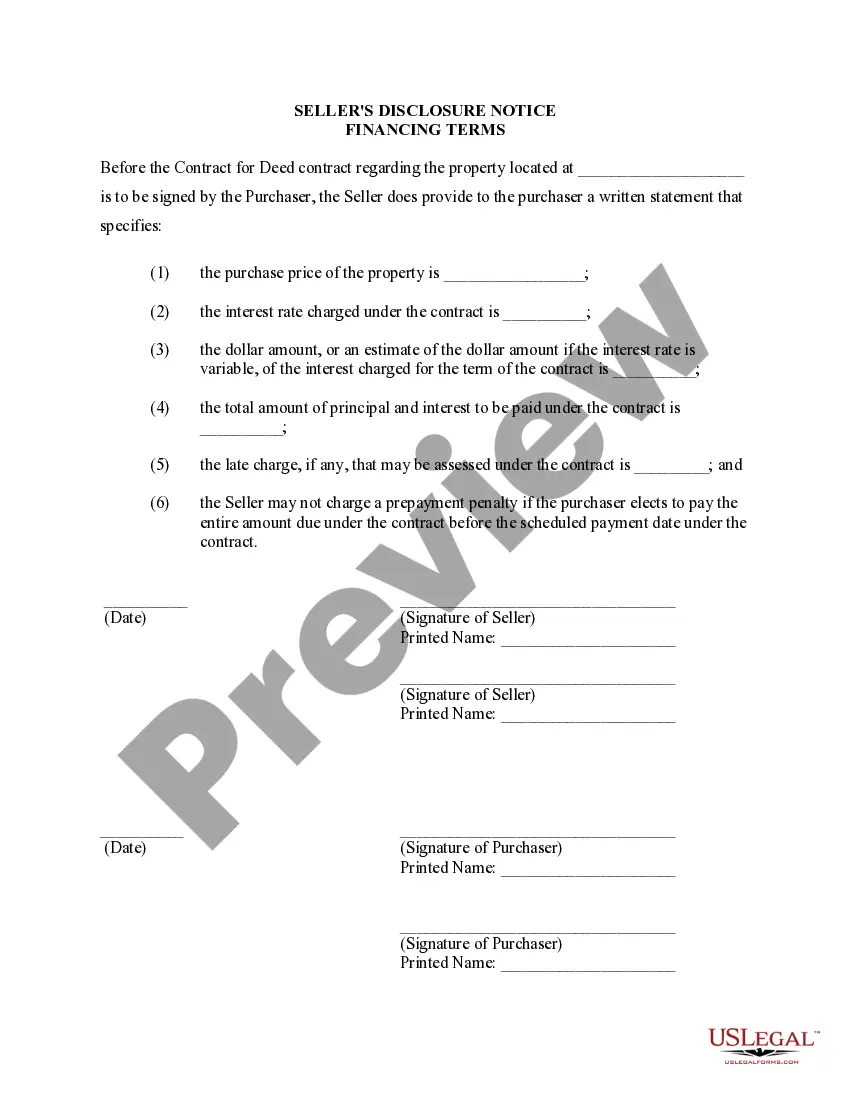

Joliet Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

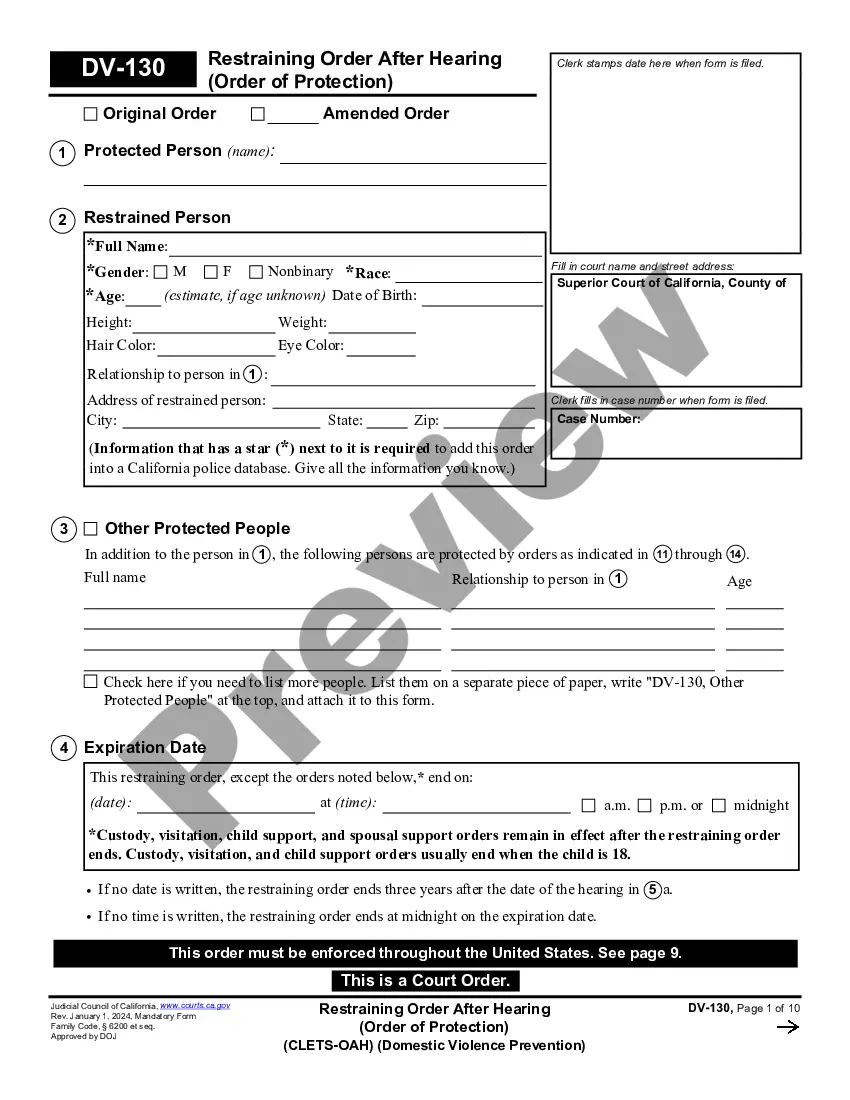

How to fill out Illinois Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Are you seeking a reliable and budget-friendly legal documents supplier to obtain the Joliet Illinois Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed also known as Land Contract? US Legal Forms is your primary choice.

Whether you require a straightforward arrangement to set guidelines for living together with your significant other or a collection of documents to process your divorce in court, we are here for you. Our platform features over 85,000 current legal document templates for individual and business purposes. All templates we provide are not uniform and tailored to meet the standards of specific states and counties.

To acquire the form, you must Log In to your account, find the necessary template, and click the Download button next to it. Please remember that you can download any previously purchased form templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can easily create an account, but first, ensure to do the following.

Now you can establish your account. Then select the subscription plan and continue to payment. After the payment is completed, download the Joliet Illinois Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed also referred to as Land Contract in any available file format. You can return to the site whenever you wish and redownload the form without incurring additional charges.

Obtaining current legal forms has never been simpler. Try US Legal Forms today, and stop spending hours understanding legal documentation online for good.

- Check if the Joliet Illinois Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed also known as Land Contract complies with the regulations in your state and local jurisdiction.

- Review the form's description (if available) to understand who and what the form is intended for.

- Restart the search if the template does not suit your particular needs.

Form popularity

FAQ

It requires that sellers fully complete a form specifically answering 22 questions about a wide range of conditions of their property from foundation to plumbing and everywhere in between.

Transfers made by court order, default, divorce, and by government entities are exempt from the disclosure requirement. Sellers with exempt property should fill out an exemption certificate provided by the Delaware real estate commission.

Which transfers of property are exempt from a disclosure report? The property consists of one to four dwelling units. The property is sold at public auction. The property is a sale, exchange, land sales contract, or lease with option to buy.

The seller must disclose known material defects to a prospective buyer. Some of the information a seller must provide about the real estate includes: flooding or leakage, including in the crawl space, basement, roof, ceilings, or chimney. material defects in the roof, ceilings, chimney, walls, windows, doors, or floors.

You need not complete a disclosure form if you never occupied the property and never had management responsibility for it, nor if you hired someone else to manage it. (See 765 ILCS § 77/5.) The law applies to conventional sales, installment sales, and sales of property owned by an Illinois Land Trust.

You need not complete a disclosure form if you never occupied the property and never had management responsibility for it, nor if you hired someone else to manage it. (See 765 ILCS § 77/5.) The law applies to conventional sales, installment sales, and sales of property owned by an Illinois Land Trust.

The Residential Real Property Disclosure Act is an Illinois statute that was enacted in 1998 with the purpose of protecting home buyers from unscrupulous sellers who falsely report the condition of their property. It is supposed to provide buyers with a reliable representation on the major conditions of a property.

The Illinois Real Property Act requires sellers to disclose known defects and problems with a property. The law protects buyers from purchasing homes that have serious defects, and it protects sellers from liability for any defects that appear after a sale is completed.

It does not cover new construction that has never been occupied, commercial properties, or certain circumstances in which residential properties are transferred, including foreclosure sales, sales due to divorce, probate, or bankruptcy, or transfers between co-owners.