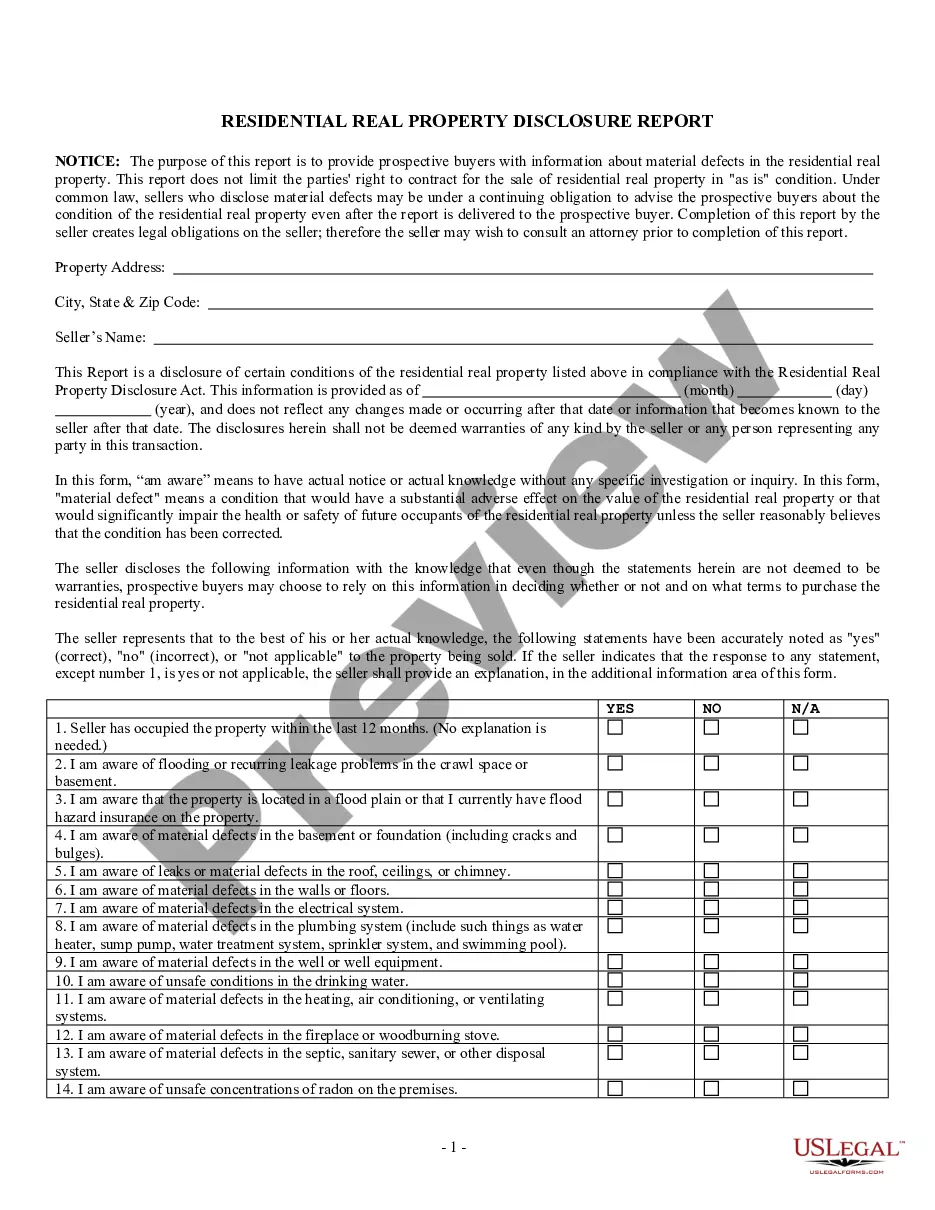

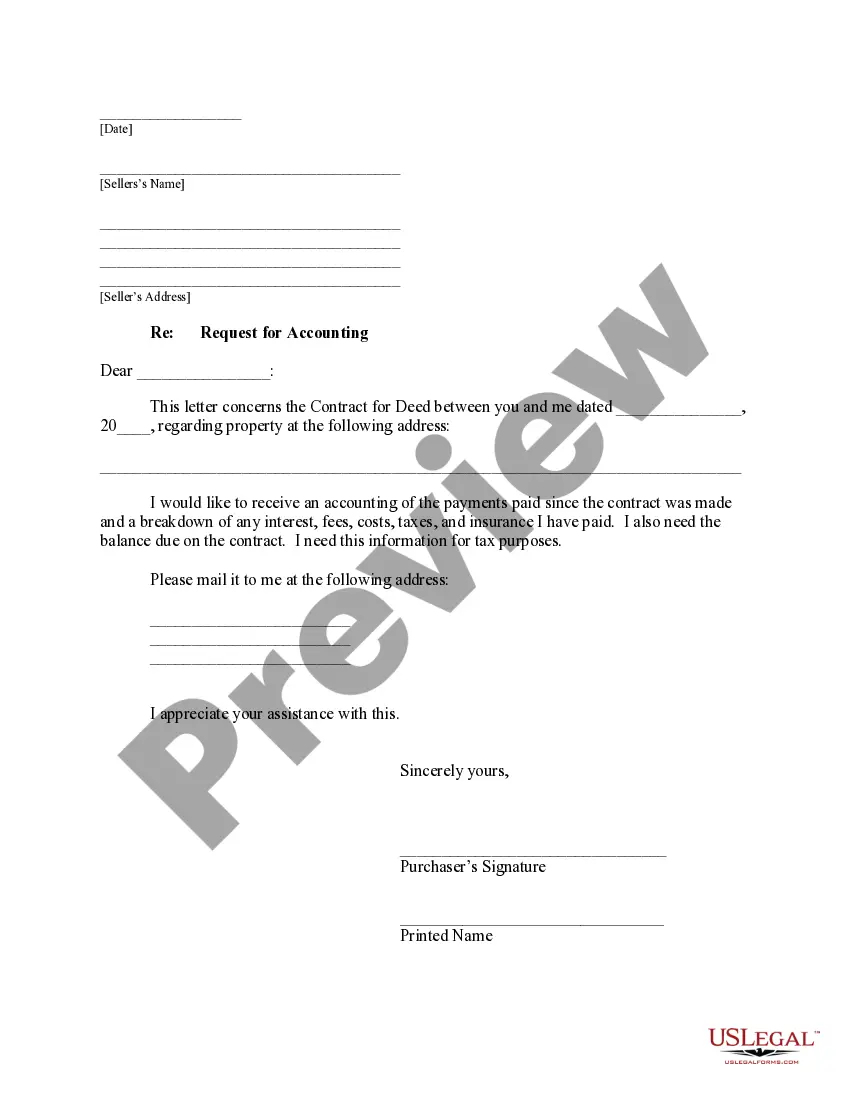

Elgin Illinois Buyer's Request for Accounting from Seller under Contract for Deed is a formal document presented by the buyer to the seller in a real estate transaction. This request seeks a detailed breakdown of the financial transactions related to the property being sold under a contract for deed arrangement. It helps the buyer obtain a clear understanding of the financial aspect of the contract and ensures transparency in the transaction process. Keywords: Elgin Illinois, buyer's request, accounting, seller, contract for deed, real estate transaction, financial transactions, property, contract, transparency. Different types of Elgin Illinois Buyer's Request for Accounting from Seller under Contract for Deed: 1. Initial Financial Statement Request: This type of request is made by the buyer at the beginning of the contract for deed agreement. It seeks an initial financial statement outlining all the payments made by the buyer, including the down payment, monthly installments, and any additional charges such as property taxes or insurance. 2. Annual Accounting Request: The buyer may submit an annual accounting request to the seller, typically towards the end of the financial year. This request includes a comprehensive report of all payments received by the seller, updated balance, interest charged (if applicable), and any other financial transactions related to the contract for deed. 3. Property Expense Breakdown Request: This type of request focuses on the breakdown of specific expenses associated with the property, such as repairs, maintenance, or improvements made by the seller. The buyer may request a detailed list of these expenses to ensure they align with the agreed-upon terms in the contract. 4. Tax and Insurance Verification Request: Occasionally, the buyer may request an accounting specifically related to property taxes and insurance payments. This helps the buyer verify that the seller has fulfilled their obligations to pay these expenses promptly and accurately, thereby protecting the buyer's interest in the property. 5. Interest Calculation Request: If the contract for deed includes an interest component, the buyer may request an accounting that details the calculation of interest charged by the seller. This request ensures that the interest rate is correctly applied and enables the buyer to verify the accuracy of the interest calculations. In all types of Elgin Illinois Buyer's Request for Accounting from Seller under Contract for Deed, the buyer is emphasizing the importance of transparency, accountability, and clarity in the financial aspects of the transaction. Through these requests, buyers can have a complete and accurate understanding of their financial obligations and the seller's compliance with the contract for deed agreement.

Elgin Illinois Buyer's Request for Accounting from Seller under Contract for Deed

Description

How to fill out Elgin Illinois Buyer's Request For Accounting From Seller Under Contract For Deed?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Elgin Illinois Buyer's Request for Accounting from Seller under Contract for Deed gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Elgin Illinois Buyer's Request for Accounting from Seller under Contract for Deed takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Elgin Illinois Buyer's Request for Accounting from Seller under Contract for Deed. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

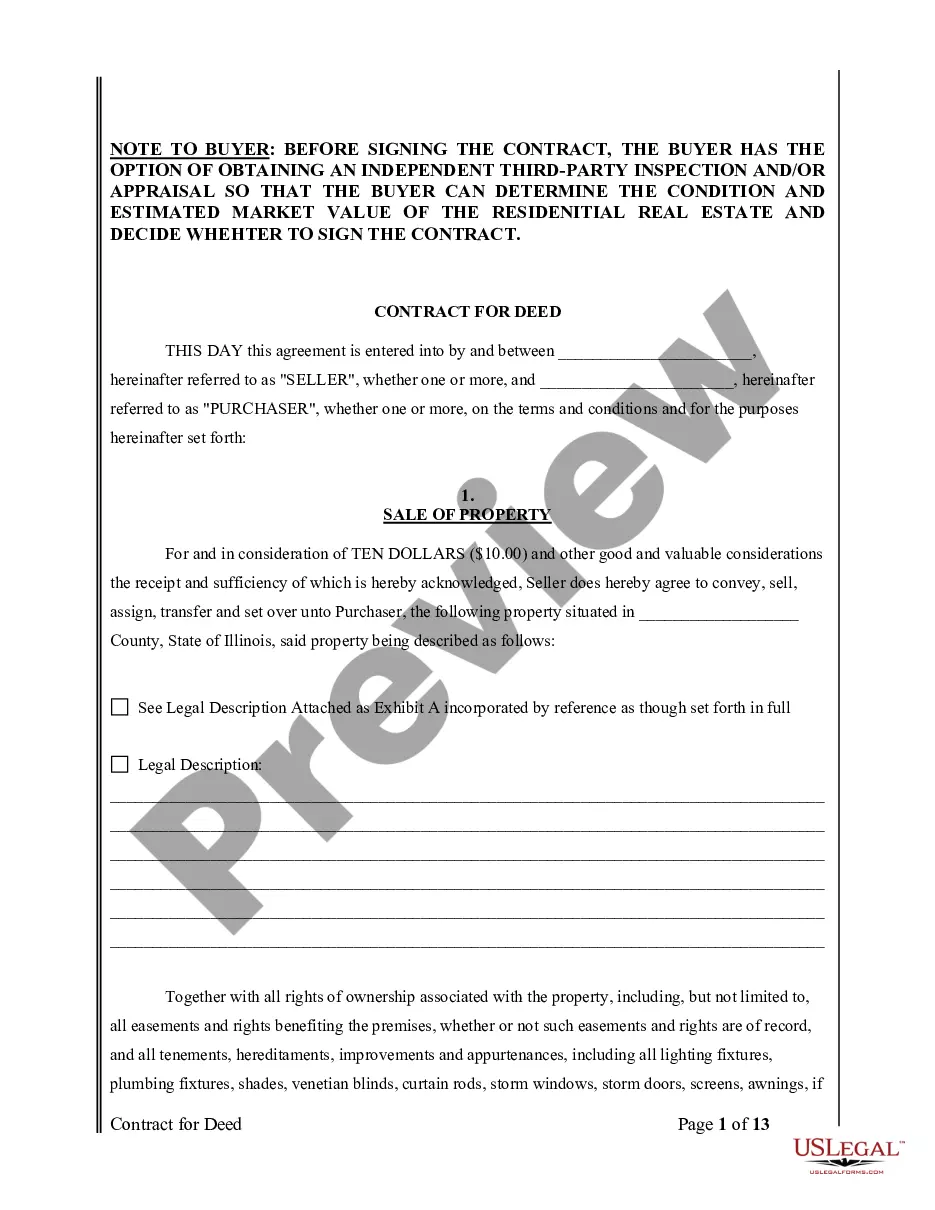

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

A Contract for Deed is a way to buy a house that doesn't involve a bank. The seller finances the property for the buyer. The buyer moves in when the contract is signed. The buyer pays the seller monthly payments that go towards payment for the home.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

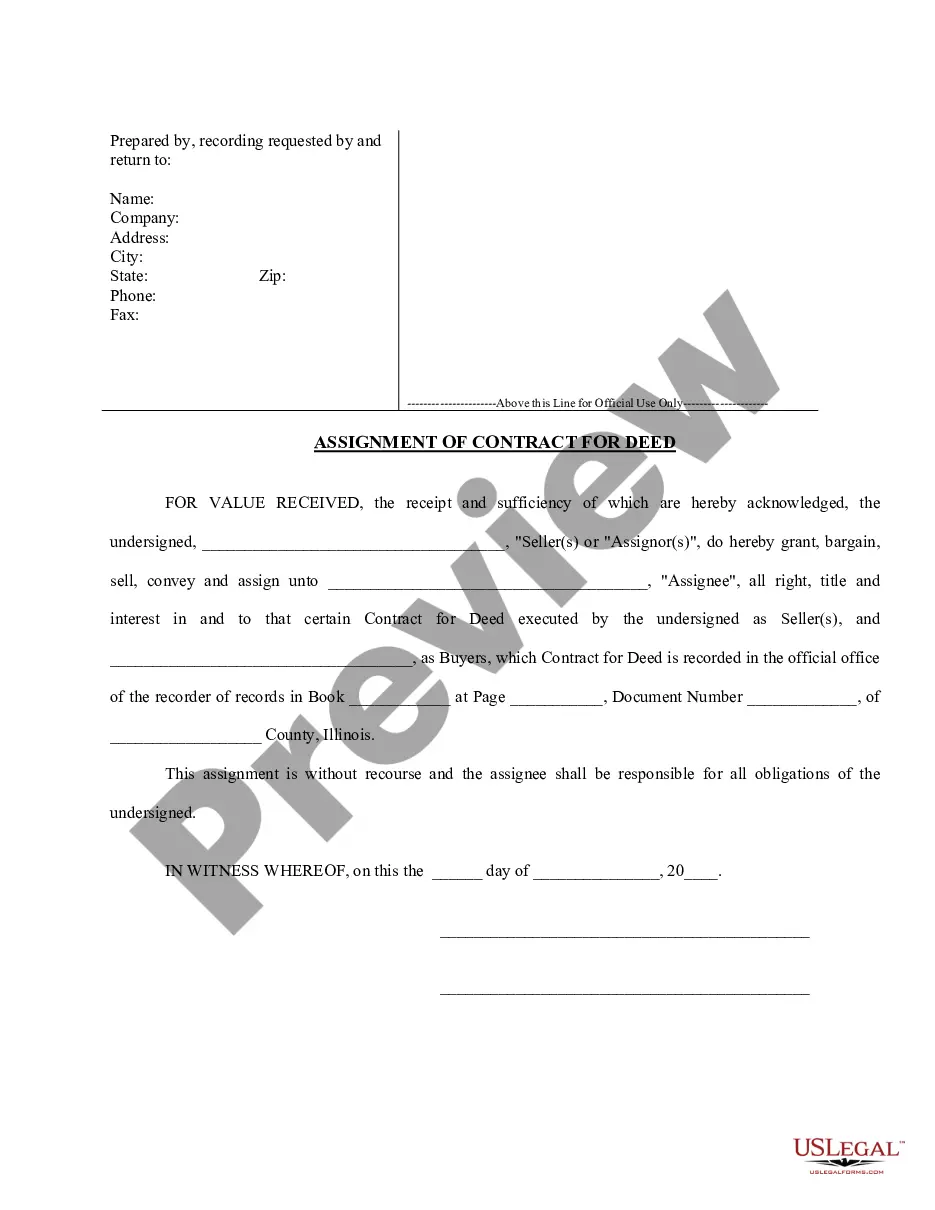

(b) If the seller fails to record the contract or the memorandum of the contract as required by subsection (a) of this Section, the buyer has the right to rescind the contract until such time as the seller records the contract.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

The buyer is the real owner of the property) to the property and makes installment payments to the Seller. When the Buyer has paid the full contract price, the Seller conveys a deed to the Buyer and the transaction is at an end. Articles of Agreement are legal and enforceable in Illinois.

Risk to the Buyer A contract for deed has risk for the buyer. Because the seller keeps legal title to property until the contract price is paid in full, the buyer does not become the owner of the property until he or she completes his payment obligations and receives title from the seller.

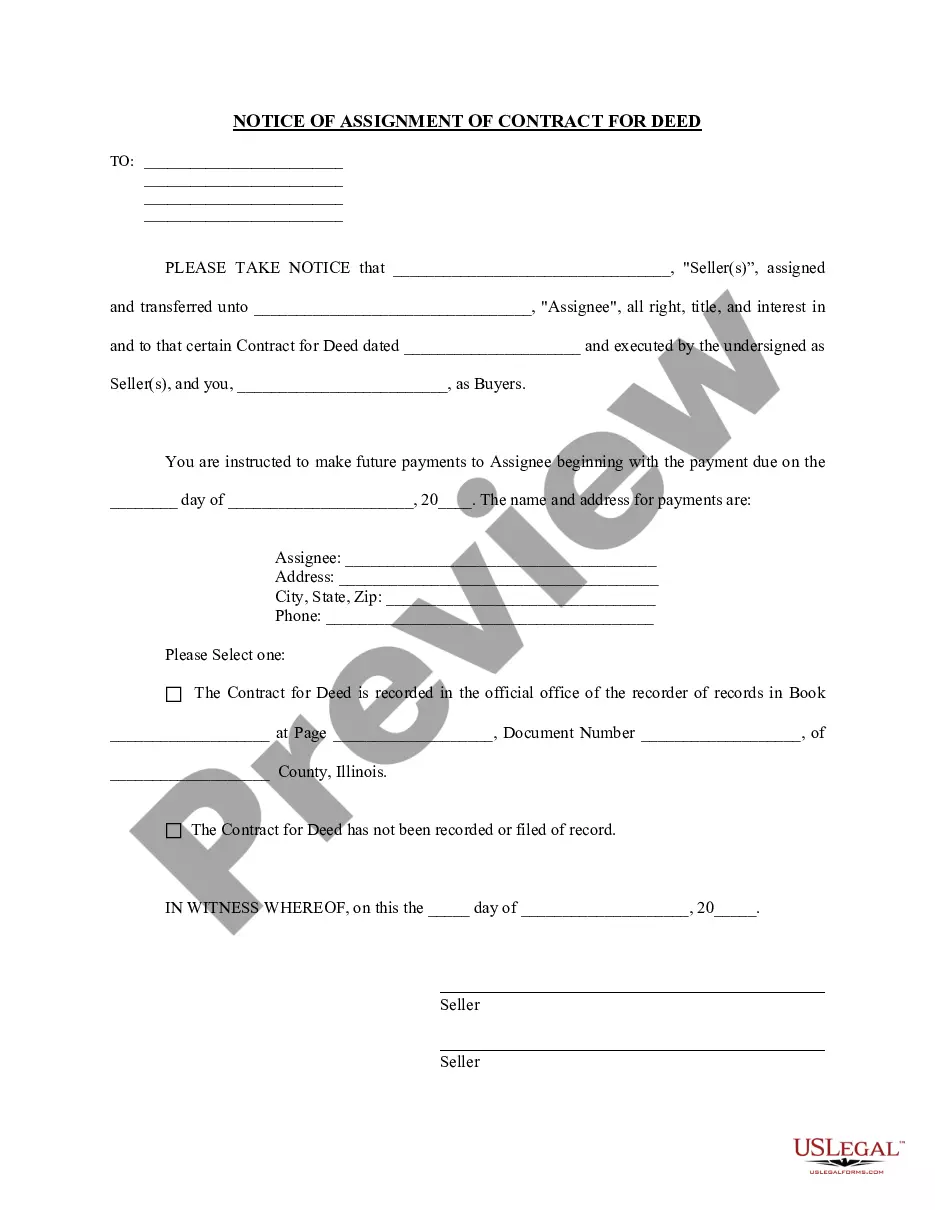

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

The seller must tell you that they want to end the contract. The seller must wait 30 days before trying to go to court to evict you. If you pay what is due within those 30 days, usually the case won't go to court and thecontract will continue. If the case does go to court, you will argue your case in front of a judge.