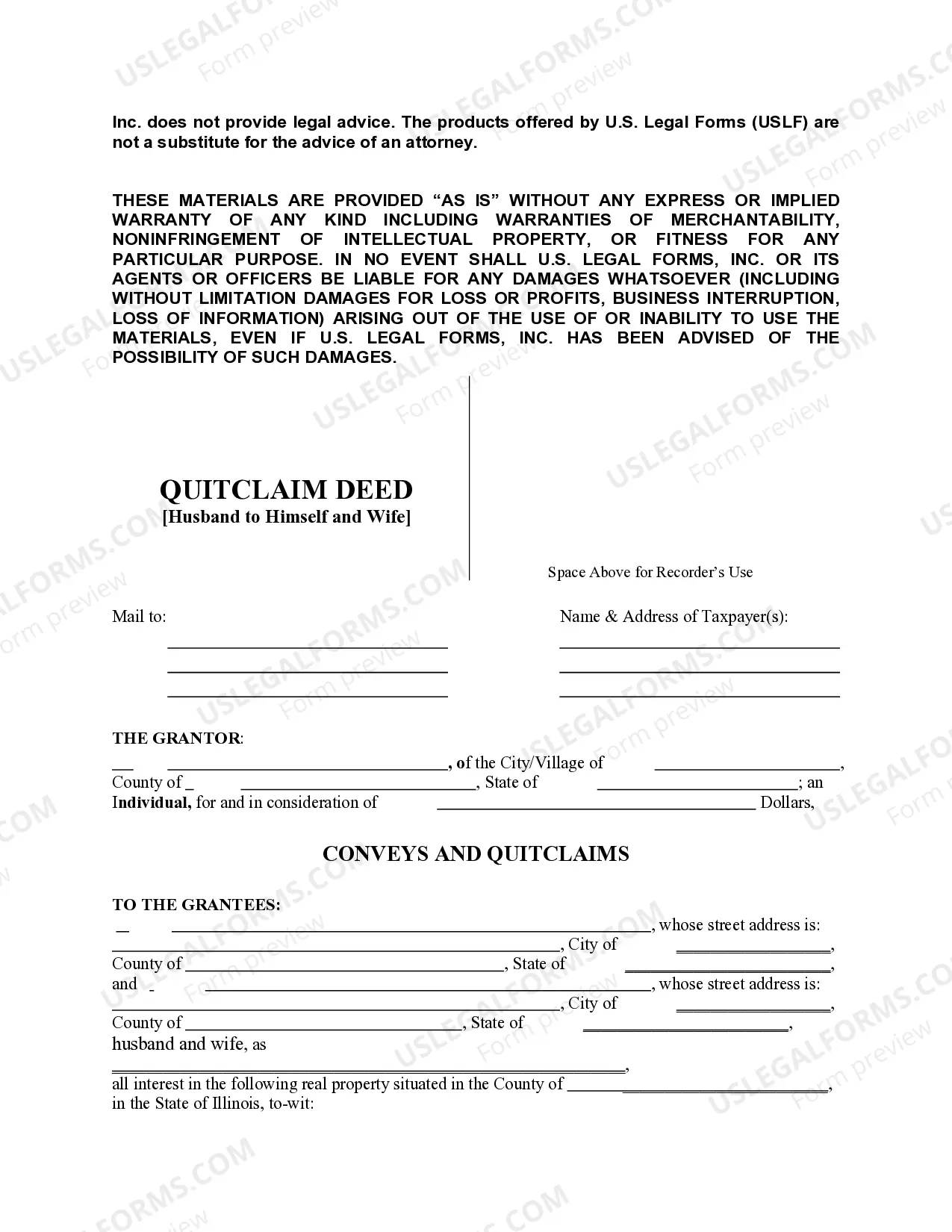

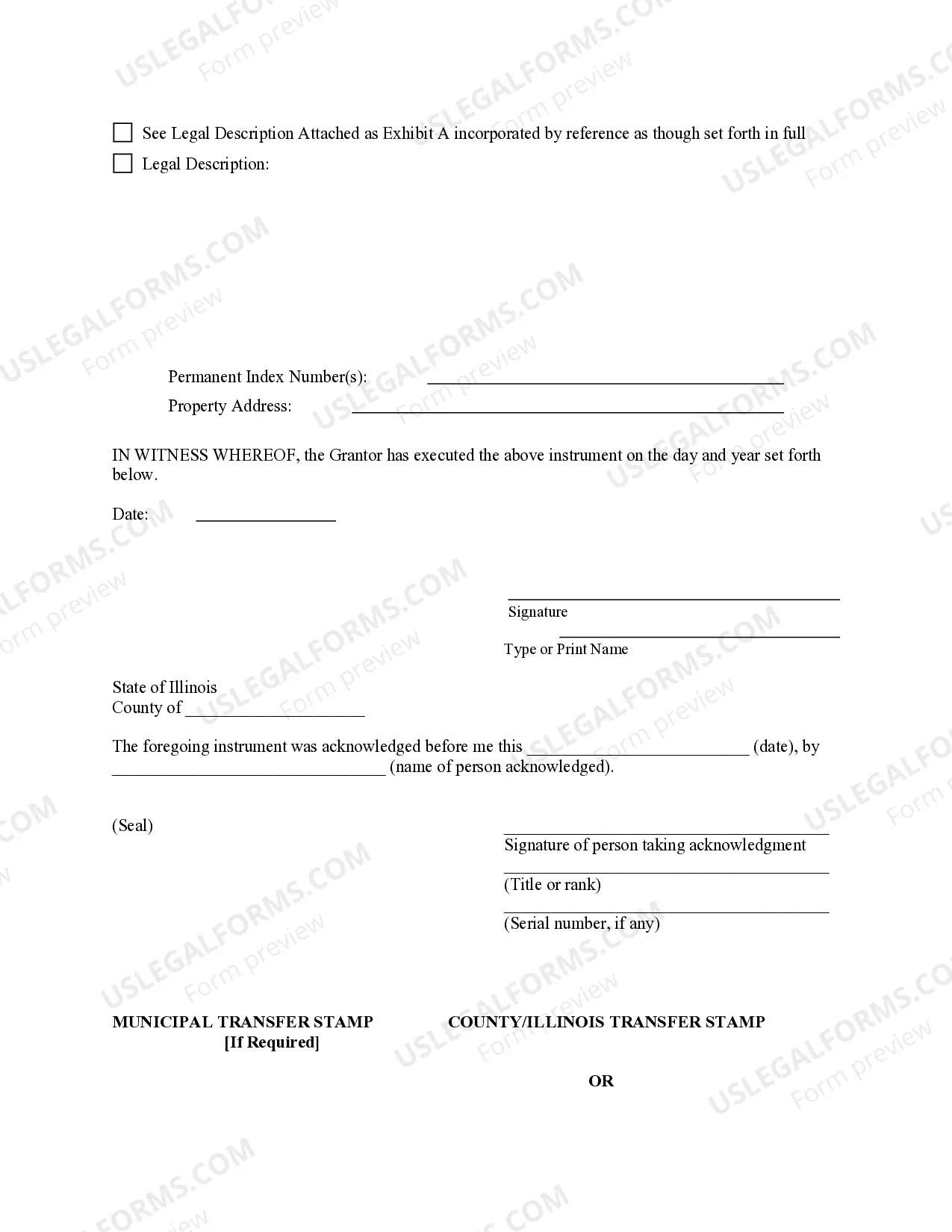

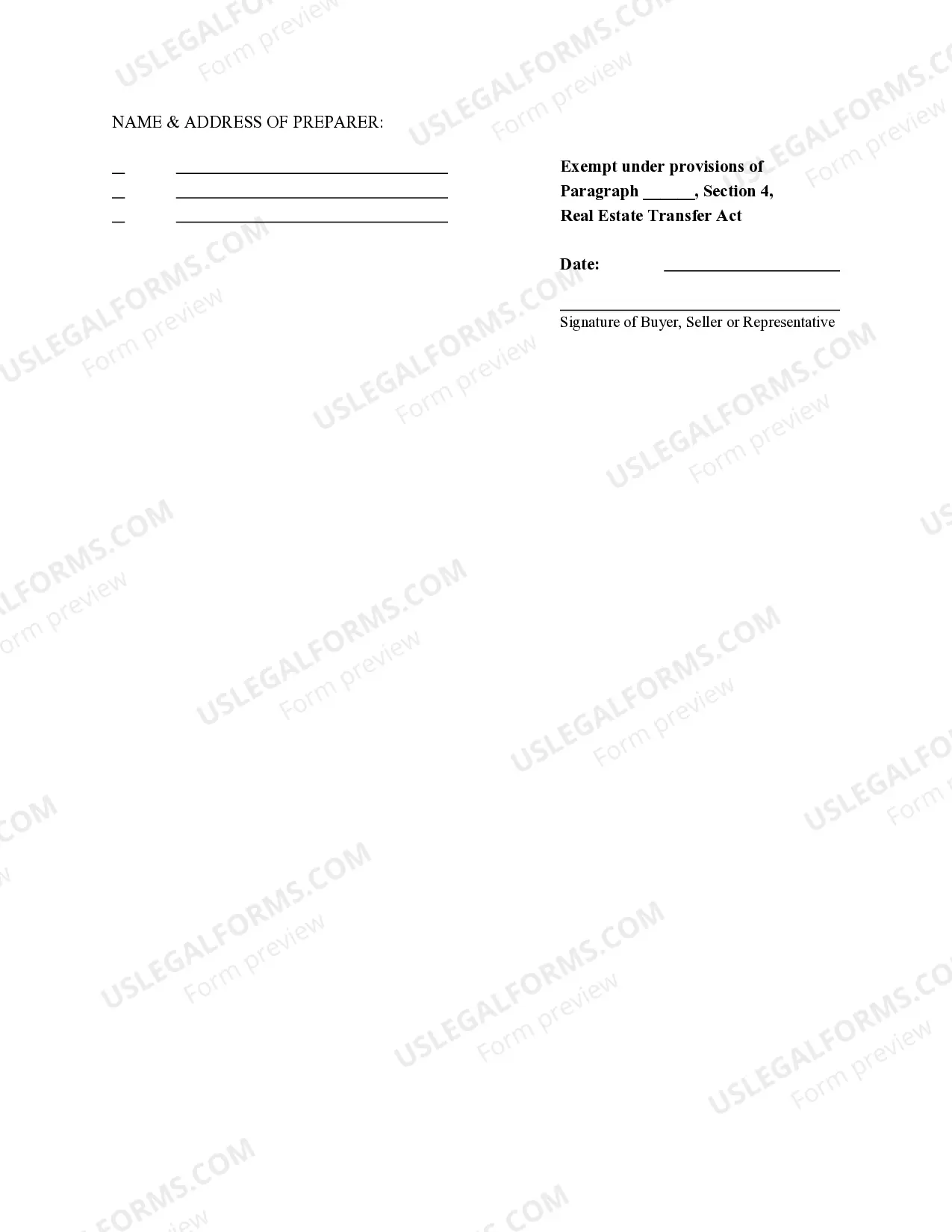

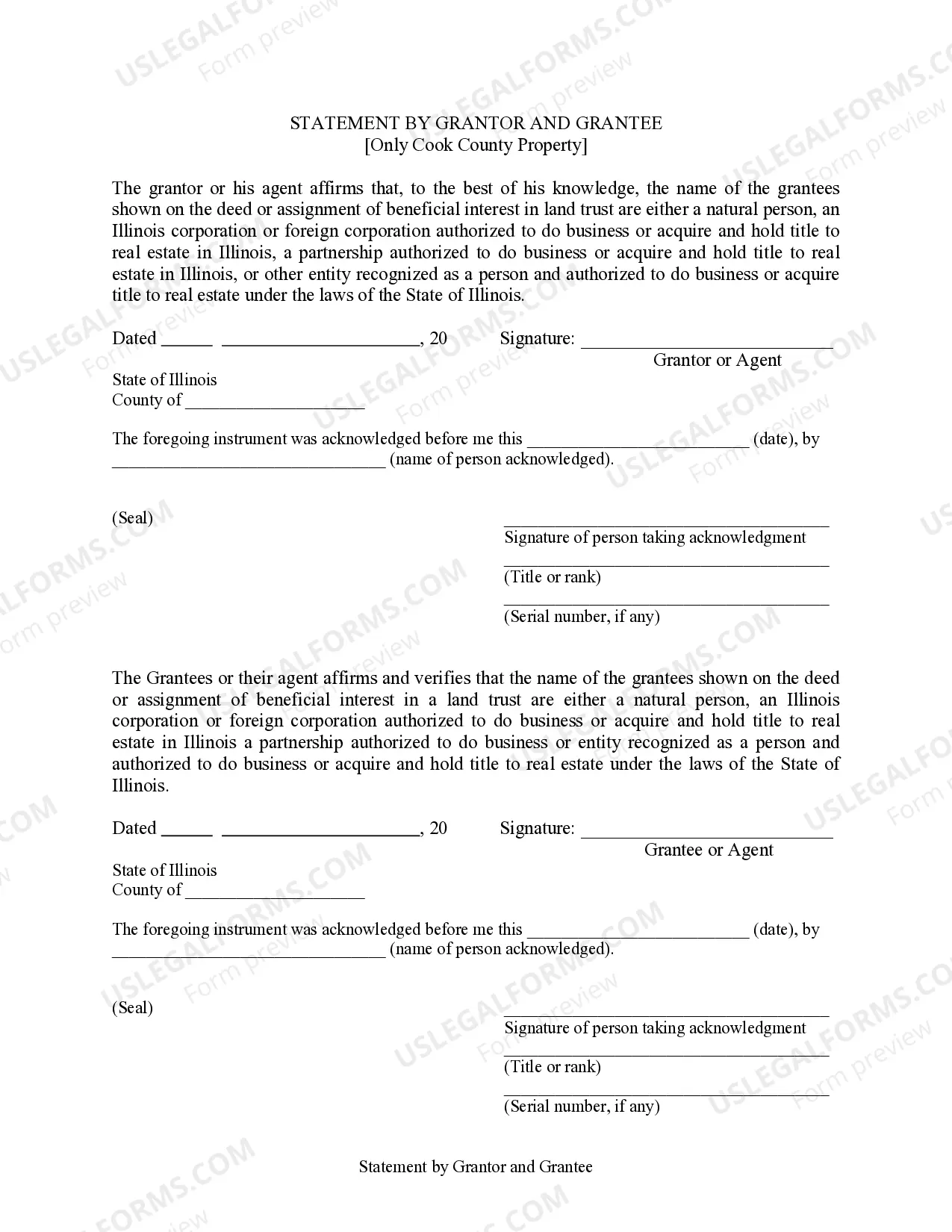

A Cook Illinois Quitclaim Deed from Husband to Himself and Wife is a legal document used to transfer ownership of a property from the husband to both himself and his wife. This type of deed is often executed in situations where the husband wants to ensure that both he and his spouse have equal rights and interests in the property. The quitclaim deed effectively releases any claims the husband may have on the property and transfers those rights and interests to both himself and his wife. Keywords: Cook Illinois, Quitclaim Deed, Husband, Himself, Wife, transfer ownership, legal document, property, equal rights, interests, claims, release, rights and interests. Different types of Cook Illinois Quitclaim Deed from Husband to Himself and Wife include: 1. Joint Tenancy Quitclaim Deed: This type of quitclaim deed creates a joint tenancy between the husband, himself, and his wife. As joint tenants, both spouses have an equal share in the property and the right of survivorship. In the event of the death of one spouse, the property automatically transfers to the surviving spouse without going through probate. 2. Tenancy by the Entirety Quitclaim Deed: This type of quitclaim deed is specifically designed for married couples. It establishes a form of joint ownership where both spouses have an equal and undivided interest in the property. The unique aspect of tenancy by the entirety is that it provides additional protection against creditors of either spouse, as neither spouse can individually sell nor encumber the property without the consent of the other. 3. Community Property Quitclaim Deed: While not recognized in Illinois, it's worth mentioning that some states operate under the community property system. In such cases, a quitclaim deed from husband to himself and wife would establish community property ownership, where both spouses share an equal interest in any property acquired during their marriage. In any of these quitclaim deed scenarios, it is crucial to consult with a qualified real estate attorney or a title company familiar with Cook County, Illinois, to ensure the proper legal completion of the documents and accurate transfer of ownership rights.

Cook Illinois Quitclaim Deed from Husband to Himself and Wife

Description

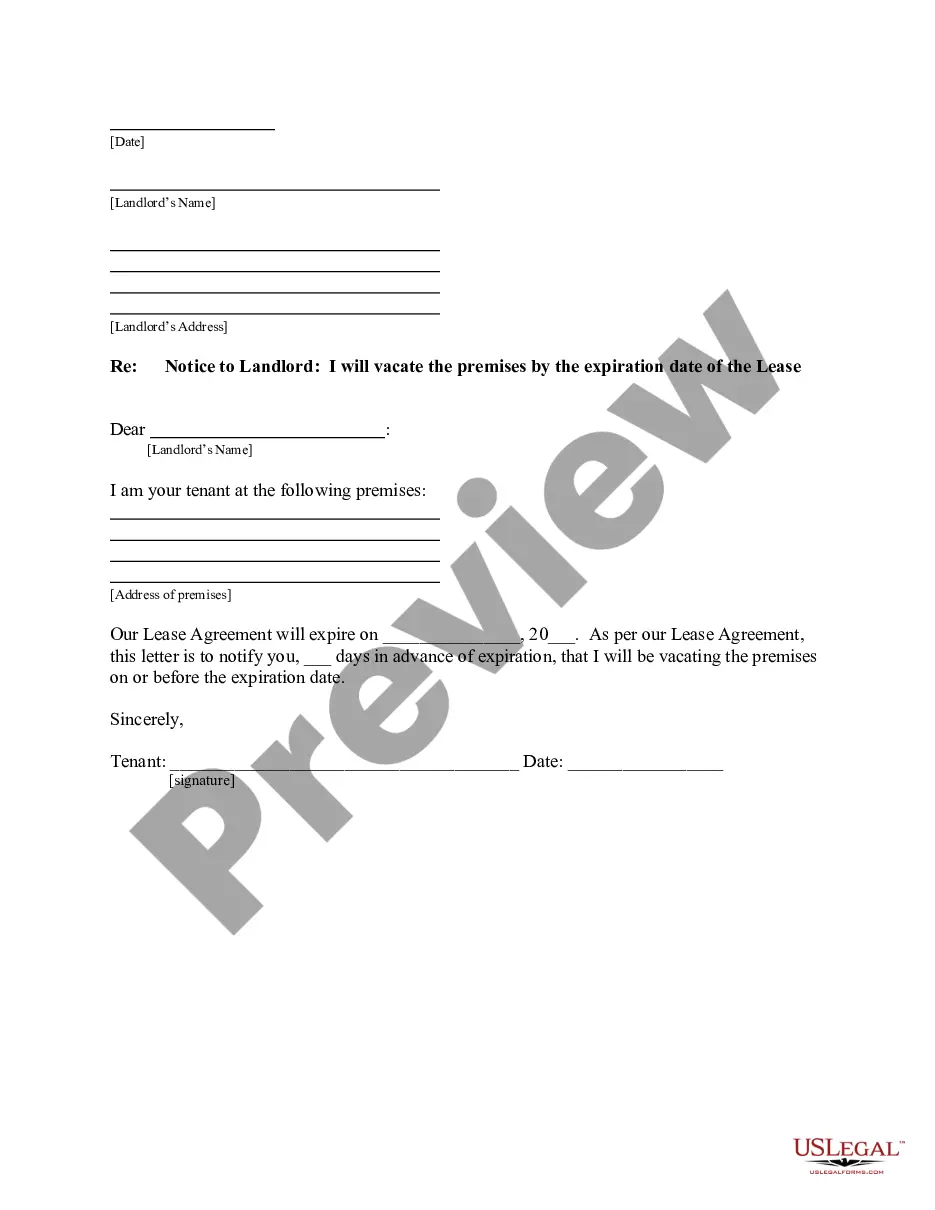

How to fill out Cook Illinois Quitclaim Deed From Husband To Himself And Wife?

Take advantage of the US Legal Forms and have instant access to any form sample you want. Our beneficial platform with a large number of templates makes it simple to find and obtain almost any document sample you will need. You are able to save, complete, and sign the Cook Illinois Quitclaim Deed from Husband to Himself and Wife in a few minutes instead of browsing the web for many hours attempting to find a proper template.

Utilizing our library is an excellent way to raise the safety of your record submissions. Our experienced legal professionals regularly check all the records to ensure that the templates are appropriate for a particular region and compliant with new acts and polices.

How do you get the Cook Illinois Quitclaim Deed from Husband to Himself and Wife? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you view. Moreover, you can find all the earlier saved files in the My Forms menu.

If you don’t have an account yet, stick to the tips listed below:

- Find the template you require. Make sure that it is the template you were seeking: verify its headline and description, and utilize the Preview feature if it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Choose the format to get the Cook Illinois Quitclaim Deed from Husband to Himself and Wife and revise and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable document libraries on the web. We are always happy to help you in any legal process, even if it is just downloading the Cook Illinois Quitclaim Deed from Husband to Himself and Wife.

Feel free to take full advantage of our service and make your document experience as straightforward as possible!

Form popularity

FAQ

Yes, you can create a Cook Illinois Quitclaim Deed from Husband to Himself and Wife on your own. However, while the process may seem straightforward, it is important to ensure that all legal requirements are met for validity. Using a platform like US Legal Forms can simplify this task, providing you with the correct forms and guidance. This way, you can avoid potential issues and ensure a smooth transfer of ownership.

After you record a Cook Illinois Quitclaim Deed from Husband to Himself and Wife, the property ownership reflects the new title. The deed becomes part of public records, which means anyone can access the details of the ownership transfer. Additionally, this process ensures that both you and your spouse have a clear and legal claim to the property. It is a vital step in protecting your joint ownership rights.

Adding a spouse to a deed is generally not difficult if you follow the correct process. You simply need to complete the Cook Illinois Quitclaim Deed from Husband to Himself and Wife and ensure both parties sign it in the presence of a notary. Should you need assistance, platforms like USLegalForms make it easier, providing guidance and templates to simplify the process.

Yes, you can execute a quitclaim deed without hiring an attorney, as long as you follow the necessary legal requirements. It is essential to use the correct form and complete it accurately to ensure it is valid. Utilizing resources from USLegalForms can help you effectively create a Cook Illinois Quitclaim Deed from Husband to Himself and Wife, offering templates and tips for self-completion.

To fill out an Illinois quitclaim deed, you will need to obtain the correct form and provide the names of the parties involved, a description of the property, and the county where the property is located. After filling in these details, sign the document in front of a notary. For further assistance, consider using USLegalForms, which offers user-friendly resources for completing your Cook Illinois Quitclaim Deed from Husband to Himself and Wife.

A quitclaim deed from one spouse to another is a legal document that transfers one spouse's interest in the property to the other. This document is particularly useful in marriage situations, as in a Cook Illinois Quitclaim Deed from Husband to Himself and Wife. It allows couples to clarify ownership and protect their rights without going through a lengthy legal process.

Filling out a quitclaim deed to add a spouse is a straightforward process. You will need to list both your names, describe the property, and sign the Cook Illinois Quitclaim Deed from Husband to Himself and Wife in front of a notary. To ensure everything is correct, you may consider using platforms like USLegalForms, which provide templates and guidance.

No, you cannot add someone to a deed without their knowledge. The law requires the consent of all parties involved, which makes the Cook Illinois Quitclaim Deed from Husband to Himself and Wife a necessary document for adding a spouse. It is crucial for the other party to understand and agree to the change to avoid legal issues in the future.

Yes, you can add a spouse to the deed without refinancing your mortgage. This process typically involves executing a Cook Illinois Quitclaim Deed from Husband to Himself and Wife. By using this deed, you can update the title to include your spouse, without the need for a complicated refinance.

No, you do not necessarily need a lawyer to file a quitclaim deed in Illinois. However, working with a lawyer might help you navigate any potential legal complexities. You can also utilize services from platforms like US Legal Forms to create and file your Cook Illinois Quitclaim Deed from Husband to Himself and Wife efficiently and correctly.

Interesting Questions

More info

Learn More Rental A rental certificate is used for property rentals and a lease that you sign at the time of rental. It can be used when you sign a lease, purchase a property at a discount or to make a decision on a place to live. Search by a rental agreement, date or property location. Learn More Tax Receiving an IRS tax receipt means the person or business that issued your tax receipt received tax from the IRS.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.