Cook Illinois Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document that serves as a formal notice to a party involved in a Contract for Deed agreement in Cook County, Illinois. This notice notifies the recipient that they are in default of their payment obligations and provides them with a certain period of time to cure the default before further legal action is taken. In Cook County, there can be different types of Cook Illinois Notice of Default for Past Due Payments in connection with Contract for Deed, based on the specific circumstances and terms outlined in the agreement. Some of these variations may include: 1. Standard Notice of Default: This type of notice is issued when a party fails to make their scheduled payments as outlined in the Contract for Deed. The notice will include details of the outstanding payments, the amount owed, and the specific date by which the default must be cured. 2. Notice of Default for Multiple Payments: In cases where multiple payments have been missed or are past due, a specialized notice may be used. This notice will include a breakdown of each missed payment, their respective due dates, and the cumulative amount owed. It will also outline the steps necessary to cure the default within a specified timeframe. 3. Notice of Default for Nonpayment of Taxes or Insurance: In some instances, a Contract for Deed may require the buyer to pay property taxes or insurance premiums directly to the seller. If the buyer fails to make these payments, a specialized notice can be issued to inform them of the default. This notice will outline the specific obligations in question, including the amounts owed and the deadline to cure the default. Regardless of the type of Cook Illinois Notice of Default for Past Due Payments in connection with Contract for Deed, it is crucial for the recipient to take immediate action to address the default. Failure to cure the default within the given timeframe may result in serious consequences, including potential legal action, foreclosure, or termination of the contract. It is advisable for both parties involved to seek legal counsel to understand their rights and obligations under the given circumstances.

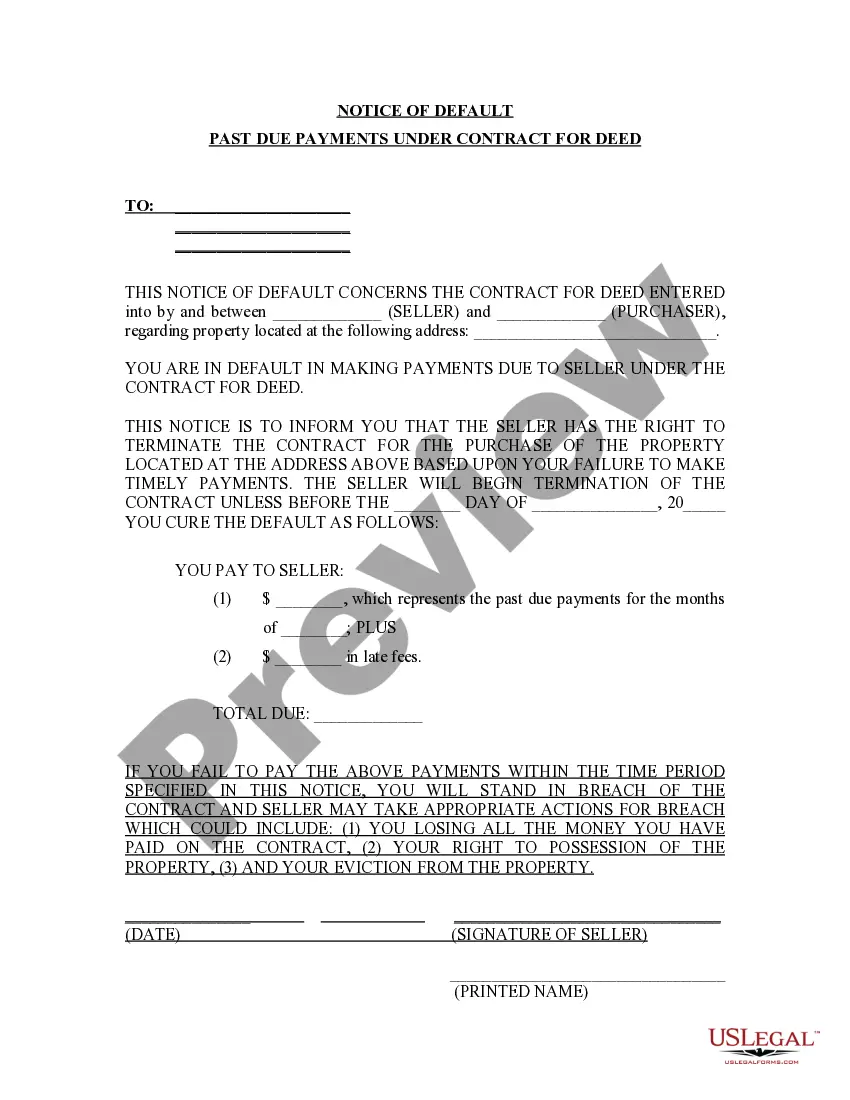

Cook Illinois Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Cook Illinois Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Do you need a reliable and affordable legal forms supplier to get the Cook Illinois Notice of Default for Past Due Payments in connection with Contract for Deed? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of particular state and county.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Cook Illinois Notice of Default for Past Due Payments in connection with Contract for Deed conforms to the laws of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is good for.

- Restart the search if the form isn’t suitable for your specific situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Cook Illinois Notice of Default for Past Due Payments in connection with Contract for Deed in any provided file format. You can get back to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours learning about legal papers online once and for all.