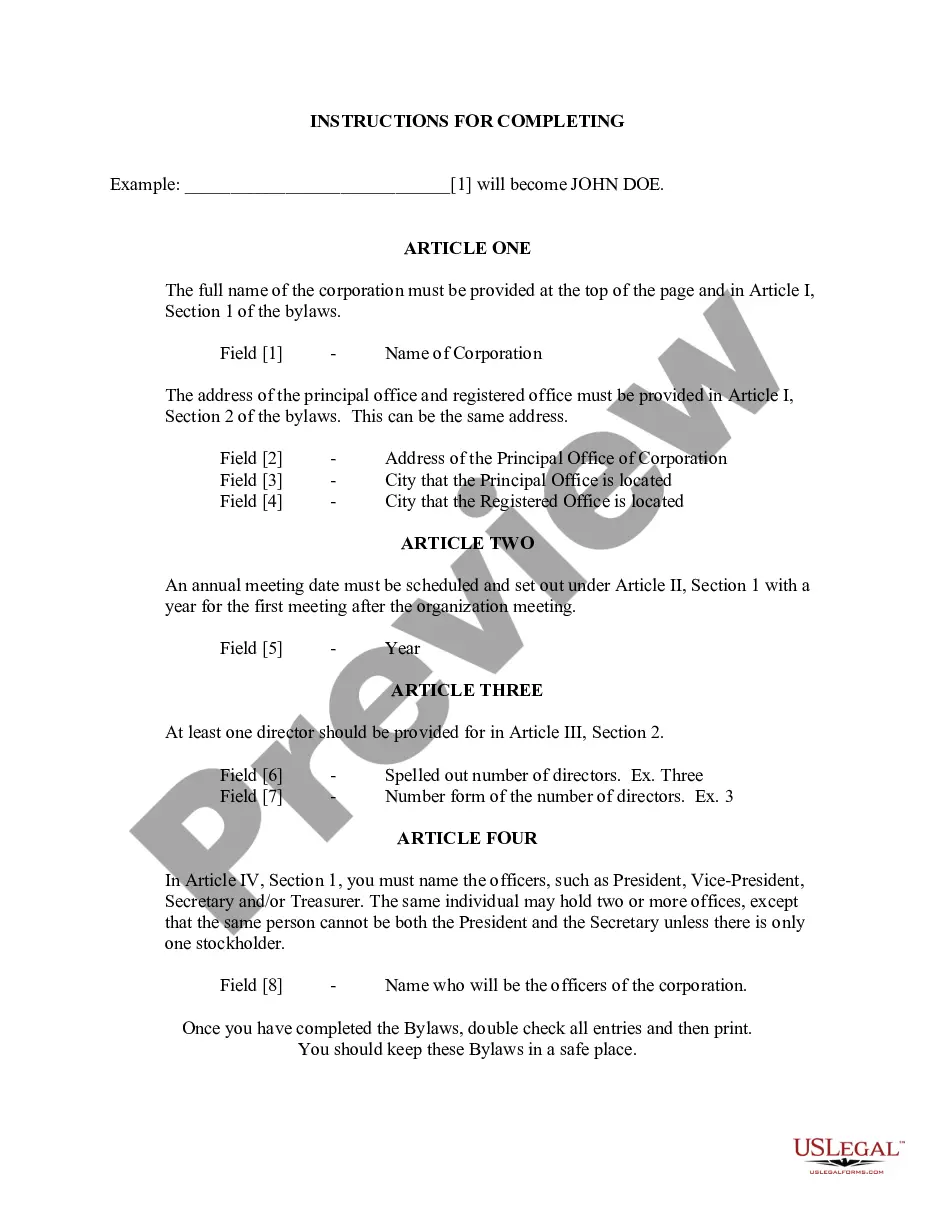

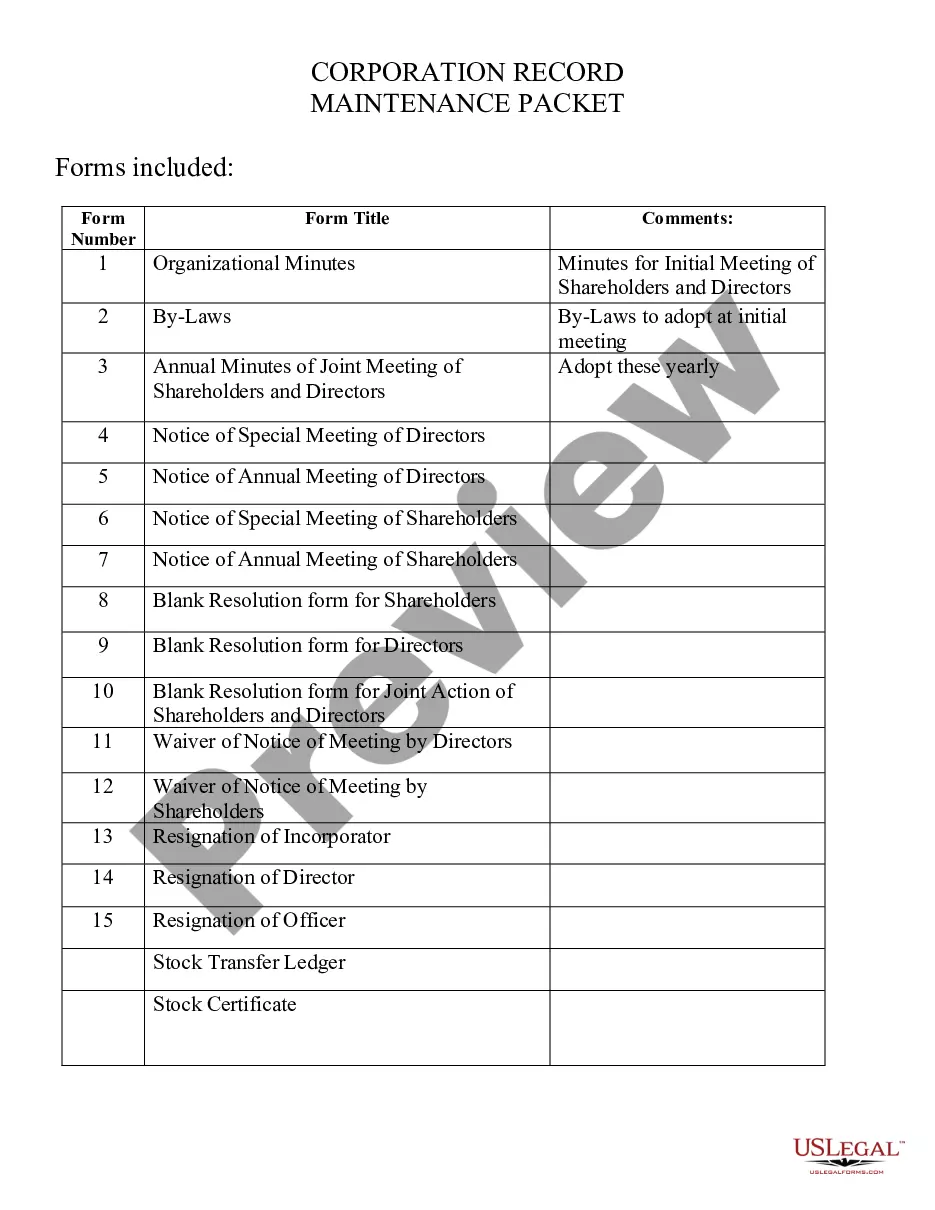

The Chicago Illinois Articles of Incorporation for Domestic For-Profit Corporation refer to the legal document that is required to be filed with the Secretary of State's office in Illinois when forming a for-profit corporation based in the city of Chicago. This document serves as the foundation and establishment of the corporation, laying out crucial information about the business. Keywords: Chicago Illinois, Articles of Incorporation, Domestic For-Profit Corporation, legal document, Secretary of State's office, for-profit corporation, foundation, establishment, crucial information, business. The Articles of Incorporation typically include important details such as: 1. Name of the Corporation: This section specifies the intended legal name of the corporation, which must adhere to legal requirements and should not be identical or too similar to an existing corporation's name in the state of Illinois. 2. Purpose of the Corporation: Here, the document states the primary activities and objectives of the corporation. This section should provide a clear and concise description of the business purpose of the corporation, which can be broad or specific depending on the nature of the business. 3. Registered Agent and Registered Office: The Articles of Incorporation specify the name and address of the corporation's registered agent, who will act as a point of contact with the state. The registered office is the official business address where legal documents can be served to the corporation. 4. Duration of the Corporation: This section outlines the intended duration of the corporation, indicating whether it is intended to be a perpetual entity or will have a specific duration. 5. Shares and Stock: If the corporation plans to issue shares of stock, this section will provide details regarding the number and type of shares authorized, as well as any restrictions, rights, or preferences associated with the shares. 6. Incorporates and Directors: The Articles of Incorporation typically need to include the names and addresses of the incorporates, who are responsible for signing and filing the document. In addition, they may also appoint the initial board of directors or specify the process for electing directors. 7. Statutory Agent: This section refers to the corporation's statutory agent. In Illinois, corporations are required to have a statutory agent who is authorized to receive legal notices on behalf of the corporation. It is important to note that the Chicago Illinois Articles of Incorporation for Domestic For-Profit Corporation may differ slightly from the statewide Illinois Articles of Incorporation. The city of Chicago may have specific requirements or additional forms that need to be completed for incorporating a business within its jurisdiction. In summary, the Chicago Illinois Articles of Incorporation for Domestic For-Profit Corporation is a critical legal document that outlines the fundamental details of a for-profit corporation. It serves as the basis for establishing the corporation's legal presence and conducting business activities within the city of Chicago, ensuring compliance with the state's regulations and requirements.

Chicago Illinois Articles of Incorporation for Domestic For-Profit Corporation

Description

How to fill out Chicago Illinois Articles Of Incorporation For Domestic For-Profit Corporation?

If you are looking for a relevant form template, it’s impossible to choose a more convenient platform than the US Legal Forms site – one of the most comprehensive online libraries. With this library, you can find thousands of document samples for company and personal purposes by categories and regions, or key phrases. Using our high-quality search option, discovering the latest Chicago Illinois Articles of Incorporation for Domestic For-Profit Corporation is as elementary as 1-2-3. Furthermore, the relevance of each record is confirmed by a group of professional attorneys that regularly check the templates on our platform and revise them according to the most recent state and county laws.

If you already know about our system and have a registered account, all you should do to get the Chicago Illinois Articles of Incorporation for Domestic For-Profit Corporation is to log in to your account and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the form you require. Look at its information and utilize the Preview option (if available) to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to get the needed document.

- Affirm your choice. Click the Buy now button. Following that, choose the preferred subscription plan and provide credentials to register an account.

- Process the transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the form. Choose the file format and download it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Chicago Illinois Articles of Incorporation for Domestic For-Profit Corporation.

Each and every form you add to your account does not have an expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you need to have an additional duplicate for enhancing or printing, you may come back and download it once again whenever you want.

Make use of the US Legal Forms professional collection to get access to the Chicago Illinois Articles of Incorporation for Domestic For-Profit Corporation you were seeking and thousands of other professional and state-specific templates on a single platform!