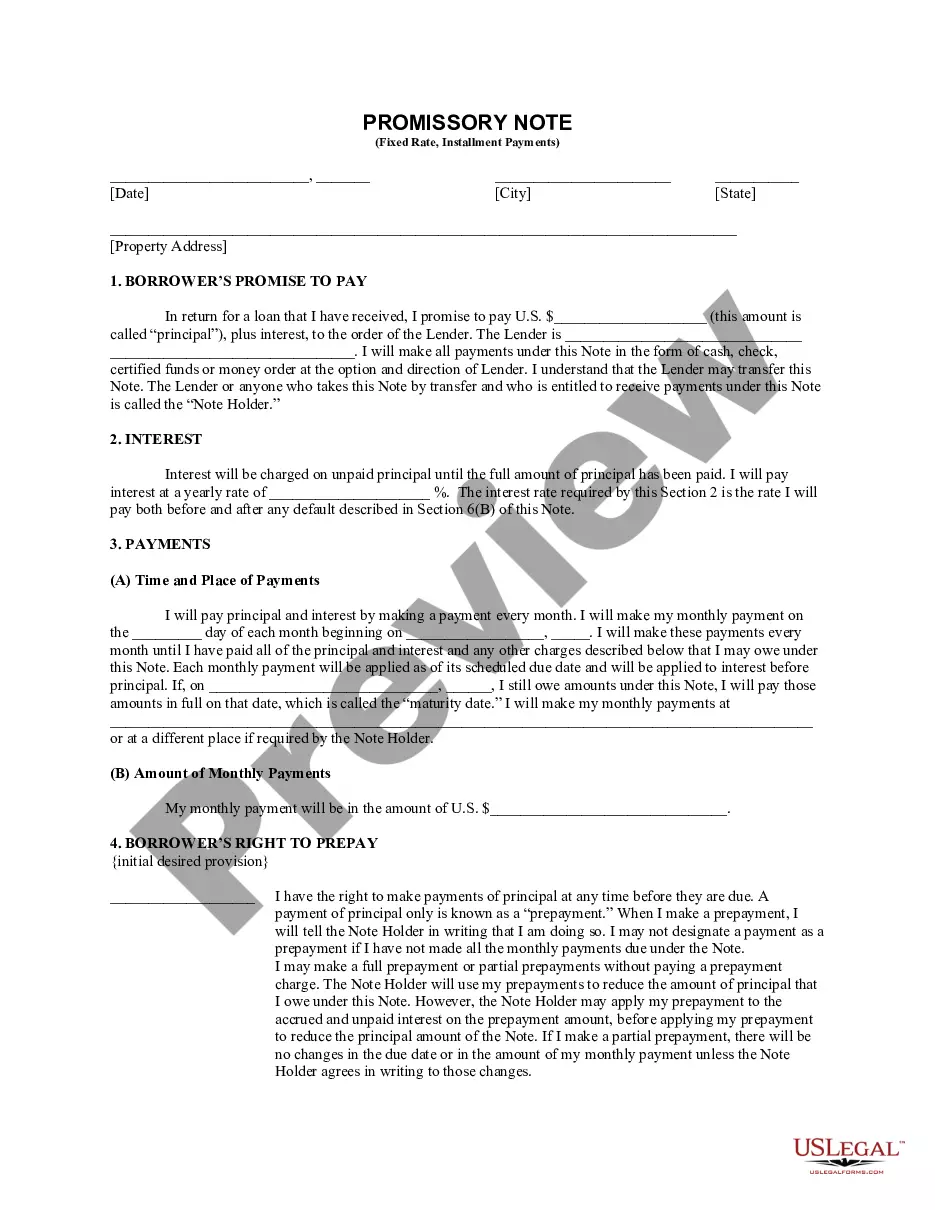

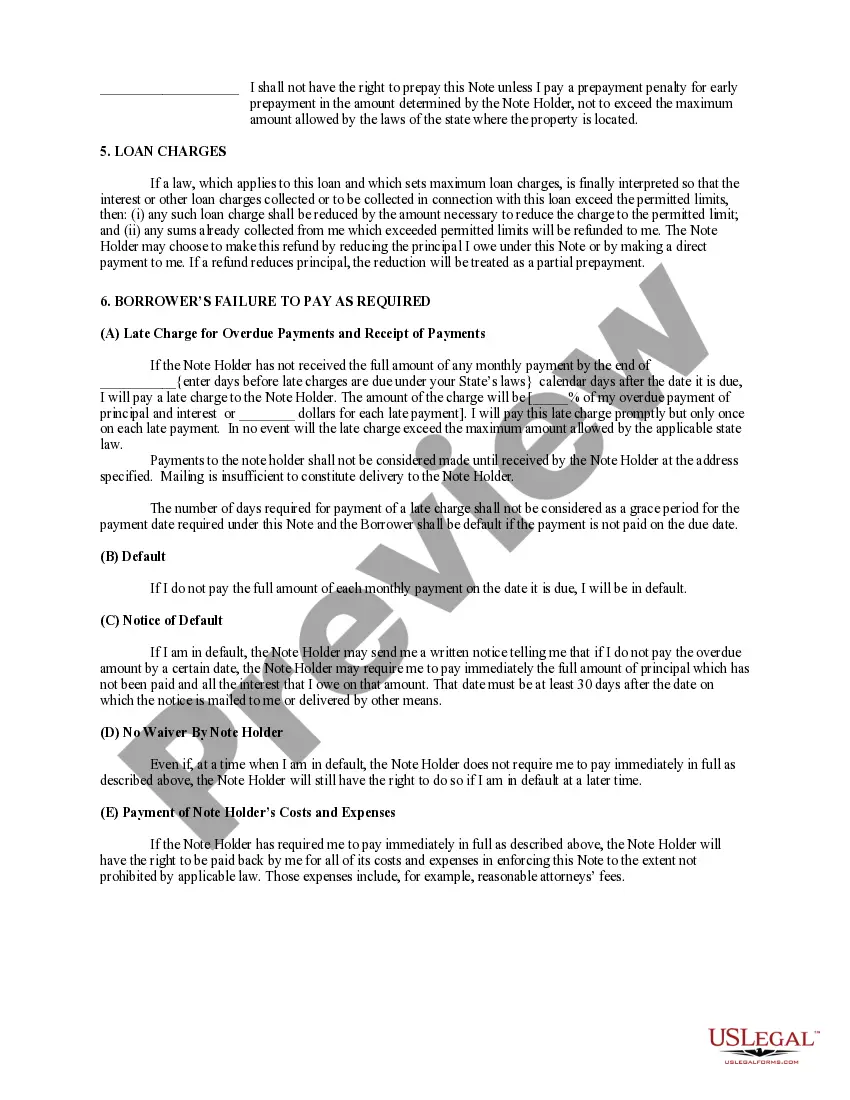

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Nampa Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho is a legal financial instrument used to document a loan agreement between a borrower and a lender in Nampa, Idaho. This note outlines the terms and conditions of the loan, including the interest rate, repayment period, and the specific property that serves as collateral. One type of Nampa Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho is the "Standard Fixed Rate Promissory Note." Under this arrangement, the interest rate remains fixed for the entire duration of the loan, promoting predictability and stability for both parties involved. Another variation is the "Variable Rate Promissory Note" for Nampa. With this type of note, the interest rate can fluctuate over time based on market conditions or a specified index. While this can result in potential savings when interest rates are low, it also carries the risk of higher payments if rates increase. The note also specifies that the loan is secured by residential real estate located in Nampa, Idaho. This means that in the event of default, the lender has the right to foreclose on the property and recover the outstanding balance through its sale. Securing the loan with residential real estate provides added security for the lender and can often result in more favorable terms for the borrower, such as lower interest rates or longer repayment periods. The Nampa Installments Fixed Rate Promissory Note for Idaho outlines the key features and obligations of both the borrower and lender. It includes details about the loan amount, the interest rate charged, the frequency and amount of installment payments, and the consequences of late payments or default. It is important for both parties to carefully review and understand the terms of the Nampa Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho before signing. Borrowers should ensure that they can comfortably meet their repayment obligations, while lenders need to assess the borrower's financial stability and the value of the residential property serving as collateral. Overall, the Nampa Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho provides a legal framework for borrowers to obtain financing while protecting the interests of lenders in Nampa, Idaho. By clearly defining the terms of the loan, this instrument promotes transparency, fairness, and facilitates successful lending relationships.Nampa Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho is a legal financial instrument used to document a loan agreement between a borrower and a lender in Nampa, Idaho. This note outlines the terms and conditions of the loan, including the interest rate, repayment period, and the specific property that serves as collateral. One type of Nampa Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho is the "Standard Fixed Rate Promissory Note." Under this arrangement, the interest rate remains fixed for the entire duration of the loan, promoting predictability and stability for both parties involved. Another variation is the "Variable Rate Promissory Note" for Nampa. With this type of note, the interest rate can fluctuate over time based on market conditions or a specified index. While this can result in potential savings when interest rates are low, it also carries the risk of higher payments if rates increase. The note also specifies that the loan is secured by residential real estate located in Nampa, Idaho. This means that in the event of default, the lender has the right to foreclose on the property and recover the outstanding balance through its sale. Securing the loan with residential real estate provides added security for the lender and can often result in more favorable terms for the borrower, such as lower interest rates or longer repayment periods. The Nampa Installments Fixed Rate Promissory Note for Idaho outlines the key features and obligations of both the borrower and lender. It includes details about the loan amount, the interest rate charged, the frequency and amount of installment payments, and the consequences of late payments or default. It is important for both parties to carefully review and understand the terms of the Nampa Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho before signing. Borrowers should ensure that they can comfortably meet their repayment obligations, while lenders need to assess the borrower's financial stability and the value of the residential property serving as collateral. Overall, the Nampa Installments Fixed Rate Promissory Note Secured by Residential Real Estate for Idaho provides a legal framework for borrowers to obtain financing while protecting the interests of lenders in Nampa, Idaho. By clearly defining the terms of the loan, this instrument promotes transparency, fairness, and facilitates successful lending relationships.