A Chicago Illinois Quitclaim Deed from Corporation to Individual is a legal document that transfers ownership of a property from a corporation to an individual, using a quitclaim deed format. This type of deed is commonly used when there is a change in ownership of a property held by a corporation, and the decision is made to transfer the property to an individual. A quitclaim deed is a legal instrument that releases any claim or interest the granter (corporation in this case) has on the property, without providing any guarantees or warranties about the property's title. This means that it transfers only the interest the corporation has in the property, if any, without promising that there are no encumbrances or defects in the title. In Chicago, Illinois, there may be different variations or specific types of quitclaim deeds used for transferring ownership from a corporation to an individual. Some potential variations may include: 1. Chicago Illinois Special Warranty Quitclaim Deed from Corporation to Individual: This type of quitclaim deed includes limited warranties provided by the corporation regarding their ownership interest. While it transfers ownership without guarantees, the corporation assures that it has not taken any actions to jeopardize the title during their ownership. 2. Chicago Illinois Full Warranty Quitclaim Deed from Corporation to Individual: In this case, the corporation provides a full warranty regarding the property's title, assuring the individual that there are no defects or encumbrances. This type of quitclaim deed offers greater protection to the individual receiving the property. 3. Chicago Illinois Granter's Quitclaim Deed from Corporation to Individual: This type of quitclaim deed includes additional clauses or provisions that address specific concerns or requirements of the granter, such as limitations on the use of the property or conditions for future sale or transfer. It is important to consult with a qualified attorney or real estate professional to ensure the appropriate type of quitclaim deed is used for the specific circumstances and to address any legal and financial implications that may arise from the transfer of ownership.

Chicago Illinois Quitclaim Deed from Corporation to Individual

Description

How to fill out Chicago Illinois Quitclaim Deed From Corporation To Individual?

If you are looking for an appropriate document, it's challenging to discover a more accessible service than the US Legal Forms website – likely the most extensive online collections.

With this collection, you can obtain a vast array of document samples for business and personal use categorized by type and region, or keywords.

Utilizing our premium search tool, locating the latest Chicago Illinois Quitclaim Deed from Corporation to Individual is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Acquire the form. Choose the format and download it to your device.

- Furthermore, the accuracy of each document is verified by a team of experienced lawyers who routinely evaluate the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to access the Chicago Illinois Quitclaim Deed from Corporation to Individual is to Log In to your account and click the Download button.

- If this is your first time using US Legal Forms, simply follow the instructions below.

- Ensure you have selected the form you need. Review its description and utilize the Preview feature to examine its content. If it does not meet your requirements, use the Search field at the top of the page to find the desired document.

- Confirm your selection. Click on the Buy now button. Then select your preferred subscription plan and provide information to create an account.

Form popularity

FAQ

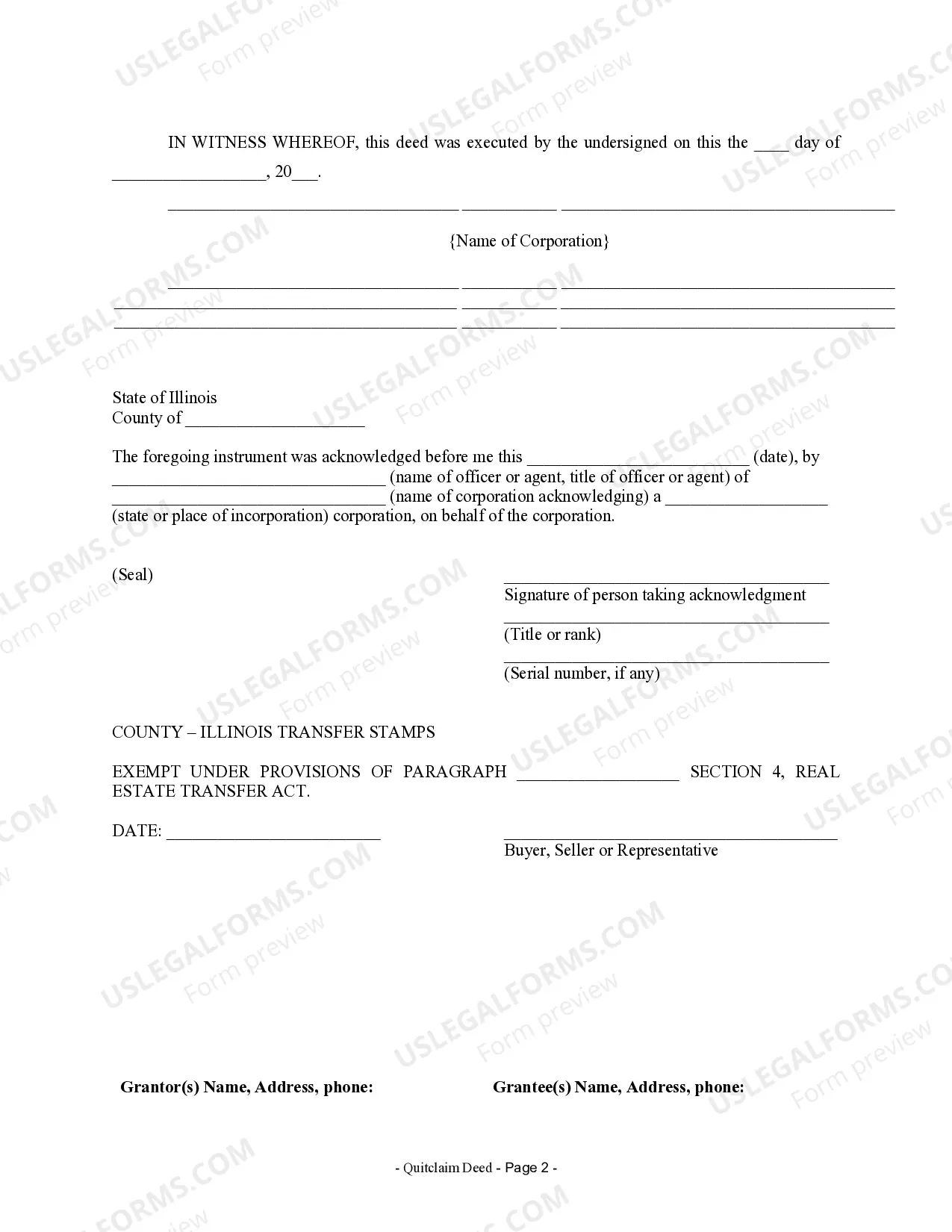

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

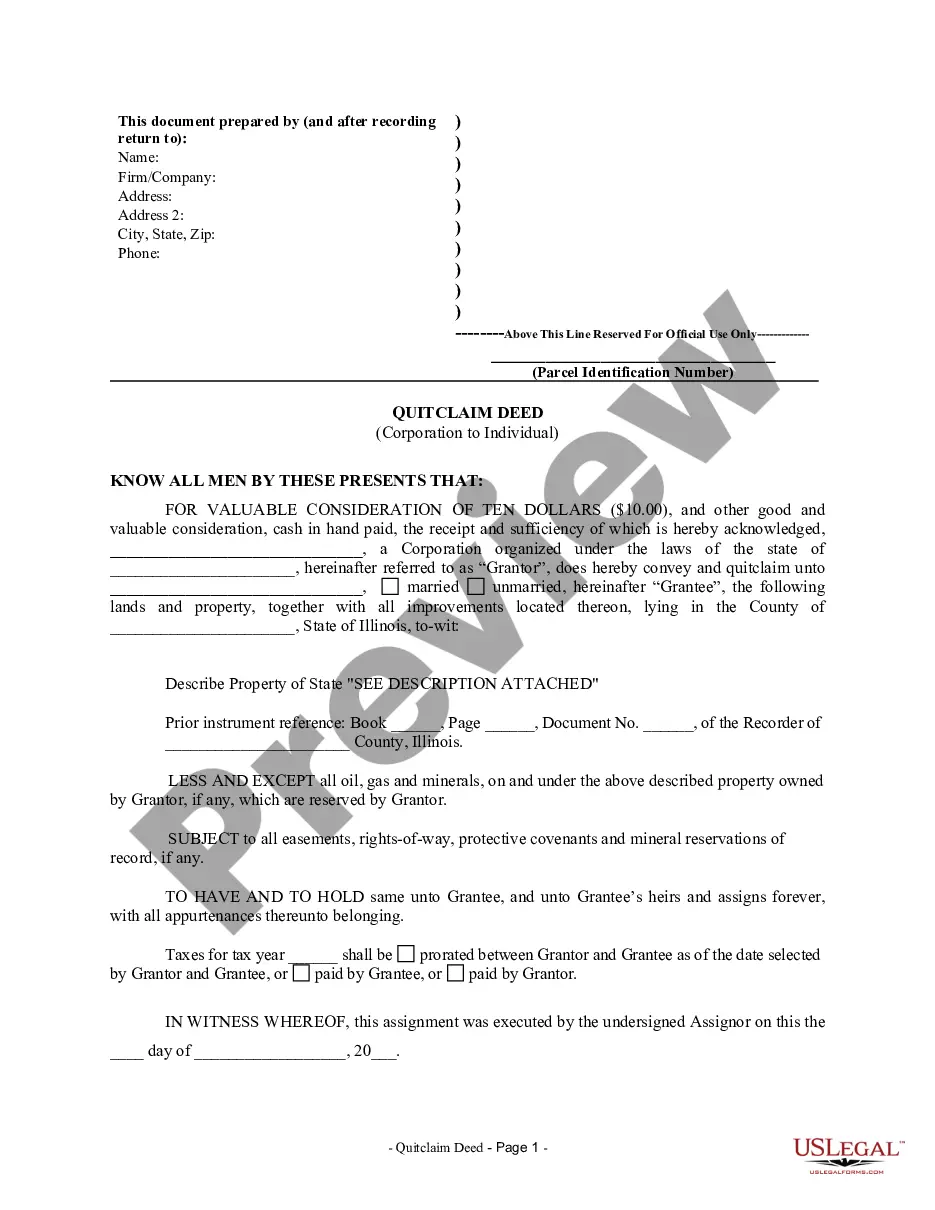

For the purpose of recording the document, your document must meet all of the recording requirements (the document has to have the property tax number, address, legal description and preparer's name and address, with signatures/notary. For recording you must provide the original plus one copy.

In order to file a deed in Cook County, the necessary documents are as follows: (1) Tax Declaration (MyDec); (2) Tax Stamps (or ?Zero Stamps? if an exempt transfer); (3) A Grantor/Grantee Affidavit (exempt transfers); (4) The Deed to be Filed (which must contain PIN number, complete legal description, commonly known

Each grantor must sign the new deed and have his or her signature witnessed by a notary public, who much acknowledge the deed. In some situations, the grantor's spouse may also be required to sign the deed. Our software can help you determine whether additional signatures are required.

Must contain the name of the person giving (Grantor) and the person receiving (Grantee). Must state in the document that you are conveying/granting/quitclaiming the property. Must have the correct property identification ? usually the legal description or at least the property address.

Visit one of the Cook County Recorder of Deeds offices. Offices are located in downtown Chicago, Bridgeview, Markham, Skokie, Rolling Meadows, and Maywood. Give the deed to the clerk and ask for it to be ?recorded.? Recording a deed means to file it.

Interesting Questions

More info

In order to comply with the Uniform Transfer of Real Property Act (ULTRA×, a quit claim deed is required. This form is available from the Illinois Department of Financial and Professional Regulation. A quitclaim deed is also a legal document that allows you to settle or transfer title to property without the filing of a notice and a lawsuit. (ULTRA, Sec. 1-103) You must comply with all applicable Treasury and Bank Secrecy Act requirements, as well as IRS guidelines. An Illinois quit claim deed does not constitute a will, and does not grant the rights or obligations of any person. A quit claim deed does not constitute probate and does not create a will or create a conveyancing or administration event in an estate (see, IRM, Probate. Note to Special Information Notice, “The Uniform Decease & Succession Act,” (April 28, 2002×, at ¶¶ 3-7×.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.