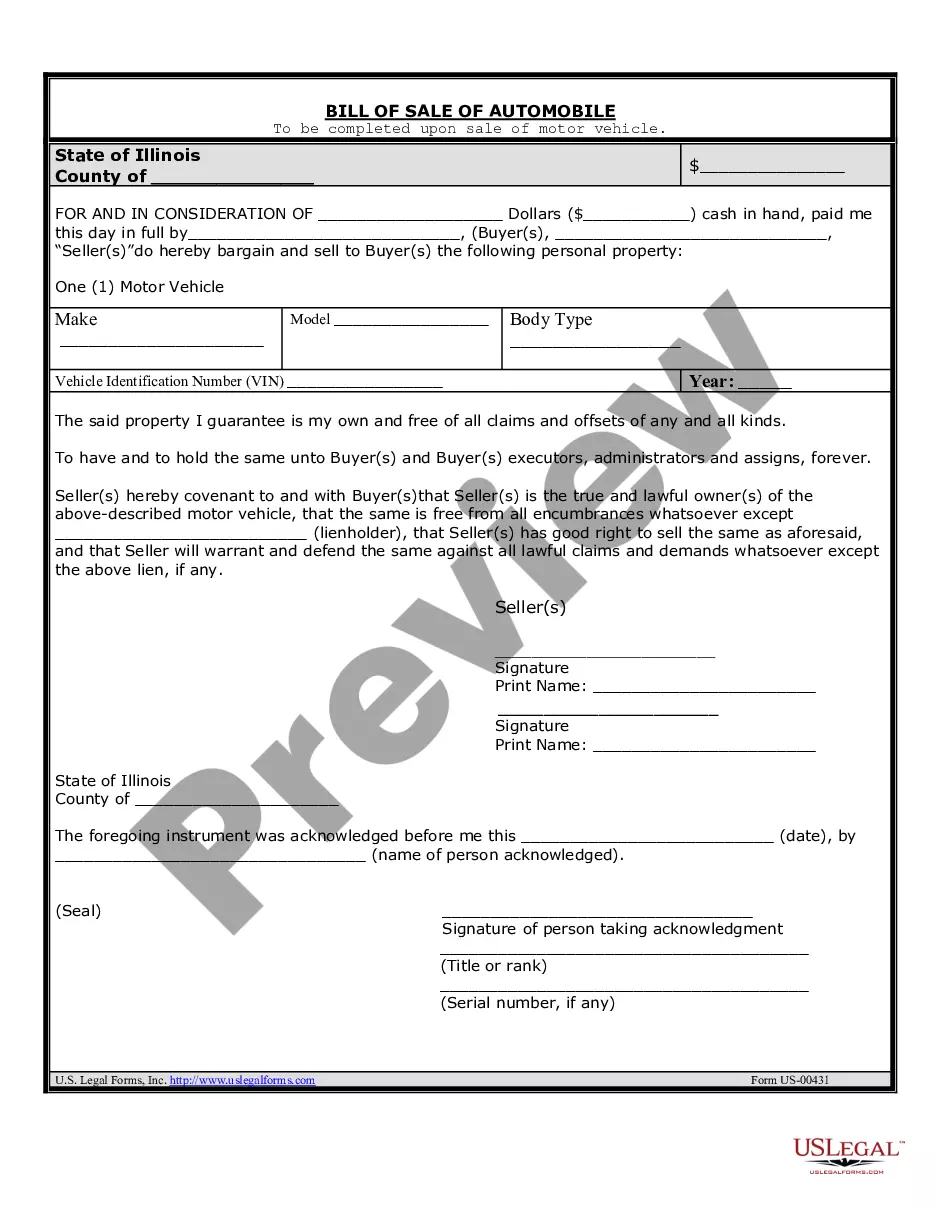

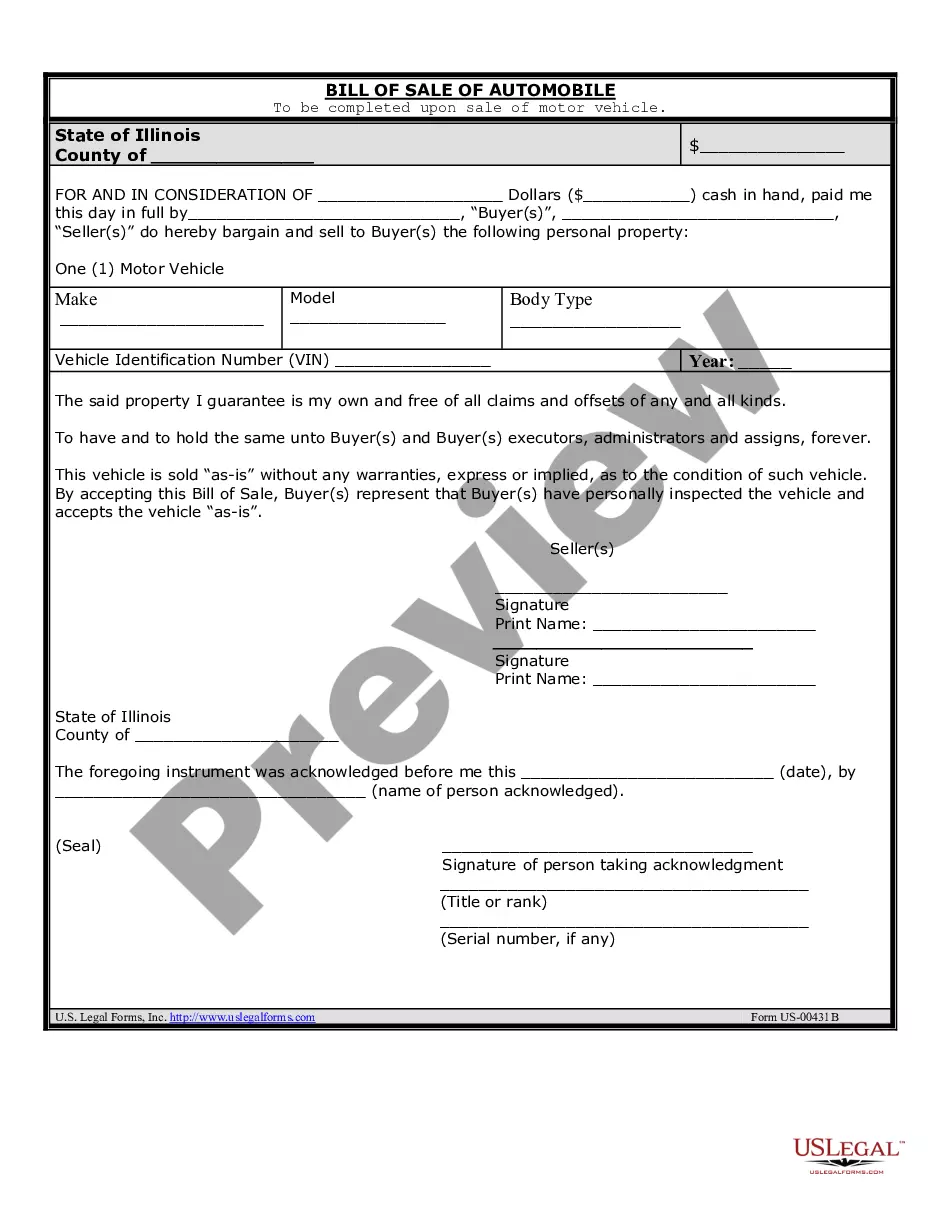

The Cook Illinois Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between the buyer and seller of a vehicle in Cook County, Illinois. This promissory note serves as evidence of the buyer's promise to repay the seller the agreed-upon purchase price in installments. The Cook Illinois Promissory Note includes important details such as the buyer's and seller's names and contact information, vehicle description (make, model, year, and vehicle identification number), purchase price, down payment amount (if any), and the agreed-upon payment schedule. Relevant keywords associated with the Cook Illinois Promissory Note in Connection with Sale of Vehicle or Automobile may include: 1. Cook County Promissory Note: This refers to the specific jurisdiction where the promissory note is being executed, indicating that it falls under the laws and regulations applicable in Cook County, Illinois. 2. Vehicle Promissory Note: This term highlights the fact that the promissory note is specifically designed for transactions involving the sale of vehicles, ensuring its relevance to the automobile industry. 3. Sale of Automobile Promissory Note: This keyword emphasizes that the promissory note is a legal instrument created for the purpose of financing the purchase of an automobile. 4. Vehicle Financing Agreement: This phrase implies that the promissory note serves as an agreement between the buyer and seller regarding the financing terms for the vehicle sale. 5. Installment Payment Agreement: This term emphasizes that the buyer is obligated to make regular installment payments to the seller over an agreed-upon period until the full purchase price is paid off. Different types of Cook Illinois Promissory Notes in Connection with the Sale of Vehicles or Automobiles can be classified based on variations in payment terms, interest rates, or other specific terms agreed upon by the buyer and seller. For instance: 1. Fixed Interest Promissory Note: This type of promissory note specifies a fixed interest rate that stays constant throughout the repayment period. 2. Variable Interest Promissory Note: This variation allows the interest rate to fluctuate over time, based on a specified index or market conditions. The buyer's payments may vary over the loan term. 3. Balloon Payment Promissory Note: This note requires the buyer to make smaller regular payments over the loan term, with a significant lump-sum final payment due at the end. 4. Acceleration Promissory Note: This type stipulates that if the buyer fails to make payments according to the agreed schedule, the full remaining balance becomes due immediately. Note: It is important to consult with legal professionals and use customized templates or forms approved in Cook County to ensure compliance with local laws and regulations.

Cook Illinois Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Cook Illinois Promissory Note In Connection With Sale Of Vehicle Or Automobile?

We always want to reduce or avoid legal issues when dealing with nuanced legal or financial matters. To accomplish this, we apply for attorney services that, as a rule, are very costly. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of a lawyer. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Cook Illinois Promissory Note in Connection with Sale of Vehicle or Automobile or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Cook Illinois Promissory Note in Connection with Sale of Vehicle or Automobile complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Cook Illinois Promissory Note in Connection with Sale of Vehicle or Automobile is proper for your case, you can pick the subscription option and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!