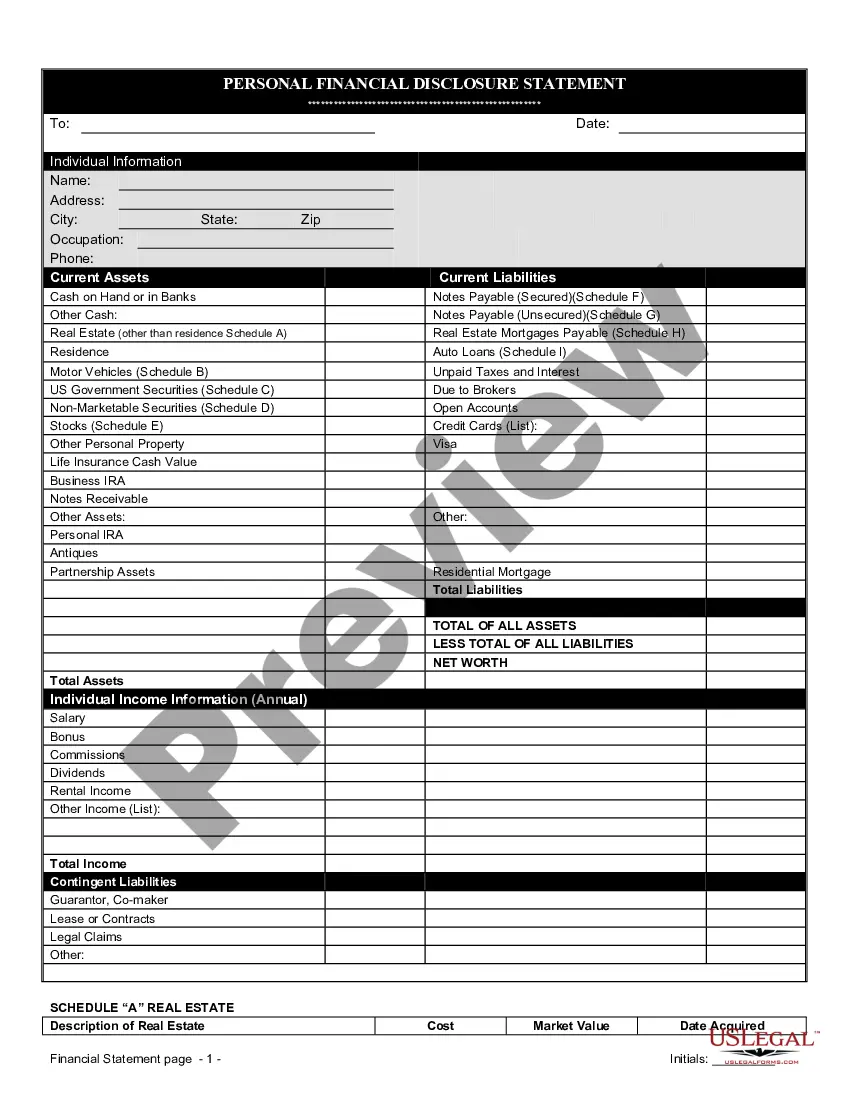

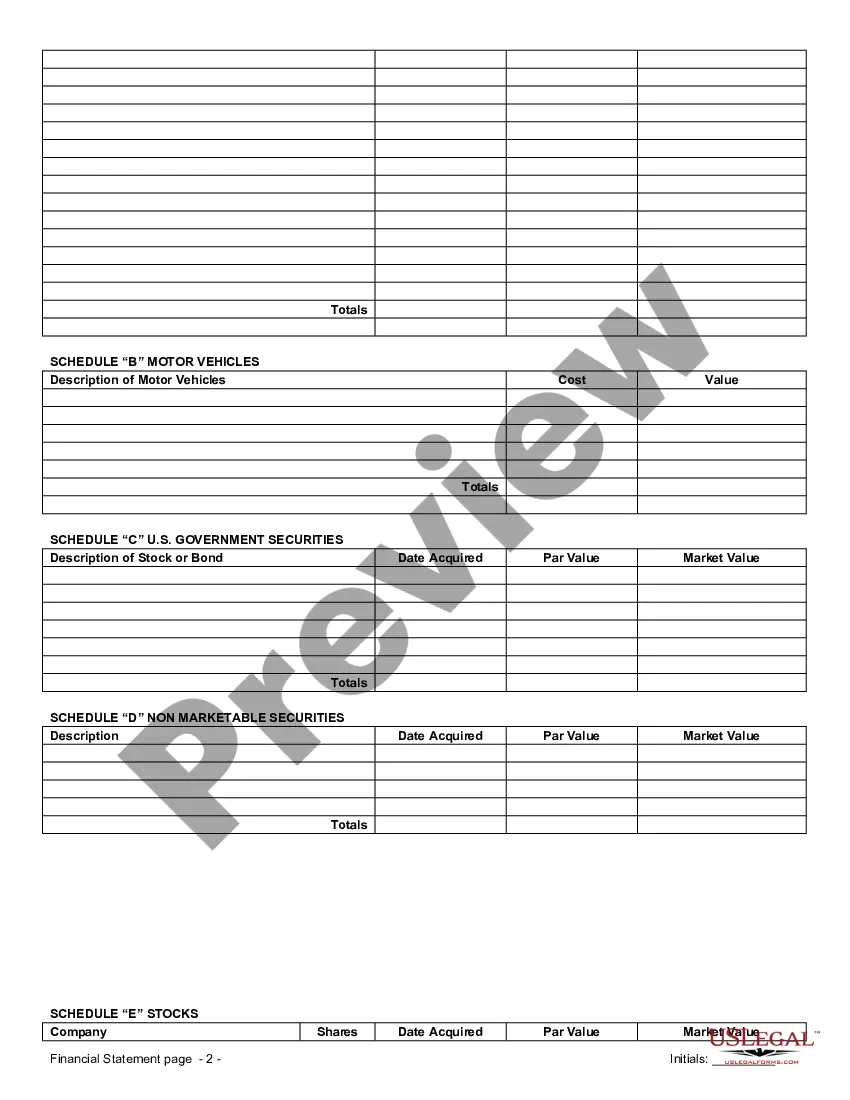

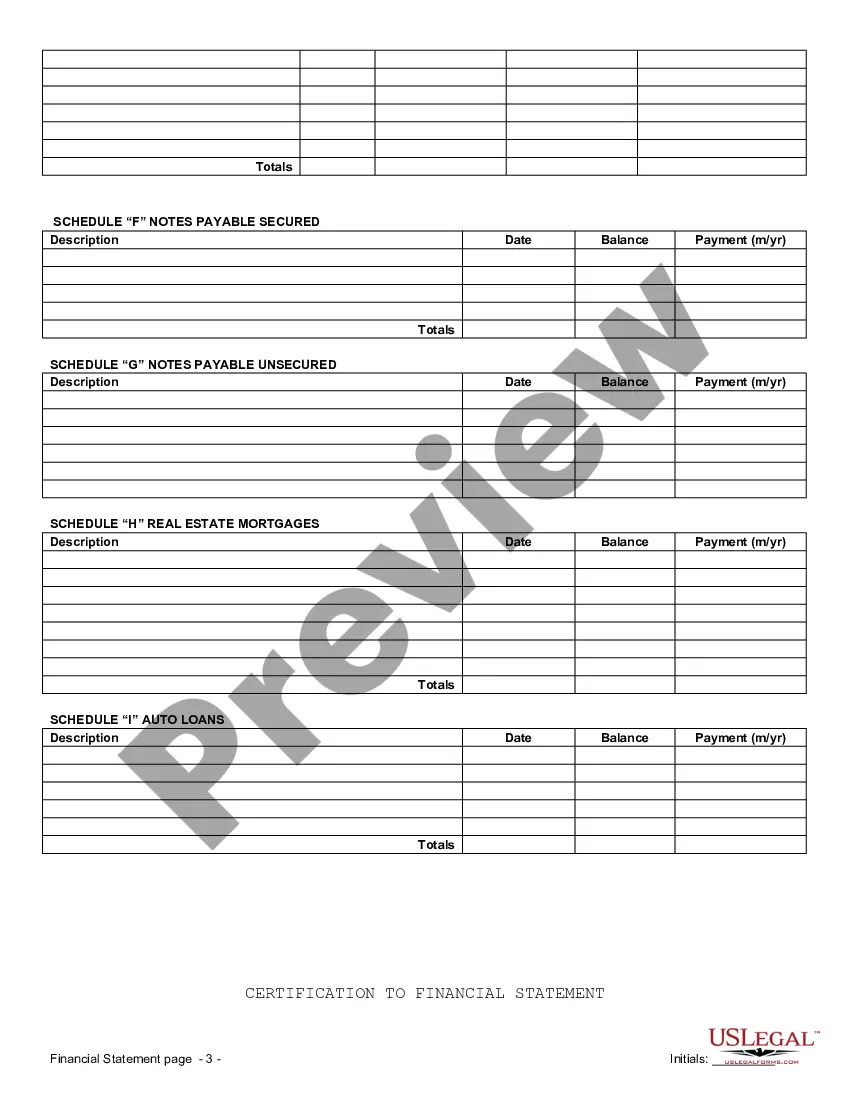

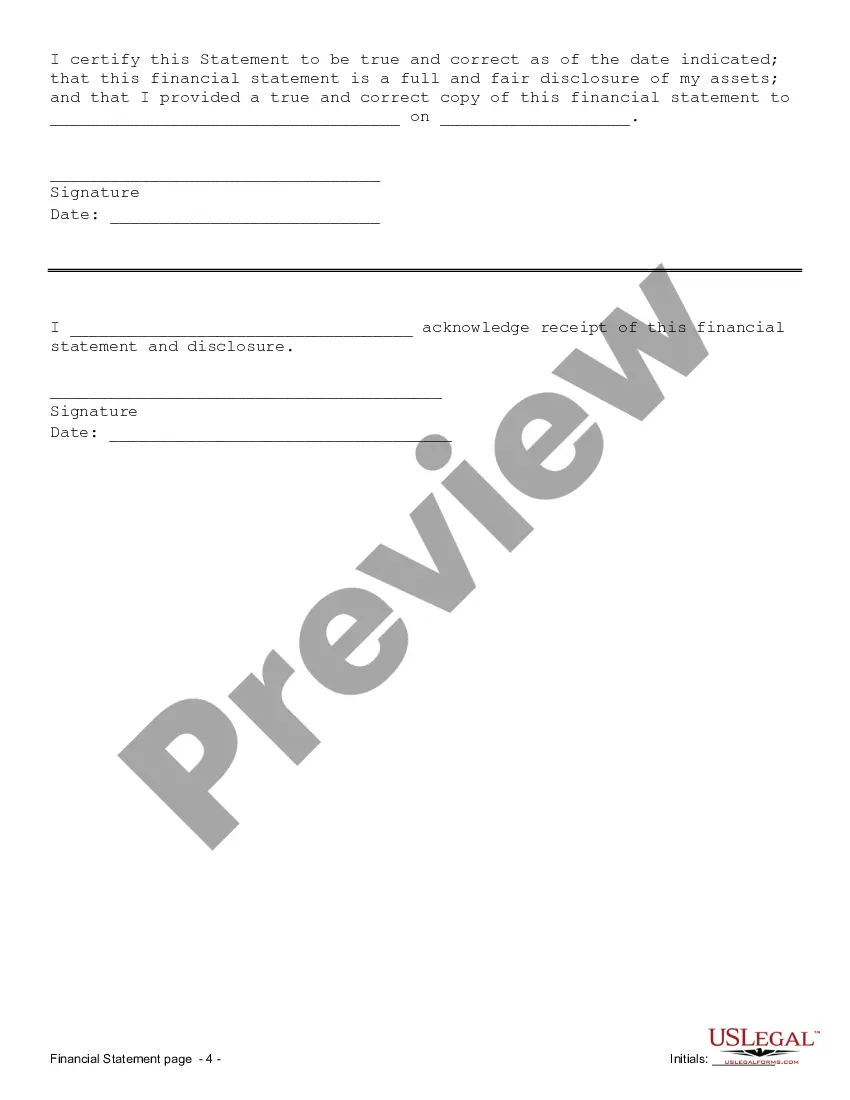

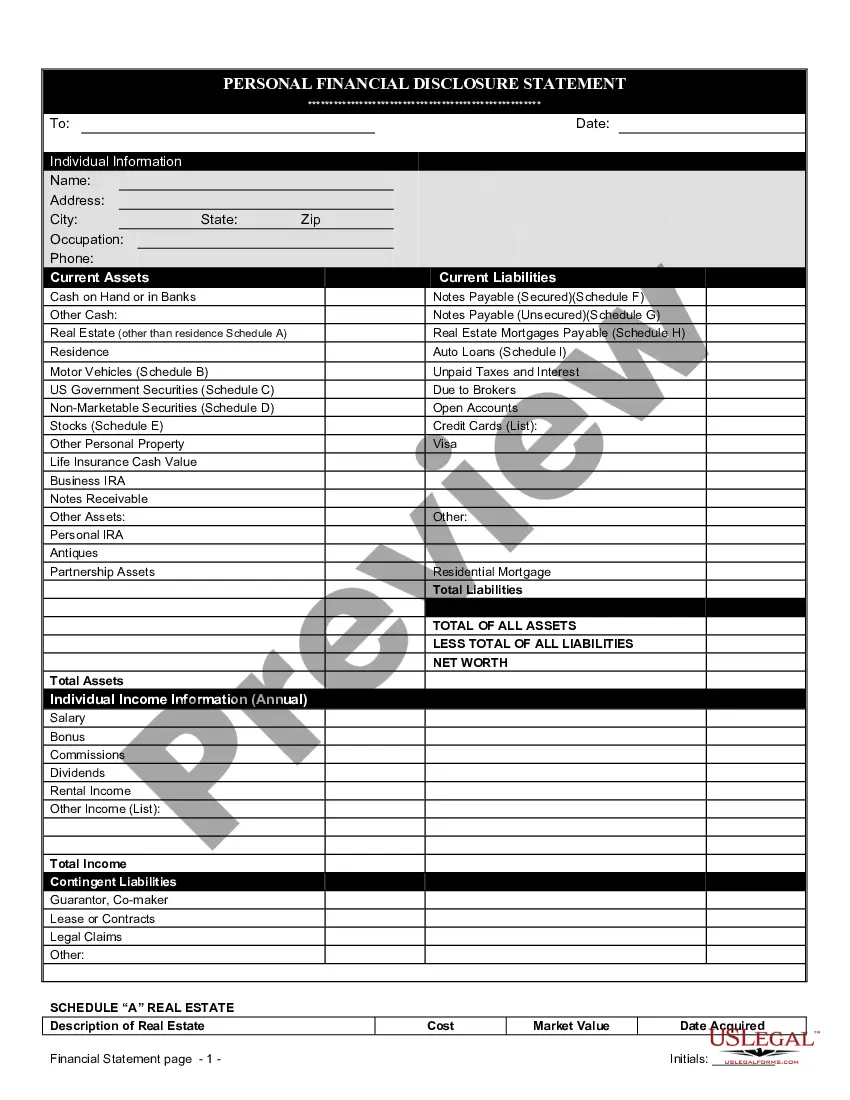

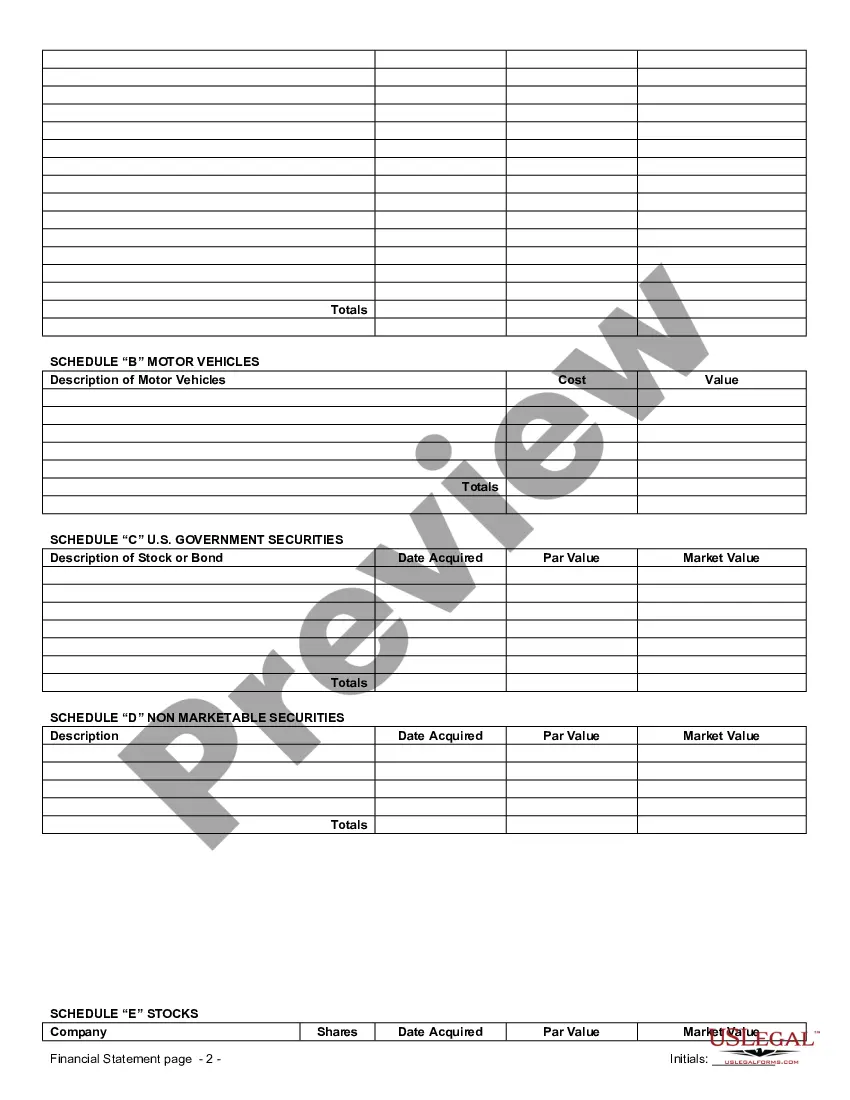

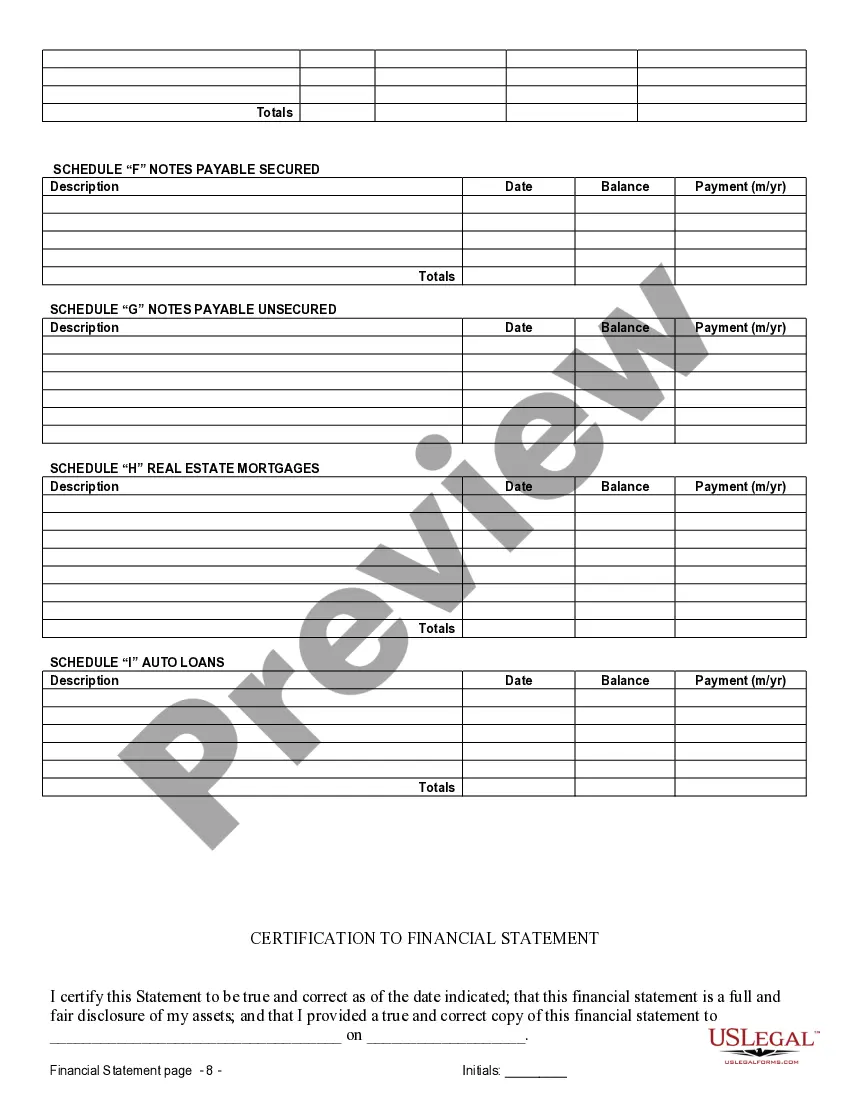

Joliet, Illinois Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview When entering into a prenuptial or premarital agreement in Joliet, Illinois, financial statements play a crucial role in safeguarding the financial interests of both parties. These statements provide a transparent and accurate representation of the assets, debts, incomes, and liabilities of each partner. Understanding the various types of financial statements that can be involved in such agreements is essential for a successful and fair prenuptial arrangement. In this article, we will delve into the details of Joliet, Illinois financial statements exclusively used in connection with prenuptial or premarital agreements. 1. Personal Financial Statement: To initiate the prenuptial agreement process, both partners are required to disclose their personal financial statements. This document highlights each individual's financial standing, encompassing their income, assets, debts, and other liabilities. It serves as a baseline for determining how the couple's finances should be divided, protected, or allocated in the event of separation, divorce, or death. 2. Bank Statements: Bank statements are vital components of Joliet, Illinois financial statements for prenuptial agreements. They provide concrete evidence of each partner's financial transactions, including deposits, withdrawals, and account balances. These statements offer a comprehensive overview of the couple's joint or separate accounts, ensuring transparency and preventing any potential financial disputes. 3. Tax Returns: Another crucial element in Joliet, Illinois financial statements related to prenuptial agreements is the submission of recent tax returns. These documents provide a clear picture of each partner's income, deductions, investments, and other financial details. Tax returns offer vital information required to determine the financial contributions, rights, and obligations of each party involved in the prenuptial agreement. 4. Property Deeds and Titles: Property deeds and titles must be included in Joliet, Illinois financial statements for prenuptial agreements, especially if there are shared assets, such as a house or real estate properties. This documentation confirms ownership, valuation, and any existing mortgages or liens on the property. Identifying and protecting these assets within the prenuptial agreement safeguards the division and distribution of properties in the future. 5. Investment and Retirement Account Statements: To secure investments and retirement accounts accrued by each party, Joliet, Illinois financial statements within prenuptial agreements also include detailed account statements. These statements delineate the value, contributions, and potential growth of investment portfolios, mutual funds, pensions, 401(k)s, and other retirement plans. By detailing these assets, couples can ensure that their financial investments are adequately protected and allocated in case of dissolution. 6. Business Financial Statements: In cases where one or both partners own businesses, financial statements related to the business(BS) are crucial. These statements typically include income statements, balance sheets, cash flow statements, and profit and loss statements. Understanding the financial health and value of any business interests helps in determining how the business will be accounted for and divided in a prenuptial agreement. It is important to note that Joliet, Illinois financial statements for prenuptial agreements must be accurate, transparent, and obtained with complete consent and disclosure from all parties involved. These statements ensure that the prenuptial agreement establishes a fair distribution of assets, debts, and income, creating a solid foundation for a sustainable marital relationship. Seeking professional guidance from attorneys or financial advisors well-versed in Illinois family law and prenuptial agreements is highly recommended ensuring compliance and fairness in the process.

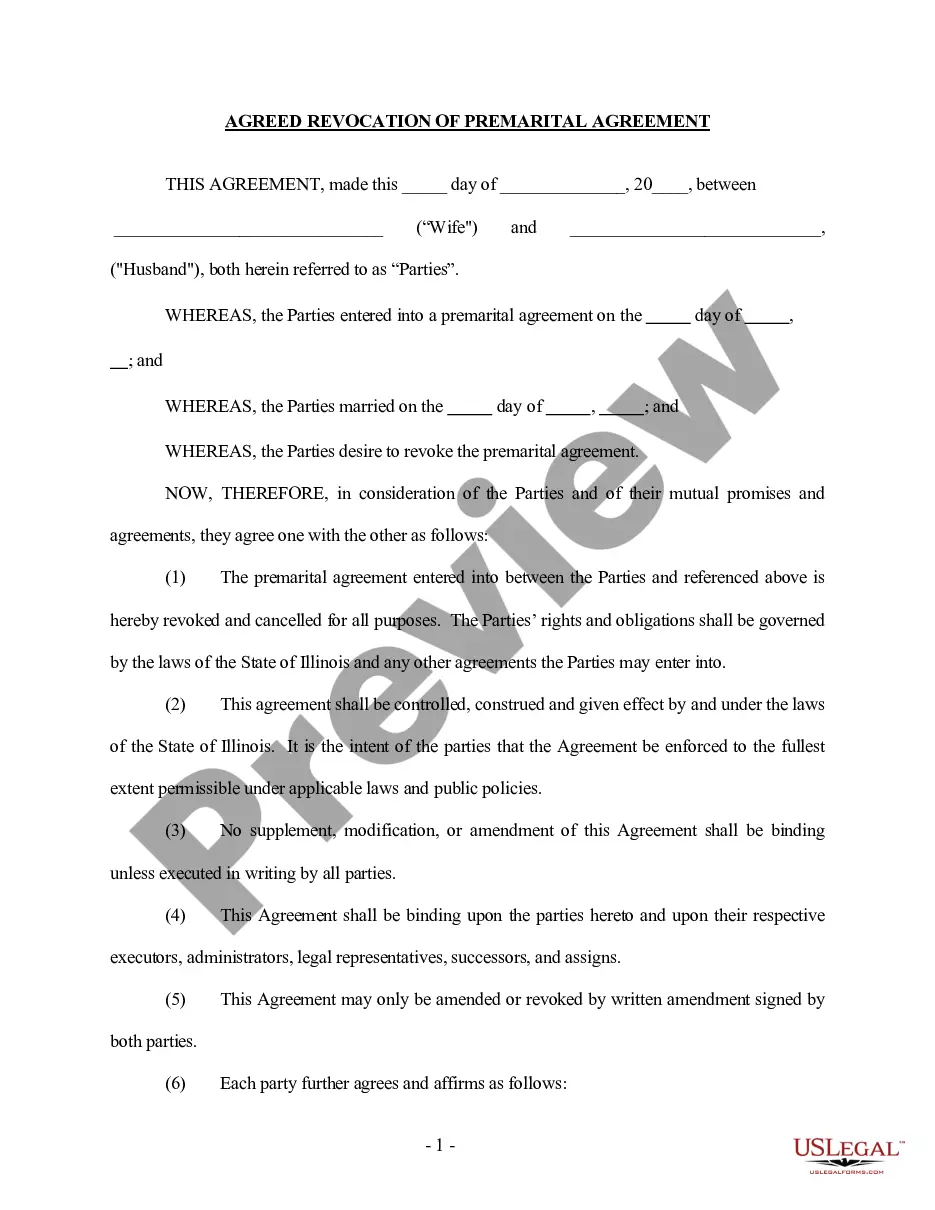

Joliet Illinois Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Joliet Illinois Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Joliet Illinois Financial Statements only in Connection with Prenuptial Premarital Agreement? US Legal Forms is your go-to solution.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked based on the requirements of separate state and county.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Joliet Illinois Financial Statements only in Connection with Prenuptial Premarital Agreement conforms to the laws of your state and local area.

- Read the form’s details (if available) to learn who and what the form is intended for.

- Start the search over if the template isn’t suitable for your specific situation.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Joliet Illinois Financial Statements only in Connection with Prenuptial Premarital Agreement in any available format. You can get back to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal papers online for good.