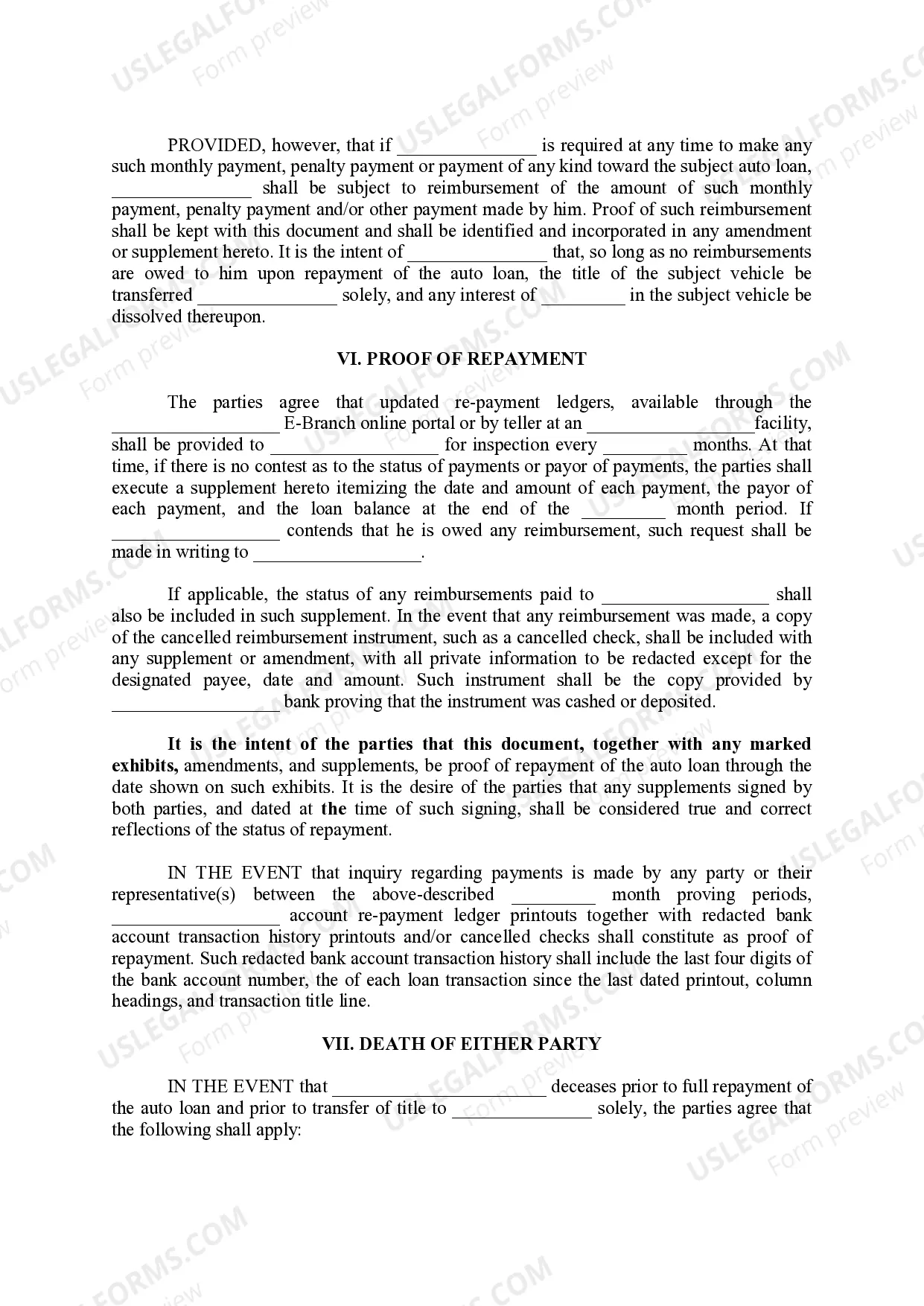

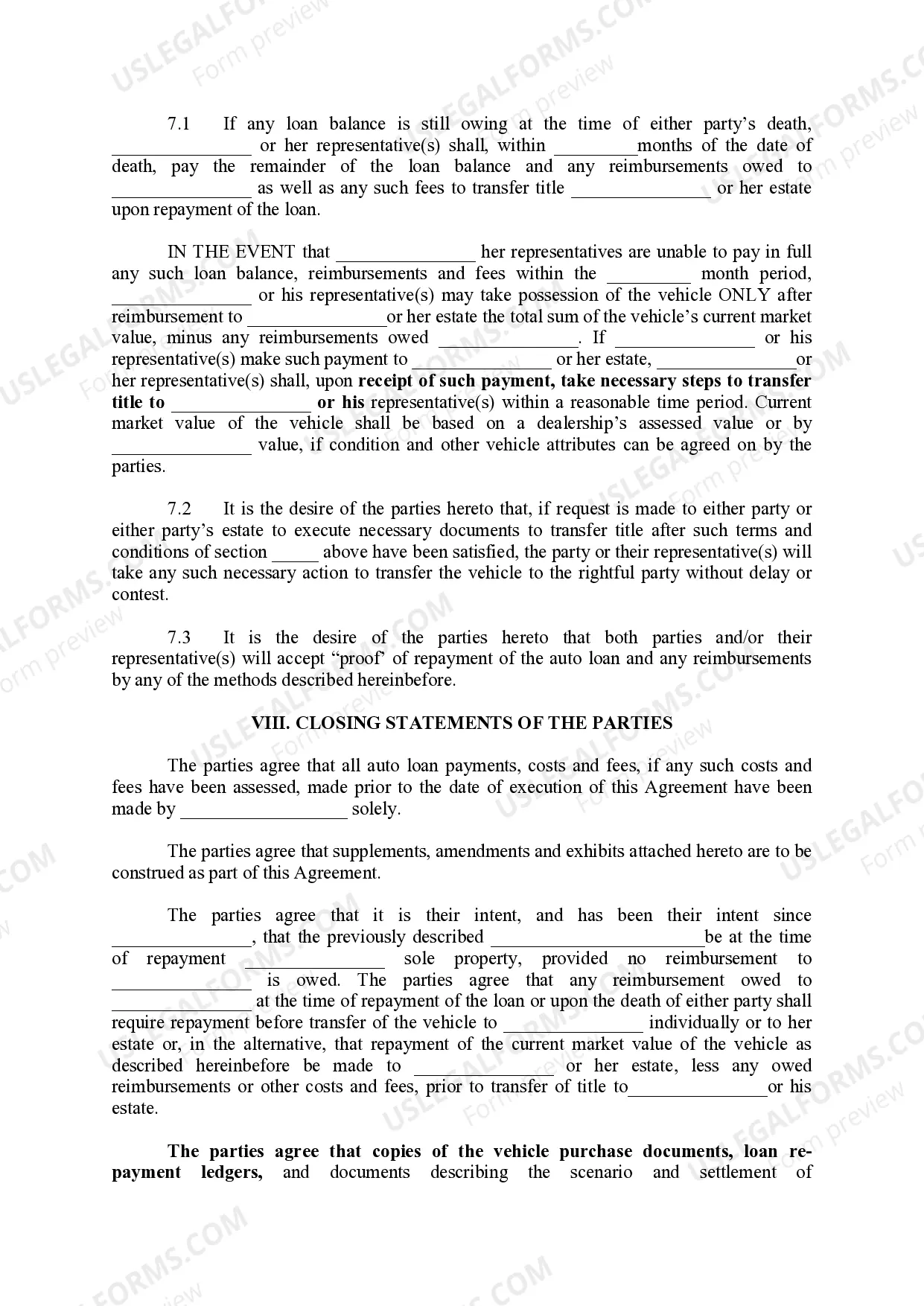

Meridian Idaho Borrower and Co Signer’s Agreement is a legally binding document that outlines the obligations, rights, and responsibilities of both the borrower and the co-signer in a financial transaction. This agreement is often used in situations where the borrower's creditworthiness may be insufficient to secure a loan or lease agreement on their own. The primary purpose of this agreement is to provide additional security for the lender by involving a co-signer who agrees to assume legal liability in case the borrower defaults on their financial obligations. The co-signer essentially acts as a guarantor, assuring the lender that they will fulfill the borrower's obligations if the borrower fails to do so. In Meridian, Idaho, there are various types of Borrower and Co Signer’s Agreements, including: 1. Student Loan Co Signer’s Agreement: This type of agreement is commonly used in student loans, where a parent or guardian co-signs the loan to help a student secure financial aid for education expenses. It ensures that both the student and the co-signer understand the terms and conditions, repayment schedules, and consequences of defaulting on the loan. 2. Rental Lease Co Signer’s Agreement: In situations where a tenant has insufficient credit history or low income, a co-signer may be required to guarantee the rent payments. This agreement clarifies the co-signer's obligations, such as making timely payments if the tenant fails to do so or covering any damages beyond the security deposit. 3. Mortgage Co Signer’s Agreement: When a homebuyer lacks the necessary credit score or income to qualify for a mortgage, a co-signer can assist in securing the loan. This agreement sets out the co-signer's duties, including assuming responsibility for monthly mortgage payments and any potential foreclosure proceedings. 4. Auto Loan Co Signer’s Agreement: Individuals with limited credit history or poor credit scores often require a co-signer to obtain an auto loan. This agreement establishes the terms for the co-signer's involvement, such as ensuring regular loan repayments, maintaining insurance coverage, and safeguarding against vehicle repossession. It is important to approach the Meridian Idaho Borrower and Co Signer’s Agreement with caution, as it is a legally binding contract that carries significant financial implications. Both the borrower and the co-signer should thoroughly read and understand the agreement before signing, and they may seek legal advice if necessary to fully comprehend their rights and obligations.

Meridian Idaho Borrower and Co Signer's Agreement

Description

How to fill out Meridian Idaho Borrower And Co Signer's Agreement?

Benefit from the US Legal Forms and have instant access to any form you want. Our helpful website with thousands of templates allows you to find and get almost any document sample you require. It is possible to download, complete, and certify the Meridian Idaho Borrower and Co Signer’s Agreement in a matter of minutes instead of browsing the web for many hours looking for a proper template.

Utilizing our library is a wonderful way to increase the safety of your record submissions. Our experienced attorneys on a regular basis review all the documents to ensure that the forms are appropriate for a particular state and compliant with new acts and polices.

How do you obtain the Meridian Idaho Borrower and Co Signer’s Agreement? If you already have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. In addition, you can get all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions listed below:

- Open the page with the template you need. Make sure that it is the template you were seeking: examine its title and description, and utilize the Preview feature if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you prefer. Then, create an account and process your order using a credit card or PayPal.

- Save the document. Indicate the format to get the Meridian Idaho Borrower and Co Signer’s Agreement and change and complete, or sign it for your needs.

US Legal Forms is among the most significant and trustworthy form libraries on the internet. Our company is always happy to assist you in any legal procedure, even if it is just downloading the Meridian Idaho Borrower and Co Signer’s Agreement.

Feel free to take advantage of our service and make your document experience as straightforward as possible!