A Cook Illinois Warranty Deed from an Individual to a Trust is an important legal document used in real estate transactions within Cook County, Illinois. This deed represents the transfer of property ownership from an individual to a trust entity, typically created to hold and manage the property for the benefit of designated beneficiaries. The Cook Illinois Warranty Deed from an Individual to a Trust is a legally binding contract that ensures the transfer of ownership rights with certain guarantees provided by the Granter (individual) to the Grantee (trust). It offers substantial protection to the Grantee against any potential claims, defects, or competing interests associated with the property. This type of warranty deed is widely used to facilitate estate planning, asset protection, and seamless property management. By transferring ownership to a trust, individuals can efficiently transfer property to their chosen beneficiaries while avoiding probate and ensuring privacy. Types of Cook Illinois Warranty Deed from Individual to a Trust: 1. Irrevocable Living Trust Warranty Deed: This type of warranty deed transfers the individual's ownership rights to an irrevocable living trust, which cannot be easily modified or revoked without the consent of the trust beneficiaries. It ensures long-term asset protection and efficient estate planning. 2. Revocable Living Trust Warranty Deed: Unlike the irrevocable living trust, this type of warranty deed transfers property ownership to a revocable living trust, which allows the individual more flexibility and control over the trust assets. The granter has the power to amend, modify, or revoke the trust during their lifetime. 3. Land Trust Warranty Deed: A land trust warranty deed is used when the individual transfers property ownership to a land trust. This type of trust provides a layer of privacy and protection for real estate assets, as the trust's name is used publicly instead of the individual's name. The beneficiary of the trust retains control over the property. In conclusion, a Cook Illinois Warranty Deed from an Individual to a Trust is a vital legal instrument that enables the transfer of property ownership from an individual to a trust entity. This type of deed offers protection, efficient estate planning options, and control over real estate assets, making it a popular choice among property owners in Cook County, Illinois.

Cook Illinois Warranty Deed from Individual to a Trust

Description

How to fill out Illinois Warranty Deed From Individual To A Trust?

We consistently aim to reduce or avert legal harm when managing intricate legal or financial issues.

To achieve this, we seek legal remedies that are typically quite costly.

Nonetheless, not every legal issue is equally convoluted.

Many can be addressed independently.

Utilize US Legal Forms whenever you need to locate and download the Cook Illinois Warranty Deed from Individual to a Trust or any other document swiftly and securely. Just Log In to your account and click the Get button next to it. If you misplace the form, you can always re-download it from within the My documents section. The process is just as simple if you’re new to the platform! You can set up your account in a matter of minutes. Ensure that the Cook Illinois Warranty Deed from Individual to a Trust adheres to the statutes and regulations of your state and locality. Additionally, it’s crucial to review the form’s outline (if available), and if you notice any inconsistencies with what you initially required, look for a different template. Once you’ve confirmed that the Cook Illinois Warranty Deed from Individual to a Trust is suitable for your case, you can choose a subscription plan and continue to payment. Then you may download the form in any available file format. For over 24 years in the market, we’ve assisted millions by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- US Legal Forms is an online repository of current do-it-yourself legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our service empowers you to manage your affairs autonomously without requiring a lawyer.

- We provide access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and localities, significantly simplifying the search process.

Form popularity

FAQ

To transfer physical items to a trust, you should list the items in the trust document and provide details about each one. You might need to execute a bill of sale for valuable items to legally transfer ownership. By using a Cook Illinois Warranty Deed from Individual to a Trust for your property, you create a clear path to asset protection. The US Legal Forms platform offers convenient resources to ensure all aspects of your trust management are handled properly.

Transferring accounts to a trust generally requires contacting your financial institutions and providing them with the trust documents. You may need to fill out specific forms to designate your trust as the account owner. Utilizing a Cook Illinois Warranty Deed from Individual to a Trust can safeguard your real estate as you consolidate your assets. The US Legal Forms platform can guide you through this process and help you complete any needed paperwork.

To move assets into a trust, you typically need to retitle the assets in the name of the trust. This process often involves creating a Cook Illinois Warranty Deed from Individual to a Trust for real estate. This deed formally transfers ownership while providing tax benefits and protection for your assets. For assistance, you can use the US Legal Forms platform to simplify the creation of necessary documents and ensure compliance with state laws.

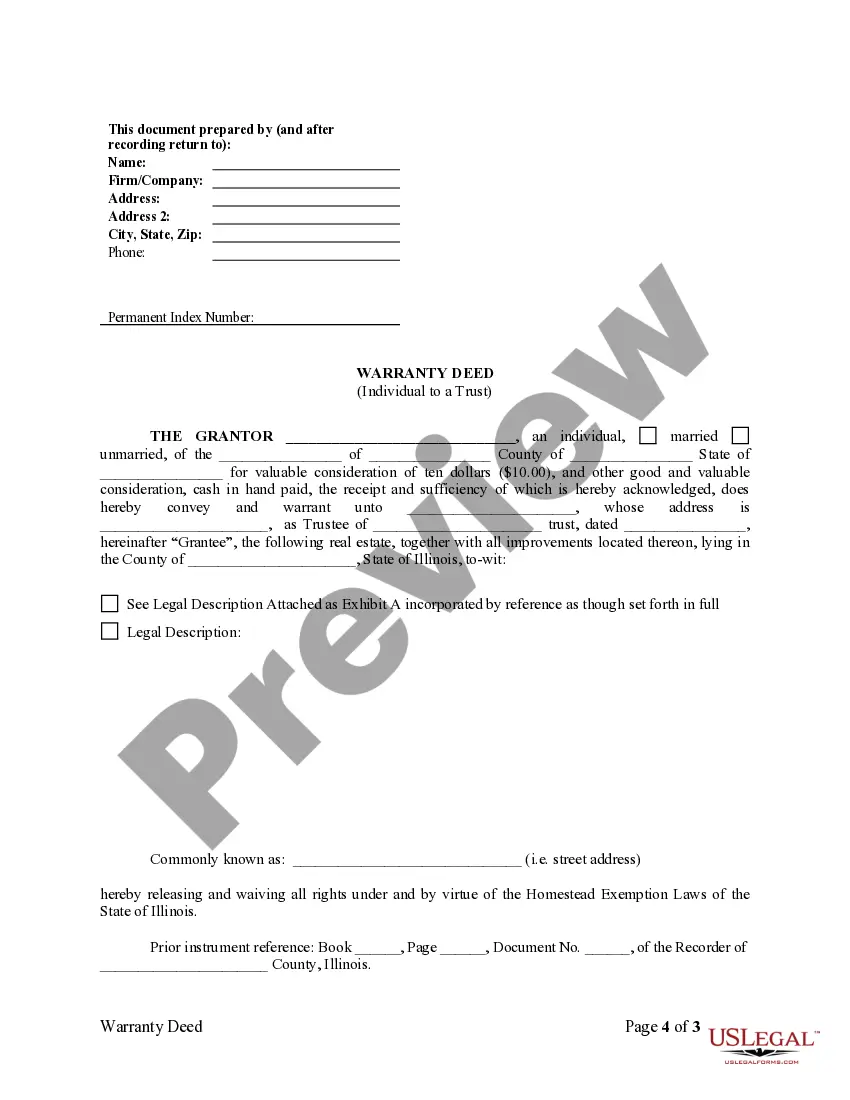

To transfer a warranty deed, you must first create and sign a new deed, which includes the grantor's name, grantee's name, and a legal description of the property. Be sure to follow specific regulations applicable in Illinois. Once completed, you will need to record the Cook Illinois Warranty Deed from Individual to a Trust with the county recorder's office to ensure the transfer is legally recognized. Utilizing USLegalForms can help streamline this process by providing the necessary forms and guidance.

To transfer assets into a trust, you generally need to execute a trust agreement outlining the terms and conditions of the trust. Then, you will re-title the assets in the name of the trust. This process typically involves completing forms specific to each type of asset. For example, if you are transferring real estate, you would use a Cook Illinois Warranty Deed from Individual to a Trust to properly document the transfer.

Transferring a deed to a trust in Illinois involves drafting a Cook Illinois Warranty Deed from Individual to a Trust. You will need to fill out the deed, which includes details about the property and the trust. Once completed, this deed must be signed and notarized. Finally, you file the deed with the county recorder’s office to complete the transfer and ensure the trust holds legal title to the property.

To transfer assets into a trust, you first create the trust document, which outlines how the assets will be managed. Then, for real estate, you should execute a Cook Illinois Warranty Deed from Individual to a Trust to officially transfer ownership. This process involves recording the deed with the county recorder’s office, ensuring legal acknowledgment of the transfer. This method secures your assets within the trust for future management.

Choosing between gifting a house or placing it in a trust depends on your goals. A Cook Illinois Warranty Deed from Individual to a Trust allows you to maintain control over the property while providing benefits to your beneficiaries. If you gift a house, you may lose control over it immediately. In contrast, using a trust can help in managing the property and possibly avoiding probate.

Yes, a warranty deed can be transferred. When you want to transfer ownership of property, you can utilize a Cook Illinois Warranty Deed from Individual to a Trust. This document ensures that the new owner receives the property with a guarantee against any claims. By correctly completing this transfer, you secure the asset in a trust, providing legal protection.

More info

They are distinguished by the title they convey:The word 'grant‥' indicates the recipient does not have all rights of title. The phrase is not legal writing. To get a grant deed, obtain a deed of trust from a trustee of a trust in which you own securities such as bonds, stocks, shares of stock, stock certificates or foreign currency. This type of deed is often called a 'non' title deed.” A Grant (Non-Title) Deed is simply an electronic transfer between two parties. For example, if Alice receives a grant deed from John Smith (Alice, a shareholder in Smith's Corporation) and a purchase order from John Smith (someone who owns stocks) to acquire stocks from the Corporation's cash, the transfer of the stock from Alice to Smith (the grantee) is treated as if it were a transfer from Bob (the issuer — Bob is the buyer×. Alice then creates a receipt showing the purchase and the purchase order, and sends them to Bob's bank.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.