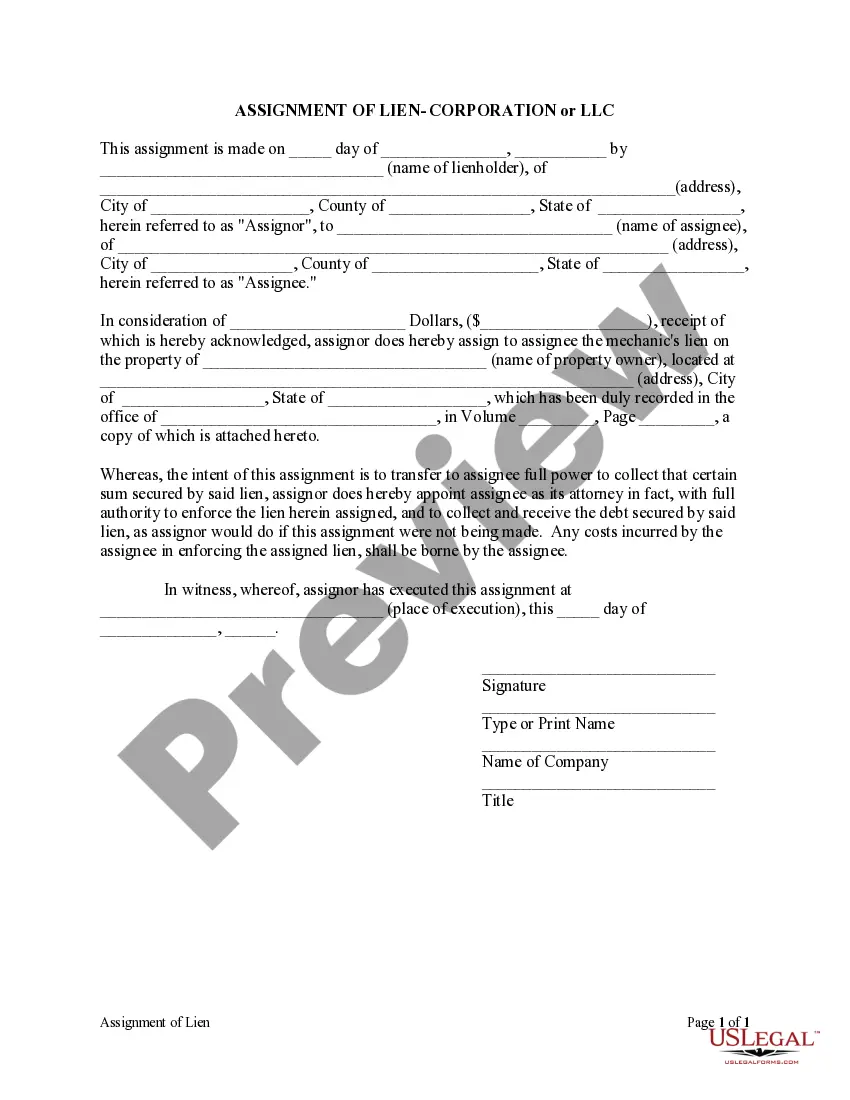

Elgin Illinois Assignment of Lien — Corporation or LLC: Explained In Elgin, Illinois, an Assignment of Lien is a legal process involving a transfer of a lien from one party to another. When it comes to corporations or limited liability companies (LLC), there are a few different types of Assignment of Lien applicable in Elgin, which can vary depending on the specific circumstances. Let's delve into the details and shed light on this topic. 1. Assignment of Lien in a Corporation: When a corporation holds a lien on a property or asset, it can choose to transfer that lien to another party through an Assignment of Lien. This may occur when the corporation wants to remove the lien from its books or transfer the lien to another entity within the corporation structure. The corporation may assign the lien to another corporation or an individual, following the necessary legal procedures. 2. Assignment of Lien in an LLC: Similar to corporations, limited liability companies operating in Elgin may also encounter situations where an Assignment of Lien is required. LCS often hold liens against properties, assets, or individuals, and they may choose to transfer these liens to other entities or individuals. This could be done for various reasons, such as restructuring the LLC, changing ownership, or removing the lien from the LLC's liabilities. Different Types of Elgin Illinois Assignment of Lien — Corporation or LLC: 1. Voluntary Assignment of Lien: This type of Assignment of Lien occurs when the corporation or LLC willingly transfers the lien to another party without any legal obligations or external factors influencing the decision. The assignment is typically done through a formal agreement, ensuring that both parties involved are fully aware of the terms and conditions of the transfer. 2. Involuntary Assignment of Lien: In some circumstances, a corporation or LLC may face legal actions leading to the involuntary transfer of the lien. This can occur when a court orders the transfer of the lien due to outstanding debts, legal disputes, or non-compliance with certain regulations. In such cases, the corporation or LLC may not have control over the transfer process and must abide by the court's decision. 3. Internal Assignment of Lien: This type of Assignment of Lien occurs within the structure of the corporation or LLC itself. For example, if an LLC has multiple subsidiaries, the parent company may assign a lien to one of its subsidiaries or transfer the lien from one subsidiary to another. 4. External Assignment of Lien: External Assignment of Lien involves transferring the lien to an individual or entity outside the corporation or LLC structure. This could be done if the corporation or LLC decides to sell the lien to a third party, such as an investor, creditor, or debt collection agency. The transfer typically requires proper documentation and compliance with state and federal regulations. In conclusion, Elgin Illinois Assignment of Lien — Corporation or LLC encompasses various scenarios where a corporation or LLC may need to transfer a lien. The types of assignments vary based on voluntaries, involvement of legal proceedings, internal or external transfers, and other factors related to the specific circumstances. It is crucial to consult legal professionals specializing in this area to ensure compliance with all regulations and to protect the interests of all parties involved.

Elgin Illinois Assignment of Lien - Corporation or LLC

Description

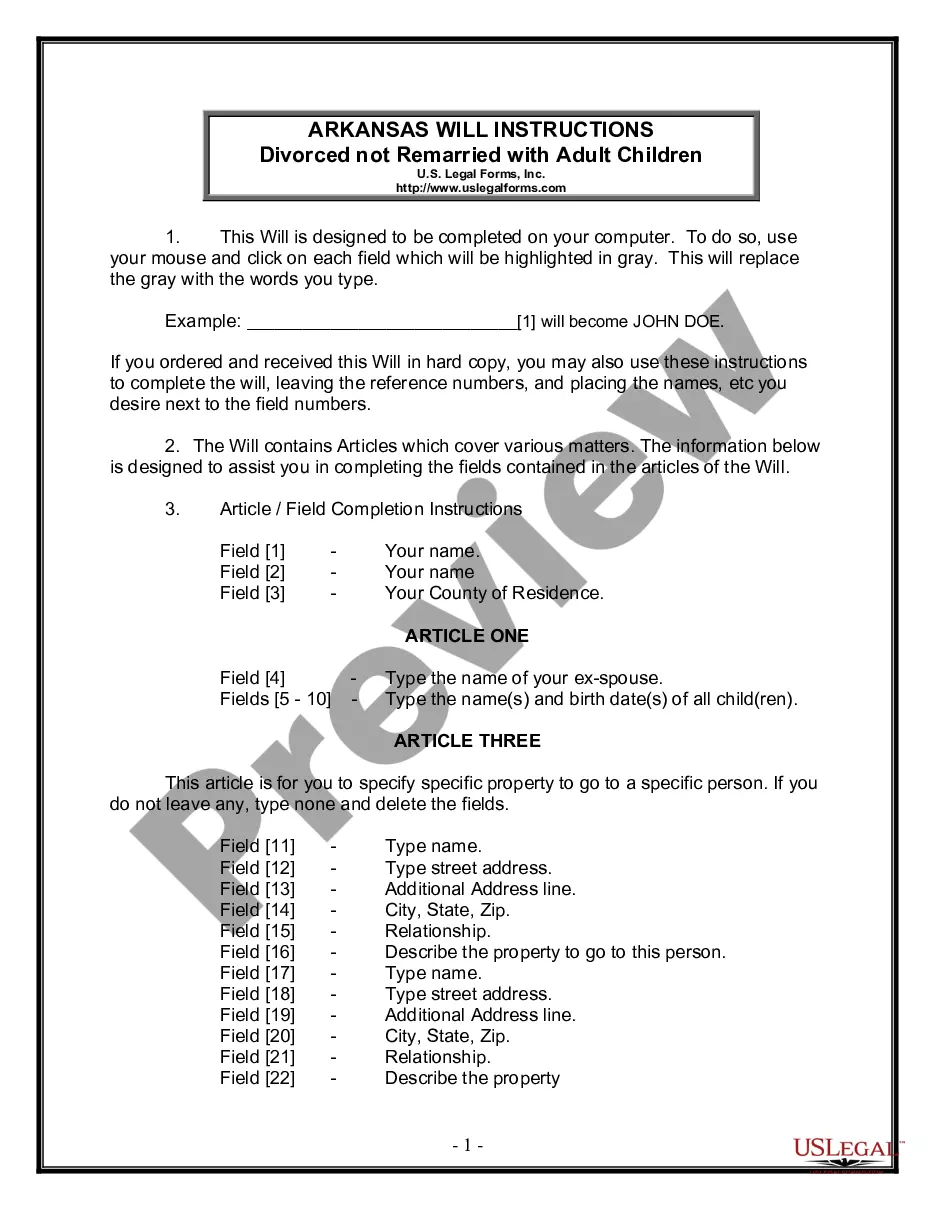

How to fill out Elgin Illinois Assignment Of Lien - Corporation Or LLC?

Make use of the US Legal Forms and get instant access to any form sample you want. Our helpful website with thousands of documents makes it simple to find and get almost any document sample you will need. You can export, complete, and sign the Elgin Illinois Assignment of Lien - Corporation or LLC in a matter of minutes instead of surfing the Net for many hours trying to find an appropriate template.

Utilizing our catalog is a great way to improve the safety of your form filing. Our professional lawyers regularly review all the records to make certain that the templates are relevant for a particular state and compliant with new laws and regulations.

How do you get the Elgin Illinois Assignment of Lien - Corporation or LLC? If you have a profile, just log in to the account. The Download option will appear on all the documents you view. Furthermore, you can find all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Open the page with the template you require. Make certain that it is the template you were seeking: check its headline and description, and utilize the Preview function if it is available. Otherwise, use the Search field to find the appropriate one.

- Start the saving procedure. Select Buy Now and select the pricing plan you like. Then, sign up for an account and process your order with a credit card or PayPal.

- Download the file. Choose the format to obtain the Elgin Illinois Assignment of Lien - Corporation or LLC and modify and complete, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy template libraries on the web. Our company is always happy to assist you in virtually any legal procedure, even if it is just downloading the Elgin Illinois Assignment of Lien - Corporation or LLC.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!

Form popularity

FAQ

Under Illinois law, a mechanics lien should be filed in the County Recorder of Deeds where the property is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

Who can file an Illinois mechanics' lien Claim? Contractors, as well as subcontractors and material suppliers can file an Illinois construction lien. If a company does not have a contract with the owner or with the contractor, they are not eligible to file an Illinois mechanics lien claim.

WHAT MUST I DO BEFORE I FILE MY LIEN? Usually there is at least one notice that you must mail before you can file your lien. These notices are sometimes called notices of intent to file lien. Illinois Document Preparation fee of $165 includes all required notices of intent.

Under Illinois law, a mechanics lien should be filed in the County Recorder of Deeds where the property is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

The Time Comes To File your Illinois Mechanics Lien In Illinois, the lien must be verified by the subcontractor with an affidavit, and must include a statement detailing the contract, the balance due, and the legal description of the property that you are attaching the lien to.

In Illinois, a mechanics lien must be filed within 4 months after completion of work to be effective against subsequent property owners. If the lien is filed after 4 months but before 2 years after completion of work, it will still be effective against the original owner.

In Illinois, a mechanics lien must be filed within 4 months after completion of work to be effective against subsequent property owners. If the lien is filed after 4 months but before 2 years after completion of work, it will still be effective against the original owner.

The deadline for contractors and subcontractors to file their statement of mechanic's lien is four months (not 120 days) from the last date of work (exclusive of warranty work or other work performed free of charge), or from the last date that materials were supplied to the project.