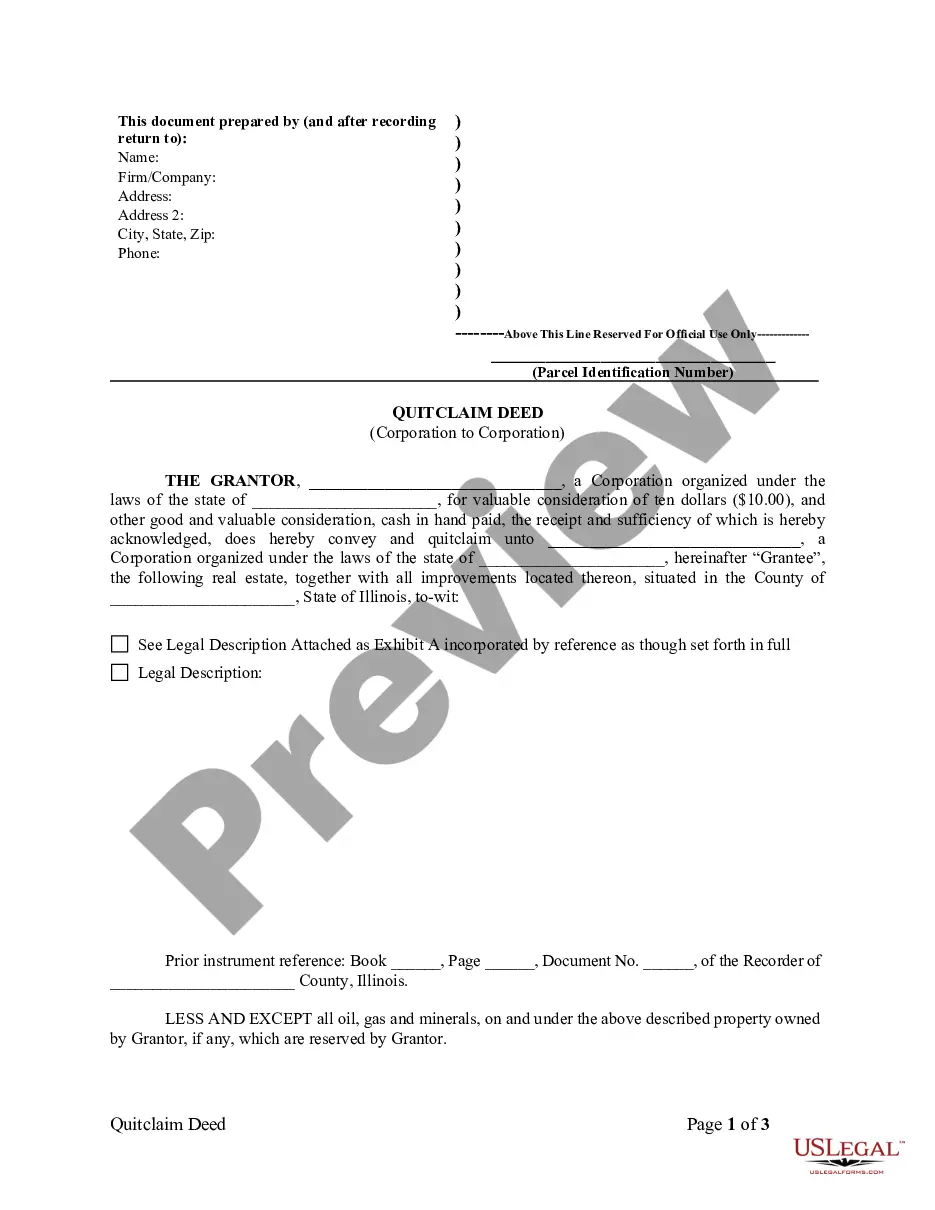

A Cook Illinois Quitclaim Deed from Corporation to Corporation is a legal document that allows one corporation to transfer its interest or ownership rights in a property located in Cook County, Illinois, to another corporation. This type of deed is commonly used when there is a need for a quick transfer of property without any guarantees or warranties regarding the property's title. A Cook Illinois Quitclaim Deed from Corporation to Corporation typically includes essential information such as the names and addresses of both corporations involved in the transfer, a clear description of the property being transferred, and a statement indicating that the corporation granting the deed (known as the granter) is transferring its interest without any warranty. This means that if any issues arise with the title or ownership of the property, the granter corporation will not be held responsible. It is important to note that a Cook Illinois Quitclaim Deed from Corporation to Corporation is different from other types of deeds, such as a warranty deed or a special warranty deed. While those deeds provide certain assurances about the property's title, a quitclaim deed only transfers the interest the granter corporation may have, if any, without making any guarantees. There may be two variations of a Cook Illinois Quitclaim Deed from Corporation to Corporation: 1. Standard Cook Illinois Quitclaim Deed from Corporation to Corporation: This is the most common type of quitclaim deed used for transferring property from one corporation to another in Cook County, Illinois. It is straightforward and includes the necessary information required for a valid transfer. 2. Enhanced Cook Illinois Quitclaim Deed from Corporation to Corporation: This type of quitclaim deed may include additional provisions tailored to specific circumstances or requirements of the parties involved. It could include clauses related to payment terms, conditions for future use of the property, or any other specific agreements reached between the corporations. In conclusion, a Cook Illinois Quitclaim Deed from Corporation to Corporation is a legal document used to transfer property between corporations in Cook County, Illinois. It is a quick and efficient way of transferring ownership rights, although it does not provide any guarantee or warranty regarding the property's title. Different variations of this deed may exist, providing flexibility to address specific needs or circumstances of the property transfer.

Cook Illinois Quitclaim Deed from Corporation to Corporation

Description

How to fill out Cook Illinois Quitclaim Deed From Corporation To Corporation?

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any legal education to create such paperwork from scratch, mainly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our service provides a huge collection with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you need the Cook Illinois Quitclaim Deed from Corporation to Corporation or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Cook Illinois Quitclaim Deed from Corporation to Corporation in minutes using our trustworthy service. In case you are presently an existing customer, you can go ahead and log in to your account to download the needed form.

Nevertheless, in case you are new to our library, ensure that you follow these steps prior to downloading the Cook Illinois Quitclaim Deed from Corporation to Corporation:

- Ensure the template you have found is suitable for your location since the regulations of one state or county do not work for another state or county.

- Review the document and read a quick description (if provided) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your credentials or register for one from scratch.

- Choose the payment gateway and proceed to download the Cook Illinois Quitclaim Deed from Corporation to Corporation as soon as the payment is done.

You’re good to go! Now you can go ahead and print the document or fill it out online. If you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

Visit one of the Cook County Recorder of Deeds offices. Offices are located in downtown Chicago, Bridgeview, Markham, Skokie, Rolling Meadows, and Maywood. Give the deed to the clerk and ask for it to be ?recorded.? Recording a deed means to file it.

You can do this through a transfer of equity. This is where a share of equity is transferred to one or multiple people, but the original owner stays on the title deeds. You'll need a Conveyancing Solicitor to complete the legal requirements for you in a transfer of equity.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The most basic service that most people chose is for me to prepare the Illinois quitclaim deed and grantor/grantee statement for $150. With this option, it will be your responsibility to get the local transfer stamp (if required) and get the deed recorded with the County Recorder.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

This option includes Option 1 above plus obtaining local municipal transfer stamps, and recording the deed with the county recorder's office. Total fees for this service ranges from $360 for townships that don't require a municipal transfer stamp to $800+ for municipalities that do require a transfer stamp.

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

If you want to transfer real estate in Illinois to a relative or a friend, you might consider doing this yourself by using a quitclaim deed. A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.

Recording ? The quitclaim deed must be recorded in the County Recorder's Office where the real estate is located (See County List). Signing (765 ILCS 5/20) ? A quit claim deed in the State of Illinois is required to be signed with a notary public present before being recorded.

Visit one of the Cook County Recorder of Deeds offices. Offices are located in downtown Chicago, Bridgeview, Markham, Skokie, Rolling Meadows, and Maywood. Give the deed to the clerk and ask for it to be ?recorded.? Recording a deed means to file it.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

Interesting Questions

More info

To avoid these disclaimers, the Grantee is required to put an acknowledgement of the title to the land for all future use in the deed. (Example — “This title is subject to liens and encumbrances…”) Why is there a warranty in my Quit Claim Deed? Most Quitclaim Deeds require a deed agreement (, property transfer) between the Grantee and the Granter. Typically, such an agreement gives a Warranty of Title and requires a Granter to make necessary improvements on the property. With a warranty in a Quit Claim Deed, any Granter can transfer the Property to another Party without making any improvements (which would cause additional taxes×. The granter agrees to make an adjustment to the property to make sure the property is adequate, the property is occupied or will be occupied, the property is safe from vandals, etc. These terms are explained on the form. However, the Granters are still responsible for making payments on the Guarantee of Title.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.