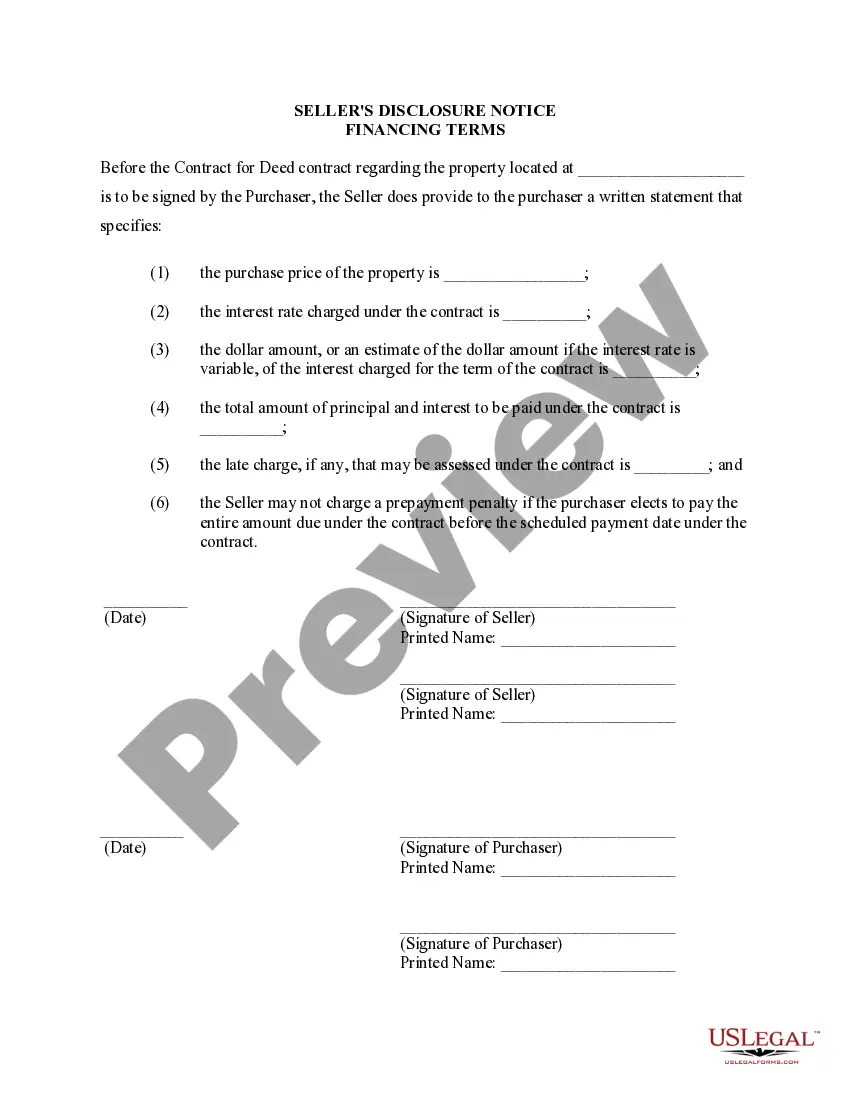

Elgin, Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an essential document that outlines the specific financing terms agreed upon between the seller and the buyer. This disclosure aims to provide transparency and clarity regarding the financial aspects of the property purchase, ensuring both parties are fully aware of their obligations and rights. The Elgin, Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed covers various key details, such as the purchase price, down payment, interest rate, payment schedule, and any additional fees or charges associated with the financing arrangement. It is crucial for buyers to thoroughly review this document before entering into a Land Contract to ensure they have a comprehensive understanding of the financial commitment they are making. Different types of Elgin, Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed can include: 1. Purchase Price: This section specifies the overall cost of the property and outlines how it will be paid over time through installments. 2. Down Payment: The down payment refers to the initial payment made by the buyer, typically expressed as a percentage of the purchase price. This section outlines the agreed-upon amount and deadline for payment. 3. Interest Rate: The interest rate details the percentage that will be added to the outstanding balance of the Land Contract, determining the cost of borrowing for the buyer. 4. Payment Schedule: This section states the frequency and due dates of the payments. It may include monthly, quarterly, or annual installments, depending on the terms negotiated between the parties. 5. Balloon Payment: In some cases, a Land Contract may include a balloon payment, which is a lump sum payment due at the end of the contract term. This section will outline the amount and due date of the balloon payment if applicable. 6. Default Clauses: The Seller's Disclosure may also include information about the consequences of defaulting on the Land Contract. This section clarifies the rights and remedies available to both the seller and the buyer in case of default. 7. Additional Fees and Charges: This section highlights any additional costs associated with the Land Contract, such as late payment fees, attorney fees, or charges for recording the contract. It is important for both buyers and sellers to carefully review the Elgin, Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed to ensure they are fully aware of the financial implications and responsibilities related to the Land Contract. Seeking legal advice or assistance may be beneficial to ensure a clear understanding of the terms and conditions outlined in the disclosure.

Elgin Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Elgin Illinois Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you’ve already used our service before, log in to your account and save the Elgin Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Elgin Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!