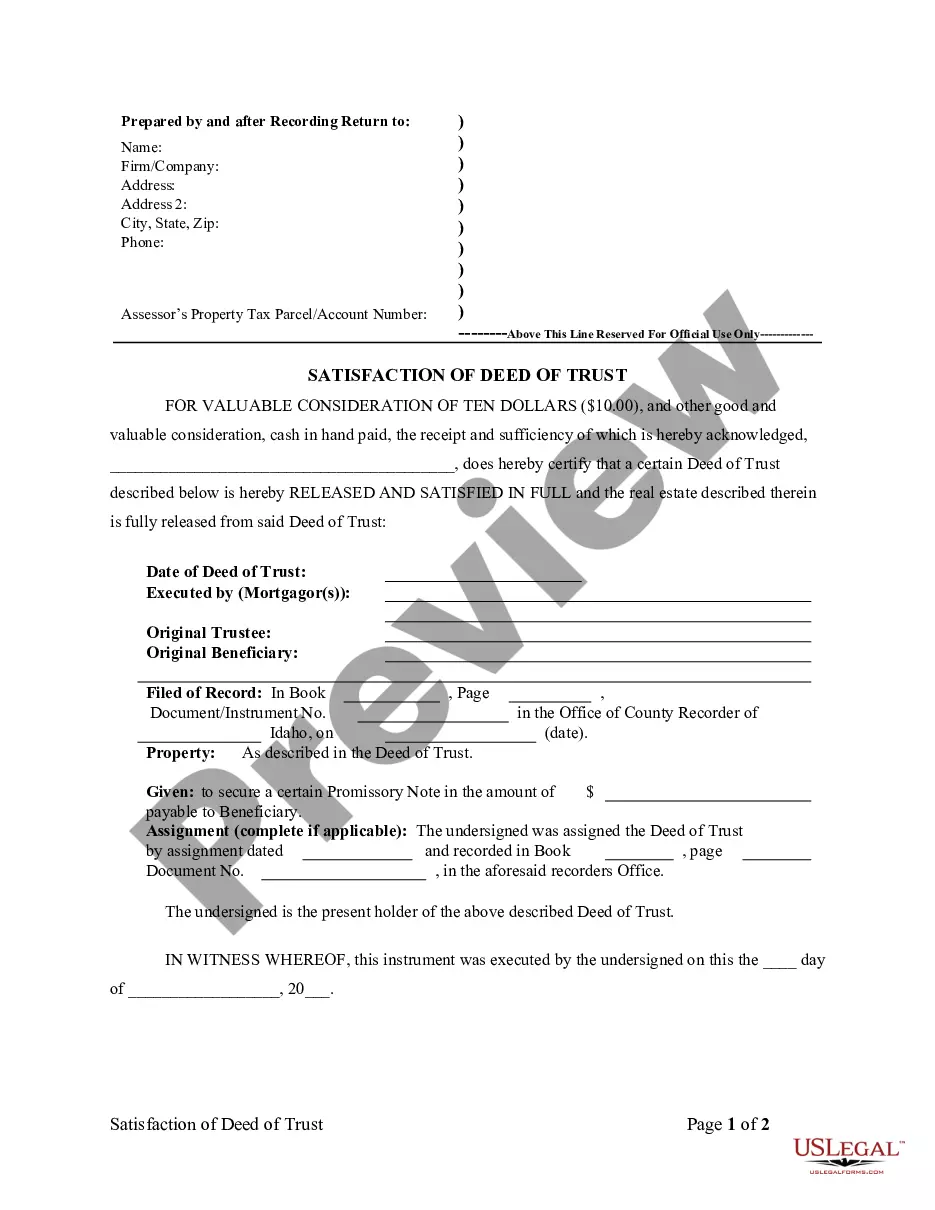

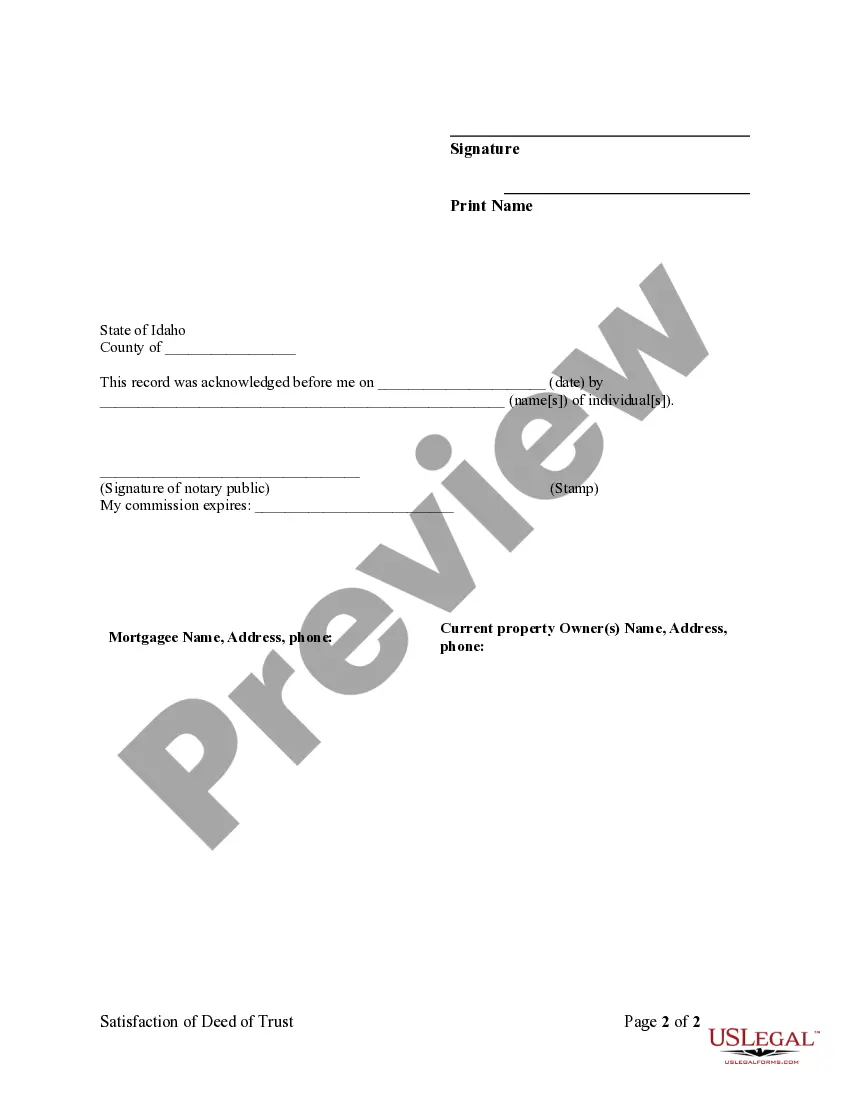

This form is for the satisfaction or release of a mortgage for the state of Idaho by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Meridian Idaho Satisfaction, Release or Cancellation of Deed of Trust by Individual process is a legal procedure where an individual or homeowner seeks to clear the title of their property by releasing the lien or security interest held by a mortgage lender. This action is usually taken after the repayment of a loan or mortgage in full. Here, we will provide a detailed explanation of the process, requirements, and types of Meridian Idaho Satisfaction, Release or Cancellation of Deed of Trust by Individual. The Satisfaction, Release, or Cancellation of Deed of Trust by Individual in Meridian Idaho is a crucial step in ensuring the homeowner has clear ownership rights to their property, without any encumbrances. It signifies the completion of the loan or mortgage repayment and the legal release of the lender's interest in the property. Once this process is completed, the homeowner can enjoy unhindered property ownership, enabling them to sell, refinance, or transfer the property without any complications. Keywords: Meridian Idaho, Satisfaction, Release, Cancellation of Deed of Trust, Individual, process, homeowner, title, lien, security interest, mortgage lender, repayment, loan, mortgage, legal, encumbrances, ownership, property, sell, refinance, transfer. Types of Meridian Idaho Satisfaction, Release, or Cancellation of Deed of Trust by Individual: 1. Full Satisfaction: This type of release occurs when the homeowner has repaid the entire outstanding loan amount, including interest, and the lender acknowledges the complete satisfaction of the debt. The lender then signs and files the necessary documents, confirming the release of the deed of trust. 2. Partial Satisfaction: In some cases, the homeowner may have made partial payments towards their loan or mortgage, resulting in a reduction of the overall debt. A partial release is obtained by demonstrating the payment made and requesting the lender to release the corresponding portion of the deed of trust, which will effectively reduce the lien amount on the property. 3. Release upon Sale: When a homeowner intends to sell their property, the buyer's lender will require the release of the existing deed of trust before closing the transaction. This ensures that the buyer obtains a clear title and the property is not encumbered by any previous mortgage or lien. 4. Release upon Refinance: Similarly, when a homeowner seeks to refinance their mortgage, the new lender requires the release of the existing deed of trust by the previous lender. This process enables the new lender to establish their own lien on the property. 5. Release due to Error or Satisfaction through Litigation: Although uncommon, errors can occur during the loan repayment process, leading to incorrect documentation or the failure to release the deed of trust. In such cases, a homeowner may have to pursue legal action or litigation to rectify the error and obtain the satisfaction or release of the deed of trust. In conclusion, the Meridian Idaho Satisfaction, Release, or Cancellation of Deed of Trust by Individual is a critical process that guarantees the homeowner clear ownership rights to their property after repaying a loan or mortgage. Different types of releases may depend on the status of the debt, such as full satisfaction, partial satisfaction, release upon sale, release upon refinance, or satisfaction through litigation. It is crucial for homeowners to understand this process and ensure all necessary documents are filed to secure their property's title rights.Meridian Idaho Satisfaction, Release or Cancellation of Deed of Trust by Individual process is a legal procedure where an individual or homeowner seeks to clear the title of their property by releasing the lien or security interest held by a mortgage lender. This action is usually taken after the repayment of a loan or mortgage in full. Here, we will provide a detailed explanation of the process, requirements, and types of Meridian Idaho Satisfaction, Release or Cancellation of Deed of Trust by Individual. The Satisfaction, Release, or Cancellation of Deed of Trust by Individual in Meridian Idaho is a crucial step in ensuring the homeowner has clear ownership rights to their property, without any encumbrances. It signifies the completion of the loan or mortgage repayment and the legal release of the lender's interest in the property. Once this process is completed, the homeowner can enjoy unhindered property ownership, enabling them to sell, refinance, or transfer the property without any complications. Keywords: Meridian Idaho, Satisfaction, Release, Cancellation of Deed of Trust, Individual, process, homeowner, title, lien, security interest, mortgage lender, repayment, loan, mortgage, legal, encumbrances, ownership, property, sell, refinance, transfer. Types of Meridian Idaho Satisfaction, Release, or Cancellation of Deed of Trust by Individual: 1. Full Satisfaction: This type of release occurs when the homeowner has repaid the entire outstanding loan amount, including interest, and the lender acknowledges the complete satisfaction of the debt. The lender then signs and files the necessary documents, confirming the release of the deed of trust. 2. Partial Satisfaction: In some cases, the homeowner may have made partial payments towards their loan or mortgage, resulting in a reduction of the overall debt. A partial release is obtained by demonstrating the payment made and requesting the lender to release the corresponding portion of the deed of trust, which will effectively reduce the lien amount on the property. 3. Release upon Sale: When a homeowner intends to sell their property, the buyer's lender will require the release of the existing deed of trust before closing the transaction. This ensures that the buyer obtains a clear title and the property is not encumbered by any previous mortgage or lien. 4. Release upon Refinance: Similarly, when a homeowner seeks to refinance their mortgage, the new lender requires the release of the existing deed of trust by the previous lender. This process enables the new lender to establish their own lien on the property. 5. Release due to Error or Satisfaction through Litigation: Although uncommon, errors can occur during the loan repayment process, leading to incorrect documentation or the failure to release the deed of trust. In such cases, a homeowner may have to pursue legal action or litigation to rectify the error and obtain the satisfaction or release of the deed of trust. In conclusion, the Meridian Idaho Satisfaction, Release, or Cancellation of Deed of Trust by Individual is a critical process that guarantees the homeowner clear ownership rights to their property after repaying a loan or mortgage. Different types of releases may depend on the status of the debt, such as full satisfaction, partial satisfaction, release upon sale, release upon refinance, or satisfaction through litigation. It is crucial for homeowners to understand this process and ensure all necessary documents are filed to secure their property's title rights.