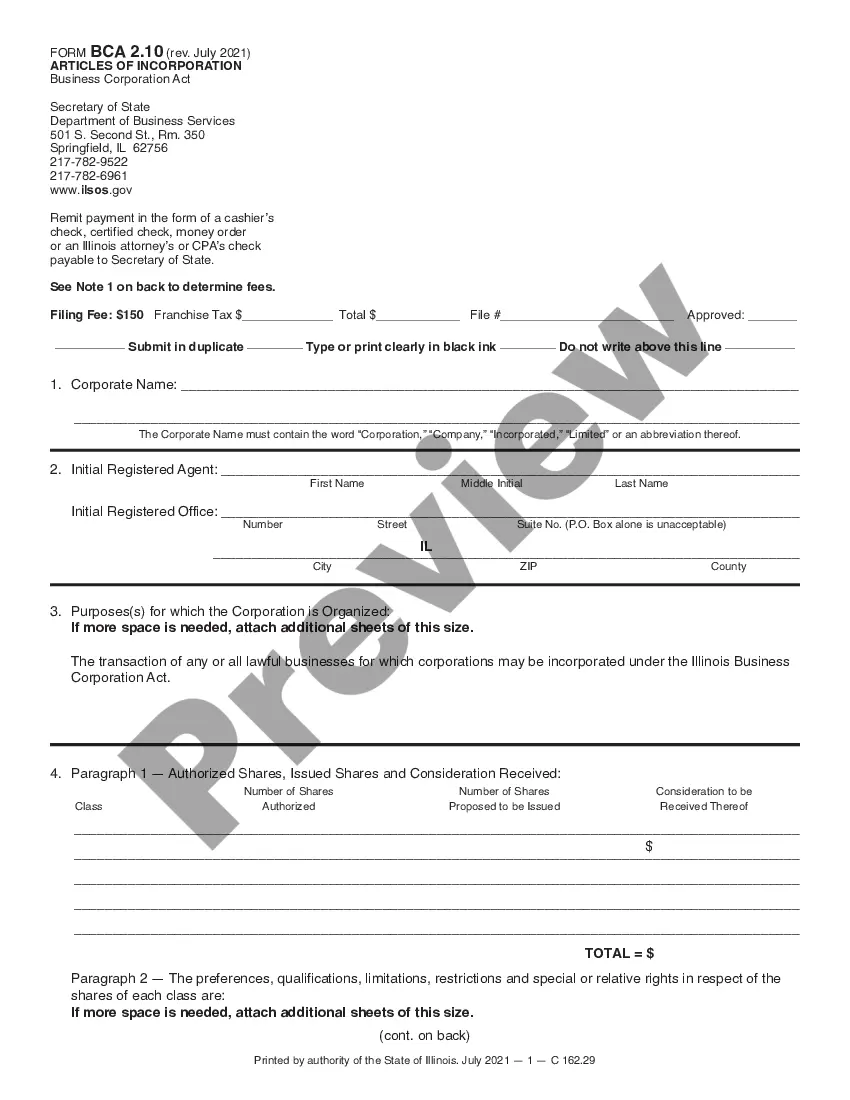

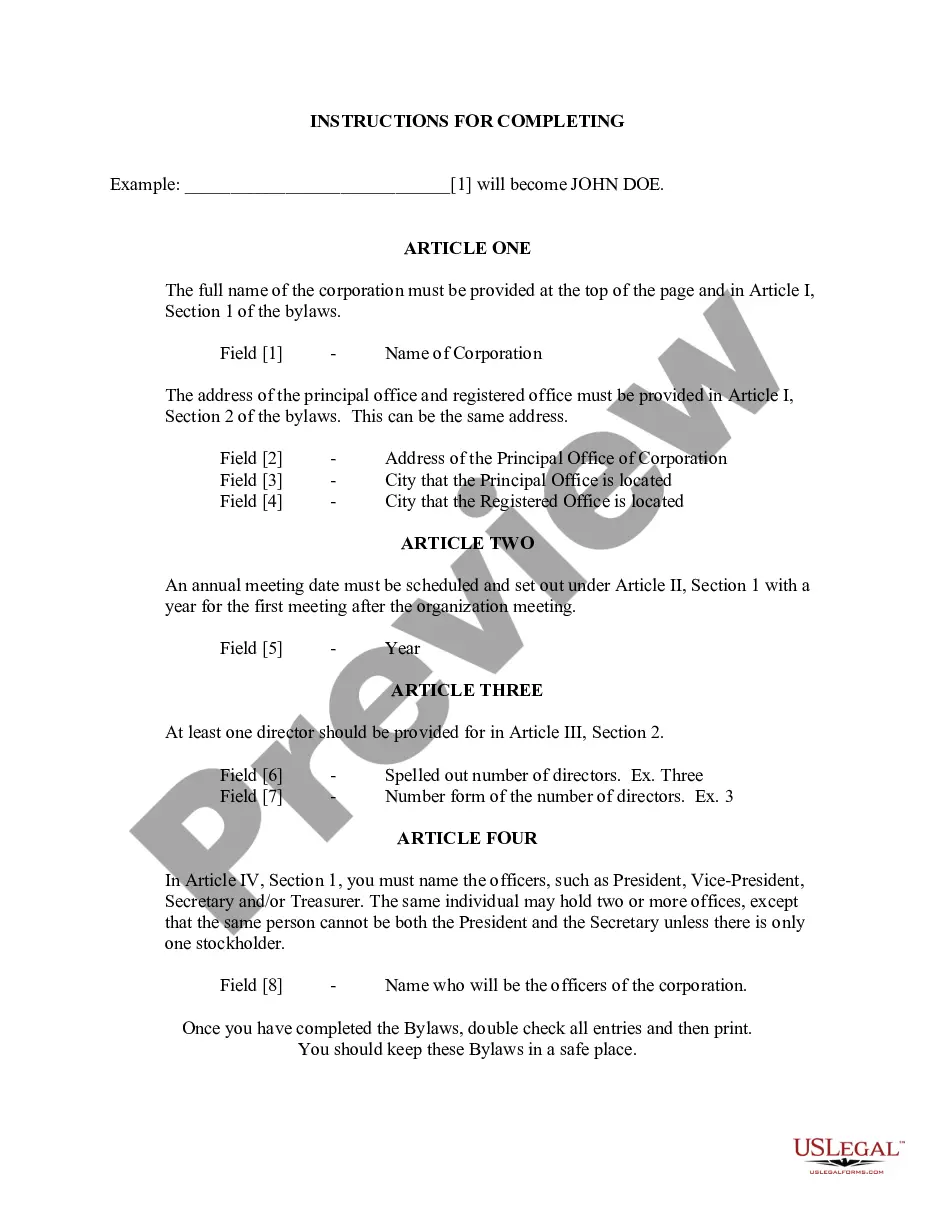

The Chicago Illinois Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that outlines and establishes the creation of a nonprofit organization within the city of Chicago, Illinois. This document is filed with the Illinois Secretary of State's office and provides crucial information about the nonprofit, its purpose, structure, and operations. The Articles of Incorporation for a Domestic Nonprofit Corporation in Chicago typically consist of several sections. These sections are designed to ensure that the nonprofit organization operates in compliance with state laws and regulations. The document will require the following keywords: 1. Name of the Corporation: The Articles of Incorporation will establish the legal name of the nonprofit organization. It should comply with the naming requirements set forth by the Illinois Secretary of State's office. 2. Purpose of the Corporation: This section describes the purpose, mission, or objectives of the nonprofit organization. It should clearly articulate the charitable, religious, educational, scientific, or other nonprofit activities the organization intends to engage in. 3. Registered Agent and Office: The nonprofit organization must designate a registered agent, who will act as the primary point of contact for legal correspondence. The registered agent must have a physical address within the city of Chicago and be available during regular business hours. 4. Duration: This section specifies whether the nonprofit organization is formed for a specific duration or will exist indefinitely. 5. Governing Board: The Articles may outline the structure and composition of the organization's governing board, including the number of directors and the terms of their service. 6. Dissolution Clause: This clause explains the procedure for dissolving the nonprofit organization in the event it is no longer able to fulfill its objectives. It outlines the steps that need to be taken to distribute remaining assets to other tax-exempt organizations. 7. Tax-Exempt Status: This section may include language indicating the nonprofit organization's intent to apply for tax-exempt status under relevant federal and state laws, such as 501(c)(3) status. 8. Amendments: The Articles should include provisions for making changes to the document in the future, including the process for amending the bylaws or other governing documents. However, as for any specific types of Articles of Incorporation, it is important to consult with legal resources or professionals who can provide accurate and up-to-date information on any variations or additional requirements in Chicago, Illinois.

Chicago Illinois Articles of Incorporation for Domestic Nonprofit Corporation

Description

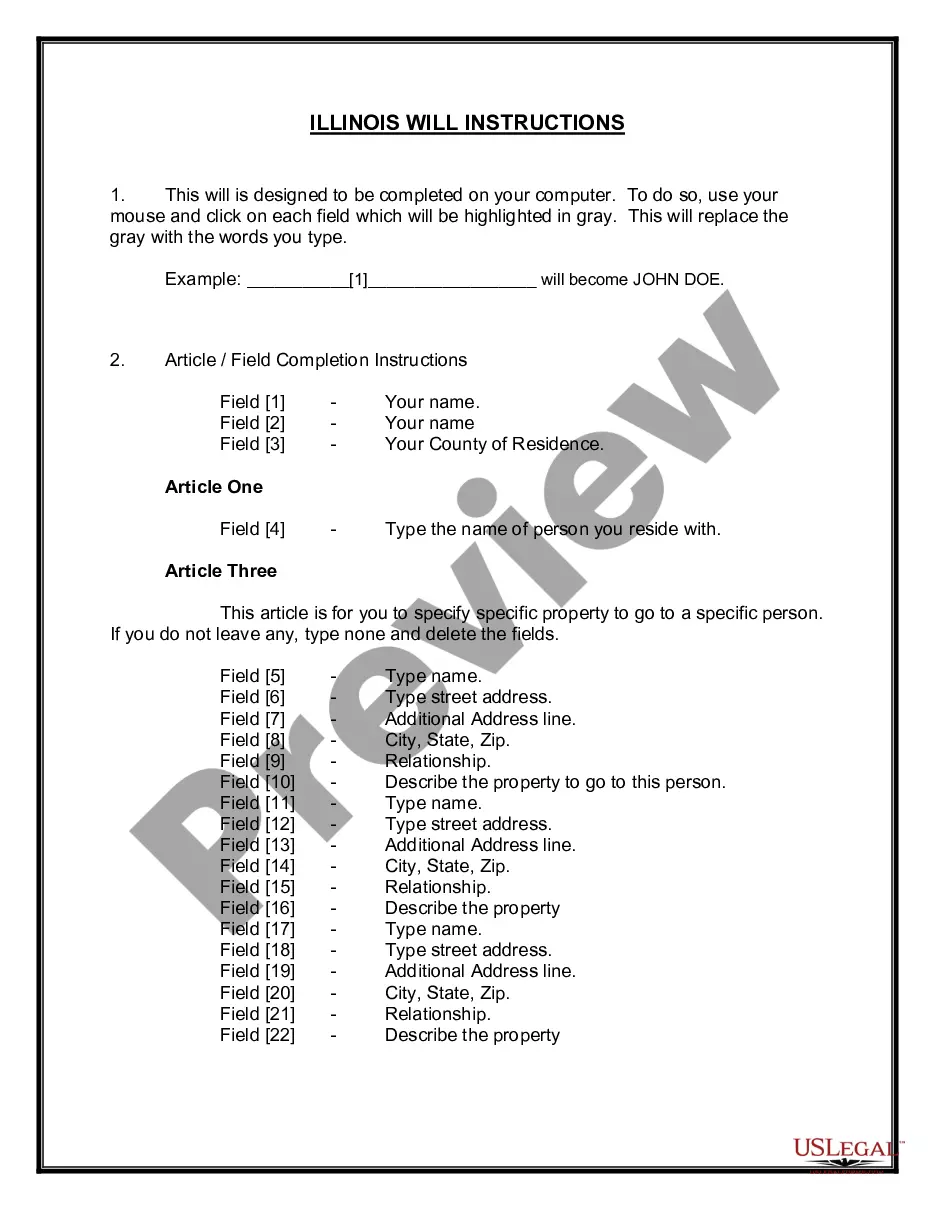

How to fill out Chicago Illinois Articles Of Incorporation For Domestic Nonprofit Corporation?

Do you require a reliable and affordable provider of legal documents to obtain the Chicago Illinois Articles of Incorporation for Domestic Nonprofit Corporation? US Legal Forms is your ideal answer.

Whether you need a simple agreement to establish rules for cohabitation with your partner or a collection of forms to facilitate your divorce through the legal system, we have you covered. Our platform features over 85,000 current legal document templates for both personal and business use. All templates we provide access to are not generic and are designed in accordance with the regulations of individual states and regions.

To retrieve the document, you need to Log Into your account, locate the desired form, and click the Download button next to it. Please remember that you can download your previously acquired form templates anytime from the My documents section.

Are you a newcomer to our website? No problem. You can create an account in just a few minutes, but prior to that, ensure to do the following.

Now you can set up your account. Then choose the subscription option and continue to payment. Once the payment is finalized, download the Chicago Illinois Articles of Incorporation for Domestic Nonprofit Corporation in any available format. You can return to the site whenever needed and redownload the document at no cost.

Obtaining current legal forms has never been simpler. Give US Legal Forms a try today, and say goodbye to spending hours searching for legal documents online.

- Check if the Chicago Illinois Articles of Incorporation for Domestic Nonprofit Corporation adheres to the statutes of your state and locality.

- Review the form’s description (if available) to understand who and what the document is meant for.

- Restart your search if the form isn’t suitable for your specific situation.

Form popularity

FAQ

You must register with the Illinois Department of Revenue if you conduct business in Illinois, or with Illinois customers. This includes sole proprietors (individual or husband/wife/civil union), exempt organizations, or government agencies withholding for Illinois employees.

Illinois requires corporations to submit articles of incorporation to operate as a legal business in the state. Incorporation documents are public records and can be viewed by anyone for any legal or business purpose. You may already have the original copy of the articles of incorporation from when you filed.

Charitable Incorporated Organisation (CIO) It has its own legal existence, which means it can enter into contracts and have debts and obligations in its own right. It must register with the Charity Commission as soon as it is set up.

Cost to Incorporate The filing fee is $50 (805 ILCS 105/115.05(a). You can file online at . Click on Departments then Business Services then NFP Articles of Incorporation. You will need to use a credit card to pay the $50 filing fee (Visa, Mastercard, Discover or American Express).

9 Legal Steps to Starting Your Own Nonprofit Complete the articles of incorporation.File the articles of incorporation.Draft bylaws.Hold an official meeting.Apply for a Federal Employer Identification Number.Apply for federal tax exemption.Familiarize yourself with initial state requirements.Register as a charity.

The Big Picture Follow the steps below to start a nonprofit organization in Illinois. Pick a name. The name must be unique.Appoint a registered agent.Choose your board of directors.State your charitable purpose.File your articles of incorporation.Create bylaws.

7 Steps to Starting a Nonprofit Define the mission of your nonprofit. Defining your nonprofit's mission statement is one of the most important steps you'll take.Do your homework.Build a team.Legally incorporate.Apply for 501(c)(3) status.Identify local partners.Build support within your community.

To purchase a copy of a corporation's Articles of Incorporation, please visit the Illinois Secretary of State Department of Business Services website - or contact them at (217) 524-8008.

Board of Directors: There must be at least three (3) directors on the board. Board members do not need to be residents of the State of Illinois. The board runs the organization, and no individual can receive any profits from organization revenues.

Technically speaking, yes, you can start a nonprofit alone. However, it takes a lot of time and effort, so if you can't work on it full-time, we strongly recommend doing it with a partner or a team. The other thing is, even if you start out completely on your own, you will very quickly need to involve other people.