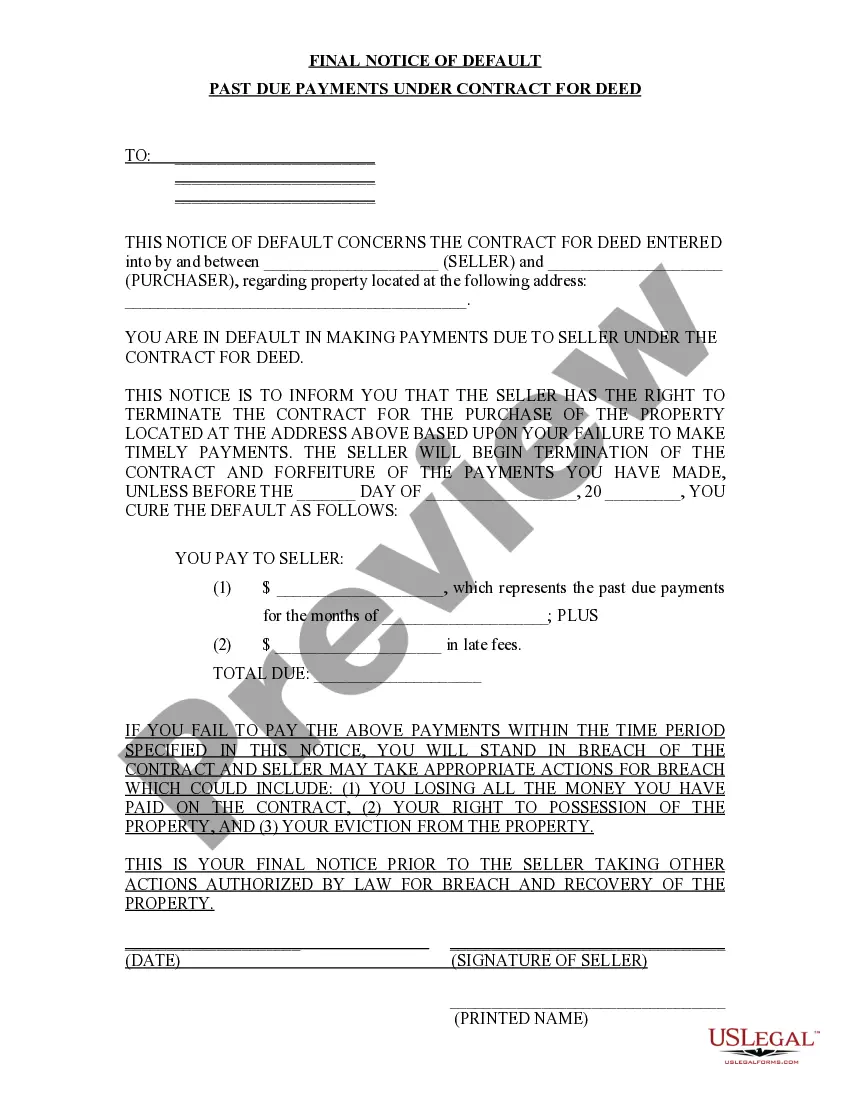

Joliet Illinois Final Notice of Default for Past Due Payments in Connection with a Contract for Deed serves as an important document in the process of property ownership transfer. It is crucial to understand its purpose, implications, and potential consequences. The notice indicates that the buyer, who signed a Contract for Deed, is in violation of the agreed-upon payment terms. It is usually sent when the buyer consistently fails to make the required payments within the agreed-upon timeline. Keywords: Joliet Illinois, Final Notice of Default, Past Due Payments, Contract for Deed, property ownership transfer, violation, payment terms, consequences. There are different types of Joliet Illinois Final Notice of Default for Past Due Payments in connection with a Contract for Deed, which are categorized based on the severity of the default: 1. First Notice of Default: This initial notice informs the buyer that they are in violation of the payment terms outlined in the Contract for Deed. It serves as a warning, urging them to promptly address the past-due payments and rectify the default to avoid further consequences. 2. Second Notice of Default: If the buyer fails to remedy the default within a specific timeframe mentioned in the first notice, a second notice is issued. This notice emphasizes the urgency to bring the payment up to date. It may include additional penalties or fees associated with the default. 3. Final Notice of Default: If the buyer does not respond or make any efforts to settle the past-due payments after receiving the second notice, a final notice of default is issued. This notice signifies that the seller has exhausted all leniency and intends to take more severe action to protect their rights and interests. The Joliet Illinois Final Notice of Default for Past Due Payments in connection with a Contract for Deed usually includes critical information such as the buyer's name, property address, the amount and due dates of the missed payments, and a clear statement highlighting the consequences if the default remains unresolved. It is essential for buyers who receive such a notice to promptly communicate with the seller or their representatives, discuss the circumstances that led to the default, and explore possible solutions to rectify the situation. Taking immediate action is crucial to mitigate potential legal complications, such as foreclosure proceedings, which could lead to the loss of property and significant financial setbacks. In conclusion, understanding the Joliet Illinois Final Notice of Default for Past Due Payments in connection with a Contract for Deed is paramount for property buyers. Complying with payment terms, addressing any defaults, and engaging in effective communication with the seller are essential steps to maintain a successful and secure property ownership transfer.

Joliet Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Joliet Illinois Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Regardless of social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any law education to draft such paperwork from scratch, mostly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you want the Joliet Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Joliet Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed quickly employing our reliable platform. If you are already a subscriber, you can go on and log in to your account to get the needed form.

However, if you are a novice to our platform, ensure that you follow these steps prior to obtaining the Joliet Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed:

- Ensure the template you have found is suitable for your area considering that the regulations of one state or area do not work for another state or area.

- Preview the form and read a quick description (if provided) of scenarios the paper can be used for.

- In case the one you selected doesn’t meet your needs, you can start over and look for the needed form.

- Click Buy now and choose the subscription option that suits you the best.

- Access an account {using your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Joliet Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed as soon as the payment is completed.

You’re good to go! Now you can go on and print the form or fill it out online. Should you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.