Joliet Illinois Limited Liability Company LLC Operating Agreement

Description

How to fill out Illinois Limited Liability Company LLC Operating Agreement?

If you are searching for a pertinent form, it’s hard to find a more user-friendly service than the US Legal Forms site – likely the largest collections on the internet.

Here you can access thousands of templates for business and personal purposes categorized by type and jurisdiction, or keywords.

With our sophisticated search feature, locating the most current Joliet Illinois Limited Liability Company LLC Operating Agreement is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Specify the file format and save it to your device.

- Furthermore, the applicability of each document is validated by a team of professional lawyers who consistently examine the templates on our site and refresh them in accordance with the latest state and local regulations.

- If you are already acquainted with our platform and possess an account, all you need to obtain the Joliet Illinois Limited Liability Company LLC Operating Agreement is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have accessed the sample you need. Review its description and use the Preview option (if available) to view its contents. If it doesn’t suit your requirements, use the Search field at the top of the screen to find the right document.

- Confirm your selection. Click the Buy now button. After that, select your preferred subscription plan and enter the information to create an account.

Form popularity

FAQ

Yes, obtaining a Joliet Illinois Limited Liability Company LLC Operating Agreement is vital. It serves as a foundational document that clarifies roles and responsibilities among members. Furthermore, an operating agreement can prevent potential disputes and provide a clear process for decision-making and profit-sharing. Investing time in creating this document can save you stress in the future.

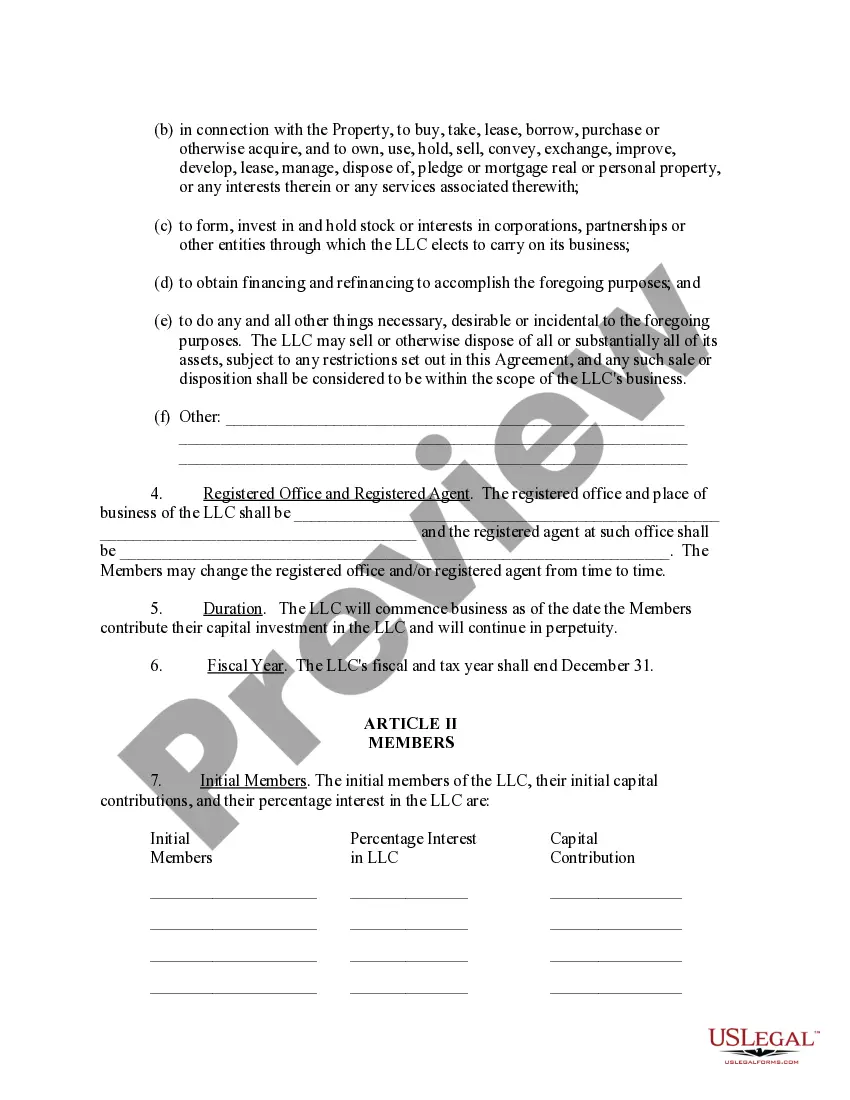

Filling out a Joliet Illinois Limited Liability Company LLC Operating Agreement involves completing a template that includes critical information about your business. Start by listing the LLC's name and purpose, followed by member information and their roles. Make sure to specify how profits, losses, and distributions will be handled. You can also utilize resources from uslegalforms to access pre-drafted templates and guidance.

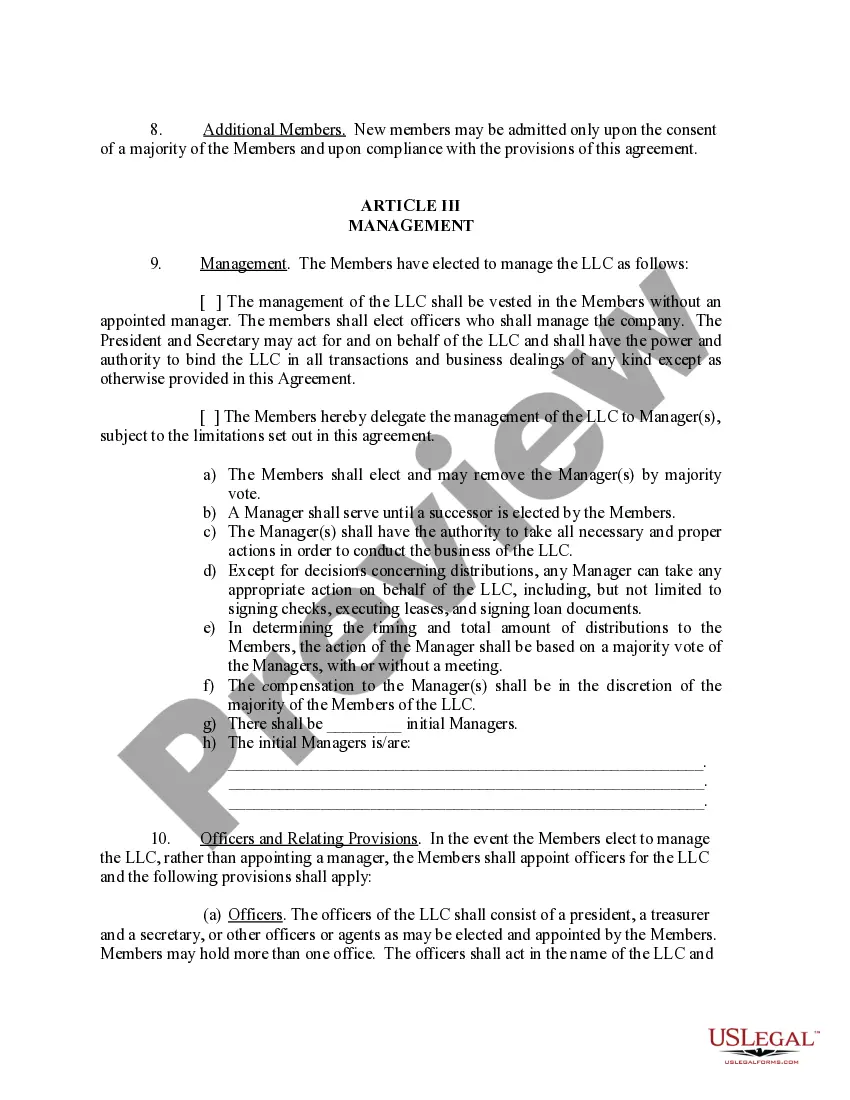

A Joliet Illinois Limited Liability Company LLC Operating Agreement typically includes essential elements such as the LLC's name, purpose, member details, and management structure. It also outlines the distribution of profits and losses among members and procedures for adding or removing members. By having a clear operating agreement, you can establish rules that govern the business and protect your interests.

Filling out an LLC in Illinois involves several steps, including choosing a unique name and filing Articles of Organization with the state. After this, you should draft an operating agreement for your Joliet Illinois Limited Liability Company LLC to outline the governance of your business. You may also need to apply for an Employer Identification Number (EIN). For a streamlined process, using USLegalForms can help you navigate these steps effectively.

You can obtain your LLC operating agreement by drafting one yourself or accessing templates and resources. If your Joliet Illinois Limited Liability Company LLC was established with a legal service, you might already have an agreement. If not, creating a new operating agreement is effective and straightforward, especially through platforms like USLegalForms, which offer ready-made templates tailored to your needs.

Absolutely, you can write your own operating agreement for your Joliet Illinois Limited Liability Company LLC. This freedom allows you to personalize the document to suit your specific needs and business structure. However, remember to adhere to relevant Illinois laws to ensure your agreement is valid. If you need help, USLegalForms provides easy-to-follow templates to aid your process.

An operating agreement and an LLC agreement are essentially the same document. Each term describes the framework within which a Joliet Illinois Limited Liability Company LLC operates. Having a clear and well-structured agreement safeguards your business and its members. If you need assistance with creating this document, consider using USLegalForms for reliable templates.

Yes, an LLC agreement and an LLC operating agreement refer to the same document governing the operations of a Joliet Illinois Limited Liability Company LLC. This document outlines various aspects of the business, including management and ownership. While both terms can be used interchangeably, ensure that your document is comprehensive and compliant with Illinois laws. USLegalForms can assist you in crafting a solid agreement.

To determine if you have an operating agreement for your Joliet Illinois Limited Liability Company LLC, check your business records and files. If you formed the LLC through a legal entity, you might have received or created an agreement at that time. If you cannot find one, it may be beneficial to draft a new operating agreement for clarity. USLegalForms offers templates that can help you get started.

Illinois does not legally require an operating agreement for an LLC, including those in Joliet. However, having one is highly recommended as it outlines the management structure and operating procedures of your company. A well-drafted operating agreement can help prevent disputes among members and clarify roles. You can create this document easily with resources from USLegalForms.