The Shareholders Agreement is signed by the shareholders to agree on how the shares of a deceased shareholder may be purchased and how shares of a person who desires to sell their stock may be obtained by the other shareholders or the corporation. Restrictions on the Sale of stock are included to accomplish the goals of the shareholders to keep the corporation under the control of the existing shareholders.

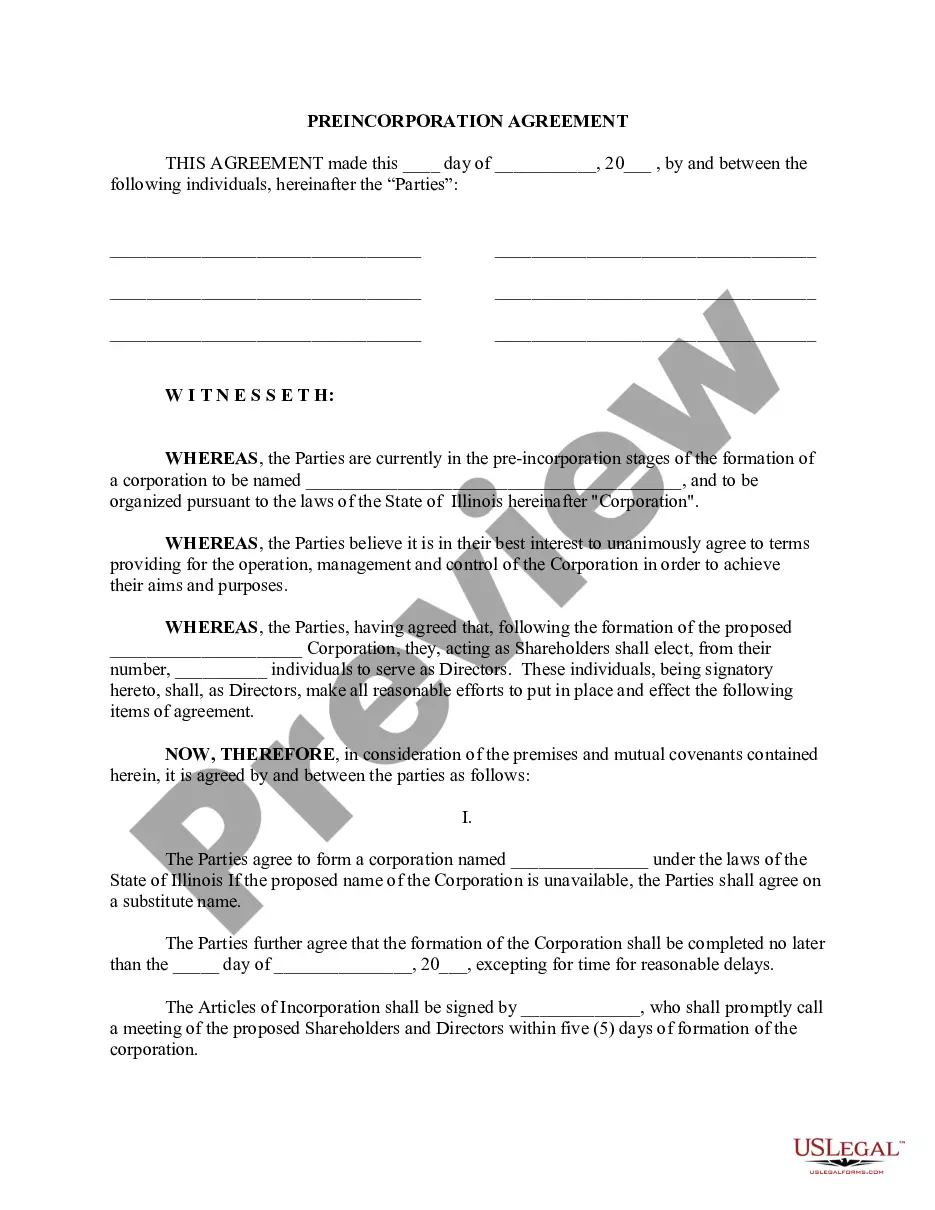

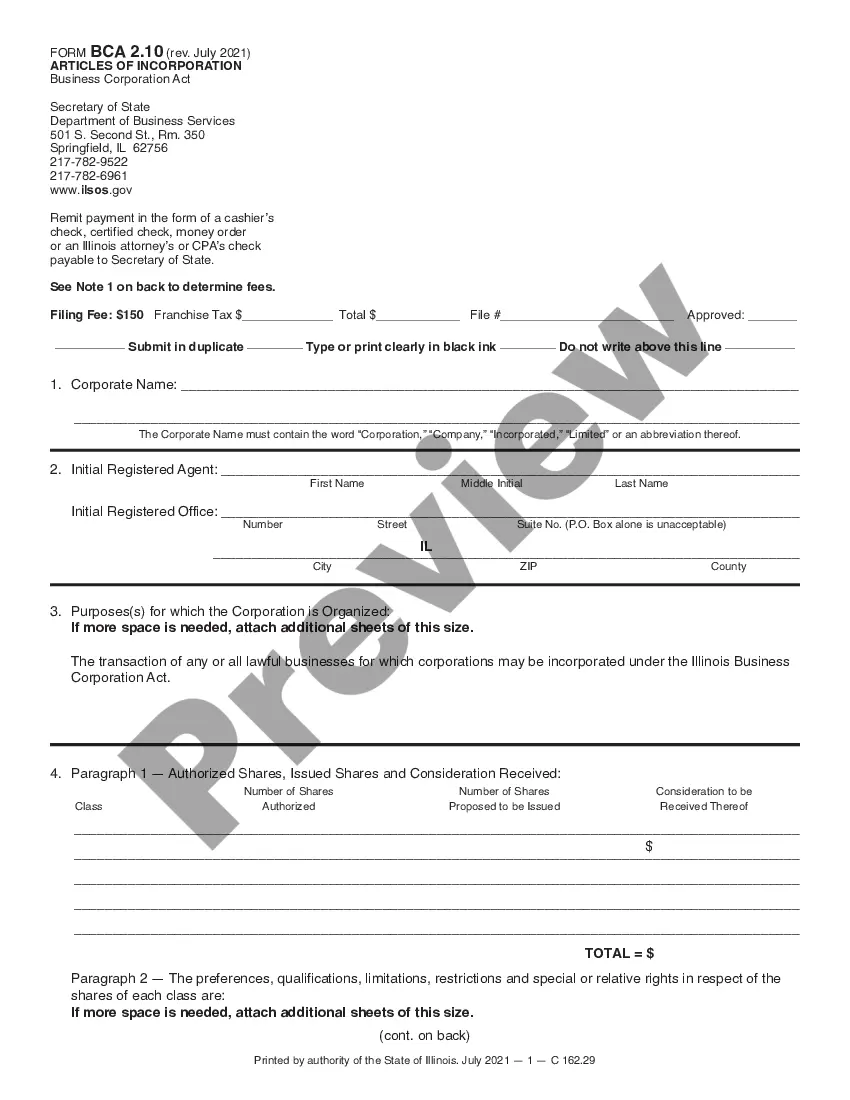

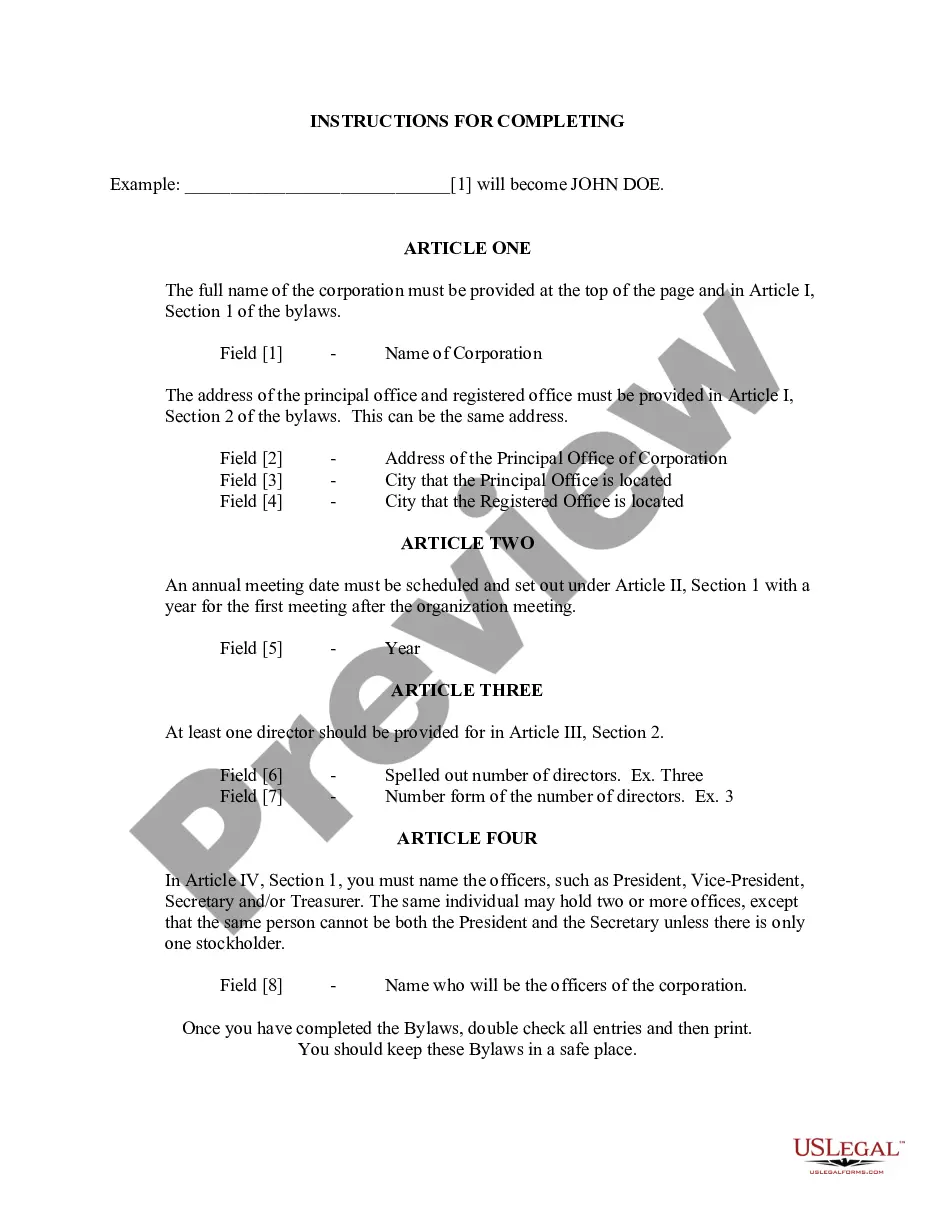

The Confidentiality Agreement is made between the shareholders wherein they agree to keep confidential certain corporate matters. Chicago Illinois Pre-Incorporation Agreement: The Chicago Illinois Pre-Incorporation Agreement is a legal document that outlines the terms and conditions agreed upon by the founders of a company prior to its incorporation in the state of Illinois. This agreement typically covers various aspects such as the purpose of the company, the roles and responsibilities of the founders, the initial capital contributions, and the ownership structure of the company. It is crucial in establishing a solid foundation for the future incorporation and operation of the business. Chicago Illinois Shareholders Agreement: The Chicago Illinois Shareholders Agreement is a legally binding contract entered into by the shareholders of a company incorporated in the state of Illinois. This agreement outlines the rights and obligations of the shareholders, including provisions related to the transfer of shares, voting rights, dividend distributions, and dispute resolution mechanisms. It also helps to establish clear guidelines for corporate governance and ensures that the shareholders' interests are protected. Types of Chicago Illinois Shareholders Agreements: 1. Vesting Agreement: This type of shareholders agreement specifies a vesting schedule for the founders' shares, ensuring that their ownership and voting rights are tied to the length of their involvement in the company. 2. Buy-Sell Agreement: This agreement outlines the procedures and terms for the sale or transfer of shares between shareholders, including situations such as death, disability, or voluntary withdrawal from the company. Chicago Illinois Confidentiality Agreement: The Chicago Illinois Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a legal contract that governs the exchange of sensitive and confidential information between parties. This agreement ensures that the shared information remains confidential and prohibits its unauthorized use or disclosure to third parties. It is a crucial tool in protecting trade secrets, proprietary information, and other confidential data that may be critical to a company's competitive advantage. Types of Chicago Illinois Confidentiality Agreements: 1. Unilateral NDA: This type of agreement is typically used when only one party is disclosing confidential information to the other party, such as when a company shares its proprietary information with an independent contractor or a potential investor. 2. Mutual NDA: In situations where both parties need to share confidential information with each other, a mutual NDA is used. This agreement ensures that both parties are bound by the same obligations of confidentiality. In conclusion, the Chicago Illinois Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement are essential legal documents that play a crucial role in establishing and governing the relationships and operations of businesses in the state of Illinois. These agreements provide clarity, protection, and guidance for the founders, shareholders, and parties involved in confidential information exchanges.

Chicago Illinois Pre-Incorporation Agreement: The Chicago Illinois Pre-Incorporation Agreement is a legal document that outlines the terms and conditions agreed upon by the founders of a company prior to its incorporation in the state of Illinois. This agreement typically covers various aspects such as the purpose of the company, the roles and responsibilities of the founders, the initial capital contributions, and the ownership structure of the company. It is crucial in establishing a solid foundation for the future incorporation and operation of the business. Chicago Illinois Shareholders Agreement: The Chicago Illinois Shareholders Agreement is a legally binding contract entered into by the shareholders of a company incorporated in the state of Illinois. This agreement outlines the rights and obligations of the shareholders, including provisions related to the transfer of shares, voting rights, dividend distributions, and dispute resolution mechanisms. It also helps to establish clear guidelines for corporate governance and ensures that the shareholders' interests are protected. Types of Chicago Illinois Shareholders Agreements: 1. Vesting Agreement: This type of shareholders agreement specifies a vesting schedule for the founders' shares, ensuring that their ownership and voting rights are tied to the length of their involvement in the company. 2. Buy-Sell Agreement: This agreement outlines the procedures and terms for the sale or transfer of shares between shareholders, including situations such as death, disability, or voluntary withdrawal from the company. Chicago Illinois Confidentiality Agreement: The Chicago Illinois Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a legal contract that governs the exchange of sensitive and confidential information between parties. This agreement ensures that the shared information remains confidential and prohibits its unauthorized use or disclosure to third parties. It is a crucial tool in protecting trade secrets, proprietary information, and other confidential data that may be critical to a company's competitive advantage. Types of Chicago Illinois Confidentiality Agreements: 1. Unilateral NDA: This type of agreement is typically used when only one party is disclosing confidential information to the other party, such as when a company shares its proprietary information with an independent contractor or a potential investor. 2. Mutual NDA: In situations where both parties need to share confidential information with each other, a mutual NDA is used. This agreement ensures that both parties are bound by the same obligations of confidentiality. In conclusion, the Chicago Illinois Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement are essential legal documents that play a crucial role in establishing and governing the relationships and operations of businesses in the state of Illinois. These agreements provide clarity, protection, and guidance for the founders, shareholders, and parties involved in confidential information exchanges.