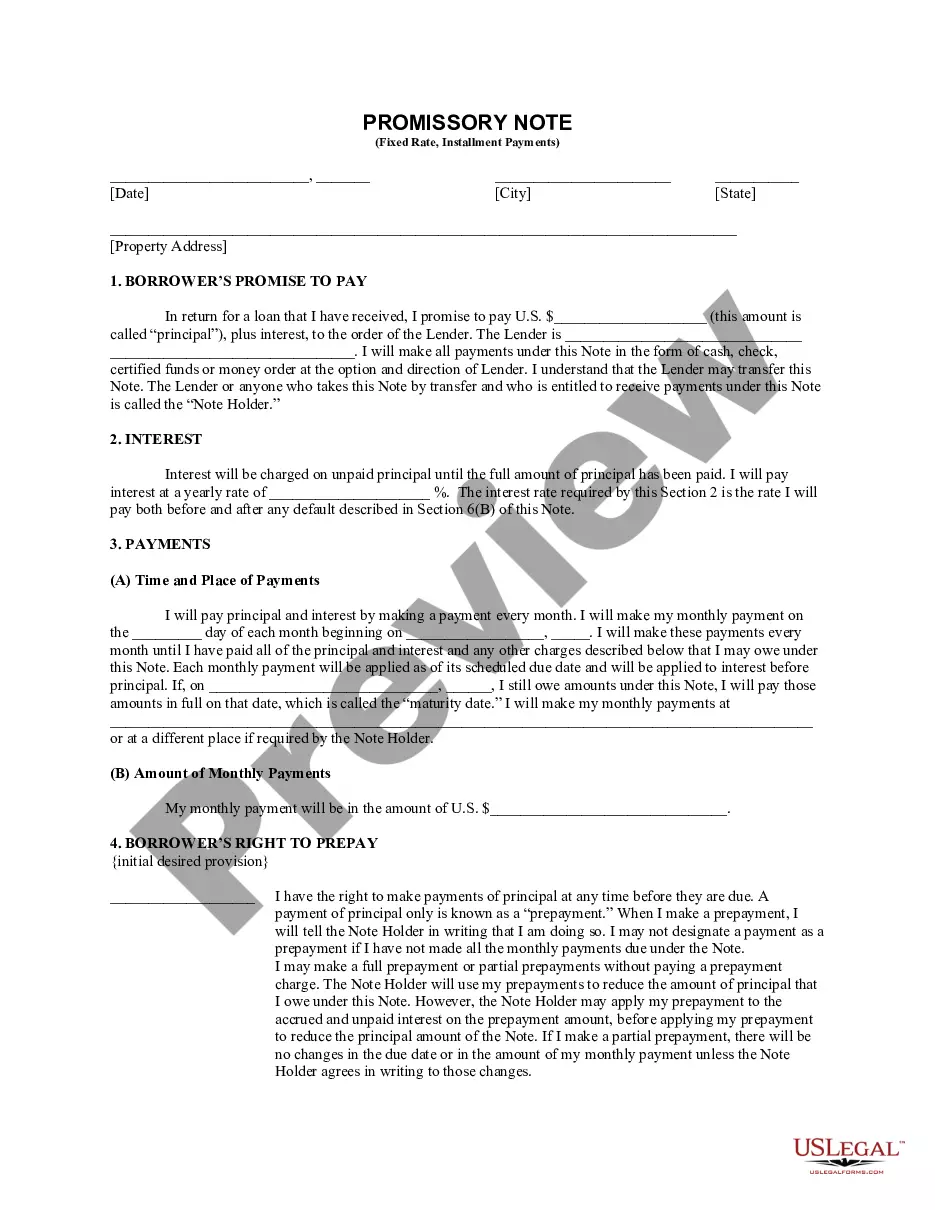

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

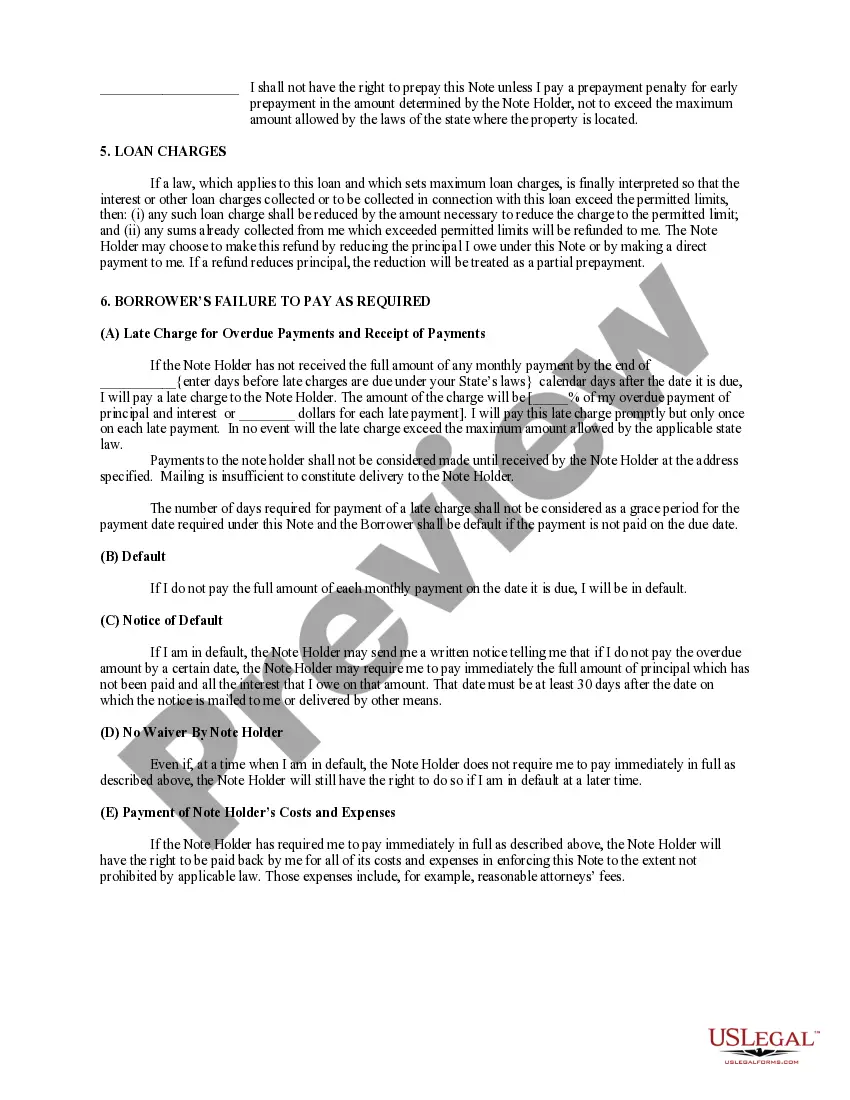

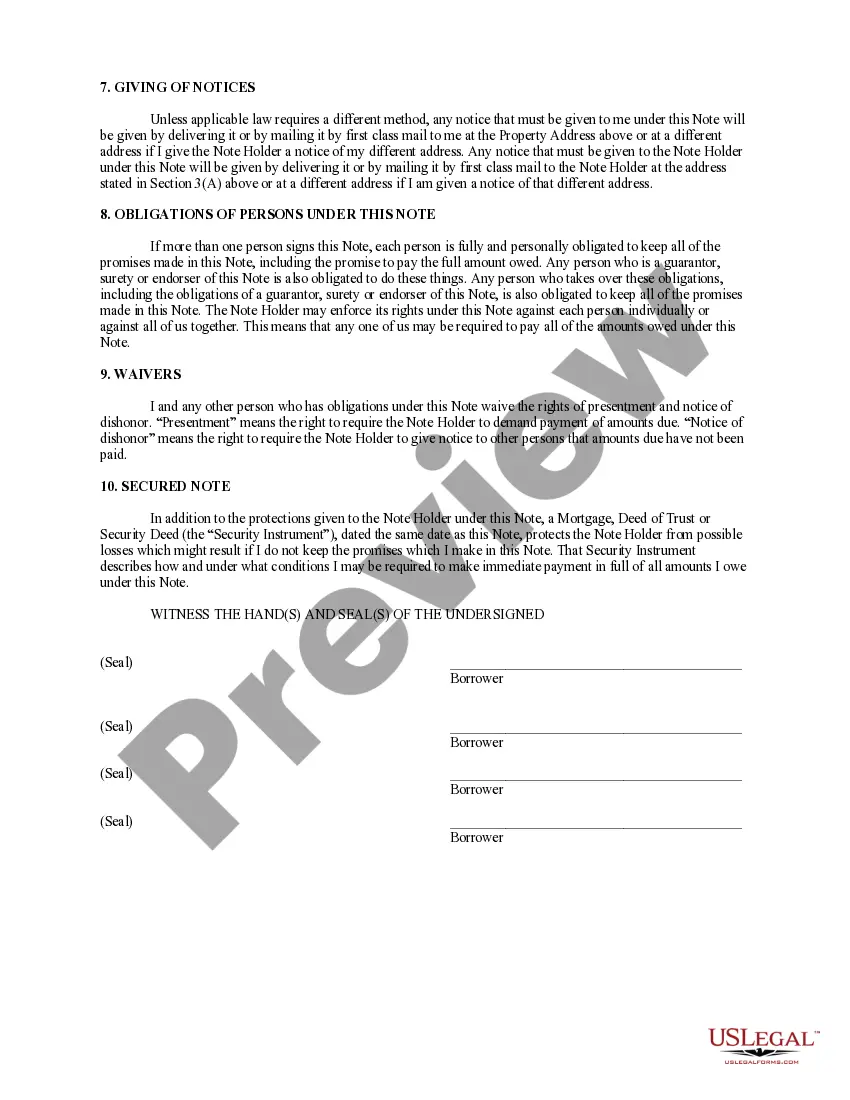

The Meridian Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho is a legal document used in real estate transactions where the borrower agrees to repay a loan in installments, with the loan being secured by the borrower's residential property in Idaho. This type of promissory note ensures that the lender has a legal claim on the property in case of default. With the Meridian Installments Fixed Rate Promissory Note, the borrower agrees to make regular payments to the lender, typically on a monthly basis, until the loan is fully repaid. The note specifies the interest rate, which remains fixed throughout the loan term, ensuring predictable monthly payments for the borrower. The promissory note is secured by residential real estate, meaning the borrower pledges their residential property located in Idaho as collateral for the loan. This provides the lender with an added layer of security, as they can initiate foreclosure proceedings in case of default. The specific property details, such as the address and legal description, are included in the note. There can be different types or variations of the Meridian Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho, based on the specific terms and conditions agreed upon between the borrower and lender. Some common variations may include: 1. Fixed Rate Promissory Note with Balloon Payment: In this type of note, the borrower makes regular installments for a specified period, usually several years, followed by a larger, final payment (balloon payment) to fully repay the remaining balance. 2. Adjustable Rate Promissory Note: This variation features an interest rate that may change over time, typically tied to an index such as the Prime Rate. As a result, the monthly payments can fluctuate, making them subject to market conditions. 3. Interest-Only Promissory Note: With this note, the borrower is only required to make interest payments for a set period, usually several years, before beginning to repay the principal amount in addition to interest. 4. Term Promissory Note: This variation specifies a fixed term, typically ranging from 5 to 30 years, during which the borrower must repay the entire loan amount, including both principal and interest, by making regular installments. These variations may have different provisions regarding prepayment penalties, late fees, default remedies, and other terms that are essential to the agreement between the parties involved. It is important for both borrowers and lenders to carefully review and understand all terms, conditions, and obligations outlined in the Meridian Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho before entering into a loan agreement.The Meridian Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho is a legal document used in real estate transactions where the borrower agrees to repay a loan in installments, with the loan being secured by the borrower's residential property in Idaho. This type of promissory note ensures that the lender has a legal claim on the property in case of default. With the Meridian Installments Fixed Rate Promissory Note, the borrower agrees to make regular payments to the lender, typically on a monthly basis, until the loan is fully repaid. The note specifies the interest rate, which remains fixed throughout the loan term, ensuring predictable monthly payments for the borrower. The promissory note is secured by residential real estate, meaning the borrower pledges their residential property located in Idaho as collateral for the loan. This provides the lender with an added layer of security, as they can initiate foreclosure proceedings in case of default. The specific property details, such as the address and legal description, are included in the note. There can be different types or variations of the Meridian Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho, based on the specific terms and conditions agreed upon between the borrower and lender. Some common variations may include: 1. Fixed Rate Promissory Note with Balloon Payment: In this type of note, the borrower makes regular installments for a specified period, usually several years, followed by a larger, final payment (balloon payment) to fully repay the remaining balance. 2. Adjustable Rate Promissory Note: This variation features an interest rate that may change over time, typically tied to an index such as the Prime Rate. As a result, the monthly payments can fluctuate, making them subject to market conditions. 3. Interest-Only Promissory Note: With this note, the borrower is only required to make interest payments for a set period, usually several years, before beginning to repay the principal amount in addition to interest. 4. Term Promissory Note: This variation specifies a fixed term, typically ranging from 5 to 30 years, during which the borrower must repay the entire loan amount, including both principal and interest, by making regular installments. These variations may have different provisions regarding prepayment penalties, late fees, default remedies, and other terms that are essential to the agreement between the parties involved. It is important for both borrowers and lenders to carefully review and understand all terms, conditions, and obligations outlined in the Meridian Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho before entering into a loan agreement.