An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification is contractual in nature and should be supported by consideration.

Elgin Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate

Description

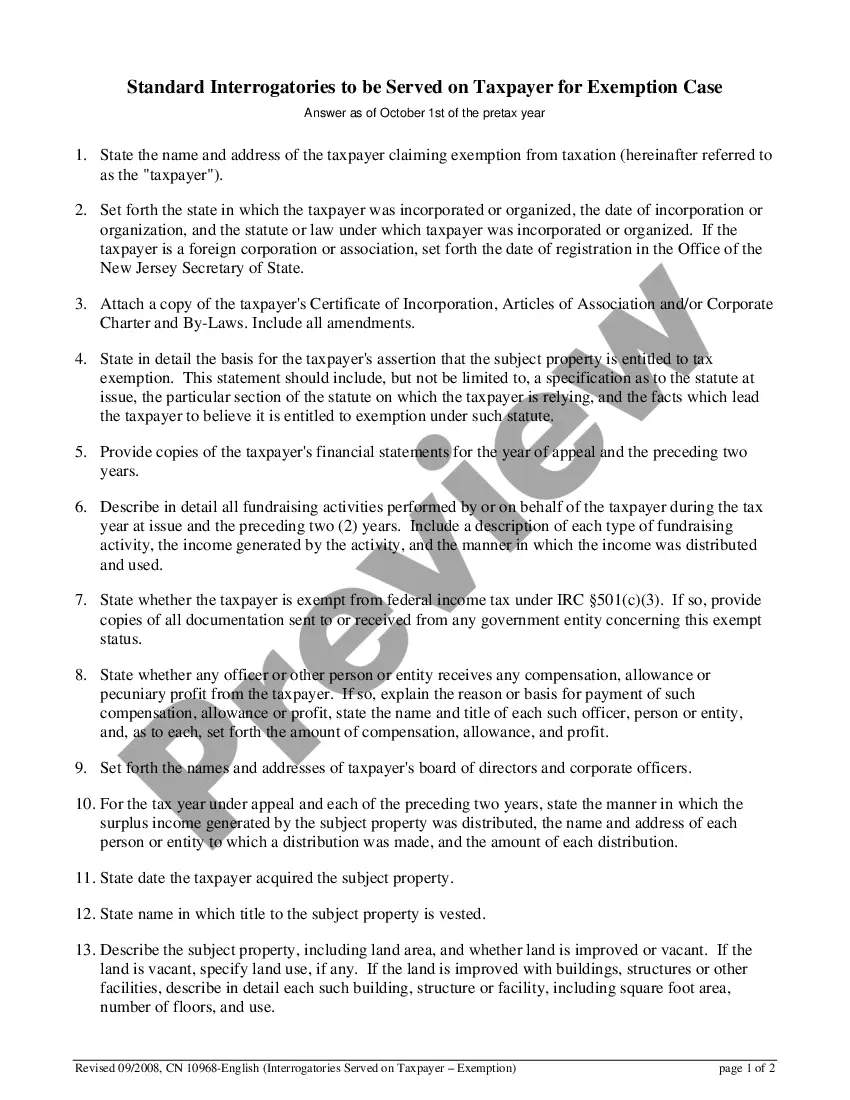

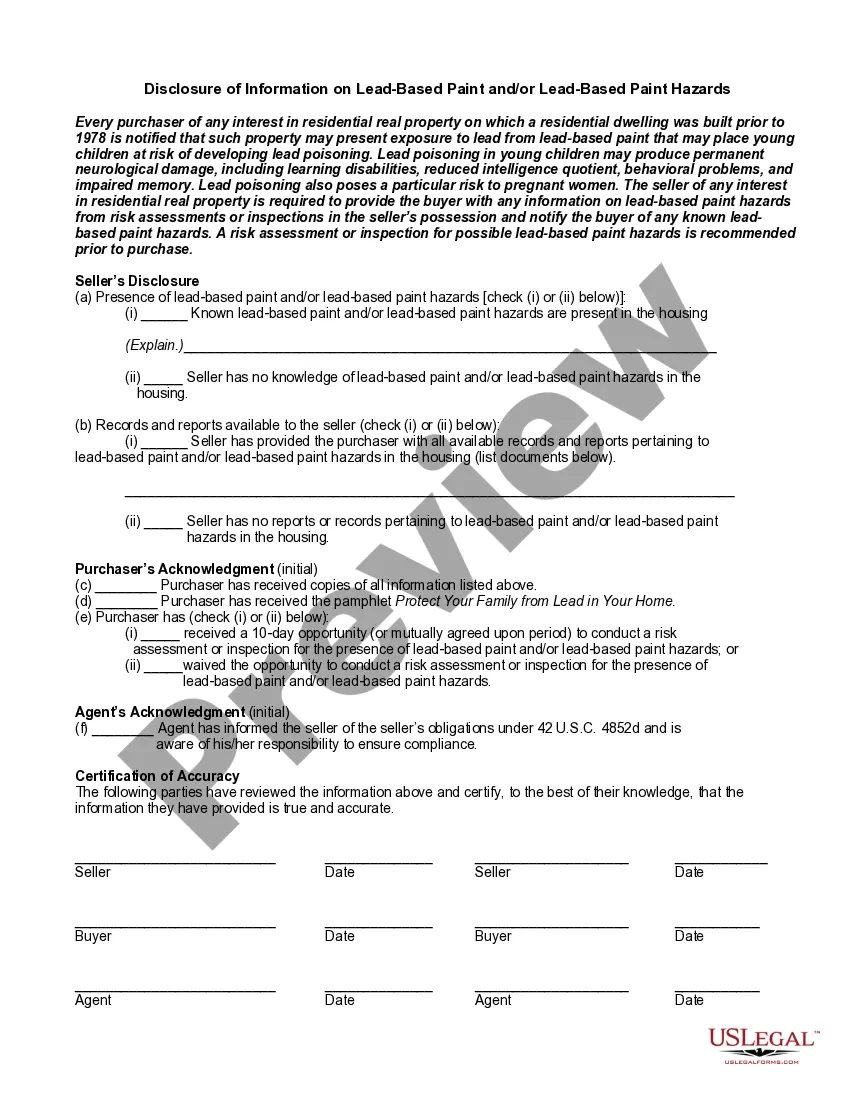

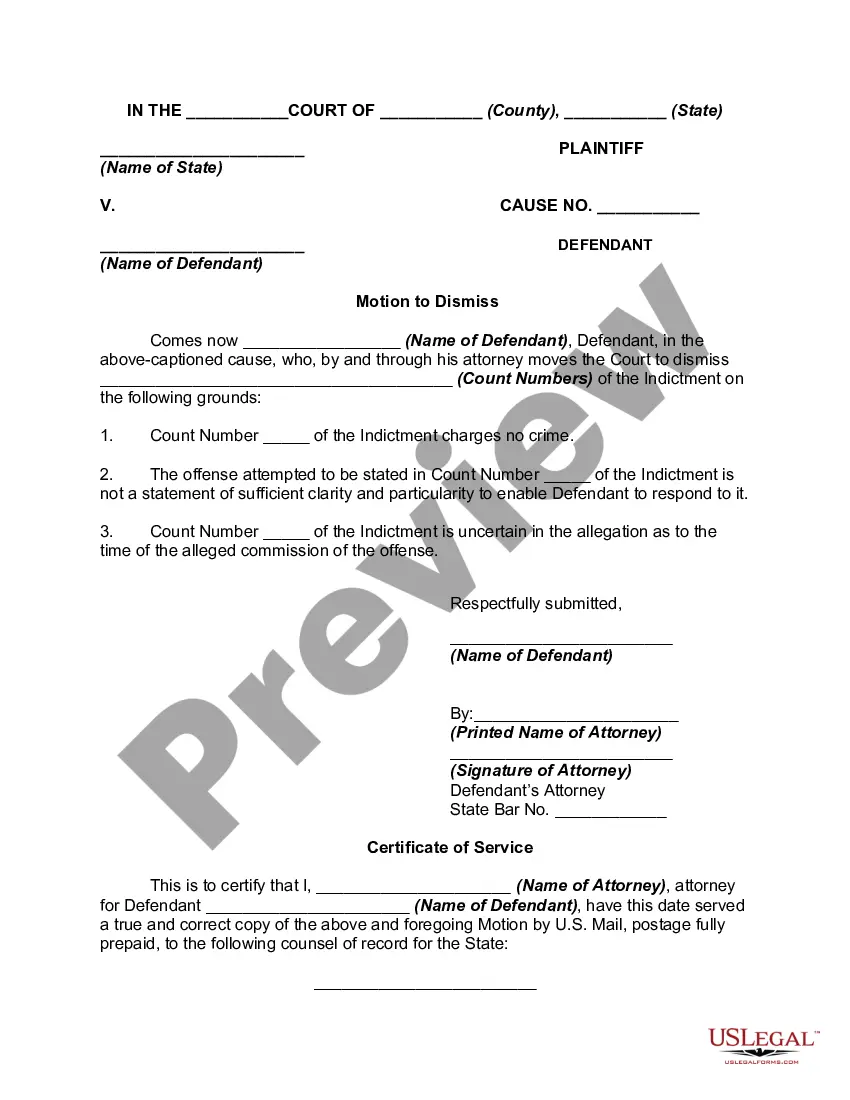

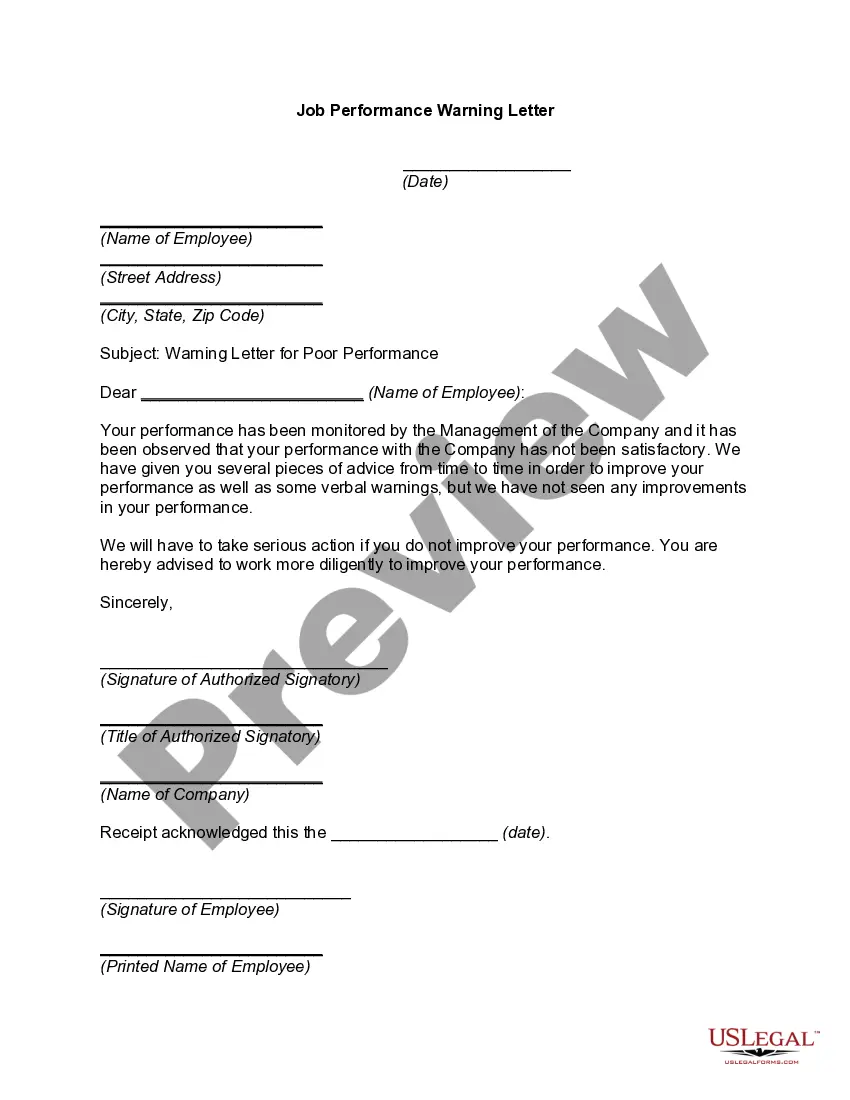

How to fill out Illinois Modification Of Mortgage Loan In Default To Bring It Current And To Change Variable Rate Of Interest To Fixed Rate?

We consistently aim to minimize or evade legal complications when managing intricate legal or financial issues.

To achieve this, we enroll in legal services that, typically, are quite expensive.

However, not all legal situations share the same level of complexity.

The majority can be handled independently.

Utilize US Legal Forms whenever you need to obtain and download the Elgin Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate, or any other document with ease and security. Simply Log In to your account and click the Get button next to it. In the event you misplace the document, you can always retrieve it again in the My documents tab. The process is equally straightforward if you’re new to the platform! You can set up your account within minutes. Ensure to verify if the Elgin Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate complies with the laws and regulations of your state and locality. Additionally, it’s vital to review the form’s outline (if available), and if you notice any inconsistencies with what you initially required, look for an alternative template. Once you’ve confirmed that the Elgin Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate is suitable for your situation, you can select a subscription plan and complete your payment. Then, you can download the document in any available format. For more than 24 years, we’ve assisted millions by providing customizable and current legal documents. Take advantage of US Legal Forms now to save time and resources!

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your issues on your own without resorting to legal advisors.

- We provide access to legal document templates that aren’t always readily accessible.

- Our templates are tailored to specific states and regions, which significantly eases the search process.

Form popularity

FAQ

In a loan modification, since the original loan is being modified and not canceled, the modification can be changed or reverted back to its original terms.

The modified internal rate of return (MIRR) assumes that positive cash flows are reinvested at the firm's cost of capital and that the initial outlays are financed at the firm's financing cost.

Defaulting on a loan modification really isn't any different than defaulting on the original loan. The lender still has the ability to declare a default, to file a mortgage foreclosure lawsuit, to obtain a judgment, and to conduct a judicial auction.

The Fannie Mae Modification Interest Rate is subject to periodic adjustments based on an evaluation of prevailing market rates....Fannie Mae Modification Interest Rate Exhibit (09/08/2022) Effective DateInterest RateJanuary 15, 20212.750%November 16, 20202.875%September 15, 20203.000%August 14, 20203.125%20 more rows ?

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.

If your servicer or lender agrees to a mortgage loan modification, it may result in lowering your monthly payment, extending or shortening your loan's term, or decreasing the interest rate you pay.

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.

The Fannie Mae Modification Interest Rate is subject to periodic adjustments based on an evaluation of prevailing market rates....Fannie Mae Modification Interest Rate Exhibit (10/07/2022) Effective DateInterest RateJanuary 15, 20212.750%November 16, 20202.875%September 15, 20203.000%August 14, 20203.125%20 more rows ?

The disadvantages of a loan modification include the possibility that you will end up paying more over time to repay the loan. The total you owe may even be more than your house is worth in some cases. In addition, you may pay extra fees to modify a loan or incur tax liability.