Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife

Description

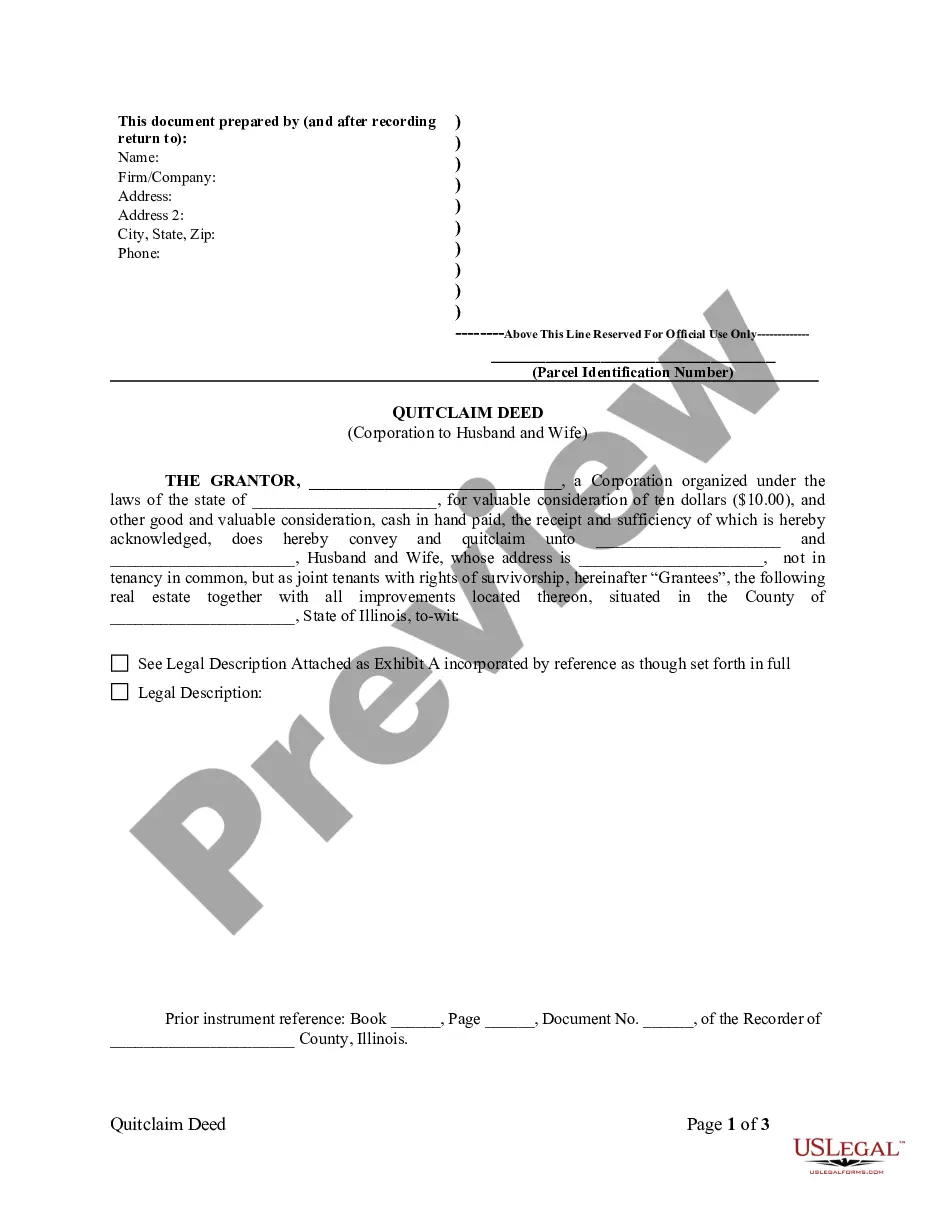

How to fill out Illinois Quitclaim Deed From Corporation To Husband And Wife?

We consistently aim to reduce or avert legal repercussions when addressing intricate legal or financial issues.

To achieve this, we seek legal counsel solutions that are typically very costly.

Nonetheless, not every legal matter is quite as complicated.

Many can be managed by ourselves.

Take advantage of US Legal Forms whenever you need to acquire and download the Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife or any other form swiftly and securely.

- US Legal Forms is an online directory of contemporary DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to take charge of your situations without the need for a lawyer's services.

- We provide access to legal form templates that are not always publicly available.

- Our templates are tailored to specific states and areas, which greatly eases the search process.

Form popularity

FAQ

To record a quitclaim deed in Illinois, start by completing the deed with the required information, including the names of the parties and a clear description of the property. Once completed, sign the Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife in front of a notary. After notarization, take the deed to the local county recorder's office for recording. This confirms the transfer of property ownership and protects your rights.

To add your spouse to your deed in Illinois, you need to execute a quitclaim deed. This deed allows you to transfer ownership from one person or entity, in this case, from a corporation to both spouses. After completing the Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife, sign it before a notary public. Finally, be sure to record the new deed at the county recorder's office to complete the process.

A deed must be recorded at the local county recorder's office in the county where the property is located. For Naperville, Illinois, you can visit the DuPage County Recorder's office to record your Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife. This step ensures that your ownership rights are public and protected. Failing to record the deed may lead to complications in future property transactions.

Whether you need a lawyer to file a Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife depends on your comfort level with legal documents. While it's possible to file this deed on your own, having legal guidance can help ensure you complete the process correctly. A lawyer can provide valuable insights and assist with any complexities related to property transfer. If you're unsure, using a reliable service like US Legal Forms might simplify your experience, as they provide the necessary forms and instructions.

Once a quitclaim deed is recorded, the transfer of property rights becomes official. The new owners gain legal claim to the property under the terms outlined in the Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife. It’s essential to keep a copy of the recorded deed for your records, as it serves as proof of ownership in future transactions.

Several factors can render a quitclaim deed invalid, including lack of proper signatures, failure to include a legal description of the property, or incomplete notarization. It’s crucial to ensure all details are accurate when preparing a Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife. Any mistakes or omissions can lead to disputes or challenges in ownership down the line.

In Illinois, a quitclaim deed replaces one party's interest in a property with another's through a simple and effective process. To execute a Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife, the grantor must sign the deed and have it notarized. It is then recorded in the county clerk's office, which grants legal recognition of the property transfer.

A quitclaim deed is most beneficial for couples, especially when transferring property between family members, like in a Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife. It allows for a straightforward transfer of property rights without the need for a lengthy and complex process. This option is ideal for spouses looking to consolidate their ownership or resolve property interests.

To fill out an Illinois quitclaim deed, start by entering the names of the parties involved, followed by the property address and a legal description. Ensure that both parties sign the document in the presence of a notary public. This process is crucial for legal validation and helps prevent future disputes regarding property rights, particularly in the context of a Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife.

An example of a quitclaim is when one spouse transfers ownership of a home to the other spouse without any warranty regarding the title. This is often used in divorce or separation situations. If you need to create a quitclaim deed, consider examples found in uslegalforms that specifically pertain to a Naperville Illinois Quitclaim Deed from Corporation to Husband and Wife for tailored guidance.