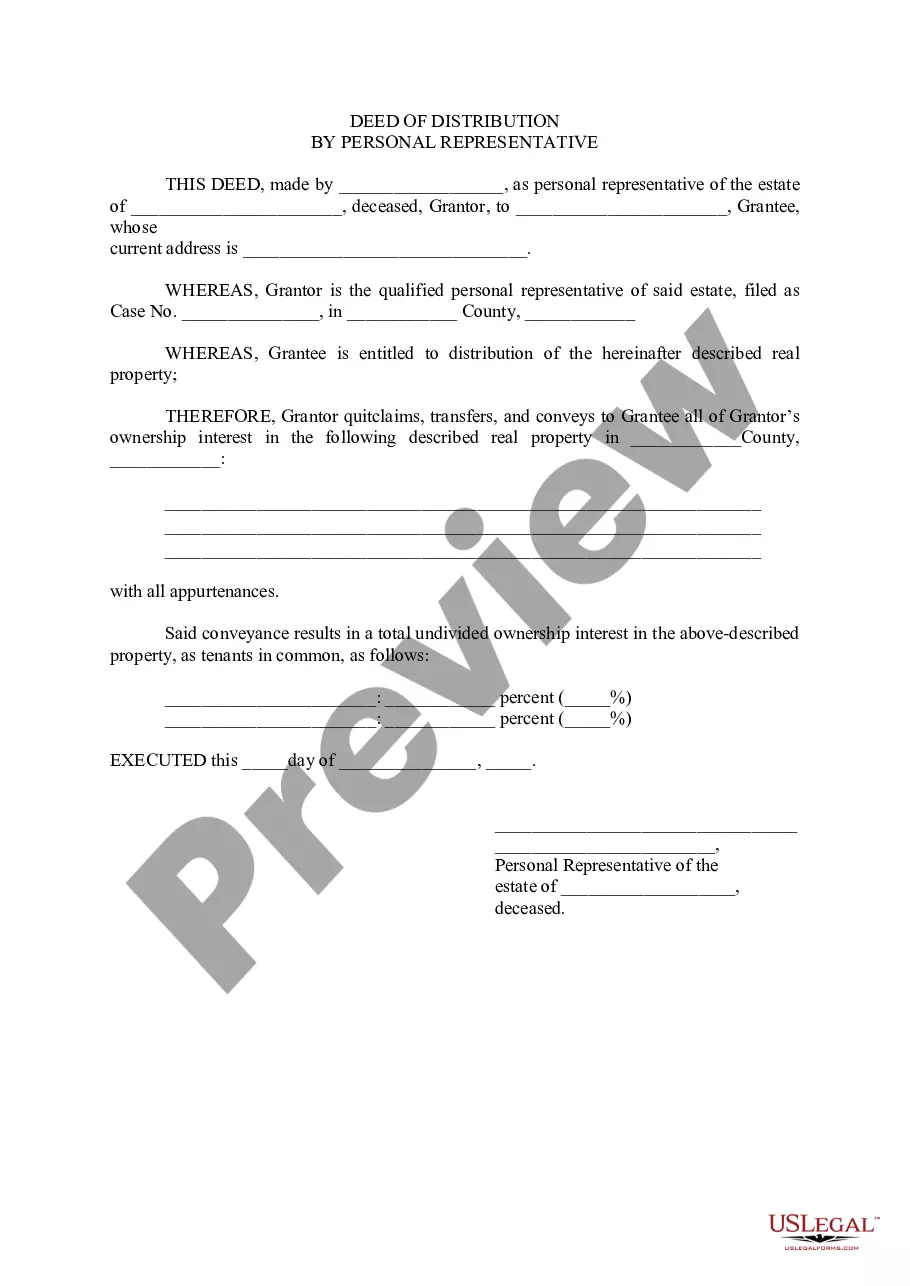

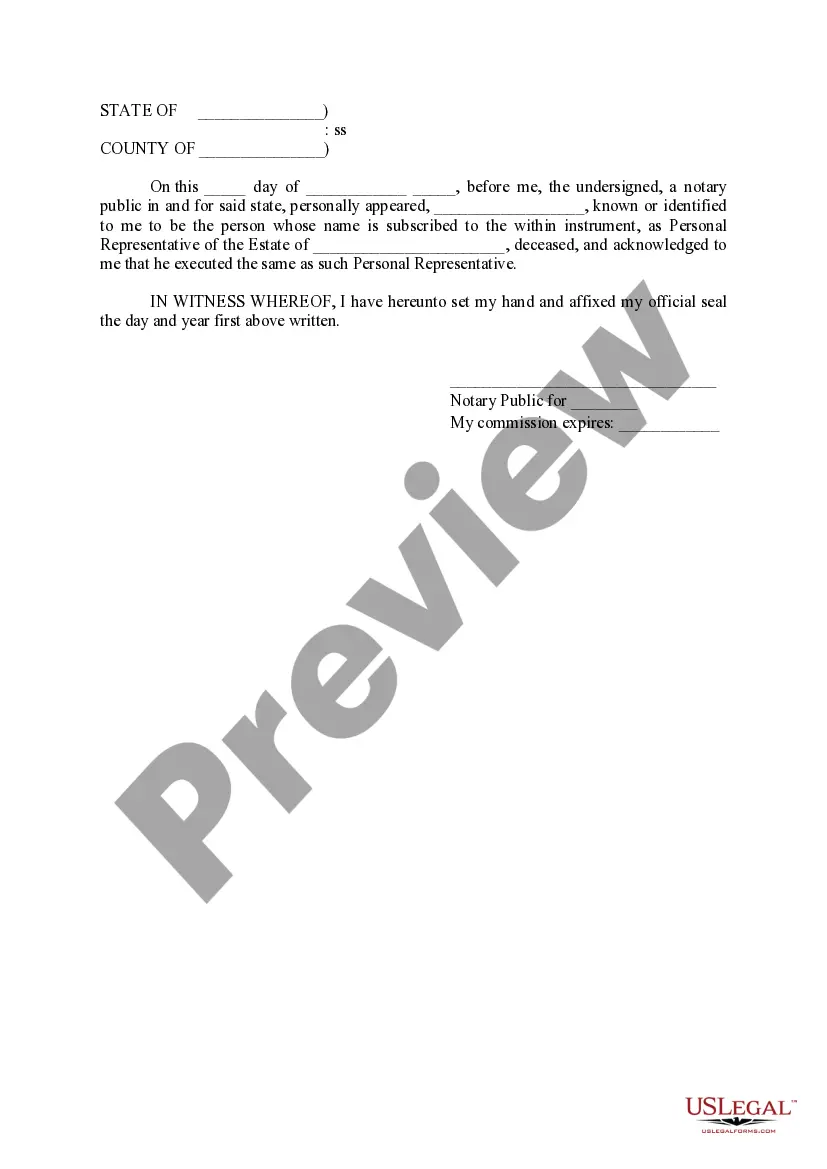

Title: Understanding the Meridian Idaho Deed of Distribution By Personal Representative: Types and Key Aspects Description: If you're involved in estate planning in Meridian, Idaho, it's crucial to familiarize yourself with the Meridian Idaho Deed of Distribution By Personal Representative. This legal document plays a significant role in the distribution of assets once someone has passed away. In this article, we'll delve into the various types of deeds of distribution by personal representatives and highlight essential aspects tied to this legal process. 1. Meridian Idaho Deed of Distribution By Personal Representative: The Meridian Idaho Deed of Distribution By Personal Representative is a legal instrument utilized when transferring the assets or property of a deceased person to beneficiaries or heirs. It is typically executed by the personal representative (also known as executor or administrator) appointed by the court to manage the deceased person's estate. 2. Types of Meridian Idaho Deed of Distribution By Personal Representative: a. General Deed of Distribution: This type of deed is used when distributing a deceased person's assets among multiple beneficiaries. The personal representative must ensure the property is properly appraised and divided according to the deceased person's will or state intestacy laws. b. Special Warranty Deed of Distribution: In cases where there may be potential issues with the title or undisclosed encumbrances on the property, a special warranty deed is utilized. It provides limited assurances to the recipient of the property against claims made by any previous owner, but only during the personal representative's time of ownership. c. Quit Claim Deed of Distribution: This type of deed is employed when the personal representative wishes to transfer whatever rights they have in a property to a beneficiary, without providing any warranties or guarantees regarding the property's condition or title. It merely transfers the personal representative's interest. 3. Key Aspects of the Meridian Idaho Deed of Distribution By Personal Representative: a. Compliance with legal formalities: The personal representative must ensure that the deed adheres to all the legal requirements dictated by the state of Idaho. This includes proper documentation, notarization, and accurate identification of the parties involved. b. Asset Appraisal: Prior to executing the deed, the personal representative must appraise the assets or property to determine their fair market value. This evaluation is essential for fair distribution among beneficiaries while considering any outstanding liabilities or debts. c. Distribution Plan: The personal representative should carefully follow the distribution plan outlined in the deceased person's will or, if applicable, the state laws of intestacy. Proper documentation and consideration of any specific bequests or conditions set forth is crucial. d. Transfer of Legal Title: Once the deed of distribution is executed, the personal representative transfers the legal title of the property to the beneficiaries or heirs mentioned therein. This transfer should be accurately recorded in the relevant county's land records. Understanding the Meridian Idaho Deed of Distribution By Personal Representative is essential for a smooth and appropriate estate settlement process. Engaging the services of an experienced attorney specializing in estate planning can provide invaluable guidance throughout the procedure.

Meridian Idaho Deed of Distribution By Personal Representative

Description

How to fill out Meridian Idaho Deed Of Distribution By Personal Representative?

Take advantage of the US Legal Forms and have instant access to any form sample you want. Our beneficial website with a huge number of templates makes it easy to find and get virtually any document sample you require. You are able to save, complete, and sign the Meridian Idaho Deed of Distribution By Personal Representative in a couple of minutes instead of surfing the Net for many hours attempting to find the right template.

Utilizing our library is a superb strategy to improve the safety of your record submissions. Our experienced lawyers on a regular basis check all the documents to make certain that the forms are appropriate for a particular state and compliant with new laws and regulations.

How do you obtain the Meridian Idaho Deed of Distribution By Personal Representative? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you view. Additionally, you can get all the previously saved files in the My Forms menu.

If you don’t have an account yet, follow the instructions below:

- Open the page with the form you need. Make sure that it is the form you were seeking: verify its headline and description, and use the Preview function if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving procedure. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the file. Indicate the format to obtain the Meridian Idaho Deed of Distribution By Personal Representative and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and reliable template libraries on the internet. Our company is always happy to help you in any legal procedure, even if it is just downloading the Meridian Idaho Deed of Distribution By Personal Representative.

Feel free to benefit from our platform and make your document experience as efficient as possible!