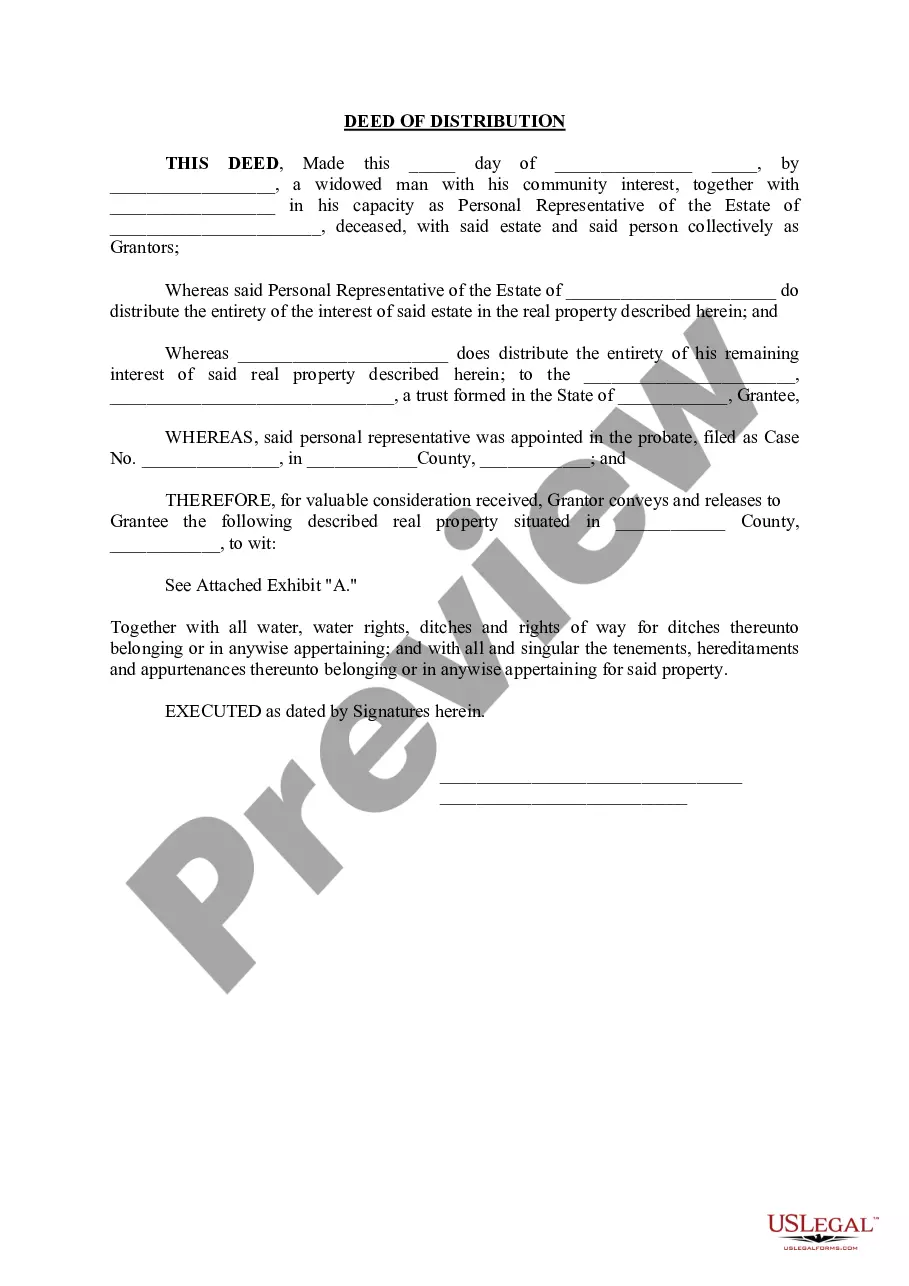

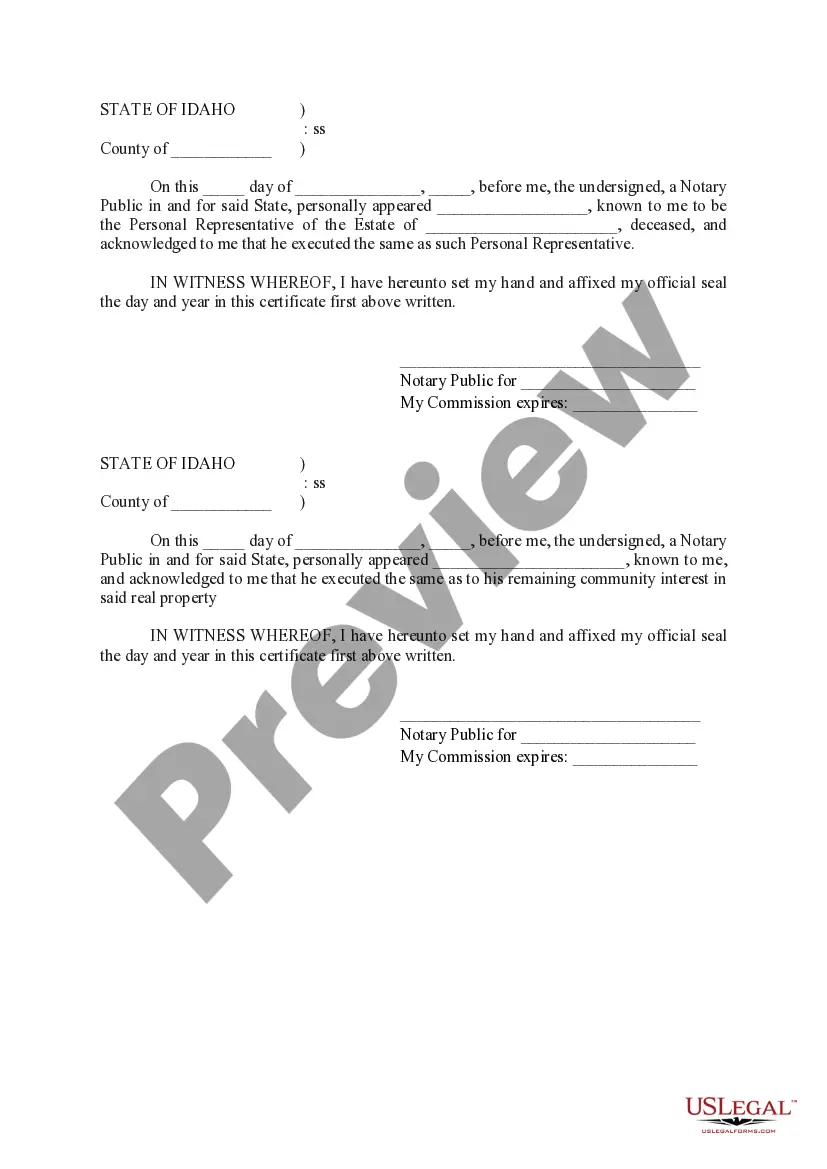

The Meridian Idaho Deed of Distribution is a legal document that outlines the division and transfer of property or assets after the death of an individual in Meridian, Idaho. This deed serves as a crucial instrument in settling an individual's estate and ensuring the distribution of assets according to their wishes or state laws. The Meridian Idaho Deed of Distribution is applicable to different types of assets, including real estate properties, bank accounts, investments, personal possessions, and any other forms of owned property. It specifies the beneficiaries who are entitled to inherit certain assets, their respective shares, and any conditions or restrictions associated with the distribution process. There are several types of Meridian Idaho Deeds of Distribution, each tailored to specific circumstances or estate planning strategies. These types include: 1. General Deed of Distribution: This is the most common type of deed used in Meridian, Idaho. It outlines the overall distribution plan for the assets, ensuring equity amongst beneficiaries and compliance with state laws. 2. Special Deed of Distribution: This type of deed is employed when specific assets or properties require special attention or have unique conditions attached. It ensures the appropriate distribution of these assets according to the designated terms. 3. Testamentary Deed of Distribution: Prescribed by a valid will, this type of deed is used to distribute assets as per the testator's wishes after their death. It is important to note that without a legally recognized will, the state's intestacy laws will determine the distribution of assets. 4. Intestate Deed of Distribution: In cases where the deceased individual did not leave a valid will or estate plan, this type of deed comes into effect. It ensures the assets are distributed according to the state's laws of intestacy, which outlines the prioritized order of inheritance for relatives. 5. Trust Deed of Distribution: If the deceased individual had established a trust during their lifetime, a trust deed of distribution is used to allocate and distribute the assets to the named beneficiaries as stated in the trust agreement. 6. Joint Tenancy Deed of Distribution: When assets are held in joint tenancy, this type of deed ensures the seamless transfer of ownership to the surviving joint tenant(s) after the death of one co-owner. It is crucial to consult with an experienced attorney or estate planning professional in Meridian, Idaho, to accurately prepare and execute the appropriate Meridian Idaho Deed of Distribution based on individual circumstances, wishes, and legal requirements.

Meridian Idaho Deed of Distribution

Description

How to fill out Meridian Idaho Deed Of Distribution?

If you are looking for a valid form template, it’s extremely hard to choose a better service than the US Legal Forms website – probably the most considerable libraries on the web. Here you can find a huge number of document samples for company and personal purposes by types and states, or key phrases. With our advanced search feature, finding the latest Meridian Idaho Deed of Distribution is as elementary as 1-2-3. Additionally, the relevance of each record is confirmed by a group of expert lawyers that on a regular basis check the templates on our platform and revise them according to the newest state and county laws.

If you already know about our platform and have a registered account, all you need to get the Meridian Idaho Deed of Distribution is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have chosen the sample you want. Look at its description and utilize the Preview feature to check its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to find the proper record.

- Affirm your decision. Click the Buy now option. Following that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the form. Select the file format and save it to your system.

- Make changes. Fill out, edit, print, and sign the received Meridian Idaho Deed of Distribution.

Each form you save in your account has no expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you need to have an additional duplicate for editing or printing, you may return and save it again at any moment.

Take advantage of the US Legal Forms extensive collection to gain access to the Meridian Idaho Deed of Distribution you were looking for and a huge number of other professional and state-specific samples in one place!