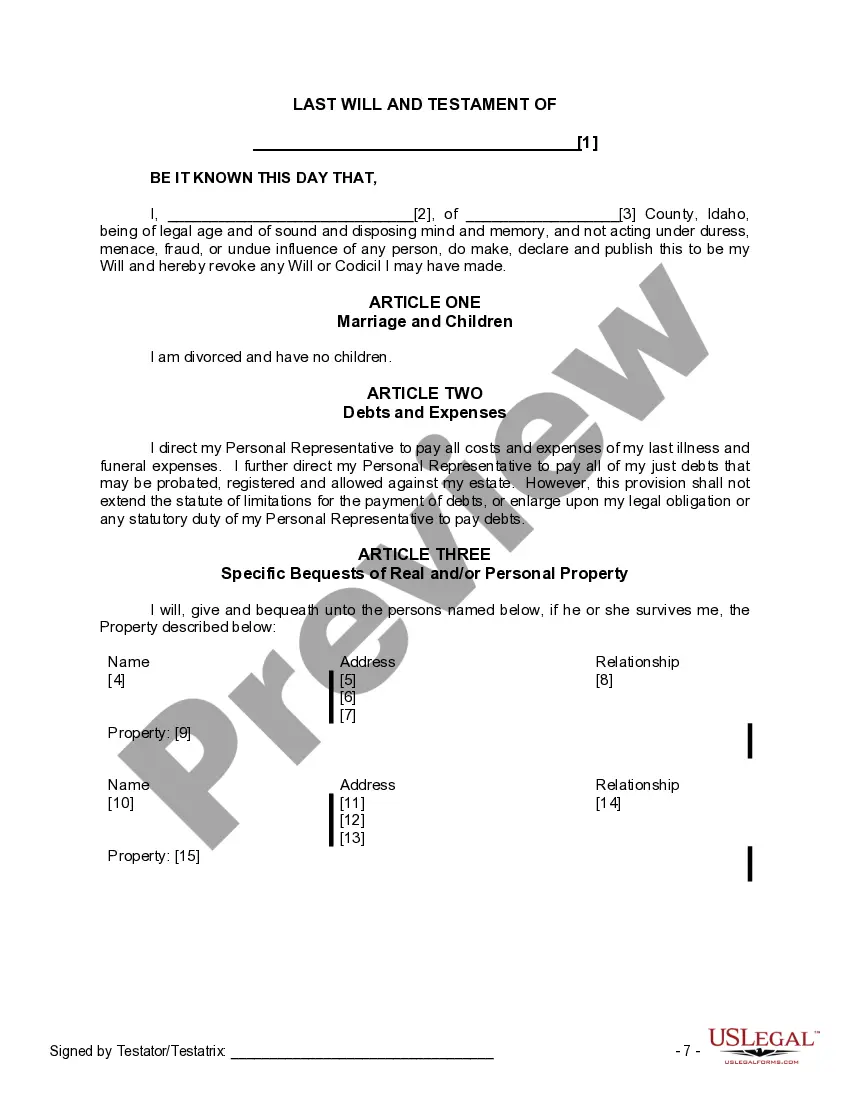

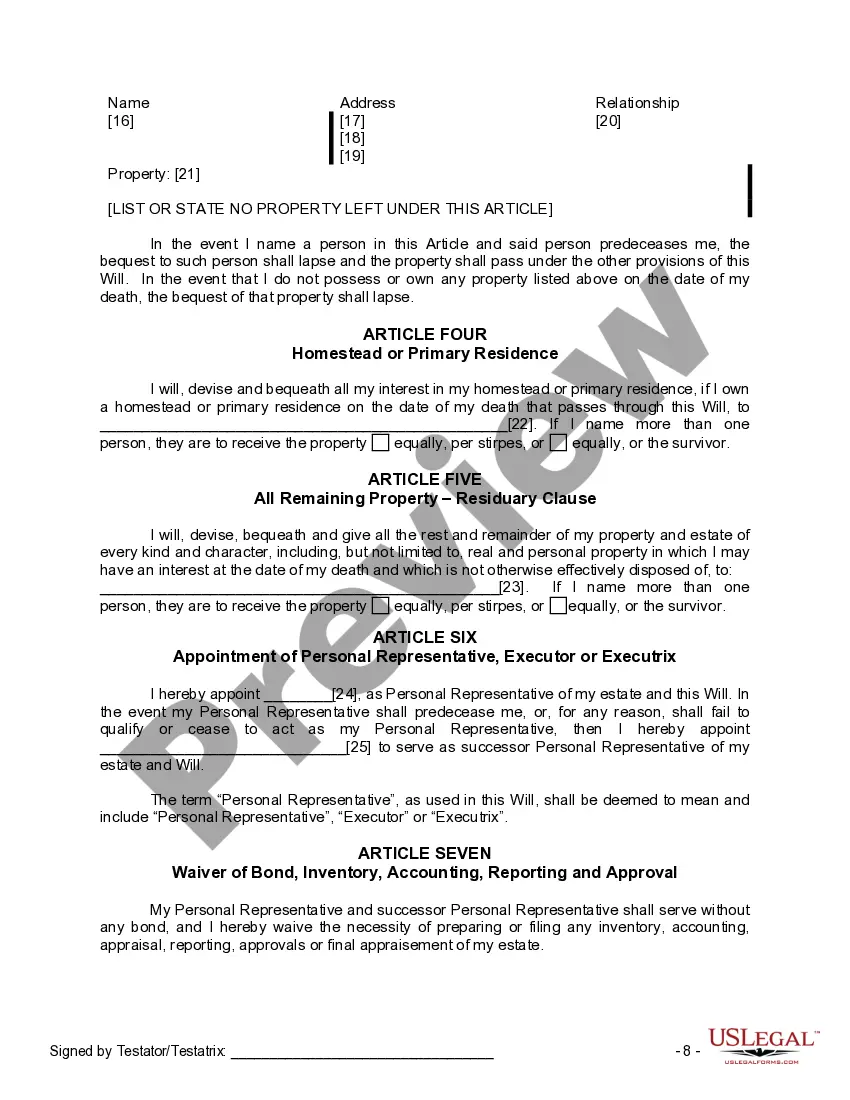

The Will you have found is for a divorced person, not remarried with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

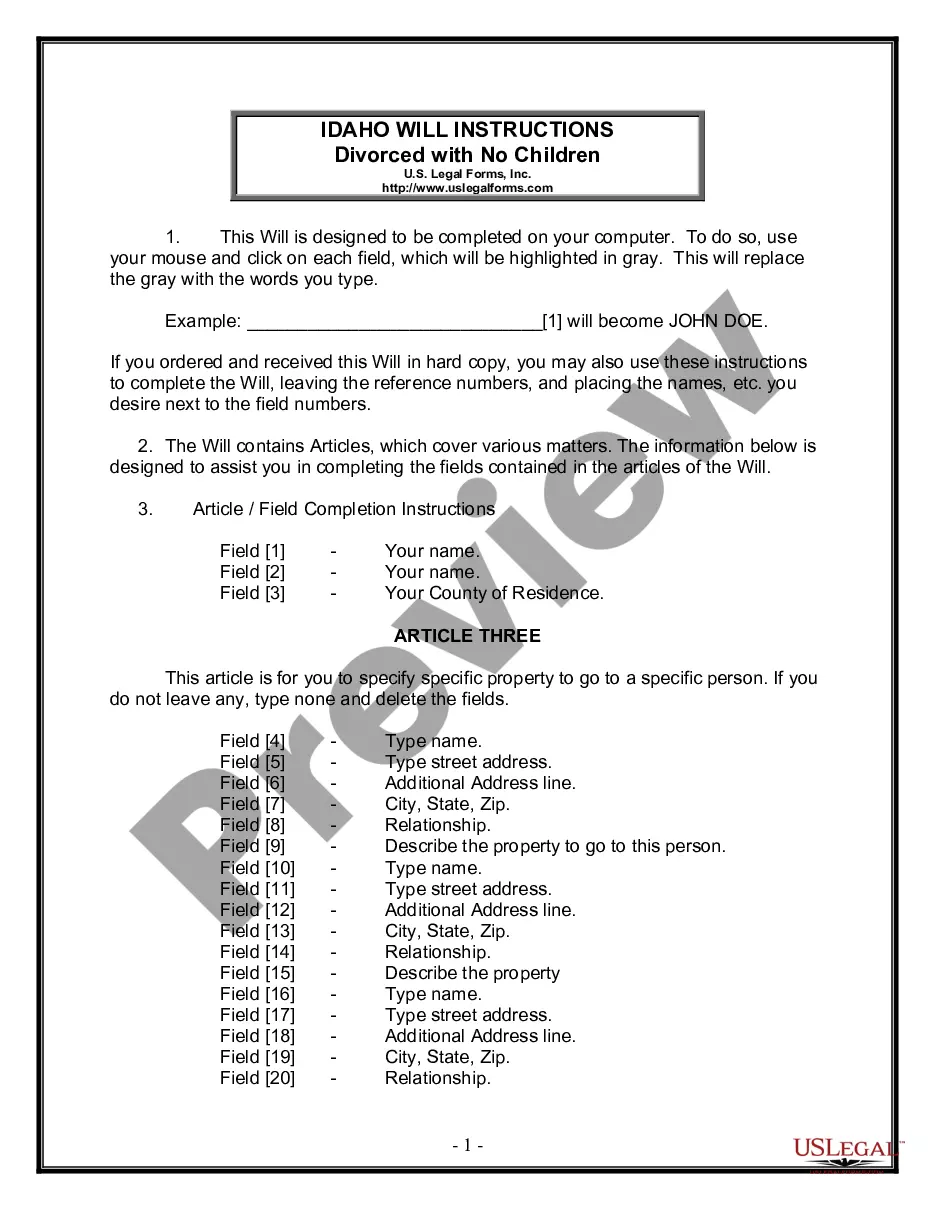

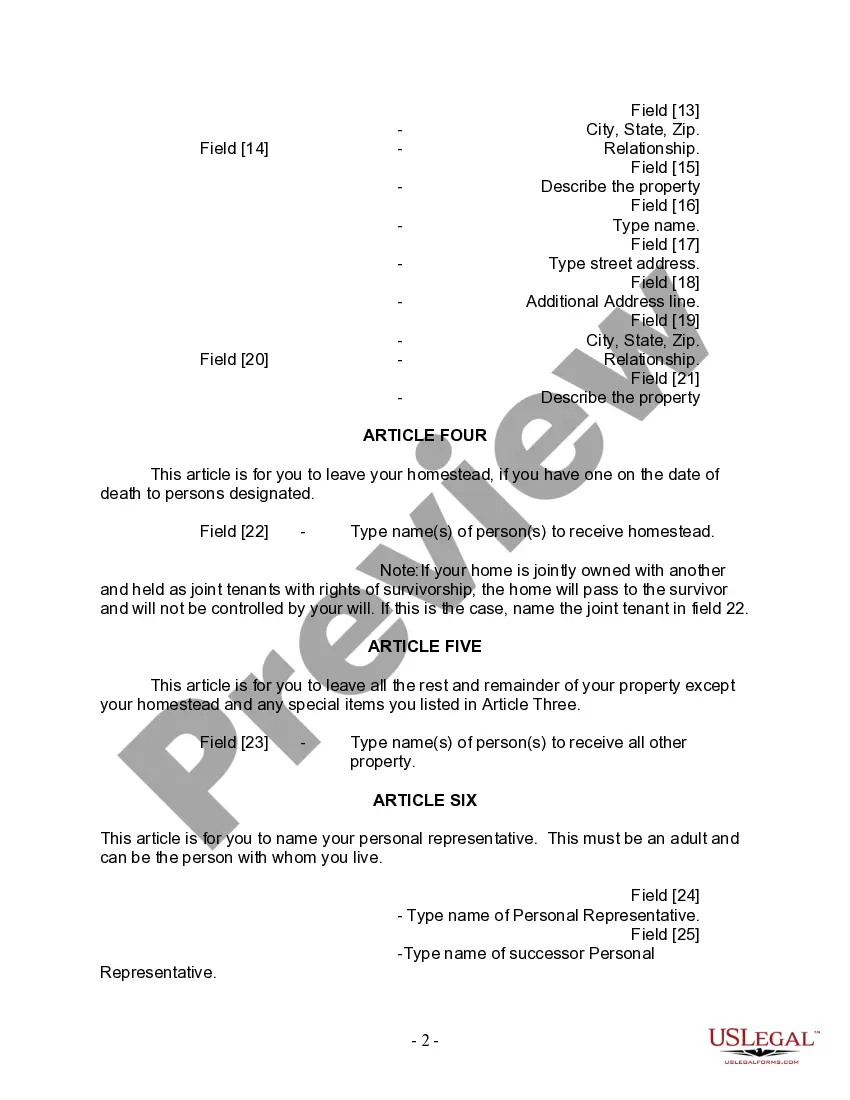

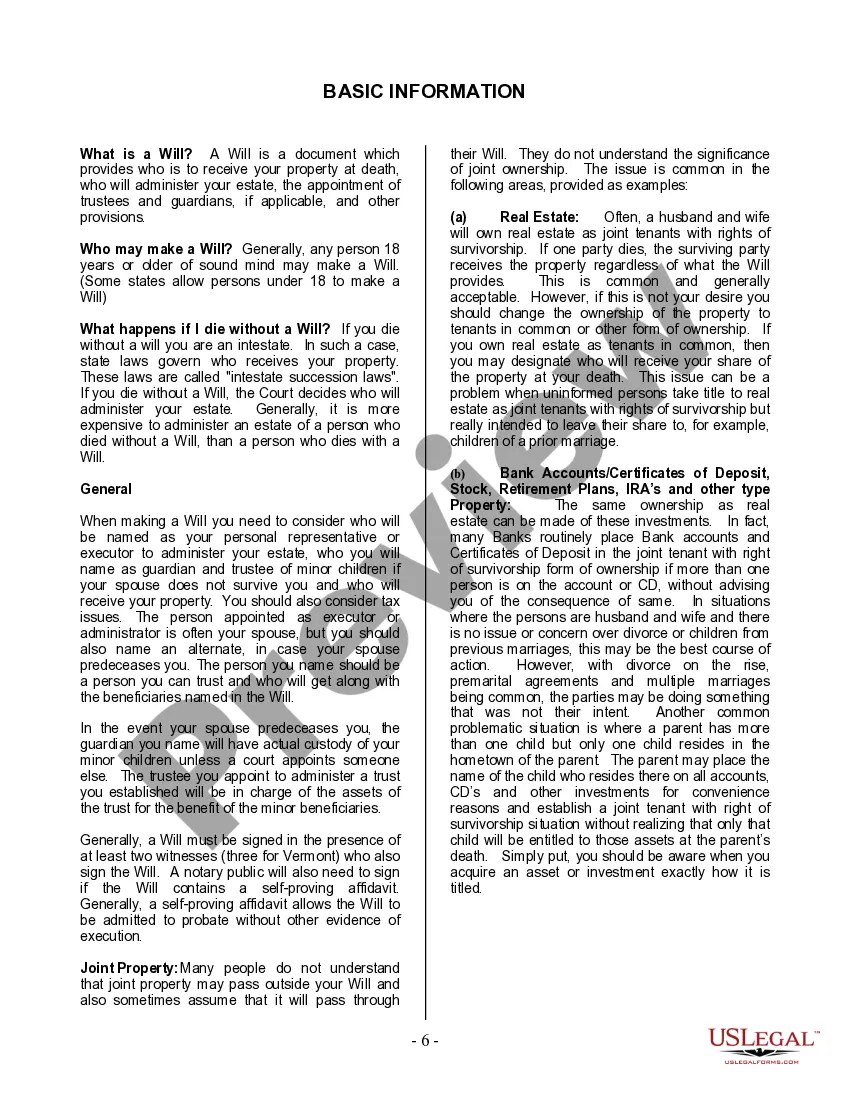

The Nampa Idaho Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legal document specifically designed for individuals in Nampa, Idaho, who have been through a divorce, have not remarried, and do not have any children. This form allows these individuals to outline their final wishes, ensuring that their assets and estate are distributed according to their preferences after their passing. By using the Nampa Idaho Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, individuals can appoint an executor to handle the administration of their estate and distribution of their assets. This includes designating beneficiaries, such as family members, friends, or charitable organizations, to whom the individual wishes to leave their property. The form allows the person to specify how they want their debts, funeral expenses, and taxes to be handled. Furthermore, they can name a guardian for any dependents they may have, such as elderly parents or pets, and allocate specific funds for their care. While there may not be different specific types of the Nampa Idaho Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, there can be variations or revisions based on individual preferences or changes in circumstances. Some modifications may include updating beneficiary designations, altering asset allocations, or changing the appointed executor. The Nampa Idaho Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children ensures that individuals have a legally binding document that clearly outlines their desires and provides peace of mind that their estate will be handled according to their wishes. It is always recommended consulting with an attorney for personalized advice when filling out these legal forms to ensure compliance with state laws and comprehensive coverage of all important aspects.The Nampa Idaho Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legal document specifically designed for individuals in Nampa, Idaho, who have been through a divorce, have not remarried, and do not have any children. This form allows these individuals to outline their final wishes, ensuring that their assets and estate are distributed according to their preferences after their passing. By using the Nampa Idaho Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, individuals can appoint an executor to handle the administration of their estate and distribution of their assets. This includes designating beneficiaries, such as family members, friends, or charitable organizations, to whom the individual wishes to leave their property. The form allows the person to specify how they want their debts, funeral expenses, and taxes to be handled. Furthermore, they can name a guardian for any dependents they may have, such as elderly parents or pets, and allocate specific funds for their care. While there may not be different specific types of the Nampa Idaho Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, there can be variations or revisions based on individual preferences or changes in circumstances. Some modifications may include updating beneficiary designations, altering asset allocations, or changing the appointed executor. The Nampa Idaho Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children ensures that individuals have a legally binding document that clearly outlines their desires and provides peace of mind that their estate will be handled according to their wishes. It is always recommended consulting with an attorney for personalized advice when filling out these legal forms to ensure compliance with state laws and comprehensive coverage of all important aspects.