Elgin Illinois Promissory Note in Connection with Sale of Vehicle or Automobile: A Comprehensive Guide In Elgin, Illinois, when buying or selling a vehicle or automobile, parties often make use of a legal document known as a Promissory Note. This document serves as a written agreement that outlines the terms and conditions of the sale, including the payment schedule and conditions for the transfer of ownership. By delving into the details of Elgin Illinois Promissory Note in Connection with Sale of Vehicle or Automobile, we can better understand its purpose and various types. Elgin Illinois Promissory Note Explained: A Promissory Note is a legally binding contract that records the financial arrangement between a buyer and a seller in a vehicle or automobile sale. It establishes the terms under which the buyer agrees to repay a specified amount of money for the purchase of the vehicle over a specific period. The document also acts as evidence of the debt owed and the agreement between the parties involved. Typically, the Promissory Note is created when the buyer cannot pay the full purchase price upfront, and the seller agrees to receive the payment in installments. Key Elements of an Elgin Illinois Promissory Note: 1. Identification of Parties: The Promissory Note must clearly identify both the buyer and the seller, including their full legal names and contact information. 2. Vehicle Details: A comprehensive description of the vehicle or automobile being sold is necessary, including the make, model, year, Vehicle Identification Number (VIN), and any distinguishing features. 3. Payment Terms: This component encompasses the total purchase price, the down payment amount (if applicable), the interest rate (if any), the installment amount, the frequency of payments (e.g., monthly or biweekly), and the due date of each installment. 4. Default Consequences: The Promissory Note should outline the consequences for defaults, such as late payments or failure to fulfill the terms. It may include penalties, late fees, or the ability to repossess the vehicle. 5. Transfer of Ownership: It is essential to state the conditions under which the seller will transfer ownership of the vehicle to the buyer. Typically, this occurs upon full repayment and often involves a separate Bill of Sale or title transfer process. Different Types of Elgin Illinois Promissory Note in Connection with Sale of Vehicle or Automobile: 1. Secured Promissory Note: This type of Promissory Note includes a security interest or lien on the vehicle being sold, meaning that if the buyer defaults, the seller has the right to repossess the vehicle as a form of collateral. 2. Unsecured Promissory Note: Unlike the secured version, an unsecured Promissory Note does not involve any security interest or collateral. This type relies solely on the buyer's promise to repay the debt as per the agreed terms. 3. Simple Interest Promissory Note: This type of Promissory Note includes an interest rate calculated on the principal amount. It ensures the seller receives additional compensation for the time value of money. 4. Balloon Payment Promissory Note: This Promissory Note is structured to allow the buyer to make lower monthly payments for a specific period, with a larger payment (balloon payment) due at the end to settle the remaining balance. This type is suitable for buyers expecting to have access to a significant sum by the end of the repayment term. Remember, while using an Elgin Illinois Promissory Note in Connection with Sale of Vehicle or Automobile can protect both buyers and sellers, it is crucial to seek legal advice or consult an attorney to ensure compliance with local laws and to customize the note according to specific requirements.

Elgin Illinois Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Elgin Illinois Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Elgin Illinois Promissory Note in Connection with Sale of Vehicle or Automobile gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Elgin Illinois Promissory Note in Connection with Sale of Vehicle or Automobile takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

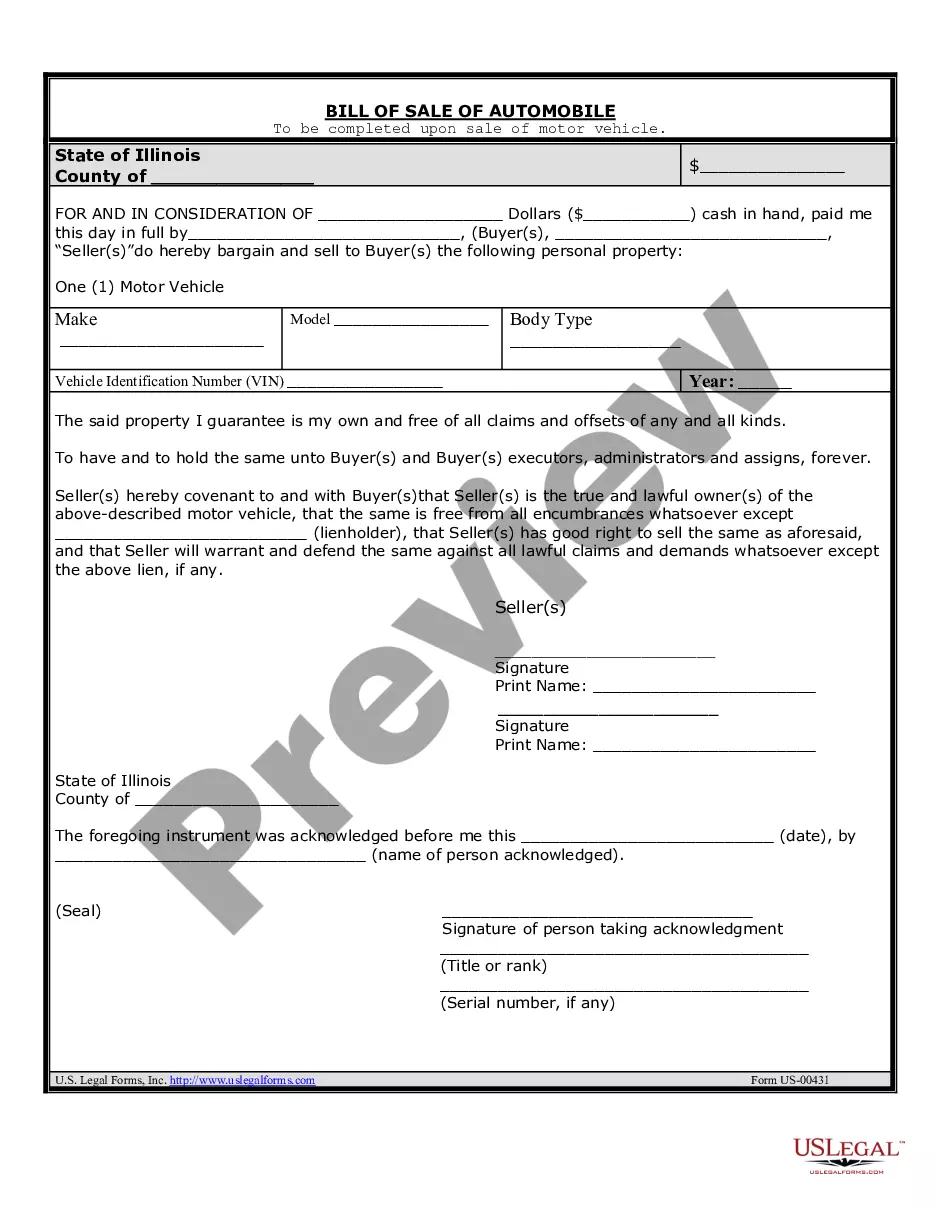

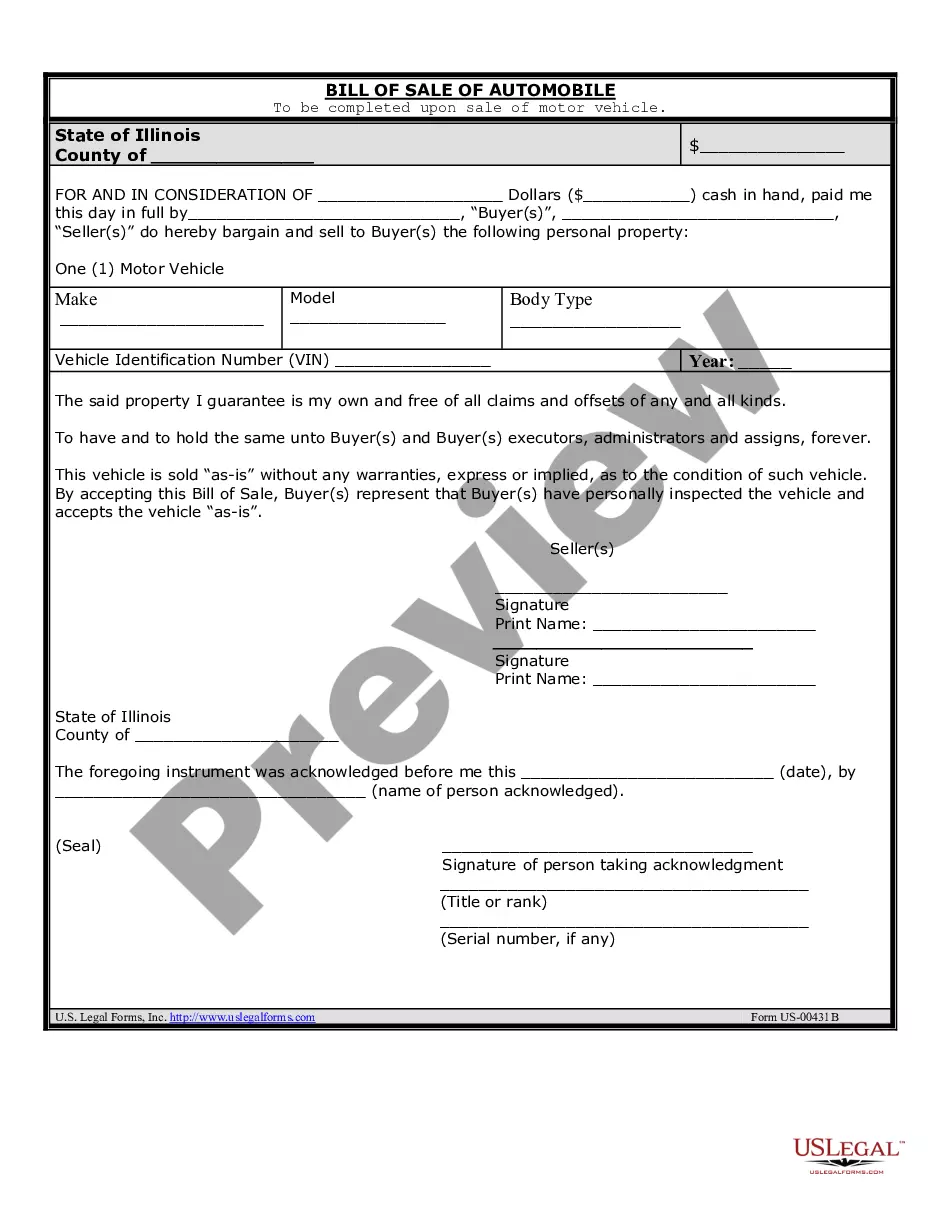

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Elgin Illinois Promissory Note in Connection with Sale of Vehicle or Automobile. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!