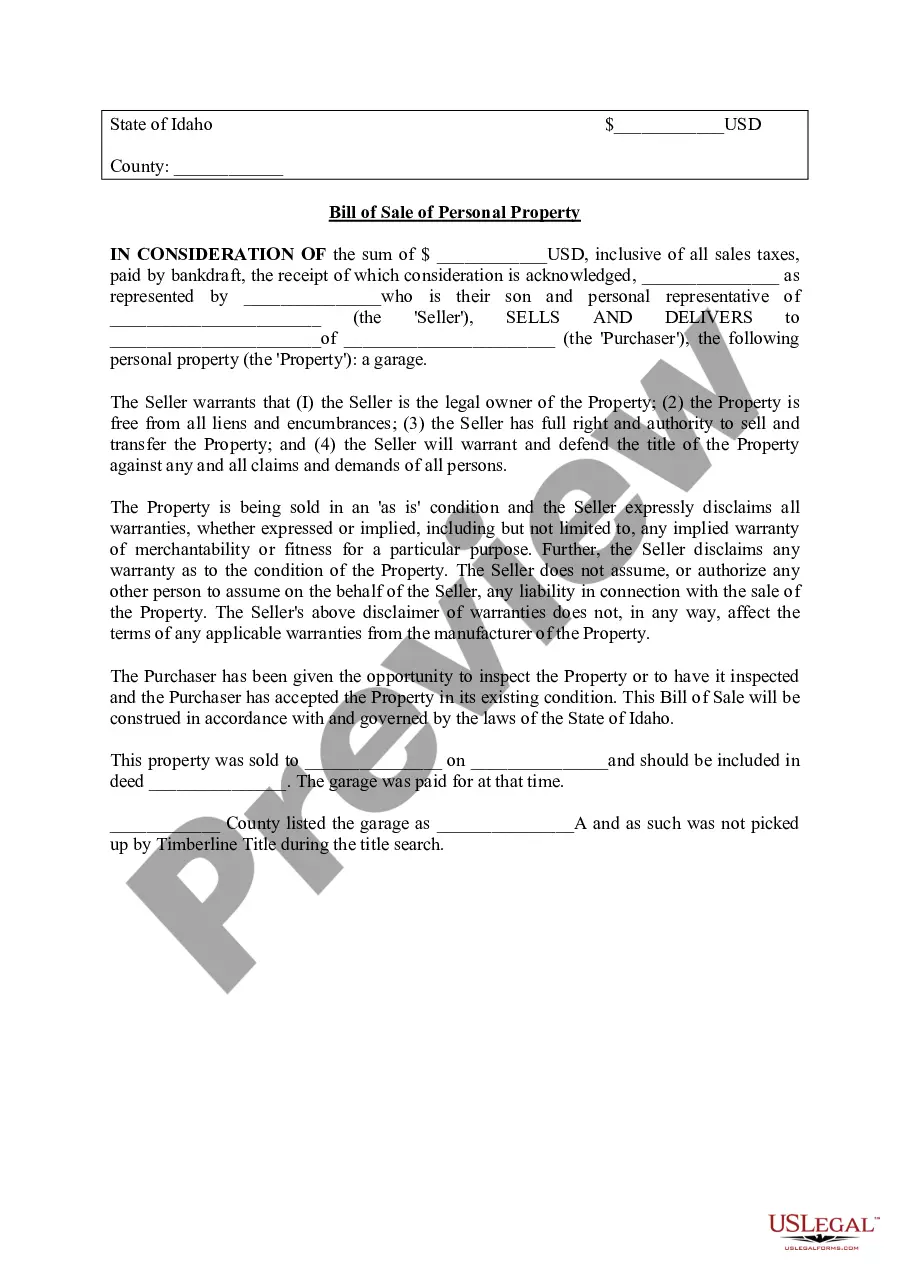

The Meridian Idaho Bill of Sale Personal Property is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. It outlines the terms and conditions agreed upon by the buyer and the seller, ensuring a smooth transaction and protecting the interests of both parties. In Meridian, Idaho, there are different types of Bill of Sale documents available for various personal property transactions. Some common types include: 1. Meridian Idaho Bill of Sale for Vehicles: This Bill of Sale is specifically used for the sale or transfer of motor vehicles such as cars, motorcycles, trucks, and trailers. It includes detailed information about the vehicle, such as make, model, year, VIN (Vehicle Identification Number), and mileage. 2. Meridian Idaho Bill of Sale for Furniture and Household Items: This type of Bill of Sale is used when buying or selling furniture, appliances, electronics, and other household items. It includes a detailed description of the items being sold, their condition, and any warranties or guarantees associated with them. 3. Meridian Idaho Bill of Sale for Electronics: This Bill of Sale is used for the sale or transfer of electronic devices like televisions, computers, smartphones, and gaming consoles. It includes information about the brand, model, serial number, and any accessories or peripherals included in the sale. 4. Meridian Idaho Bill of Sale for Jewelry: When buying or selling valuable jewelry, such as rings, necklaces, or watches, a specific Bill of Sale is recommended. This document should include a detailed description of each piece, including gemstones, metals, and any appraisals or certifications associated with them. 5. Meridian Idaho Bill of Sale for Livestock: For the purchase or transfer of livestock, such as horses, cattle, sheep, or pigs, a Bill of Sale tailored to livestock is required. It includes information about the breed, age, sex, and any registration or health records associated with the animals. 6. Meridian Idaho Bill of Sale for Business Assets: This type of Bill of Sale is used when buying or selling business assets, such as machinery, equipment, inventory, or intellectual property. It includes a comprehensive list of the assets being transferred, their condition, and any outstanding liabilities or encumbrances. Regardless of the type of personal property being sold or transferred, it is crucial to accurately describe the items, include any warranties or guarantees, and indicate the agreed-upon purchase price and payment terms. Seeking legal advice or using a trusted template can help ensure that the Meridian Idaho Bill of Sale Personal Property is legally binding and protects the rights and interests of both parties involved.

Meridian Idaho Bill of Sale Personal Property

Description

How to fill out Meridian Idaho Bill Of Sale Personal Property?

If you’ve already used our service before, log in to your account and download the Meridian Idaho Bill of Sale Personal Property on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Meridian Idaho Bill of Sale Personal Property. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!

Form popularity

FAQ

An appraiser from the county assessor's office must visit your property at least once in each five-year period. During the other four years, the county assessor will use information from property sales and/or from the inspections of other properties to estimate the current market value for your property.

HOW DOES ONE APPLY? You must complete an application for a Homestead Exemption. You can get an application by emailing us or calling our office at (208) 287-7200. A Homestead Exemption application can also be filled out online.

House Bill 389 passed in the 2021 legislative session increasing the maximum Homestead Exemption at $125,000. The Homestead Exemption is the lesser of 50% of the assessed value or $125,000 for the 2023 assessment year. Page last updated October 3, 2022.

Homestead Exemption reduces the value used to calculate property taxes by 50 percent of the home, including up to one acre of land, up to a maximum dollar amount determined by the state Legislature. Homestead Exemption is available to all Idaho property owners on their primary residence.

Idaho law defines personal property as everything that's the subject of ownership and that isn't included within the term real property. Examples are tools, unattached store counters and display racks, desks, chairs, file cabinets, computers, office machines, and medical instruments.

Personal Property - Any property other than real estate. The distinguishing factor between personal property and real property is that personal property is movable and not fixed permanently to one location, such as land or buildings.

BOISE, Idaho (KMVT/KSVT) ? Senate Republicans passed a bill that aims to keep Idaho senior citizens in their homes by allowing more people to qualify for a property tax reduction. Senate Bill 1241 increases the maximum home value for a homeowner to qualify for Idaho's circuit breaker program from 125% to 200%.

Does Idaho have a homesteading exemption? Yes. Idaho's homestead exemption grants the owner $100,000 protection from creditors so long that a Declaration of a Homestead is on file.

(3) The declaration of homestead must contain: (a) A statement that the person making it is residing on the premises or intends to reside thereon and claims the premises as a homestead; (b) A legal description of the premises; and. (c) An estimate of the premises actual cash value.

Idaho property tax rates for the past five years YearAverage urban rateAverage rural rate20201.129%0.798%20191.327%0.893%20181.438%0.951%20171.511%0.994%1 more row