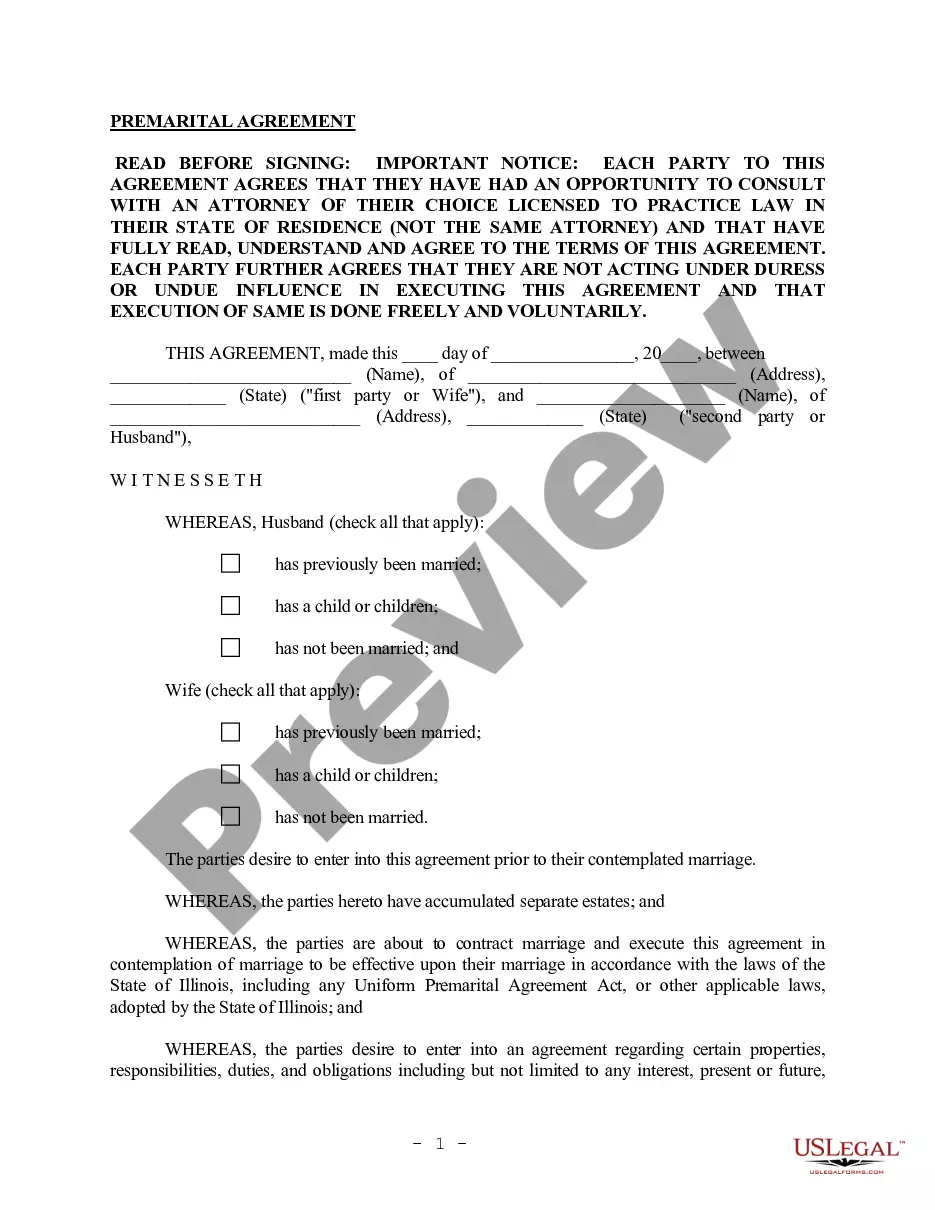

The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce.

These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will disposed properly. A Cook Illinois Prenuptial Premarital Agreement without Financial Statements is a legal document that outlines the rights and obligations of each spouse before entering into marriage. This type of agreement aims to protect individual assets and specify how property and debts will be divided in the event of divorce or death. Key Points: 1. Purpose: The primary purpose of a Cook Illinois Prenuptial Premarital Agreement without Financial Statements is to establish the distribution of assets, debts, and other financial matters in case of divorce, separation, or death. 2. Asset Protection: By clearly defining the separate property of each spouse, this agreement safeguards assets acquired before marriage or through gifts, inheritances, or personal businesses from becoming marital property subject to division. 3. Debt Allocation: It establishes how existing debts or future liabilities will be assigned, ensuring that each spouse is responsible only for the debts they incurred individually. 4. Division of Property: In case of divorce, the agreement can specify how jointly acquired property will be divided, either through specific percentages or a predetermined formula. 5. Spousal Support: The agreement may address the issue of spousal support or alimony by outlining the amount, duration, and circumstances under which it will be paid. 6. Inheritance Protection: It can include provisions to protect the inheritance rights of children from previous marriages or other beneficiaries. 7. Modification and Enforcement: The agreement should specify the conditions under which amendments can be made and the procedures for its enforcement. Types of Cook Illinois Prenuptial Premarital Agreements without Financial Statements: 1. Standard Prenuptial Agreement: This is a basic agreement that covers the division of assets, debts, and spousal support if the marriage ends in divorce. 2. Limited Prenuptial Agreement: This type of agreement focuses on specific assets or financial matters, rather than covering all aspects of the marriage. 3. Postnuptial Agreement: Similar to a prenuptial agreement, but it is signed after the marriage has already taken place. It serves the same purpose of protecting individual assets and clarifying financial rights in case of divorce. In summary, a Cook Illinois Prenuptial Premarital Agreement without Financial Statements is a legal contract that helps couples establish a clear framework of their financial rights and obligations before entering into marriage. By considering this agreement, spouses can protect their assets, assign debts fairly, and ensure a smoother future in case of unforeseen events.

A Cook Illinois Prenuptial Premarital Agreement without Financial Statements is a legal document that outlines the rights and obligations of each spouse before entering into marriage. This type of agreement aims to protect individual assets and specify how property and debts will be divided in the event of divorce or death. Key Points: 1. Purpose: The primary purpose of a Cook Illinois Prenuptial Premarital Agreement without Financial Statements is to establish the distribution of assets, debts, and other financial matters in case of divorce, separation, or death. 2. Asset Protection: By clearly defining the separate property of each spouse, this agreement safeguards assets acquired before marriage or through gifts, inheritances, or personal businesses from becoming marital property subject to division. 3. Debt Allocation: It establishes how existing debts or future liabilities will be assigned, ensuring that each spouse is responsible only for the debts they incurred individually. 4. Division of Property: In case of divorce, the agreement can specify how jointly acquired property will be divided, either through specific percentages or a predetermined formula. 5. Spousal Support: The agreement may address the issue of spousal support or alimony by outlining the amount, duration, and circumstances under which it will be paid. 6. Inheritance Protection: It can include provisions to protect the inheritance rights of children from previous marriages or other beneficiaries. 7. Modification and Enforcement: The agreement should specify the conditions under which amendments can be made and the procedures for its enforcement. Types of Cook Illinois Prenuptial Premarital Agreements without Financial Statements: 1. Standard Prenuptial Agreement: This is a basic agreement that covers the division of assets, debts, and spousal support if the marriage ends in divorce. 2. Limited Prenuptial Agreement: This type of agreement focuses on specific assets or financial matters, rather than covering all aspects of the marriage. 3. Postnuptial Agreement: Similar to a prenuptial agreement, but it is signed after the marriage has already taken place. It serves the same purpose of protecting individual assets and clarifying financial rights in case of divorce. In summary, a Cook Illinois Prenuptial Premarital Agreement without Financial Statements is a legal contract that helps couples establish a clear framework of their financial rights and obligations before entering into marriage. By considering this agreement, spouses can protect their assets, assign debts fairly, and ensure a smoother future in case of unforeseen events.