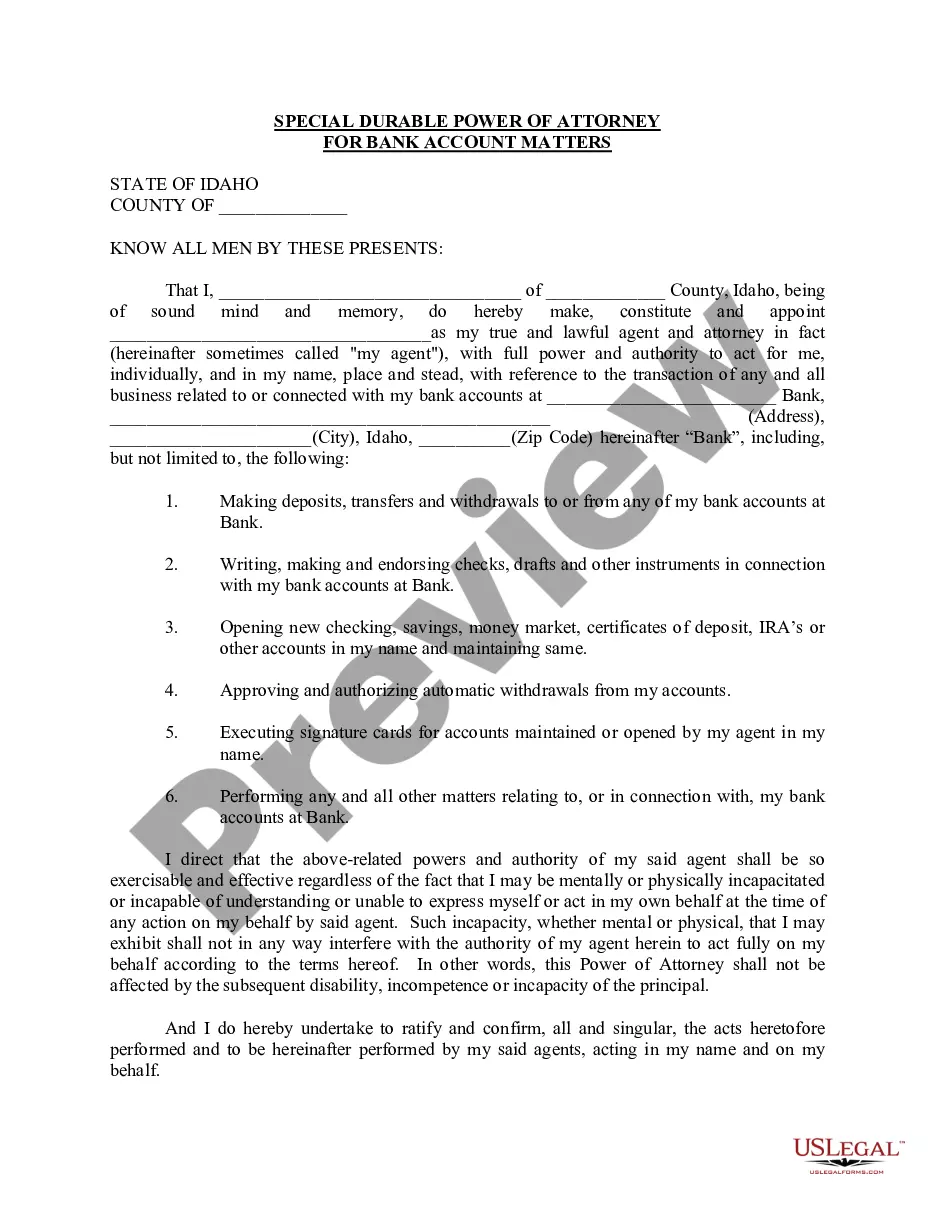

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

A Meridian Idaho Special Durable Power of Attorney for Bank Account Matters refers to a legal document granting a trusted individual the authority to manage specific banking affairs on behalf of someone else. This particular type of power of attorney allows the appointed individual, known as the agent or attorney-in-fact, to handle financial transactions and make decisions related to bank accounts when the principal (the person granting the power) is unable or incapable of doing so themselves. It is essential to understand the different types of Meridian Idaho Special Durable Power of Attorney for Bank Account Matters, as each may cater to varying requirements and circumstances. One type of Meridian Idaho Special Durable Power of Attorney for Bank Account Matters is focused on a specific bank account or a set of accounts. This type of power of attorney grants the agent authority solely over the specified accounts, limiting their access and control to those particular funds. It provides a narrow scope of power but can be beneficial in situations where the principal wants to ensure their regular bills, expenses, or investments are seamlessly managed. Another type of Meridian Idaho Special Durable Power of Attorney for Bank Account Matters is designed with broader authority. It enables the agent to oversee multiple bank accounts held by the principal, granting them the power to perform various banking activities such as depositing or withdrawing funds, paying bills, monitoring transactions, and even executing investment decisions if stated explicitly. This more comprehensive power of attorney is suitable for individuals seeking comprehensive financial management and assistance. Additionally, Meridian Idaho Special Durable Power of Attorney for Bank Account Matters can vary based on the level of durability. A durable power of attorney remains valid even if the principal becomes incapacitated or mentally unstable, ensuring the continuity of financial affairs. Non-durable power of attorney, on the other hand, ceases to be effective if the principal loses their mental capacity, which may not be suitable for long-term financial management purposes. It is crucial to consult with an attorney or legal professional well-versed in Meridian Idaho laws when drafting a Special Durable Power of Attorney for Bank Account Matters. They can guide you through the process, ensuring your document aligns with the state's specific requirements and reflects your unique preferences and circumstances.A Meridian Idaho Special Durable Power of Attorney for Bank Account Matters refers to a legal document granting a trusted individual the authority to manage specific banking affairs on behalf of someone else. This particular type of power of attorney allows the appointed individual, known as the agent or attorney-in-fact, to handle financial transactions and make decisions related to bank accounts when the principal (the person granting the power) is unable or incapable of doing so themselves. It is essential to understand the different types of Meridian Idaho Special Durable Power of Attorney for Bank Account Matters, as each may cater to varying requirements and circumstances. One type of Meridian Idaho Special Durable Power of Attorney for Bank Account Matters is focused on a specific bank account or a set of accounts. This type of power of attorney grants the agent authority solely over the specified accounts, limiting their access and control to those particular funds. It provides a narrow scope of power but can be beneficial in situations where the principal wants to ensure their regular bills, expenses, or investments are seamlessly managed. Another type of Meridian Idaho Special Durable Power of Attorney for Bank Account Matters is designed with broader authority. It enables the agent to oversee multiple bank accounts held by the principal, granting them the power to perform various banking activities such as depositing or withdrawing funds, paying bills, monitoring transactions, and even executing investment decisions if stated explicitly. This more comprehensive power of attorney is suitable for individuals seeking comprehensive financial management and assistance. Additionally, Meridian Idaho Special Durable Power of Attorney for Bank Account Matters can vary based on the level of durability. A durable power of attorney remains valid even if the principal becomes incapacitated or mentally unstable, ensuring the continuity of financial affairs. Non-durable power of attorney, on the other hand, ceases to be effective if the principal loses their mental capacity, which may not be suitable for long-term financial management purposes. It is crucial to consult with an attorney or legal professional well-versed in Meridian Idaho laws when drafting a Special Durable Power of Attorney for Bank Account Matters. They can guide you through the process, ensuring your document aligns with the state's specific requirements and reflects your unique preferences and circumstances.